My back-to-work morning train WFH reads:

• Institutional Investors See Resilience in Commercial Real Estate: While the industry is forever changed following the pandemic, portfolio managers expect a rebound ahead. (Chief Investment Officer)

• Why Gen Xers and Millennials Are Giving More Money to Their Kids Than Baby Boomers: Older generations are afraid of losing it all, while younger adults fear soaring costs will jeopardize their children’s future. (Barron’s)

• Underestimate Elon at your peril. Only fools think Elon is incompetent; as an industrialist, Elon is unmatched by any American in the country’s entire history — Henry Ford, his closest competitor for the title, failed in the aerospace industry. (NoahOpinion) see also Does Elon Musk Still Care About Selling Cars? Mr. Musk, one of President Trump’s main advisers, has not outlined a plan to reverse falling sales at the electric car company of which he is chief executive. (New York Times)

• Why Germany’s Confidence Is Shattered and Its Economy Is Kaput: Historians and economists say risk-averse leadership is holding back Europe’s largest economy. (Wall Street Journal)

• Probabilities and Payoffs: The Practicalities and Psychology of Expected Value: The prime task of an investor is to find opportunities with gaps between price and value, with price being fairly straightforward and value more of a challenge to assess. A common approach to estimate value is to consider expected value, the sum of the products of various payoffs and their associated probabilities. We discuss some of how these ideas can be helpful for investing in various asset classes. (MS Counterpoint Global)

• The American Dream Is Not a Coin Flip, and Wages Have Not Stagnated: These debates are technical, and it is easy for doomers to dismiss the methods they do not like. Rather than get into the weeds, it is easier to claim the mantle of populism and tell Americans they “are right to believe their lyin’ eyes.” (Civitas Institute)

• Why I Stopped Caring About Enhancing Everyone’s Thinking: The natural selection of critical thinking and the Socratic paradox. (Psychology Today)

• The Future Looks Ratty: In a warming world, urban rats are thriving. There’s a simple solution, but the implementation isn’t easy. (Biographic)

• Are federal workers lazy? Let’s look at the data. As Elon Musk’s U.S. DOGE Service targets federal workers, we investigate how hard those folks have been working for their government paychecks. (Washington Post)

• The Weird New Putting Technique That’s Driving the Golf World Completely Nuts: An unorthodox putting technique called AimPoint is taking over the sport. Not everyone is happy about it. (Wall Street Journal)

Be sure to check out our Masters in Business interview this weekend with Charley Ellis, founder of Greenwich Associates (1972) Trustee at Yale, Chairman of Yale Endowment’s Investment Committee and member of the Vanguard Group’s Board of Directors. He is the author of 21 books, including “Winning the Loser’s Game” (now 8th ed). His most recent book is is “Rethinking Investing: A Very Short Guide to Very Long-Term Investing.”

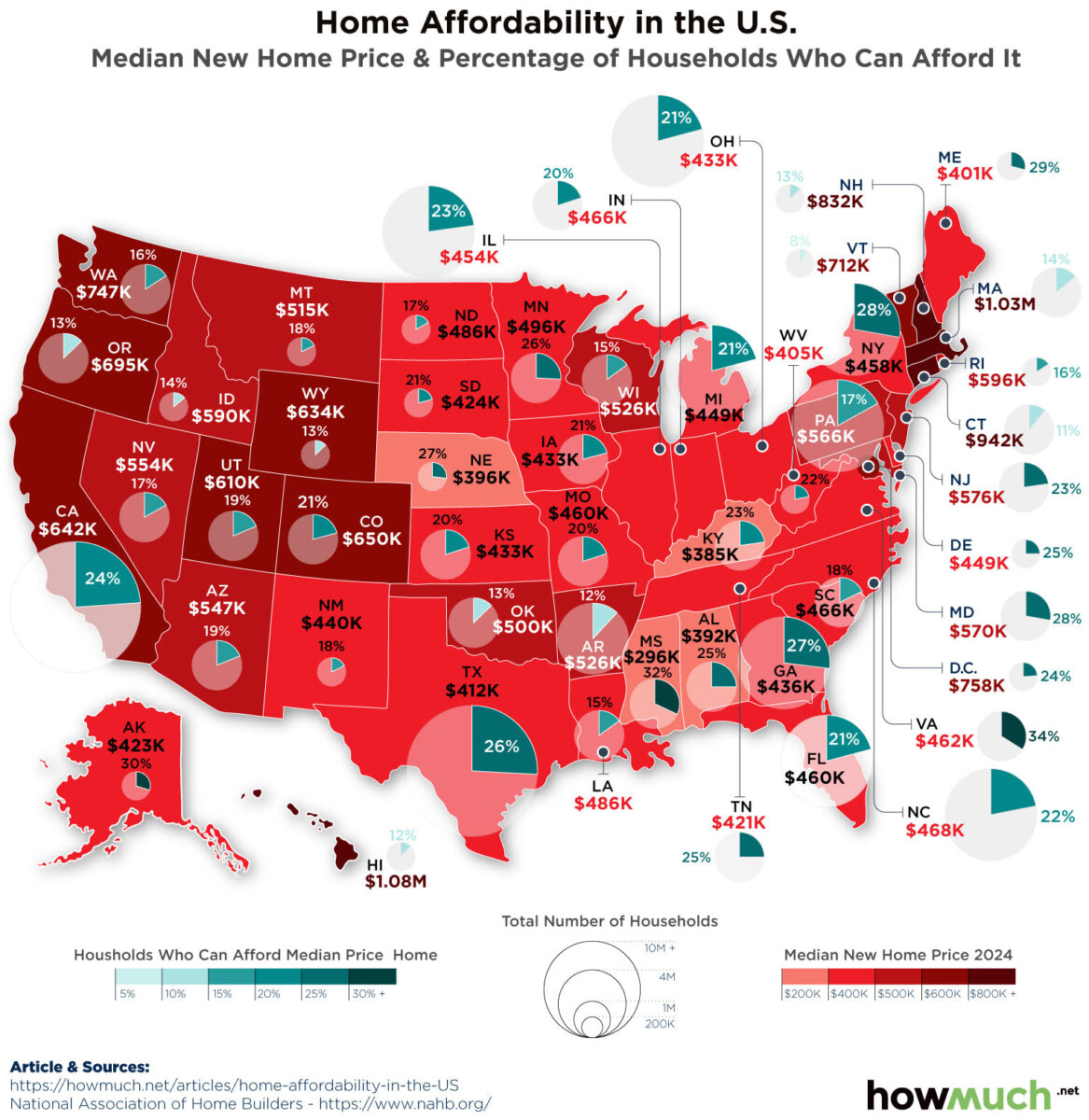

Median U.S. Home Prices and Housing Affordability by State

Source: How Much

Sign up for our reads-only mailing list here.