The Wall Street Journal – U.S. Profit Streak Hit by Global Weakness

Bid adieu to growing profits. Slowing economies from the U.S. to China, increasingly wary shoppers, recession in much of Europe and a stronger dollar could bring to an end at least 10 continuous quarters of profit growth for America’s biggest companies. Until Friday, the outlook had been for further growth in earnings. But forecasts are now turning negative amid a number of profit warnings from companies like

Starbucks Corp. SBUX -9.42%and Illinois Tool Works Inc. ITW +3.19%In the third quarter, earnings by companies in the S&P 500 are expected to shrink for the first time since just after the recession ended, according to Thomson Reuters, which surveys Wall Street analysts.

Comment

The story above is correct that earnings season has not been good so far. Keep this in mind as many stories will try to rationalize last week’s rally as a reaction to earnings expectations. Simply put, this is wrong. Earnings so far are not good and the rally was all about Draghi’s “whatever it takes” (detailed below) comment and Hilsenrath’s story last week suggesting “more QE might be coming.” These headlines showed, yet again, that the mere hope of running the printing presses can more than offset 300 sub-par earnings reports.

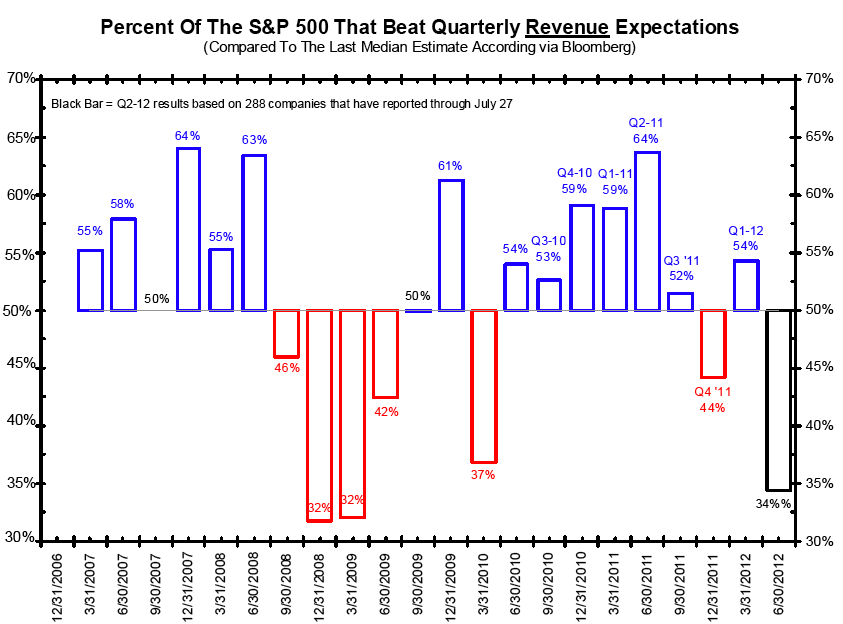

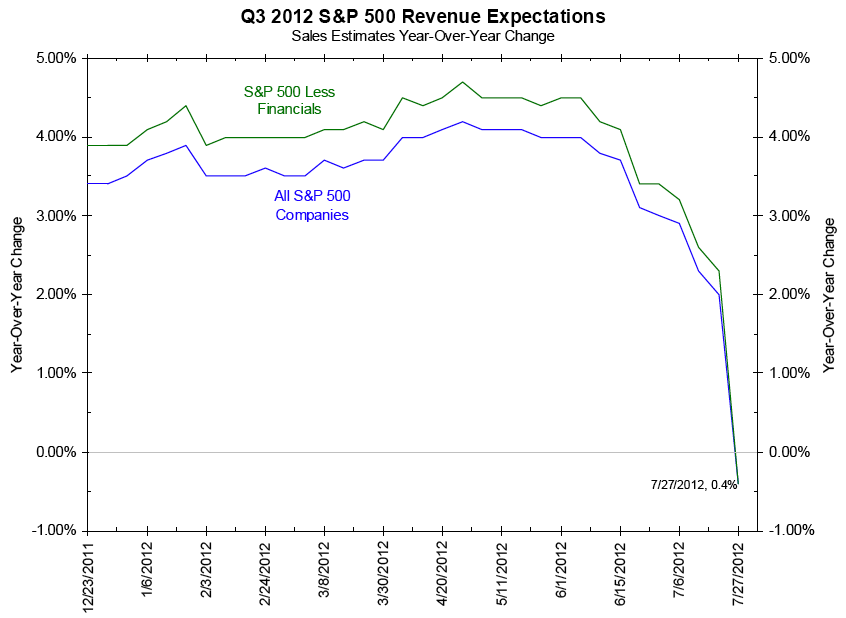

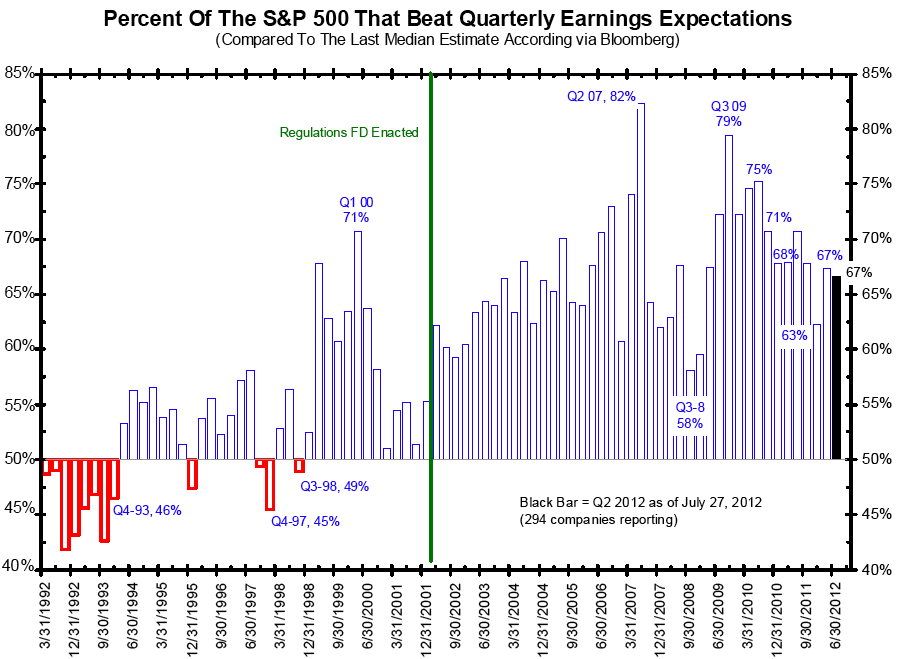

The charts and tables below detail earnings to-date. Of particular note are the poor revenue numbers. The charts show that negative revenue growth typically occurs during recessions.

Click to enlarge:

˜˜˜

˜˜˜

˜˜˜

˜˜˜

Source:

Bianco Research

Charts of the week

August 1, 2012

~~~

For more information on this institutional research, please contact:

Max Konzelman

max.konzelman@arborresearch.com

800-606-1872

What's been said:

Discussions found on the web: