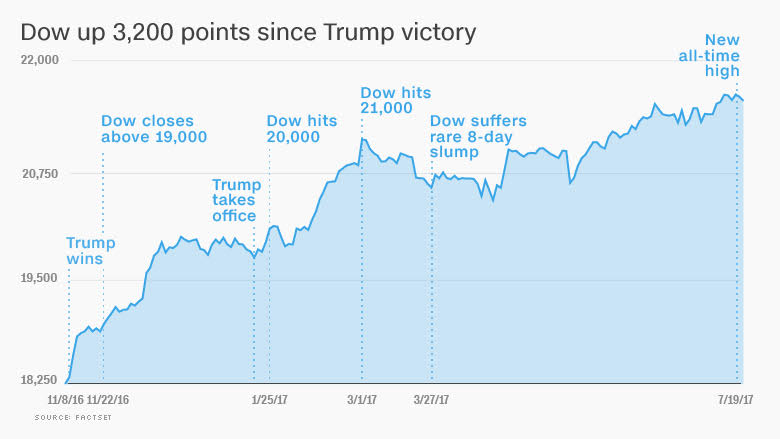

How much wrong can you spot in this CNN Money graphic? (Answer after the jump):

Source: CNN Money

Answer: Start with “Denominator Blindness” — the tendency to see one number without any proportionality or context.

-Measuring markets in points not percentages is a classic error

-Lack of context: How does this compare to period immediately prior?

-No Global comparisons made? How did USA do relative to other markets

Whoever drafted that chart suffers from what we have previously called “Denominator Blindness.” This is the tendency to become overly excited by big round numbers without any real understanding of context or what they really mean. It’s a common mistake, the kind that can lead investors to make costly errors in their portfolios.

Showing a 3,000-point rally without any context is pointless. For example: How does this rally compare to other markets around the world over the same period? How does it compare to other post-election periods? How significant is 3000 points – is that a lot or a little? Missing proper proportionality and context can occur in numerous ways: it can take place across different eras, locations, or using wrong measures of gain.

Nothing too significant: just time, space & identity.

You can make the same complaint about media market analysis during Obama and Bush presidencies as well:

It’s going to blow up the deficit, won’t create any jobs and will cause all sorts of other problems.”

A hedge-fund manager was lecturing me about the Jobs and Growth Tax Relief Reconciliation Act of 2003, better known as the Bush tax cuts. I had been suggesting that this fund close its short positions on technology stocks, and move to a more constructive equity posture. I was getting nowhere.

The fund manager, active in New York Democratic politics, couldn’t see past the policy issues involved. As long as George W. Bush was the U.S. president, this manager’s bias was against long positions. But as an astute market observer noted at the time, “Give me a trillion dollars, and I’ll throw you one hell of a party.”

How did missing that party work out for him? From the pre-Iraq war lows, U.S. markets rallied 96 percent during the next four years. Chalk up another bad investment decision to political bias, emotional involvement and lack of objectivity.

Before Republicans chuckle too hard, the exact same conversations played out six years later. In March 2009, I kept hearing how the newly elected, Kenyan-born, Marxist President Barack Obama was going to be bad for investors. Some 10,000 Dow points ago — literally, the very day of the lows — Michael Boskin, chairman of the Council of Economic Advisors under President George H. W. Bush, penned a Wall Street Journal op-ed titled, “Obama’s Radicalism Is Killing the Dow.”

The same errors over and over.