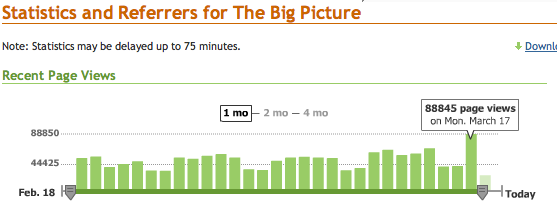

We noted back in February that the surge in page views tends to occur towards a tradable low — not THE low, but usually one that is good for a few weeks. That last contrary signal worked out quite well.

We got another such signal on Monday — page views skyrocketed to what might actually have been the single biggest one day total.

In other Contrary Indicator news, it was reported yesterday that Goldman Sachs replaced the perennially optimistic Abbie Joseph Cohen as their chief markets forecaster.

Have a look at the chart below. This suggests a temporary crescendo of bearish activity:

Above you will find the latest snap of the traffic. Inexplicably, Typepad uses GMT to GMT as their day, rather than having the date be set to the users locale (i.e., midnight to midnight EST).

>

I’m writing this Monday night, and hopefully won’t be too embarrassed about this Tuesday morning (Ed: Futures are considerably higher this morning). Be aware that Producer Price Index (PPI) and Housing Starts are out at 8:30am, and the FOMC announcement is at 2:15pm, so today is likely to be quite volatile.

~~~

I am curious if any other bloggers saw a similar traffic surge . . .

I think it’s just your site that gets this traffic, Barry. At times of extreme uncertainty, a lot of us look to you for level-headed analysis that just doesn’t exist anywhere else. Don’t know about everyone else, but late Sunday night I kept hitting refresh every few minutes to see if you had anything to add.

Calculated Risk saw a very large increase in their views and comments as well.

I agree…traffic in our discussion forums was normal yesterday – but I’m sure people were reading headlines and blogs like crazy.

I know I was.

George

Barry, good job on the show last night. Maybe CNBC should think about replacing Kudlow like GS did with Abby Joseph Cohen. Kudow has not been right on a single thing in the last year, CNBC should give him a mop and keep him away from the on air programing.

~~~

BR: Thanks for the kind words — I’ll get the video up later this afternoon.

Agree, a tradable bottom but not THE bottom.

The entrails of MY owl says 4 to 6 weeks of fair weather. Enjoy!

A mention in ISI probably didn’t hurt your traffic much.

Barry,

Just a thought. With MF Global and GFI down hard yesterday, could it be “telegraphing” the CFTC will change margin requirments to 50% or more to trade corn, wheat oil etc?

They did this in the 70’s.

Interesting – of course you’d have to divide my traffic by 100 but with that yesterday didn’t see a surge. Su. did when I put up an emergency focus post a bit but I’ve been wailing about the credit metastasis for months now. My biggest surge was actually on the Yhoo/MS deal – different strokes.

OT – maybe a tradable low per se but it also tells us something else. Mr. Market really wants to go up because they think this is normal and are ignoring the economic and credit breakdowns. Floyd Norris’ recent Rose appearance is a jewel and worth your time. He discusses this “it’s time to buy” meme that’s going around in context. Yeah they’re right if this were a normal cycle. Of course now it’s Summers/Feldstein AND Krugman all discussing why it’s not. Does it get any more authoritative ? That’s two Clark medals btw as well as at least one likely Nobel.

After the crescendo of weekend activity, I am left pondering a couple of unaswered questions:

Does this mean $2 is the new $0?

Are Bear Stearns execs now considered rogue traders?

Indicative of heightened concern I would think. People seeking answers to address their fears. Good job on Kudlow btw, although when he’s set in his thoughts he’s a tough nut to crack to give equal air time.

It wasn’t just you BR. The action in Asia and over here by the Fed over the weekend raised a lot of eyebrows and had everyone(myself included) scouring the net to catch up.

If you are trying to arrive at the conclusion of “People seem to be turning to the net as much as…or in some cases…in lieu of the TeeVee”…I do believe the tide is slowly turning that way.

Folks are starting to smell a rat in the MSM. ‘Bout bloody time!

My page views were nearly double the average for a Monday in the past four weeks. What’s interesting, however, is that my content is light in “financial news” and heavy in logic, self-awareness, and emotional intelligence.

Perhaps people are wanting a momentary escape from the “noise” before diving back in…

On a separate note, what effects do readers here believe the over-abundance of information is having on investor behavior and financial markets? Is the herd more irrational and quicker to respond to news than in the previous Bear Market and Recession? How many people were reading blogs on a daily basis 6 years ago?

People are trying to hard to catch the bottom. Any negative big day and people jump on it with everything. Eventually they will get burned.

This is not the bottom even short term I don’t think. Not with hits like this:

*DJ Goldman’s $1B Mortgage Losses Mostly Prime And Alt-A >GS

I have no choice but to tell all my friends to cover all the short positions they built just few days ago! No doubt, they will hit me in a very hard way! This is what trading life means!!!!! F$£K!!!

CAPITULATION! MY WAY!!! Have a good trading day!

One more thing, I’m not very sure the bull is here, but surely the BEAR(BSC) is killed! A relief!!!

I am leery of this contrary indicatory – I am afraid that too many are confusing Long Term Capital Management,the company, with Long Term Capital Management, the event.

The only thing that has changed is the perception that one land mine has been sidestepped – but that doesn’t mean we’re not still in the middle of a minefield, blindfolded.

Did anyone catch Jon Stewart last night? He started with “There’s a little saying in the news business, ‘Stocks before whores, and we’re all poor'” Hilarious. In addition I’m starting to wonder if I shouldn’t invest in weed… at least that makes me happy when it goes up in smoke.

How’s this for a contrary indicator: Market opens UP 200.

If the FED were not f*cking around trying to save things, all of the shorts would have made a sh*tload of money already. Instead, we get whipsawed for our diligence. I would say that its more profitable to be a sheep, but nah – It’s just more comfortable. F*cking lack of free markets.

As I cruise the net for info, I can find calls for deflation, inflation, $150 oil, commodity crashes, opportunities w/ corp debt, tradable bottom for stocks, etc. With this much confusion it appears to me to be in the 3-4th inning, not the end.

Barry, do your spikes in traffic also coincide with big Fed actions? Not trying to burst anyone’s bubble (I visit this blog faithfully), just trying to get a larger perspective on things.

Posted by: pete_bk | Mar 18, 2008 9:32:13 AM

And, because it’s contraband, it’s naturally tax-free!

It’s nice that we have redeeming social value.

How many people were reading blogs on a daily basis 6 years ago?

Posted by: The Financial Philosopher | Mar 18, 2008 9:09:38 AM

____

All of this info is free, and should be marked to market.

Barry – simple reason for the spike.

You were quoted on pg C1 in yesterdays WSJ at the bottom of Mark Gongloff’s column.

“”This has become the new bird flu,” says Barry Ritholtz, director of equity research at independent research firm Fusion IQ. “it’s infected everybody.””

Like I said before – you slay me.

Great blogs just keep getting more people watching.

Apparently Federal money is ‘free’ too provided you are the right kind of people.

Your old paradigm has shifted. This site and Calculated Risk are no longer the obscure little sites that we “smart” web viewers went to for some unabashed truth amid the bull. With Krugman quoting you guys and references in the MSM, your viewership is bound to go up on things beside the state of trading on the Street.

“Indicative of heightened concern I would think. People seeking answers to address their fears.”

“Folks are starting to smell a rat in the MSM. ‘Bout bloody time!”

Both of these comments apply in my case. I wouldn’t know a derivative from, well, anyway I do care about the future value (or lack of) my home, how much food might cost, employment prospects, what we should do with our retirement plans, etc.

This blog has become one of my main sources for an accurate picture of what is going on with the economy.

Hard to break delusions I guess. Esp. when it is a GSM – Goverment Sponsored Markets.

And you have quadruple witching:

Fed, Benny, Paul and President showing up all over, every-day…and brokers today saying we are cool again!

Quarter-end on the horizon now.

Collective Psyche is hard to break out of.

I come to this site for reinforcement of what I already know. I also go to a couple of traditional bullish sites to balance my cynical nature.

This site is also good for an occasional belly laugh and for the insights of certain posters.

TBP actually does good research. Something that has become increasingly difficult to find.

My traffic is up about 50%. But I agree with other bloggers who’ve responded here: many individual investors are seeking a information, opinion and comforting community (whether they’re in the bear or the bull camp) in this period of confused momentum.

BR,

Well I agree with you, I noticed comments were up big on yours and other blogs also. But, the ultimate trading bottom signal has to go to…. CINEFOZ….applause…

When he gets bitchy and starts to imply there are terrorists conspiricies at work taking our markets down. Damn, if i didn’t cover my shorts in Futs, and shorted gold.(Gold short posted here yesterday morning btw, out 1/3 position this morning, counter trend trade only short time frame). I just love that guy…LOL

Financial Philosopher,

Great point, I keep wondering what the Broad use of blogs, social networking, and this faster and broader dissemination of “Information” will, and has been on “Mother Market”. Even more interesting is the possible impact on the “wall street bubble” consciousness.

It’s a very interesting point, probably waisted on the multitude of petty Mouthbreathers.

Thoughtful and objective commentary such as yours will continue to gain traction over the sophomoric emotional sound bites of CNBC or FBN. Particularly on days where significant news is breaking.

Having chucked the TV from my trading room 2 years ago to avoid the emotional CNBC hype, I can attest to the fact that less TV=more profitable trading results.

Barry …

It’s a flight to quality !!!

Seriously.

Congratulations.

At the end of the day, I believe traffic at financially oriented web sites is driven by publicly available information, and its timing. Nonetheless the traffic volume may be valuable non-public commentary on the public information. Certainly the Sunday BSC action, and the runup to it, were quite controversial in several ways.

Yeah, I’ve had to turn to some other obscure blogs for the deeper analysis these days. ;^)

CR and BR are still must reads, though.

“But, the ultimate trading bottom signal has to go to…. CINEFOZ….applause…”

And that is why we ought to play nice with him.(as well as with each other)

“Don’t tap the aquarium” is an aphorism that also apply outside of the favorite game of Chris Moneymaker*. :-D

*Sorry for the cryptic way to describe it but Typepad filter seems to have a bout of Victorian moralism today

I had a small spike yesterday, but nothing to write about. Levels are near the beginning of March, which was pretty high.

Barry, do your spikes in traffic also coincide with big Fed actions? Not trying to burst anyone’s bubble (I visit this blog faithfully), just trying to get a larger perspective on things.

This is exactly what I was going to ask.

Interesting indicator you have discovered. I will have to do a little more research on my blog traffic patterns.

out 2nd position (now 2/3) of my short gold call. Posted in here on Monday, 1029.80 was entry, out 1/3 yesterday morning. 980.40 exit just a few minutes ago. This was counter trend short swing trade only. Stop at 1017.30 for last posistion. This posted for Cinefoz only, You see Cine, this is how you post a top or bottom call. Not these bottom calls that go on for 3 months, with you averaging down the whole time, while missing some great oppurtunties in both directions.

out last 1/3 gold ss 955.30 from 1029.80. I am not a swing trader by nature and this trade worked out far better than I thought. So I take my profits and go. Probabaly should just trail stop instead. But it is what it is. Thanks again cinefoz… the ultimate contraian indicator.