Source: Medium

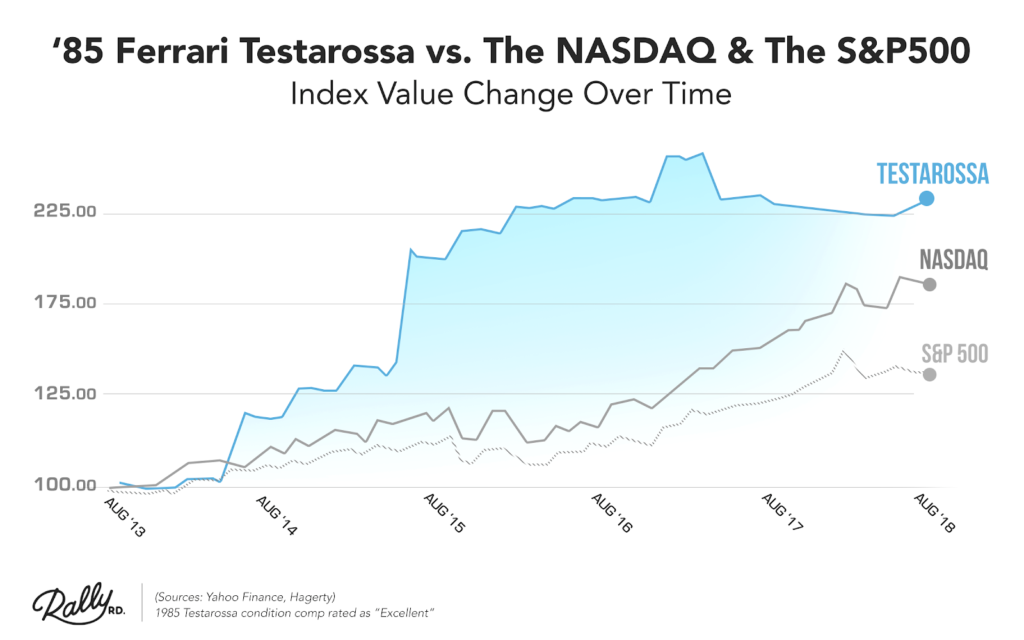

All you need is some cash, a good mechanic — and a time machine — and you too can beat the broader indices.

Or not.

Regular readers know of my affinity for beautiful automobiles. Whenever I find a gorgeous rolling sculpture, or a high-horsepower performer, or simply a lovely cruiser that tickles my fancy, I post a few snaps of it on Friday mornings.

However, I am very much aware of how challenging it is to turn that interest into an investment. Selecting a car after the fact to show how well the class has done is simply cheating. Hey, just buy Apple in 1985 and hold onto it for 43 years! Investing is easy!

The bigger question for investors is how well has the overall group of this investment class (collectible automobiles) has done versus a handful of limited production Ferraris or other makes manufactured in limited numbers — the Apple and Amazons of automobiles.

These cars have always been expensive to maintain, to store, to keep in top shape. A bad repaint or questionable valve job could significantly diminish the value of a vehicle. Then there is the issue of how modest the market is for these vehicles when you want or need liquidity. The most rarest and valuable Ferraris and Aston Martins and Mercedes Benz — those that go for 7 and 8 figures — have a very small pool of potential buyers.

Take the Ferrari Testarossa mentioned above: it is a 12-cylinder, mid-engined, high production car — all told, Ferrari made about 10,000 Testarossas, 512 TRs, and F512 Ms — making it one of the few mass-produced Ferrari products. Not much of a racer either; this is hardly the stuff of legend.

Let a specific car become less fashionable — they go in and out of style regularly, and can lose prestige — and that big value is at risk. The aforementioned red head in the chart has been thought of as an over the top example of Ferrari’s designers losing sight of what made these cars beautiful in the first place. You can still find Testarossas for under $100k, but see this one — used by Michael Jackson in a Pepsi commercial — that is listed for 7X what is typical; (it has yet to sell).

One last thing: When it was introduced as new in 1984, the 1985 Testarossa listed for $90,000 (but dealers charged huge premiums over list due to “Ferrari fever.”) You can still find Testarossas for that original list price — meaning the net returns over 43 years has been precisely zero — before maintenance, storage and repair costs.

As a comparison, in 1985, the benchmark S&P500 was about 200, and it closed yesterday at 2,821.93. That generated an average annual return of about 8.5%, returning 1,400% price appreciation since then, and, with dividends reinvested, over 3,000% total return (in nominal terms, like the chart above, neither is adjusted for inflation).

Selecting investments after the fact is easy; ask yourself this question: What car do you want to buy as an investment for the next 34 years to be sold in 2052?

Not my favorite Ferrari