My back-to-work morning train WFH reads:

• The Dow Is Close to 50,000. How the Heck Did We Get Here So Fast? It took a 103-year slog through market crashes, depression, and crippling inflation to reach that “once-unthinkable milestone,” as The Wall Street Journal called it on March 30, 1999. The milestones that fell at 20,000, 30,000, and 40,000, coming in rapid succession beginning in 2017, were greeted with progressively less fanfare. The significance of the Dow, once the heartbeat of Wall Street, was also questioned. (Barron’s)

• The Degenerate Economy is TOO Crowded and Inflation is a Nightmare: The massive grifting is overwhelming the demand for speculation at least for the moment. Further, the speculative reach for anything ‘prediction markets’ feels like a mistake right now. Is it time to invest in the ‘opposite’ of degeneracy and if so, what even is the opposite? (Howie Town) see also There’s something worse than recession and we’re already in it. Mamdani, Trump are just opposite expressions of the same problem. (DowntownJoshBrown)

• How the Supreme Court Could Save Christmas: Alas, our self-described “Tariff Man” president hasn’t taken the hint. Instead, Trump has septupled(!) the average effective tariff rate (from 2.4 percent in early January to 17.9 percent today), and threatened to jack up rates further. His tariffs are being challenged in court, however. SCOTUS heard oral argument, and the justices sounded very skeptical that Trump has the broad tariffing power he claims. Betting markets placed the odds that Trump’s tariffs survive at a measly 24 percent. (The Bulwark)

• The Astonishing Bull Market Will End One Day. Are You Ready? Big stock gains have always been followed by big losses. Here are tips on how to prepare. (New York Times)

• Feeling Great About the Economy? You Must Own Stocks: Investors’ rosy feelings about their stock market gains are powering spending—but it’s a different story for everyone else. (Wall Street Journal)

• Just What the Doctor Ordered: When Dr. Phil signed off his talk show in 2023, he pivoted to MAGA media. It’s not working so well for him. (Slate)

• Will Paramount Cancel Jon Stewart? The comedian talks about the suppression of political speech under Donald Trump, why social media doesn’t mix well with democracy, and the future of “The Daily Show.” (New Yorker)

• Parents Fell in Love With Alpha School’s Promise. Then They Wanted Out: In Brownsville, Texas, some families found a buzzy new school’s methods—surveillance of kids, software in lieu of teachers—to be an education in and of itself. (Wired)

• Traditional Media Never Took the Christian Right Seriously: A radical religious movement that views strongman leaders, even abusive ones, as essential to carrying out a divine plan for themselves and for America, helped propel him to power, and keep him there. (Talking Points Memo)

• ‘Take On Me’ has been stuck in our heads for 40 years. Here’s how it got there. The full story of how A-ha emerged from the Norwegian tundra with the ultimate ’80s pop song, and its unexpected afterlife. (Washington Post)

Be sure to check out our Masters in Business interview this weekend with Brandon Zick, CIO of at Ceres Partners, where he is responsible for all investments, including Ceres Partners flagship farmland fund and Ceres Food & Agriculture private equity strategies. He serves on the Federal Reserve Bank of Chicago Advisory Council and Small Business, Agriculture & Labor sub-council. Ceres was just purchased by Wisdom Tree Investing.

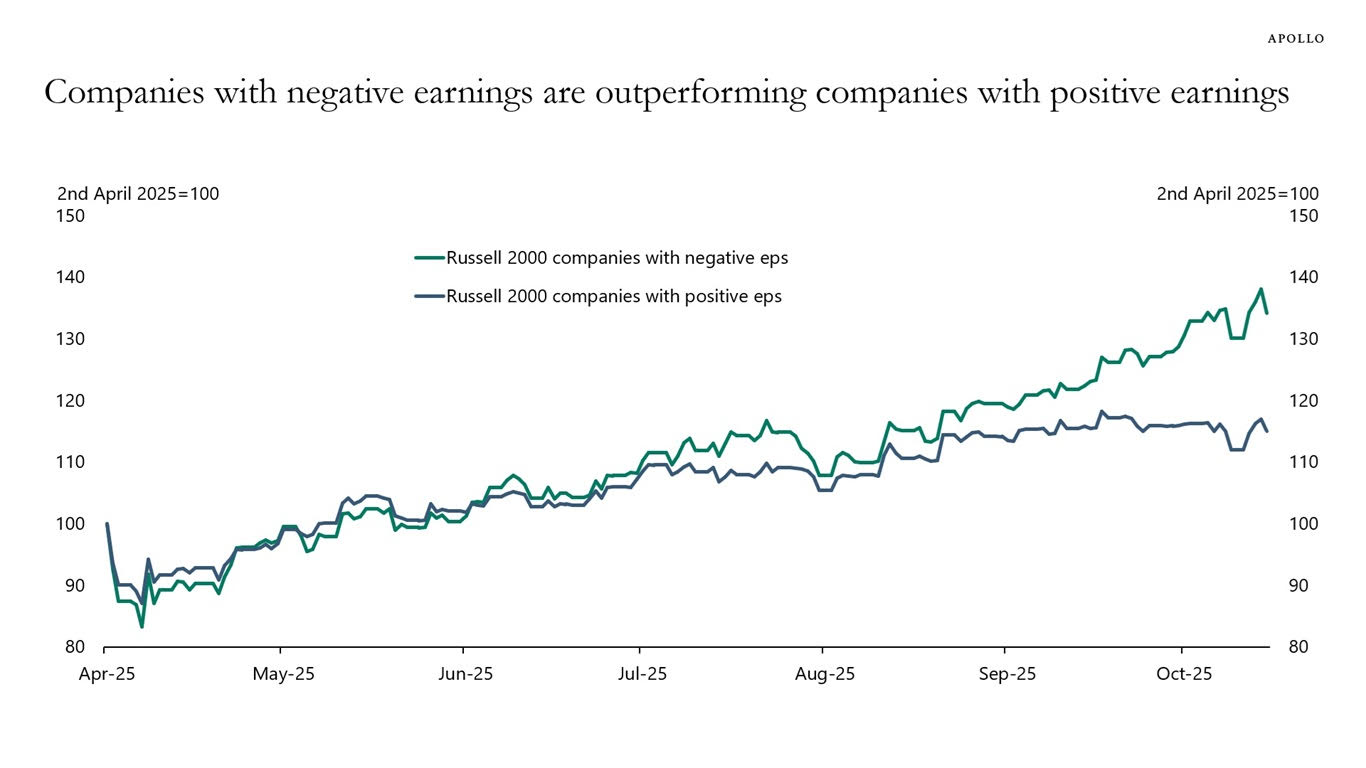

Stock prices of companies with negative earnings have been outperforming stock prices of companies with positive earnings

Source: Apollo

Sign up for our reads-only mailing list here.