My back-to-work morning train Futureproof reads:

• From Covid to today: five years that changed our money: With the anniversary of the first lockdown approaching, inflation and market volatility are now facts of financial. (Financial times)

• Stocks Tumble Into Correction as Investors Sour on Trump: The S&P 500 is now more than 10 percent below its last record high — a line in the sand for investors worried about a sell-off gathering steam. (New York Times) see also The Bond Market’s Trump Trade Is Looking Like a Recession Trade: Bond traders are signaling an increasing risk that the US economy will stall as President Donald Trump’s chaotic tariff rollouts and federal-workforce cuts threaten to further restrain the pace of growth. (Bloomberg) see also Trump Turns His Back on the Markets. It Could Break MAGA. The president has tried to acknowledge the stock market’s fall without backing off from the policies that triggered it. He’s playing with fire. (Barron’s)

• Investors spy the dawn of a tectonic shift away from US markets. A historic global trade war, a proposed $1.2 trillion European fiscal bazooka and the emergence of China as tech race leader are upending global flows of money, marking a potential turning point for investor capital away from the United States. (Reuters)

• How to Crack the US Housing Market as a First-Time Buyer: The ultimate guide for rookie purchasers hoping to achieve the American Dream. (Bloomberg)

• The Parallel Economy and the New Rules of American Power: We have a few forces at work – (1) bot-driven information warfare has distorted our perception of economic reality and (2) seemingly deliberate policy volatility creates conditions for an economic downturn (3) and a Trump ‘parallel economy’ is positioned is emerging to capitalize on the resulting confusion – perhaps, reducing Trump’s market concerns. Understanding all of this requires unpacking four interconnected phenomena… (Kyla’s Newsletter)

• AI Boom Reshapes Power Landscape as Data Centers Drive Historic Demand Growth: The power industry was once considered slow-moving and perhaps even boring. That is no longer the case as technology has expanded and power demand projections skyrocket. New reports released by analysts at Enverus and Deloitte are examined to provide insight on what’s likely to evolve in the power industry over the coming year and beyond. (Power)

• The Last Decision by the World’s Leading Thinker on Decisions: Shortly before Daniel Kahneman died last March, he emailed friends a message: He was choosing to end his own life in Switzerland. Some are still struggling with his choice. (WSJ) see also Remembering Daniel Kahneman: A Mosaic of Memories and Lessons. Identifying errors in judgment and choice was something Kahneman seemed called to do, particularly as it applied to his own thinking. (BehavioralScientist)

• Trump doesn’t seem to know why he launched a giant trade war: The president’s reasons for imposing tariffs on Canada and Mexico keep changing (and none make sense). (Vox)

• Why Hasn’t Silicon Valley Fixed the Bay Area’s Problems? Examining the dark side of capitalism’s effect on urban development (Bloomberg)

• Maybe Trump Wants to Help Ukraine After All: Tuesday’s meeting ended with the Americans handing Kyiv a clear advantage—militarily and diplomatically—and putting Moscow in a tight, awkward spot. The two countries agreed to a 30-day ceasefire in the Russia–Ukraine war, segueing into negotiations toward a permanent peace. Whatever the Russians decide, Ukraine will enjoy an immediate resumption of U.S. military and intelligence assistance. (Slate)

Be sure to check out our Masters in Business interview this weekend with Stephanie Kelton, professor of economics and public policy at Stony Brook University and a Senior Fellow at the Schwartz Center for Economic Policy Analysis. Previously, she was Chief Economist on the U.S. Senate Budget Committee, and was named by Politico as one of the 50 people most influencing the policy debate in America, and one of Barron’s top 100 Women in Finance. Her book “The Deficit Myth” became an instant New York Times bestseller.

Europe Becomes a Union

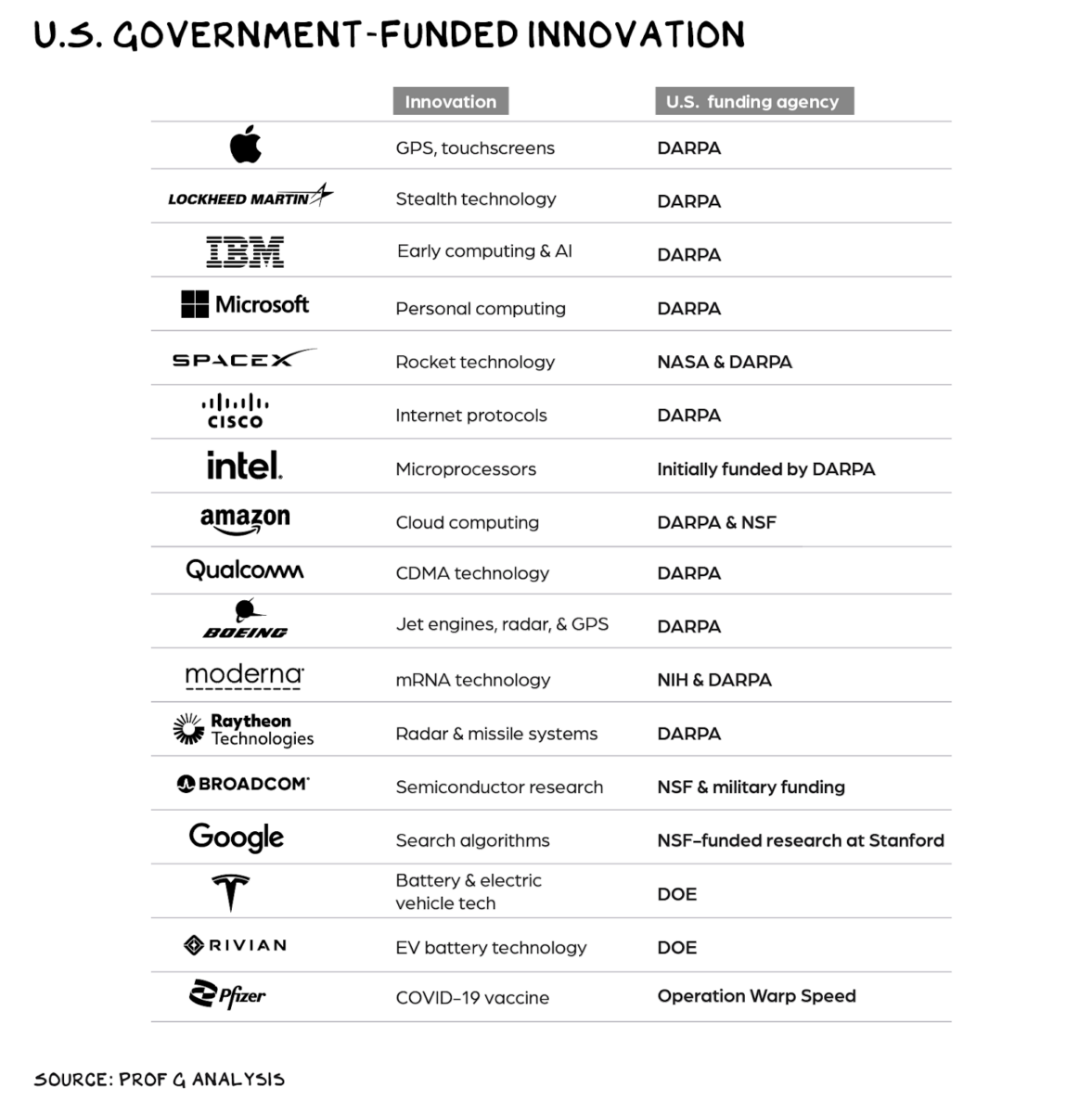

Source: No Mercy/No Malice

Sign up for our reads-only mailing list here.