My back-to-work morning train WFH reads:

• World-Beating Stock Rally Creates New Headaches in Korean Market:.South Korean stocks are on track to post their strongest gains in a quarter century, with the Kospi up 61% so far in 2025. The rally has stirred doubts about its staying power due to growing anxiety over heated AI valuations. Some investors already pulling back due to concerns over the market’s sustainability. (Bloomberg)

• Berkshire Without Buffett: What’s Next for the Company and the Stock: As the legendary investor prepares to step down as CEO, here’s what his designated successor, Greg Abel, should do to bring Berkshire into the 21st century. (Barron’s)

• What I Meant When I Said Substack Isn’t Cool: The platform owns the newsletter space so completely its name is a synonym for the form, writes Chris Black, but it’s still just another algorithm. (GQ)

• The Risks Lurking in Wall Street’s Insurance Takeover: The retirement accounts and life insurance policies of the average American fueled massive private equity returns. Experts say the systemic risks are too big to ignore. (Bloomberg)

• The Good News and Bad News About California Film Shoots: More features are shooting in the state (even if TV is still falling in L.A.), but overall production spend is down notably as recent on-location activity is fueled by smaller-budget indie projects. (Hollywood Reporter)

• Will the YIMBY ‘Holy Grail’ Deliver an LA Building Boom? Supporters of the California zoning reform bill SB 79 say it will unleash a wave of multistory apartment buildings. In low-rise-loving Los Angeles, that could be a tall order. (CityLab)

• The Pentagon Can’t Trust GPS Anymore. Is Quantum Physics the Answer? New devices navigate without satellites or risk of enemy jamming signals. (Wall Street Journal)

• When it comes to nukes and AI, people are worried about the wrong thing: A rogue AI killing us all is, for now at least, a far-fetched fear; a human consulting an AI on pressing the button is the scenario that should keep us up at night. (Vox)

• (Some) MAGA Girls Just Wanna Have Fun: What does it mean to be female and conservative in 2025? (The Atlantic)

• The Humble Ladybug Is Having a PR Crisis: Once known for bringing good luck, the insect is getting a bad rap thanks to an invasive species; ‘too many ladybugs’ (Wall Street Journal)

Be sure to check out our Masters in Business interview this weekend with Morgan Housel, whose new book, “The Art of Spending Money, Simple Choices for a Richer Life” was just published. His first book, “The Psychology of Money” sold over 10 million copies.

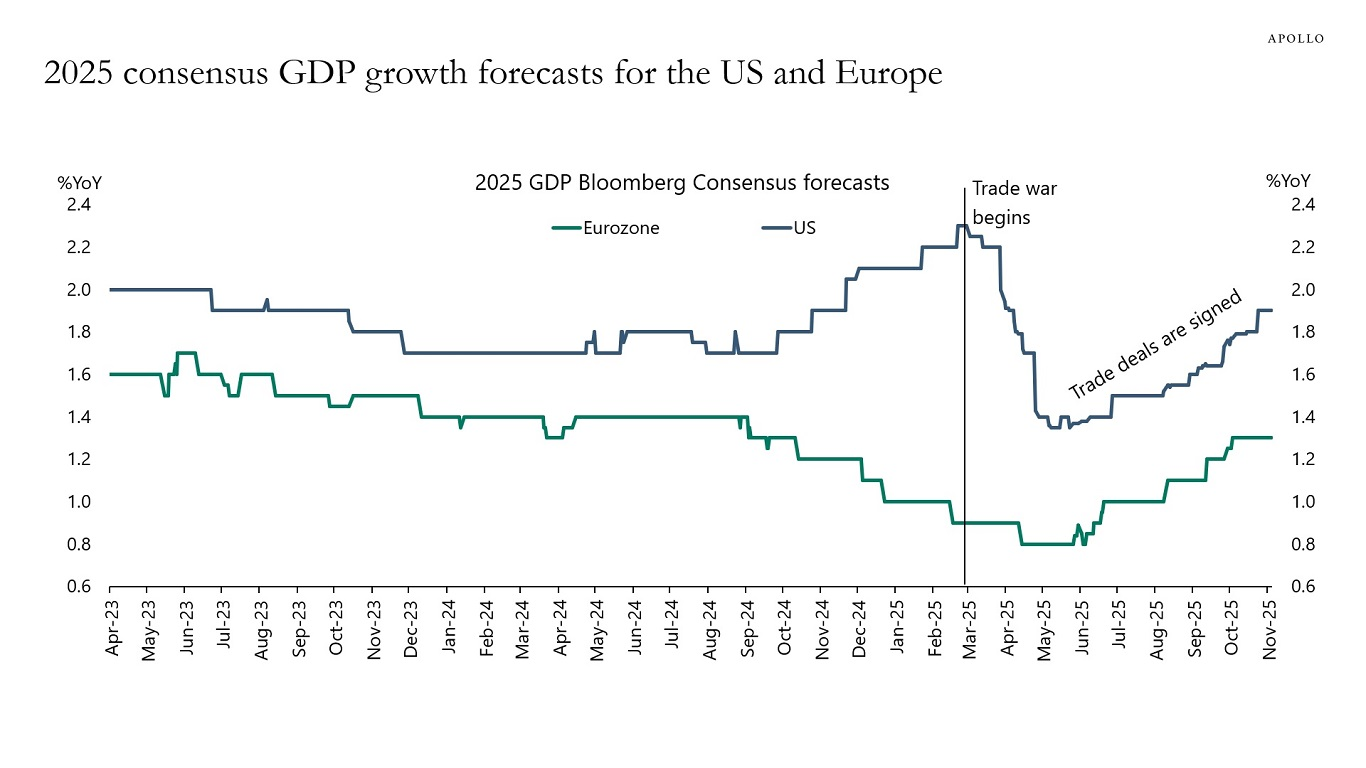

Growth is likely to reaccelerate in 2026, driven by lower trade war uncertainty, a weaker dollar, and a possible GDP boost of ~1 percentage point due to accelerated depreciation

Source: Apollo