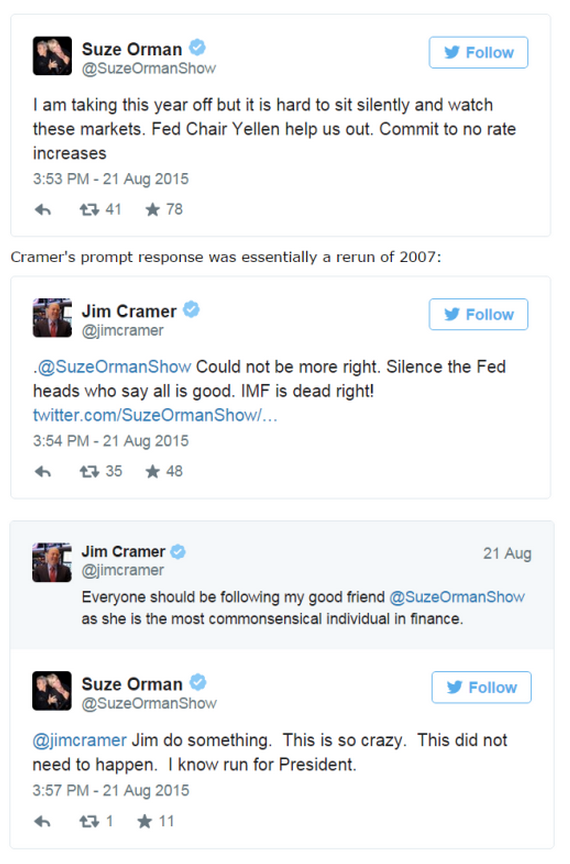

I am reminded how utterly worthless as a market observer/financial adviser Suze Orman is in this series of tweets. Its simply amazing how much terrible advice and lack of comprehension people can reveal in a mere 140 characters.

“Demands for low rates begin as the financial class panics”

Hat tip: Vulgar Trader

She would have been a real hoot in 1987.

Orman proffers financial advice as White Castle proffers sliders.

Both cause rectal dysfunction.

Barry, Goofs like those two remind me of why your blog is so aptly named.

Cramer says she is right. That’s reliable proof that she is wrong.

She want Jim Cramer for President!!! – well I guess it would be better than Trump.

Maybe I am thinking wrong. But I hope this down turn holds for six weeks more. I will retire by then and will put a final contribution into my 457B plan of 24K which is about 80% stock funds. Another bite of the apple.I will not depend on those savings to pay my bills so I view this market down turn as an opportunity. I plan on not take a distribution unless the market is up. If the market is down when I hit RMD age a little less than a decade away I will simply pay the tax on the distribution and re-invest with that money which should net more or less the same shares but lower my tax bill per share. Mr. Ritholtz is right markets go up and they go down regularly. And actually the opportunities to make money are greater in down turns if you have the right mind set and are prepare to take advantage of them.

At least people are starting to see the stupid, but there is something worse than stupid going on here

https://www.youtube.com/watch?v=Ft49mr0uSVQ

Suzie? I have a question. I have $10,000 in credit card debt and $10,000 in cash, what should i do?

And that’s only with the S&P down ~8% from all-time highs after a 200% diagonal run-up. Imagine what they’d be saying if real and persistent losses were allowed to occur for say a year?

“no rate increases” is fine — there’s actually a case there not that it’s relevant to markets or that Orman could make it — but everything else is either bullshit or self/cross-promotion; two televangelists loping each others mule.

Suze Orman is to be congratulated for trying to raise the personal financial IQ of the general population, but she should stick to her knitting and not stray into the world of macro-economics where the Ritholz/Adams Principle (that I just made up) needs to be heeded: “Nobody knows the future, so don’t panic (towels help)”.

Thanks for being a source of reason in Schiff/Cramer-World Barry.

Suze and Jim should be ashamed of themselves for calling for more millionaire-welfare-by-policy but commended for tacitly and (perhaps) unwittingly admitting that today’s market is so dependent on Fed actions, not actual asset values.

I’d like to add a reminder to “stocks go up and down.” Juiced markets sometimes crash and this one has had an IV from the Fed for 6 years now. The next few weeks should be interesting. QE4, anyone?

As witnessed by the Chinese stock market.

Send in the clowns!

The Fed will only raise int rates if their money center banks are positioned to benefit from collapsing stock prices – but if they aren’t then it’s all hands on deck at the Fed to patch the stock dirigible.

If the TBTF banks are net short, hold on to your hats! In fact, if G-S is net short kiss your portfolio goodbye for the duration.