Click to enlarge

Source: The Motley Fool

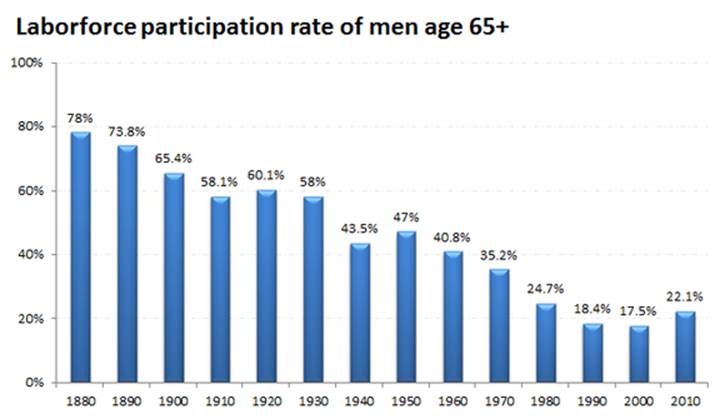

“The entire concept of retirement is unique to the late-20th century. Before World War II, most Americans worked until they died.”

The quote above is from Morgan Housel. He has become the most consistently interesting writer on Motley Fool (a site I never really grokked).

I was reminded of this over the weekend when I finally got around to reading a post of his on the flight back from the West Coast. The chart above is from a longer piece on savings for retirement — and we all know all the usual memes on that subject all to well.

But here is the crazy thing we often forget: Throughout history, most people never really got to retired. Men typically were working at age 65 and beyond. In 1880, 78% of Men over the age of 65 were still working. Most men worked til they dropped. Only recently — since the 1940s — have less than a majority of over 65 year old men not been employed in some capacity.

That is an astonishing data point. Retirement as we know it today is a less than century old phenomena. The truth of the matter is that most Humans (particularly males) never had the opportunity to retire. They simply worked until they died. You could not work, but then you wouldn’t eat — leading to the same resolution.

The combination of Social Security, private pension funds, IRAs and 401(ks) are the funding mechanisms. They are quite imperfect, but what they require is tweaking, not undoing. Raise the FICA cap on Social Security, and that becomes financially sound. In IRAs and 401(k)s, you can replace high cost under-performing active funds with low cost passive ETFs and see an immediate improvement in returns. There are simple fixes for what are essentially actuarial issues.

One last thing: Note that after 120 years of the labor force participation rate dropping for the over 65 male, it has begun ticking up again. The key question is whether this is merely a post-crisis catch up caused by 3 crashes — Stocks, houses & stocks again — or whether it represents a fundamental change in society.

We probably won’t know for another 5 years or so, but it is worth watching closely.

Source:

The Biggest Retirement Myth Ever Told

Morgan Housel

Motley Fool May 2, 2013

http://www.fool.com/investing/general/2013/05/02/the-biggest-retirement-myth-ever-told.aspx

What's been said:

Discussions found on the web: