The week between Christmas and New Year’s Eve Monday morning reads:

• Charles Schwab CEO Explains Why Investing Works—and Gambling Doesn’t. Rick Wurster, Charles Schwab CEO, says the firm manages $11.8 trillion in assets across 46 million client accounts, serving both retail and independent advisors. Schwab is attracting younger investors, with one in six new clients being Gen Z and 60% of new-to-firm clients under 40 years old, he said. Wurster says Schwab plans to launch spot crypto trading in 2026. (Barron’s)

• Data shows the ‘Made in USA’ brand still suffered under tariffs: Fewer shoppers are return customers of ‘Made in USA’ products. That’s because it still sends the wrong brand signal: expensive. (Fast Company) see also US Trade Dominance Will Soon Begin to Crack: Savvy countries will discover there’s a way to mitigate the harm incurred by Trump’s tariffs—and it’ll boost their own economies while making goods cheaper too. (Wired)

• Family Offices Have Become the New Power Players on Wall Street: Wealthy families are launching offices to manage their money at a record clip and are getting a seat at the table in significant deals. (Wall Street Journal)

• The boomer-doomer divide within OpenAI, explained by Karen Hao: There are two sides to the AI debate, and both are perpetuating the idea that AI is “inevitable, all-powerful, and deserves to be controlled by a tiny group of people,” says the Empire of AI author. (Big Think)

• After three decades of pretty constant growth, the consultancy boom just hit an AI-shaped wall: A partnership with AI may be good for consultants looking to decorate their LinkedIn profiles with AI badges, but it also reflects a deep shift within the industry, as the traditional model built on adding more people to bill for long hours begins to unwind. (Sherwood)

• The Sleeper Issue That Could Destroy the Economy: Trump may have stopped threatening Jerome Powell—but he’s still got designs to control the Fed. (The Bulwark) see also Historic Shift Underway in China’s Economy as Investment Slump Deepens: Investment in manufacturing, infrastructure and property is expected to fall this year, a remarkable turn for an economy whose growth reshaped the world. (New York Times)

• Societies with Little Money Are among the Happiest on Earth: Wealth and well-being go together in many studies, but certain communities complicate this link. (Scientific American)

• Trump’s Own Mortgages Match His Description of Mortgage Fraud: The Trump administration has argued that Fed board member Lisa Cook may have committed mortgage fraud by declaring more than one primary residence on her loans. We found Trump once did the very thing he called “deceitful and potentially criminal.” (ProPublica)

• 4 surprising, proven rules to avoid getting sick this winter: We all know the basics of avoiding winter bugs, but science is uncovering lesser-known tricks that make a real difference. (BBC Science Focus Magazine)

• Jack Black and Paul Rudd: ‘I had a traumatic experience when I was a kid’ Hollywood’s comedy kings talk about the movies that shaped them and joining forces for Anaconda, a satire about a giant snake. (The Times)

Be sure to check out our Masters in Business interview this weekend with comedian Jay Leno, former Tonight Show host, and creator of Jay Leno’s Garage.

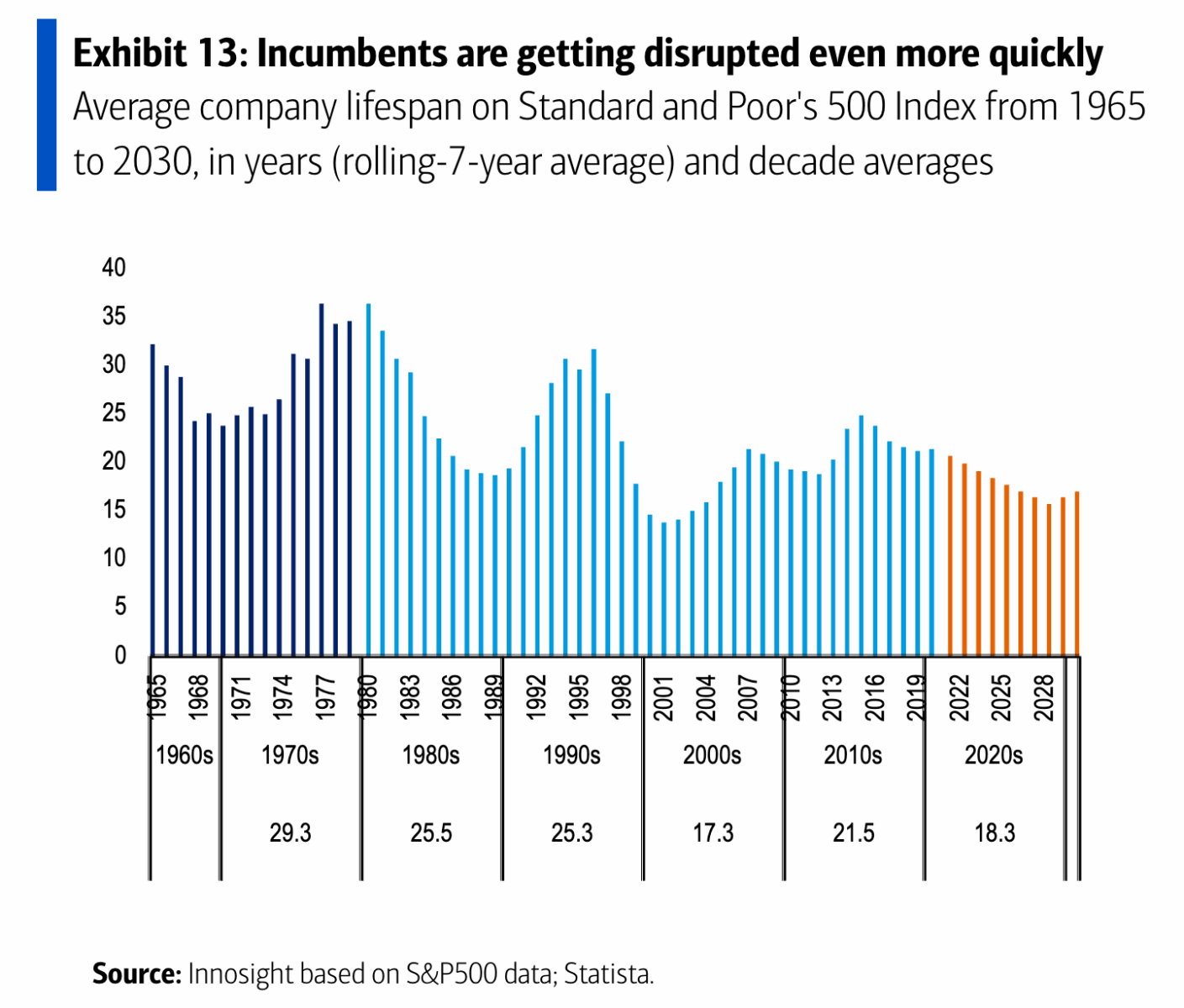

Stocks are spending less time in the S&P 500

Source: TKer

Sign up for our reads-only mailing list here.