What’s your story?

I don’t mean your personal history, relationship status or childhood neuroses. I refer to your market narrative. What story or stories are you telling yourself to rationalize your investment posture?

This is not insignificant. For many investors, a tidy little narrative help makes them comfortable with their positioning, regardless of that tale’s accuracy. This creates potential hazards as market conditions change.

We see dangerous, money losing narratives all the time — with politics, gold, elections, venture capital investments, financial crisis analyses, market crashes, individual stocks, models, just about any stock market event. Humans simply love a good story.

Why is that? Narratives impose a rationality on market action that is random and meaningless. This is especially true of the daily action, which is noisy and irrational. Investors are not fond of admitting this, so instead, they construct stories to convince themselves that (a) what is going on is rational; (b) they understand what is driving the market at any given moment; (c) they are well positioned to take advantage of it.

For most people most of the time, that story belongs in the fiction section. No one likes to admit they live in a random and meaningless universe.

The dominant narrative I see these days is about the Trump rally, and it goes something like this: The election of President Donald Trump, along with the retention of the House and Senate by his party, creates a scenario for sweeping changes in Washington and an end to partisan gridlock. Corporate tax reform, tax cuts, deregulation, repatriation of trillions in overseas profits and a major domestic infrastructure program are very likely, and U.S. markets are rallying in response.

This is a bit of an after-the-fact correlation, and the tidy little story fails to withstand scrutiny. There is also an element of politics attached.

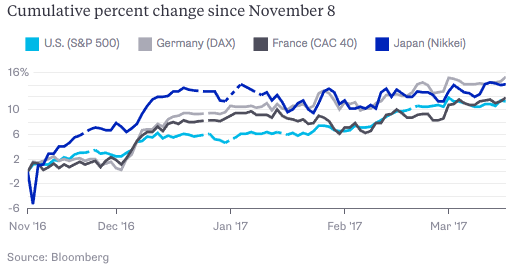

Stock Markets Since Trump’s Election

You can see it in that chart: Why on earth have France, Germany and Japan outperformed the U.S. S&P 500 Index since the presidential elections in November? Why would Trumponomics send French, German and Japanese bourses even higher? Especially at a time when the U.S. president is threatening a global trade war? When all of these countries are rallying simultaneously, the more likely cause (assuming we can find it) would be something common to all of them.

Given that markets around the world have rallied as much or more than the U.S., then perhaps the underlying driver isn’t U.S. centric but something broader, global — such as an improving economy and healthy profits. There are no expectations of a tax reform or tax cuts or deregulation or repatriation in these other developed nations.

But if that’s the case, it undercuts the mainstream narrative of U.S. animal spirits rekindled by those expectations in the U.S. markets.

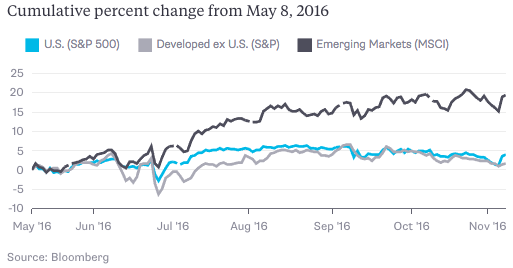

Consider that most global equity markets had been rallying during the six months prior to our November elections. Over the same period, the U.S. markets were flat. If you want to make the claim that we here in the States are now rallying due to that narrative, perhaps there is a better explanation.

Famed short-seller and hedge fund manager Jim Chanos of Kynikos & Associates observed in an email exchange, “While it seems obvious that the U.S. markets are embracing Trump’s vision of less regulation and lower corporate taxes, keep in mind that every developed market has pretty much matched the S&P 500 since the election. Those countries are not all deregulating and/or cutting taxes as Trump is proposing.”

Chanos further points out that “animal spirits” is simply one definition of a bull market moving higher. U.S. equities have tripled since the March 2009 lows; the post-election rally may simply be a continuation of that prior move.

If France, Germany and Japan are outperforming U.S. markets since the election, that implies the mainstream narrative is wrong.

Those market professionals looking for a good explanation for the U.S. stock rally should reconsider their obvious narratives. Otherwise, they won’t be prepared when the storyline eventually turns.

Originally: Once Upon a Time, There Was a Trump Rally