• Déjà bubble: Can bubbles repeat? Bubbles might be especially likely to repeat today thanks to social media, which creates a hothouse environment for ideas to spread across the investor population. If we think of bitcoin investing as a virus, this virus can evolve, mutating and spreading to susceptible minds. Just as the rise of modern air transportation allowed highly contagious diseases to spread across the globe in days, the rise of social media allows highly contagious ideas to infect financial markets. (Acadian)

• Options and Crypto Are Popular With Younger Investors. They Might Be Sorry. Members of Gen Z are starting their investing journey at younger ages than older generations did. (Barron’s) see also The Cryptocurrency Scam That Turned a Small Town Against Itself: How did a successful, financially sophisticated banker gamble his community’s money away? (New York Times)

• From Investment to Savings: When Finance Feeds on Itself: The rapidly blossoming marriage of private credit and insurance retirement liabilities contorts the economic identity that investment is a function of savings. Amid these changes, private equity firms found a long-horizon capital source in life insurers, whose annuity and pension liabilities require consistent, bond-like returns. The result is a circular system wherein retirement savings feed insurance contracts, which fund leveraged private lending, which then loops back to support the insurers’ spreads and payouts. (American Affairs Journal)

• It Was Never Going To Be Me: The United States is now a Great Power but not a Good Power. To be clear, I don’t mean “good” in the sense of doling out foreign aid and research grants lavishly and stupidly and for my pet social activist causes. I mean “good” in the sense of policy goals beyond realpolitik. I mean “good” in the sense of what the Framers of the Constitution called a more perfect Union, where ideas like liberty and justice for all aren’t just side effects of being the biggest bully on the block, but are the direct goals of public policy even at the cost of “efficiency.” (Epsilon Theory)

• Elite lawyers sell out the rule of law: Sullivan & Cromwell announced its ambition to become the leading Wall Street “MAGA” law firm by taking on the representation of Trump in the appeal of his “hush money” felony conviction. S&C has made it clear they will be “defending” Trump by joining in his campaign to undermine the legitimacy of New York’s criminal justice system — and with it, the prosecutors, the judge, and even the jurors who had the temerity to hold him to account for his crimes. (Public Notice)

• Revenge of the Covid Conspiracy Theorists: After years of GOP attacks on US health agencies, Trump appointees are poised to bring Covid-19 conspiracies to their leadership of US agencies. Federal workers are scared of what comes next. (Wired)

• Philosophical economics: Shameless Robber Barons: Wealth inequality (and note, I am not talking about income inequality, which is what most people refer to when they discuss inequality) has been rising in the US and other developed countries for about five decades, but it is not (yet) as high as it was at the start of the 20th century. (Klement On Investing)

• Elon Musk’s wrecking ball: The world’s richest man is taking a torch to the American state on behalf of Donald Trump. (Financial Times)see also Our Government Is Experiencing a Rapid Unscheduled Disassembly: Musk is moving fast and breaking important things. (Paul Krugman)-a see also DOGE Slashes Health Care for Sick 9/11 First Responders: Musk, Trump, and RFK Jr.’s cuts to the CDC have halted 9/11 health care for Ground Zero workers. (Rolling Stone) see also DOGE’s Only Public Ledger Is Riddled With Mistakes: The figures from Elon Musk’s team of outsiders represent billions in government cuts. They are also full of accounting errors, outdated data and other miscalculations. (New York Times)

• New JAMA Research Shows How Much — and How Rapidly — Part D Plans Have Shifted Drug Costs to Consumers: One of the big questions about the Medicare Part D drug benefit, as it enters its “IRA phase,” is what will happen to patient out-of-pocket costs. As a reminder, the overall structure of the IRA is not designed, in particular, to save patients money but rather to save the government money. (Cost Curve)

• Art Adviser. Friend. Thief. Lisa Schiff became the country’s leading art consultant, and drew her clients close. Then she stole millions from them. Now facing up to 20 years in prison, is she ready to repent? (New York Times)

Be sure to check out our Masters in Business interview this weekend with Charley Ellis, founder of Greenwich Associates (1972) Trustee at Yale, Chairman of Yale Endowment’s Investment Committee and member of the Vanguard Group’s Board of Directors. He is the author of 21 books, including “Winning the Loser’s Game” (now 8th ed). His most recent book is is “Rethinking Investing: A Very Short Guide to Very Long-Term Investing.”

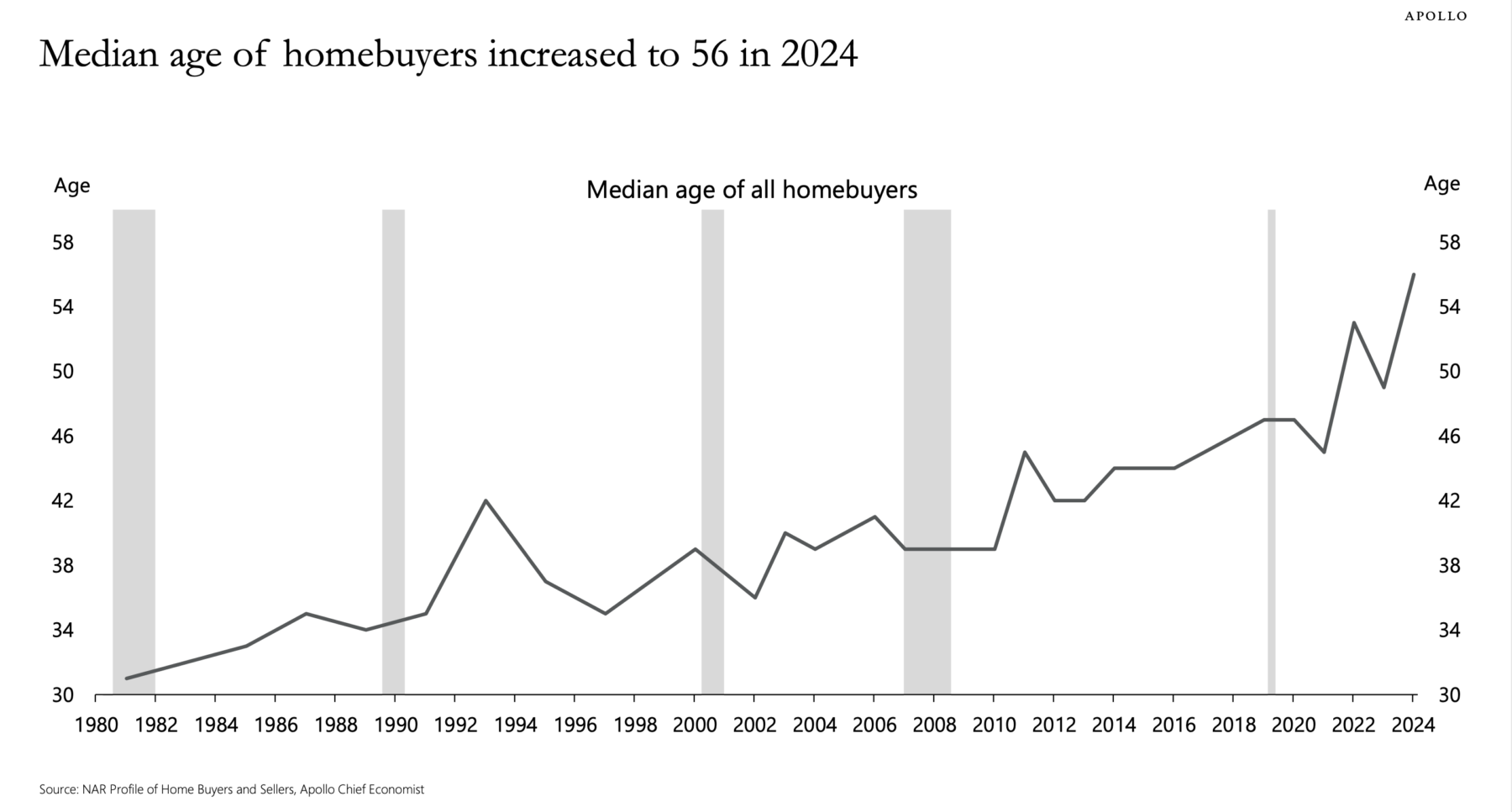

Rising home prices and high mortgage rates have pushed the median age of homebuyers to a record-high 56 years old in 2024, up from 45 in 2021

Source: Apollo

Sign up for our reads-only mailing list here.

~~~

To learn how these reads are assembled each day, please see this.