My back-to-work morning train reads:

• Why This CEO Won’t Let Private Funds Near His Company’s 401(k): Untangling his father’s estate caused the executive to rethink the benefits of alternative investments.(Wall Street Journal)

• America vs. the World: President Trump wants to return to the 19th century’s international order. He will leave America less prosperous—and the whole world less secure. (The Atlantic) see also Trump Is Risking a Global Catastrophe: His irrational fixation on Greenland could lead to widespread conflict. (The Atlantic)

• With Powell, the Guardrails Are Holding: Trump seems to always get his way, but limits are finally starting to catch up. (Bloomberg)

• Tracking AI’s Contribution to GDP Growth: To measure how AI-related investment is showing up in GDP, we focus on components of nonresidential fixed investment that capture the infrastructure behind AI adoption and related investments in software and R&D. (St.Louis Fed)

• Buying a home is 150% more expensive than in 2019. The plan to shut out institutional investors could raise costs even more. The biggest part of the overall “affordability” problem is the explosion in the cost of housing. (Fortune) see also The Dream of a Florida Retirement Is Fading for the Middle Class: The Sunshine State used to be where all walks of life could afford to retire. That’s changing as it grows pricier. (Wall Street Journal)

• The American Worker Is Becoming More Productive: U.S. workers are getting more done. That’s great for the economy—though not always great for workers. (Wall Street Journal)

• The Fight on Capitol Hill to Make It Easier to Fix Your Car: As vehicles grow more software-dependent, repairing them has become harder than ever. A bill in the US House called the Repair Act would ease those restrictions, but it comes with caveats. (Wired)

• How the White House is Losing the Fight on the ICE killing: New data shows the smear campaign of Renee Good is failing miserably (The Message Box) see also ICE is now a 70-30 issue — for Democrats: By using brutal force in public, ICE has given Democrats a chance to change how voters think about immigration policy. Will they take it? (Strength In Numbers)

• What if the idea of the autism spectrum is completely wrong? For years, we’ve thought of autism as lying on a spectrum, but emerging evidence suggests that it comes in several distinct types. The implications for how we support autistic people could be profound (New Scientist)

• Netflix’s $82.7 billion rags-to-riches story: How the DVD-by-mail company swallowed Hollywood. It’s a story so good it could have been a screenplay. In 2000, Reed Hastings and Marc Randolph sat down across from John Antioco, then CEO of video rental giant Blockbuster, and pitched him on acquiring their still unprofitable DVD-by-mail startup, Netflix, which at the time had around 300,000 subscribers. But when they told him their price—$50 million and the chance to develop and run Blockbuster’s online rental business—Antioco balked. It was a famously shortsighted business decision: By 2010, Blockbuster had filed for bankruptcy, and Netflix had stormed Hollywood with its entertainment streaming service. (Fortune)

Be sure to check out our Masters in Business interview this weekend with Nobel laureate Richard Thaler and his University of Chicago Booth School colleague Alex Imas on the update and reissue of his classic book The Winner’s Curse.

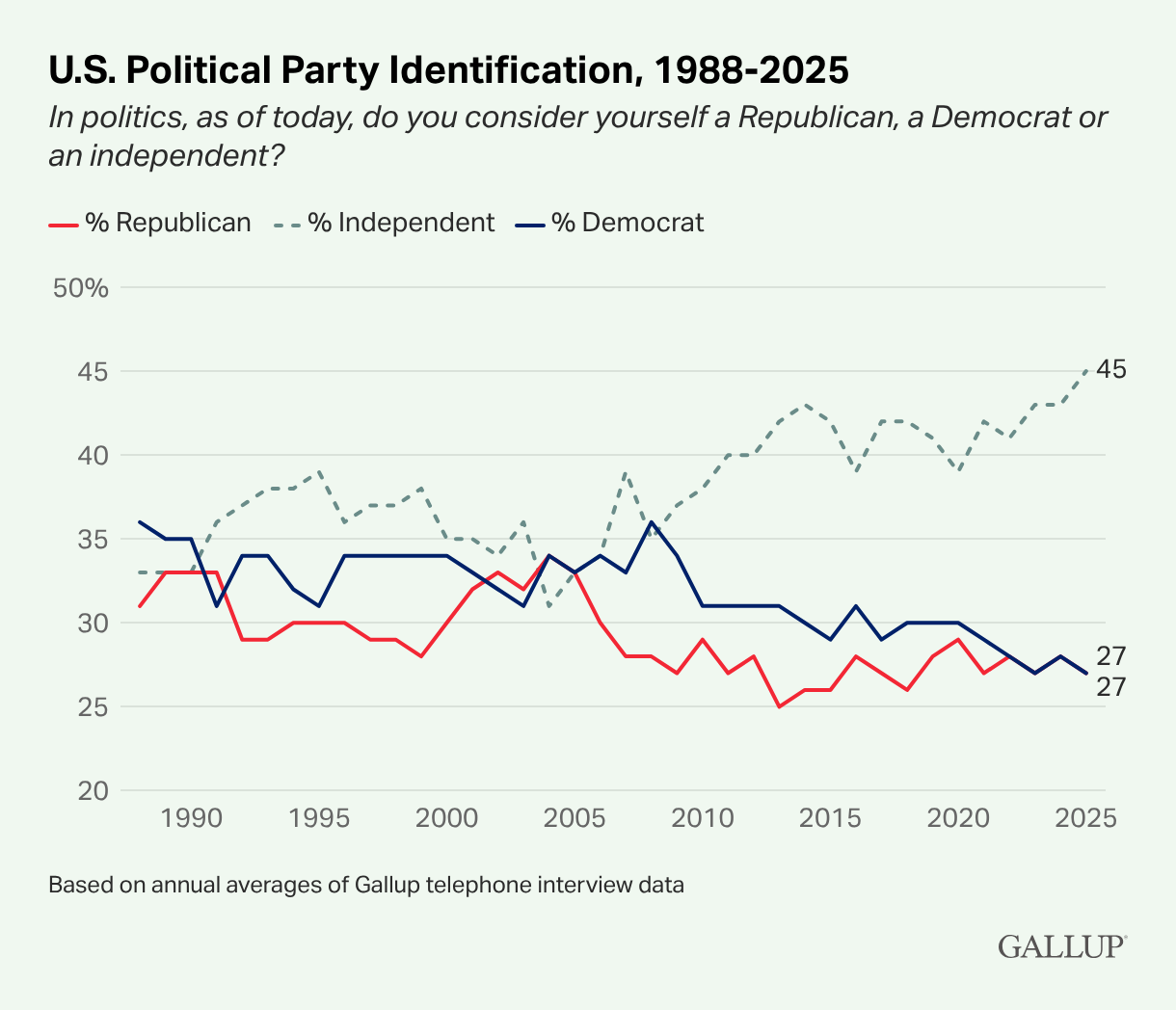

New High of 45% in U.S. Identify as Political Independents

Source: Gallup

Sign up for our reads-only mailing list here.