My back-to-work morning train WFH reads:

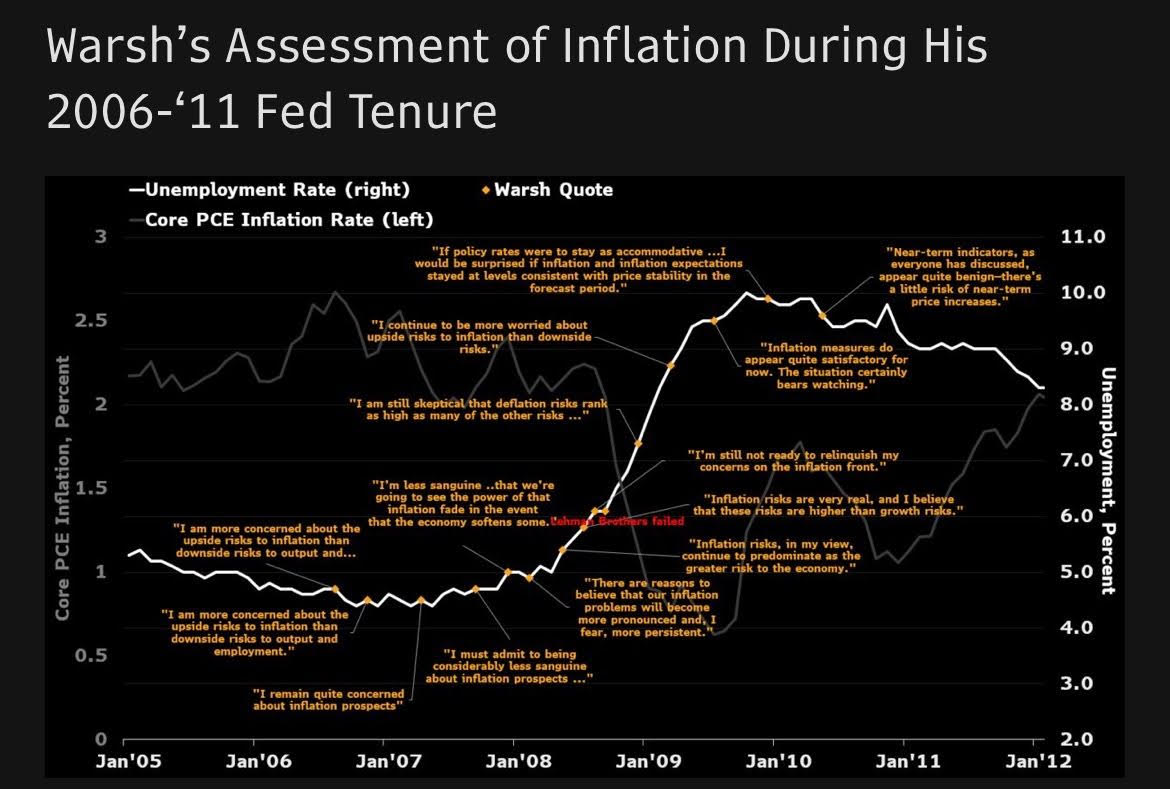

• Kevin Warsh Is Trump’s Man—and His Own. How He Will Reshape the Fed. Kevin Warsh is President Trump’s nominee for the next chair of the Federal Reserve, Trump says in a social-media post. (Barron’s) see also A Bad Heir Day at the Fed: No, Kevin Warsh isn’t qualified. (Paul Krugman)

• What happens after the Age of the Dollar ends? International financial anarchy. A lot of people have this vague idea that the world’s finances are based on the U.S. dollar, but they don’t really know exactly what that means, and they don’t know what it would mean for the dollar to lose that status. In fact, people are right to be a little confused, because there are basically a few different ways that the dollar matters to the international financial system. (Noahpinion)

• Why public expectations of inflation matter: Think of my analysis here regarding the wisdom of the crowds as aggregating the FT’s findings. It plots actual inflation together with the one-year forecast of the BoE and one-year public expectations of inflation since 2006. The public has over-predicted actual inflation by an annual average of only 0.1 percentage points by 0.5 percentage points in terms of the median (although they wildly miss major turning points). (LSE Business Review)

• How high can prices in the Hamptons go? Median prices hit record $2.3M, fueled by Wall Street money and low inventory. (The Real Deal)

• Millions in bets ride on what Trump will say, do or invade next: More than $200 million is staked on political or government actions on Polymarket and Kalshi, raising concerns about insider trading from officials in the know. (Washington Post) see also When All Bets Are Off, All Bets Are On: Investors hate uncertainty. Speculators love it. (Wall Street Journal)

• ‘I just don’t have a good feeling about this’: Top economist Claudia Sahm says the economy quietly shifted and everyone’s now looking at the wrong alarm. (Fortune)

• ‘Spy Sheikh’ Bought Secret Stake in Trump Company: $500 million investment for 49% of World Liberty came months before U.A.E. won access to tightly guarded American AI chips. (Wall Street Journal)

• Jeffrey Epstein files: don’t be fooled. Millions of files are still unreleased. Federal prosecutors had identified 6 million files that were ‘potentially responsive’ to the law, but only released 3.5. Why? (The Guardian)

• The Midseason Steal Who Turned Into a Super Bowl Triple Threat: No one in the NFL has broken off more huge scoring plays than Seattle Seahawks’ Rashid Shaheed, the rare trade deadline acquisition who can return kicks, take handoffs, and catch bombs through the air. (Wall Street Journal)

• When Bruce Springsteen (Hank Azaria) Met Michael Stipe (Michael Shannon): Both actors pay homage to rock ’n’ roll greats onstage. But their relationships to their muses — and how they perform their songs — are very different. (New York Times)

Be sure to check out our Masters in Business interview this weekend with Kate Burke, CEO of Allspring Global Investments a global asset manager with more than 600 billion dollars in assets under advisement. She is also a director on the firm’s board. Previously, she was at AllianceBernstein as COO/CFO.

Kevin Warsh’s assessment of inflation during his Fed governorship (2006-2011)

Source: LinkedIn

Sign up for our reads-only mailing list here.