MiB: Ed Yardeni on the Roaring 20s

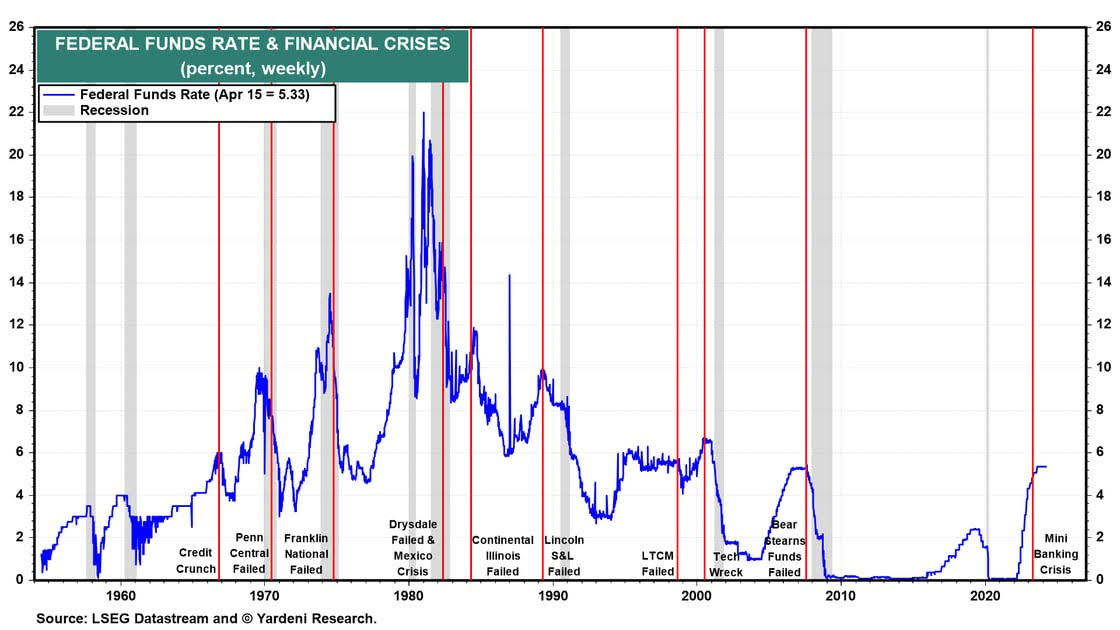

This week, we speak with Dr. Ed Yardeni, President of Yardeni Research, a provider of global investment strategies and...

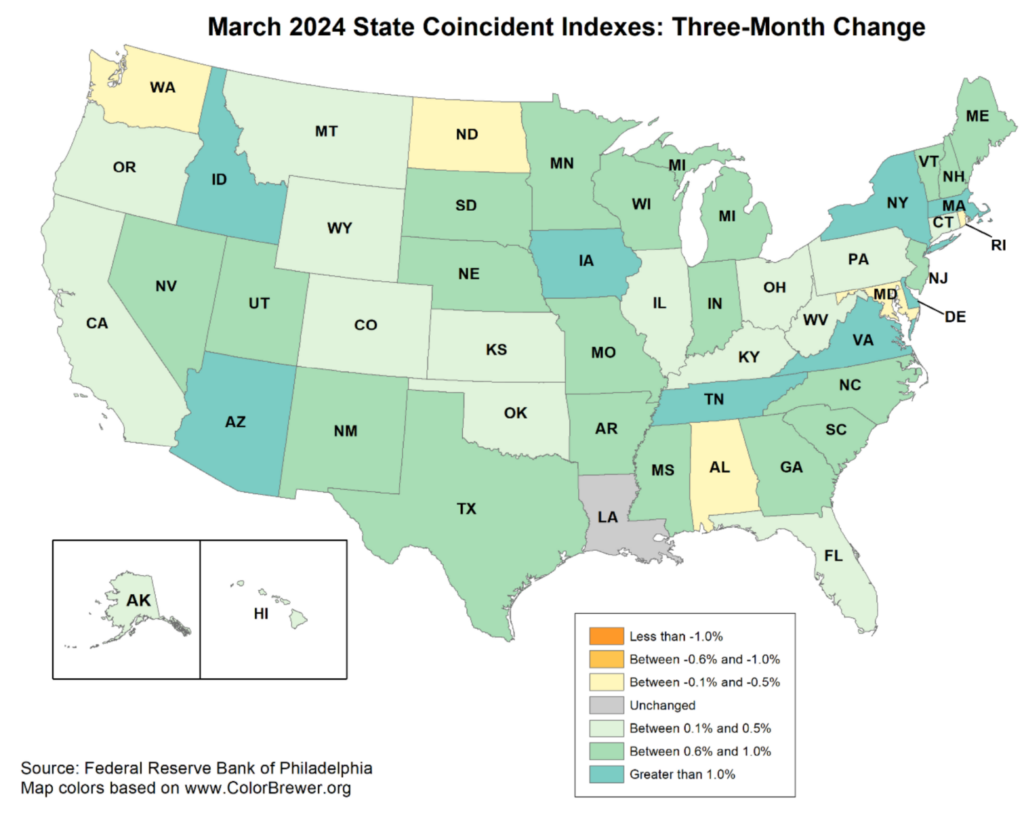

A quick note on the state of the economy in light of some recent data. Q1 2024 Gross Domestic Product expanded at a...

A quick note on the state of the economy in light of some recent data. Q1 2024 Gross Domestic Product expanded at a...

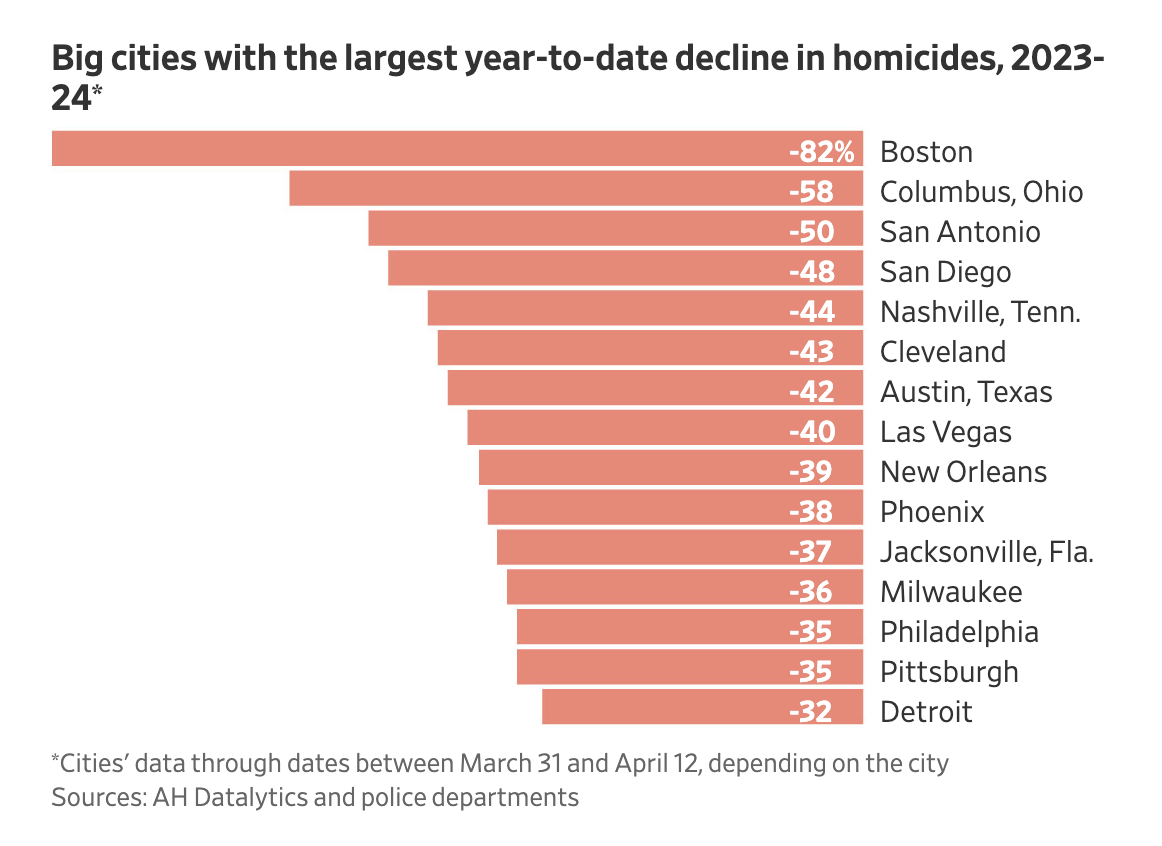

Avert your eyes! My Sunday morning look at incompetency, corruption and policy failures: • ‘Water is more valuable than oil’: the...

Avert your eyes! My Sunday morning look at incompetency, corruption and policy failures: • ‘Water is more valuable than oil’: the...

The weekend is here! Pour yourself a mug of coffee, grab a seat by the fire, and get ready for our longer-form weekend reads: • He...

The weekend is here! Pour yourself a mug of coffee, grab a seat by the fire, and get ready for our longer-form weekend reads: • He...

Get subscriber-only insights and news delivered by Barry every two weeks.