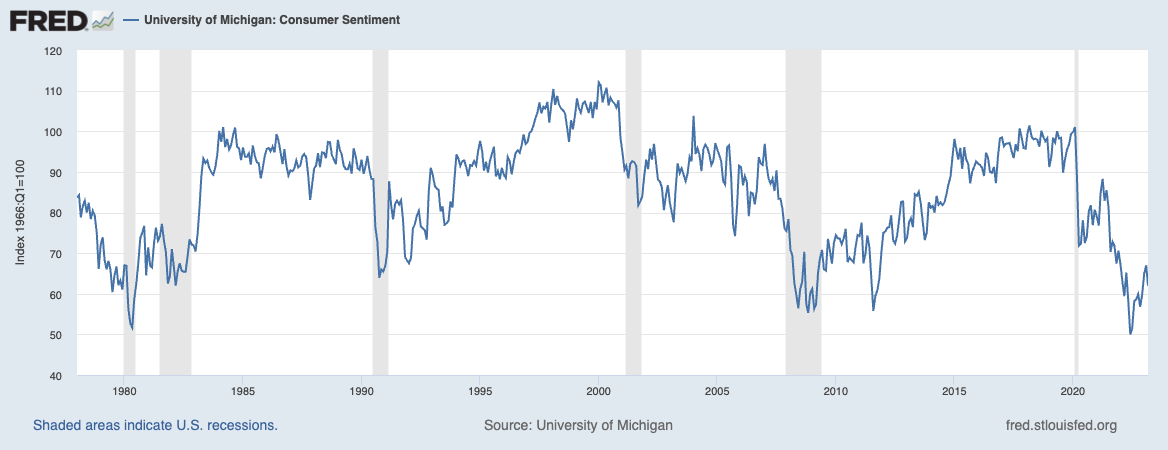

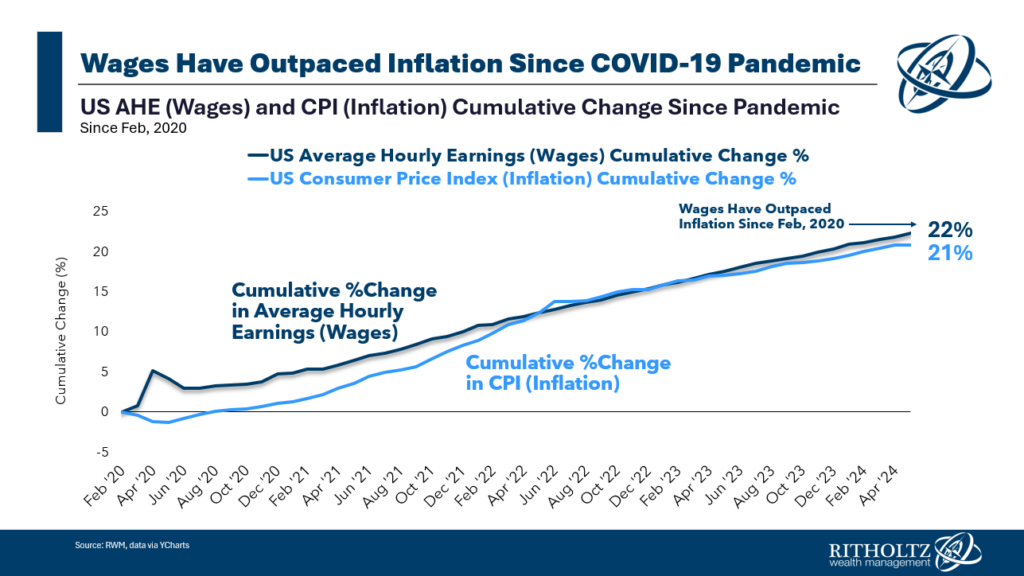

I’ve been observing how radically unusual various sentiment readings have been for a few years now. It made little sense to...

I’ve been observing how radically unusual various sentiment readings have been for a few years now. It made little sense to...

Read More

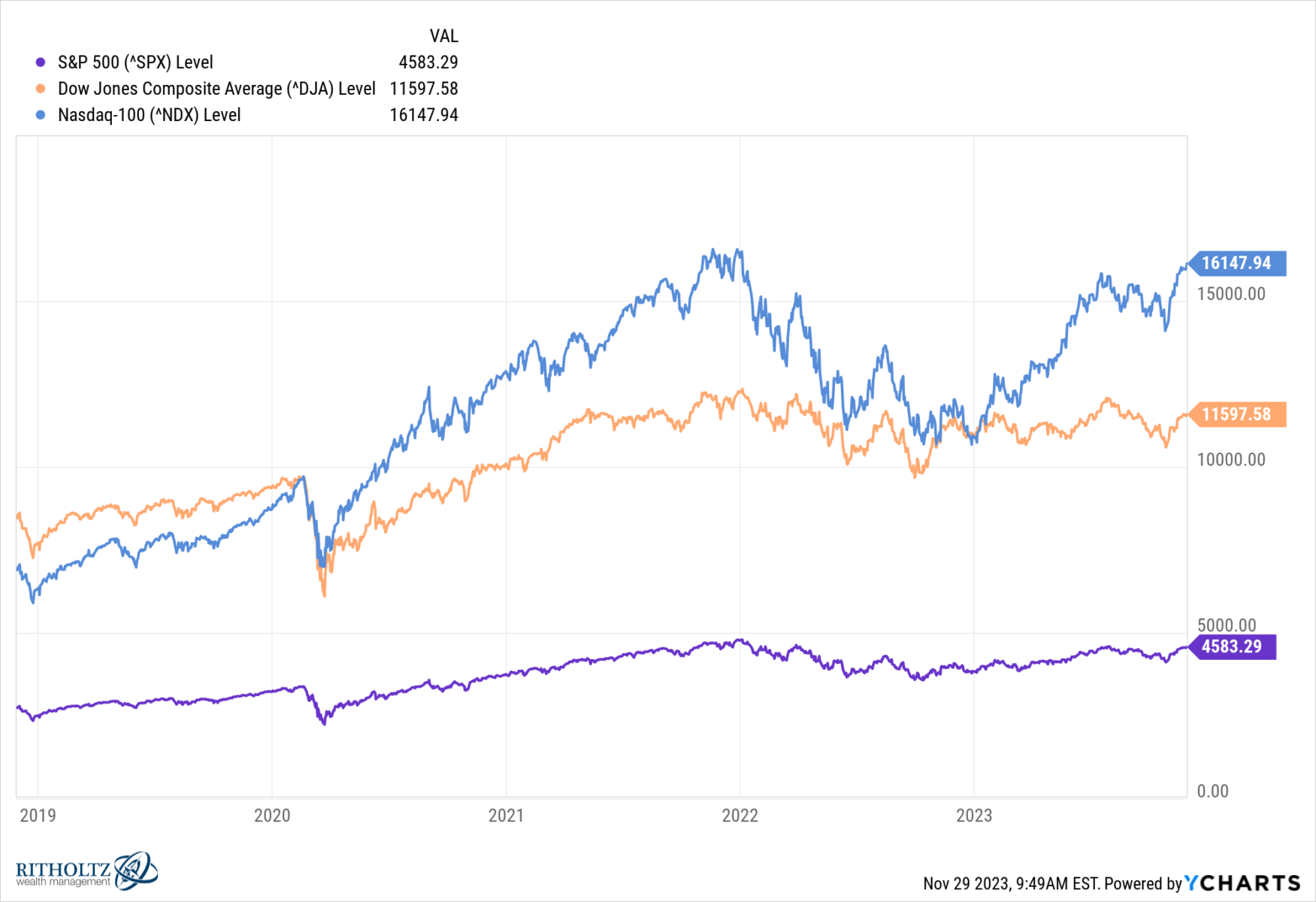

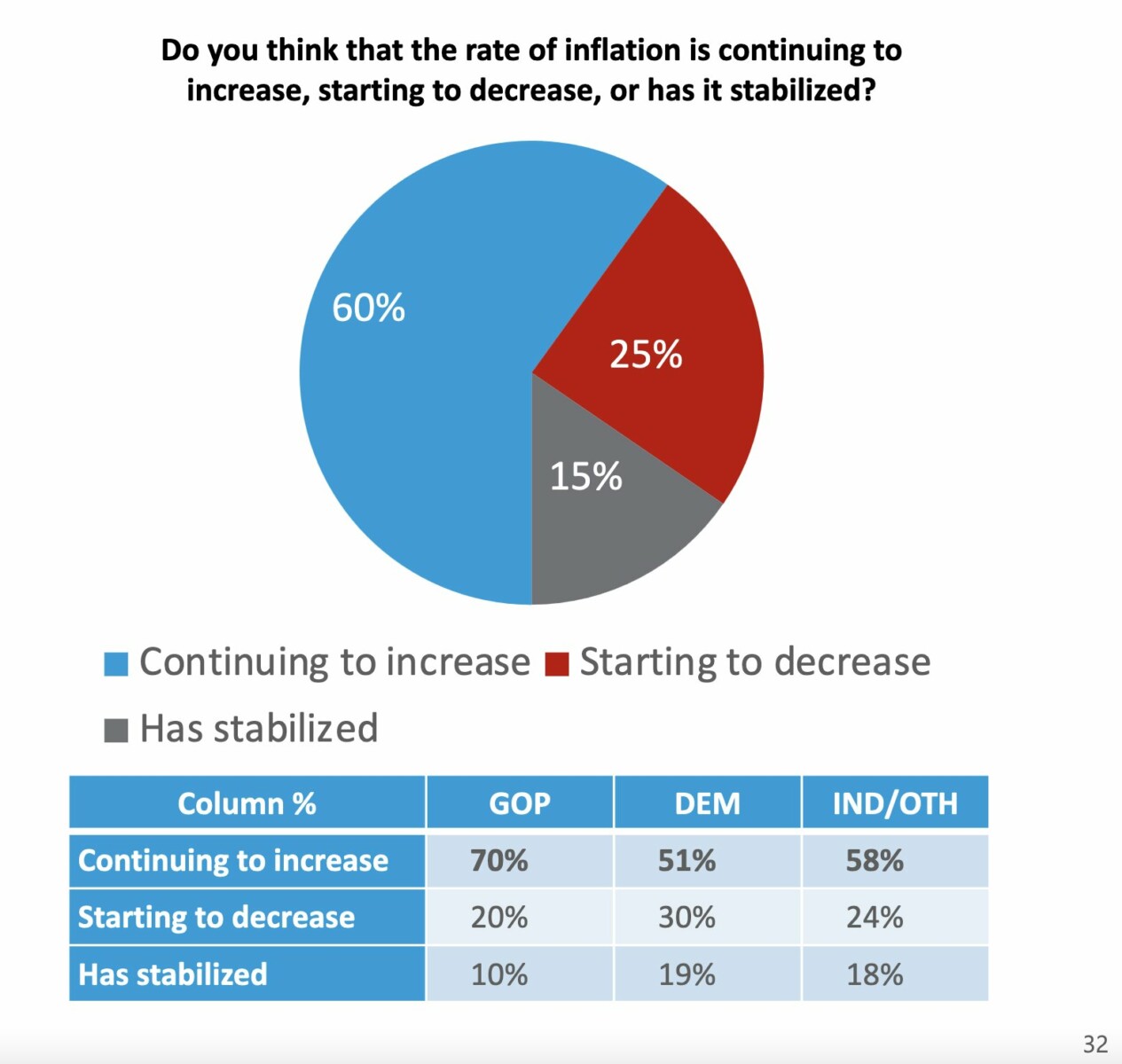

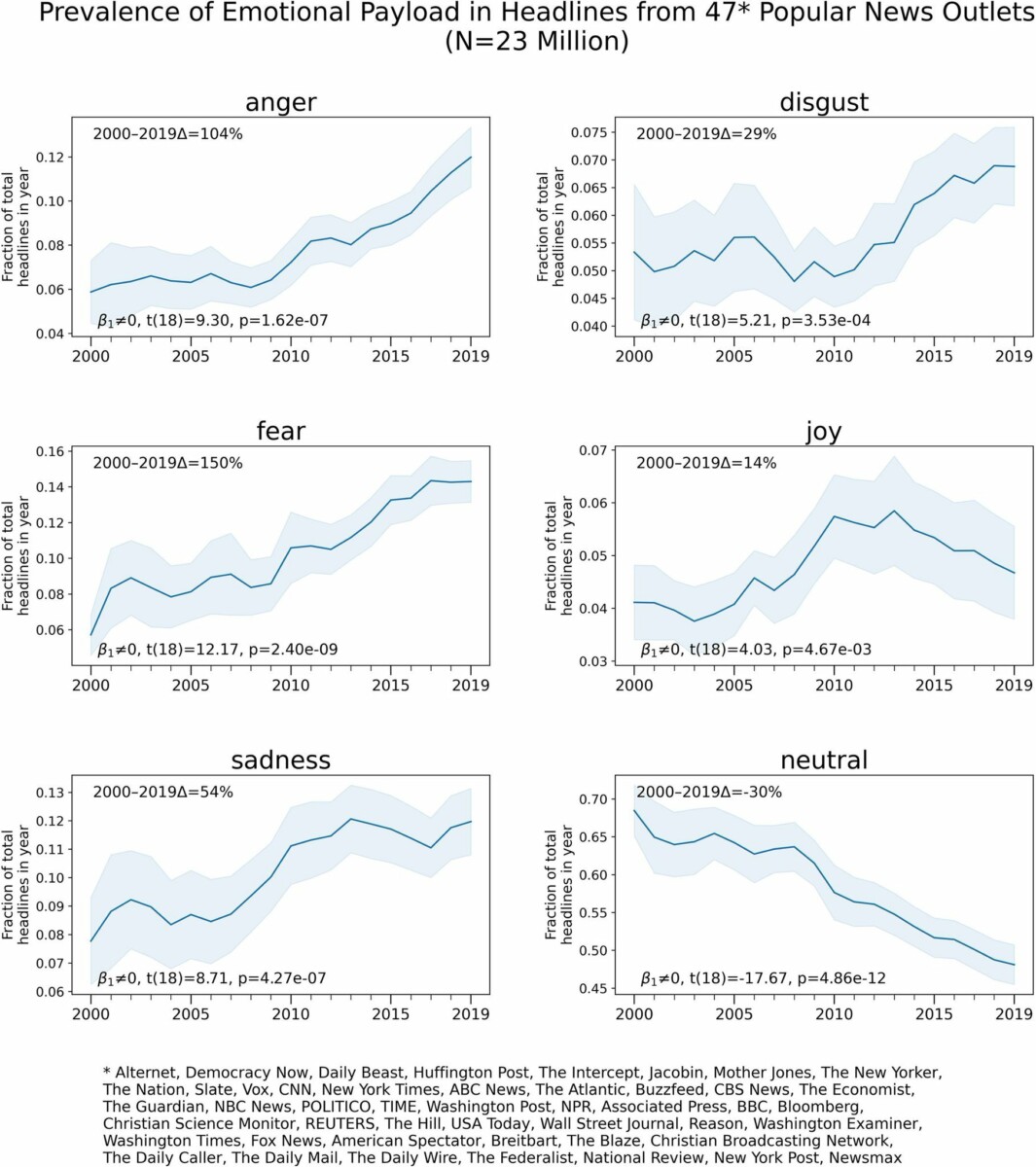

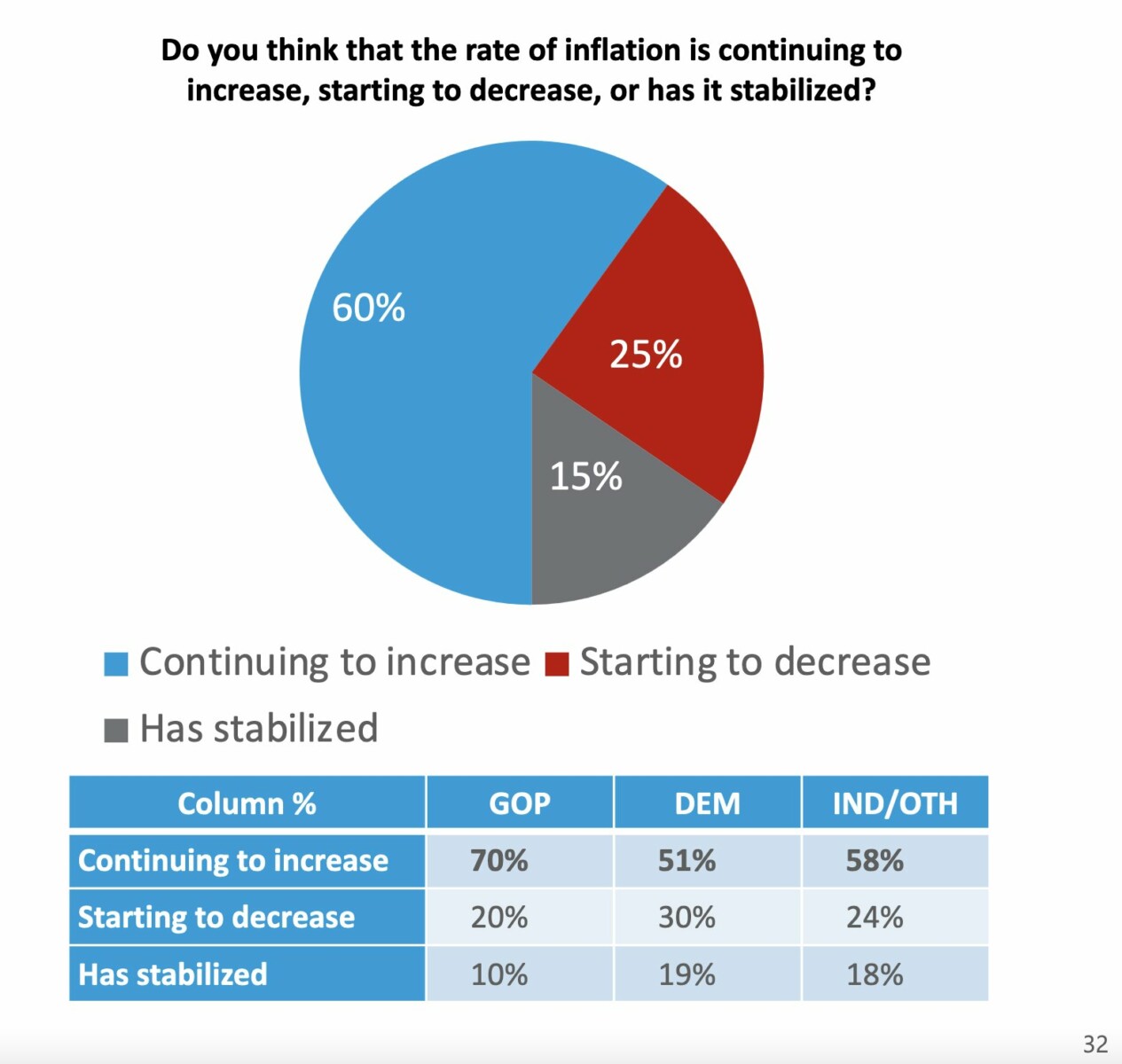

My long-standing skepticism about survey data has reached the point where I feel compelled to comment on the current state...

My long-standing skepticism about survey data has reached the point where I feel compelled to comment on the current state...

Read More

I have a vivid recollection of the period following the Great Financial Crisis: I spent March to September of 2008 writing Bailout...

I have a vivid recollection of the period following the Great Financial Crisis: I spent March to September of 2008 writing Bailout...

Read More

This week, we speak with Peter Atwater, president of Financial Insyghts and an adjunct professor at William & Mary and...

Read More

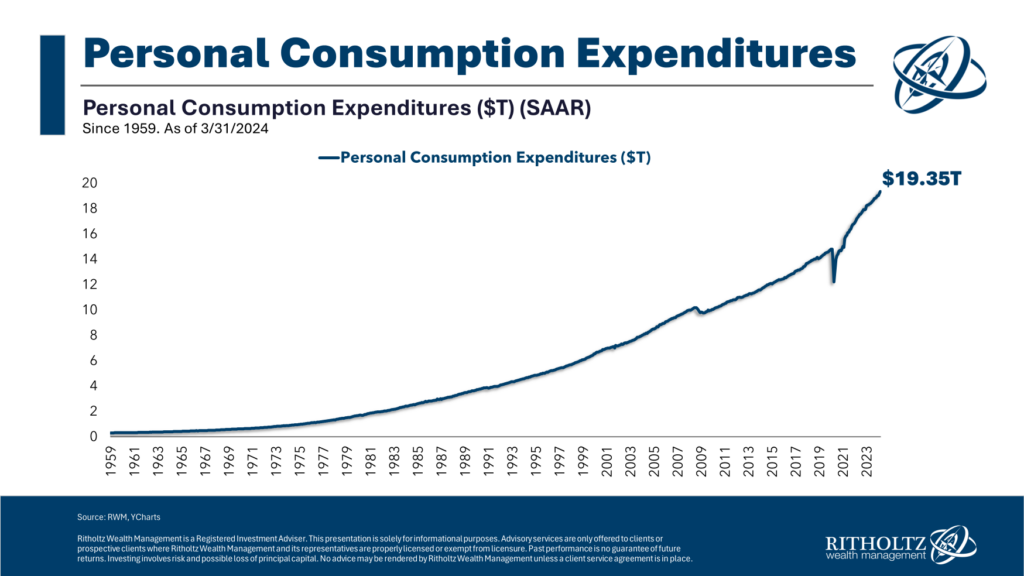

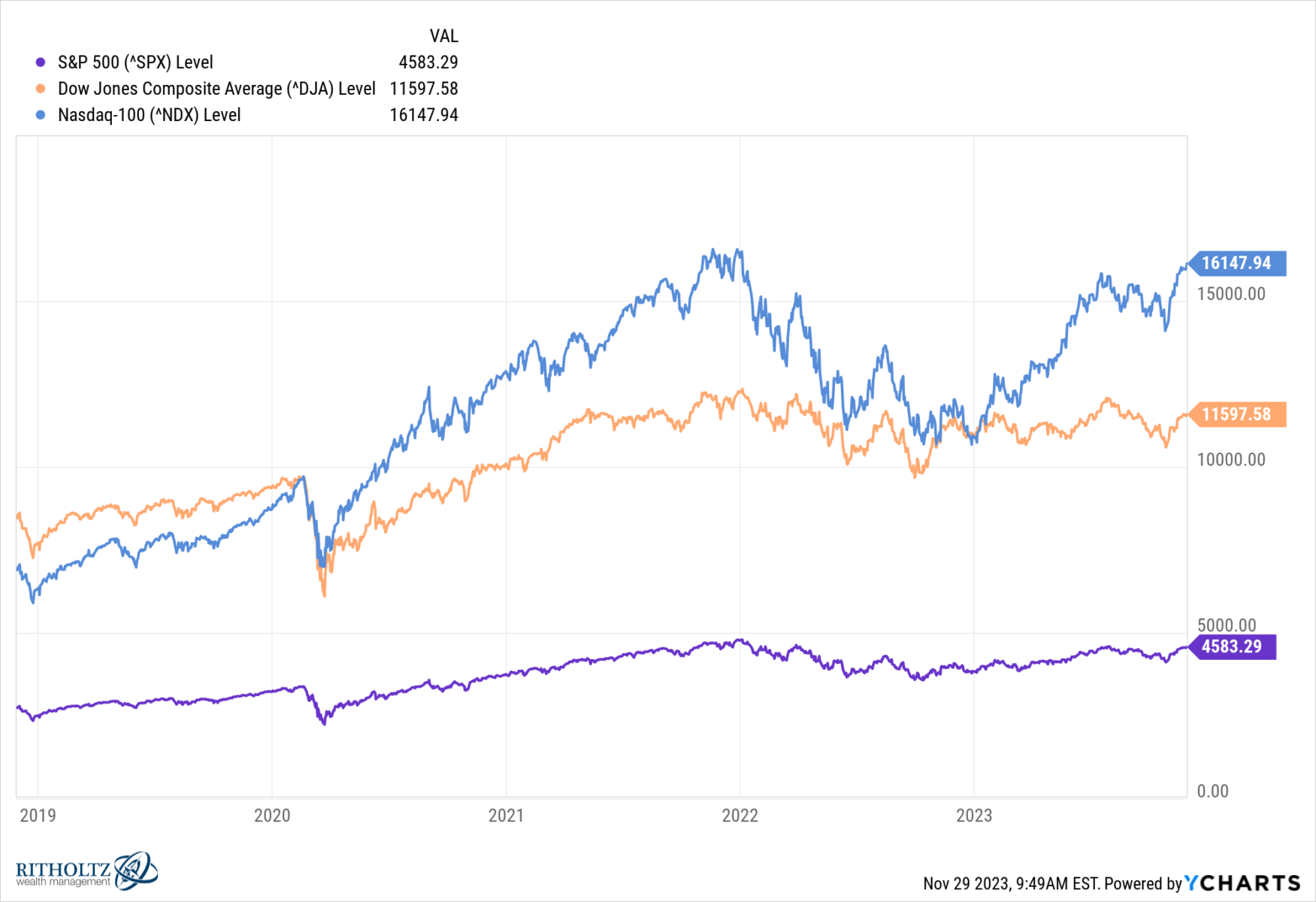

One of my favorite responsibilities as chief investment officer at Ritholtz Wealth Management is the quarterly conference call I do for...

One of my favorite responsibilities as chief investment officer at Ritholtz Wealth Management is the quarterly conference call I do for...

Read More

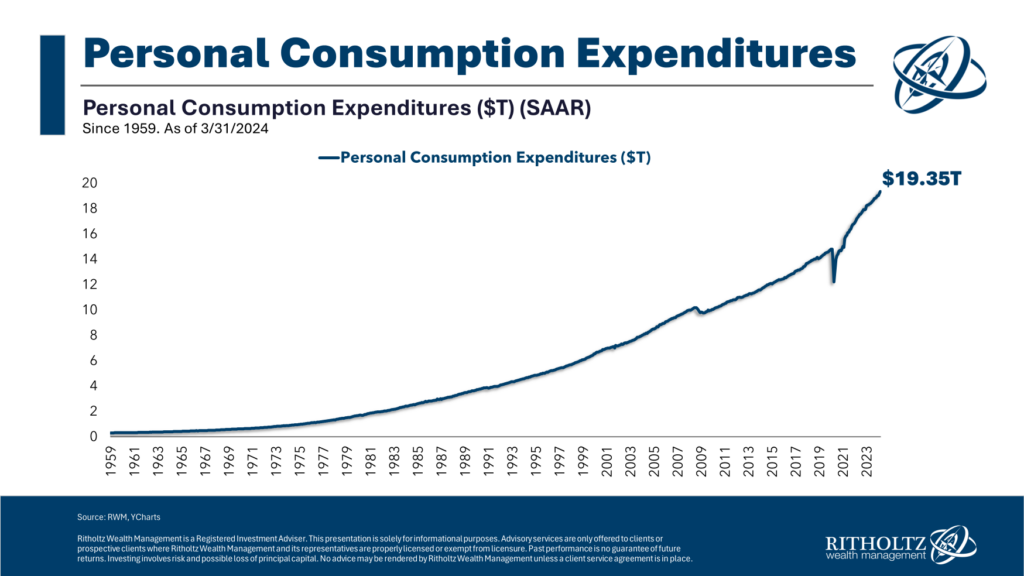

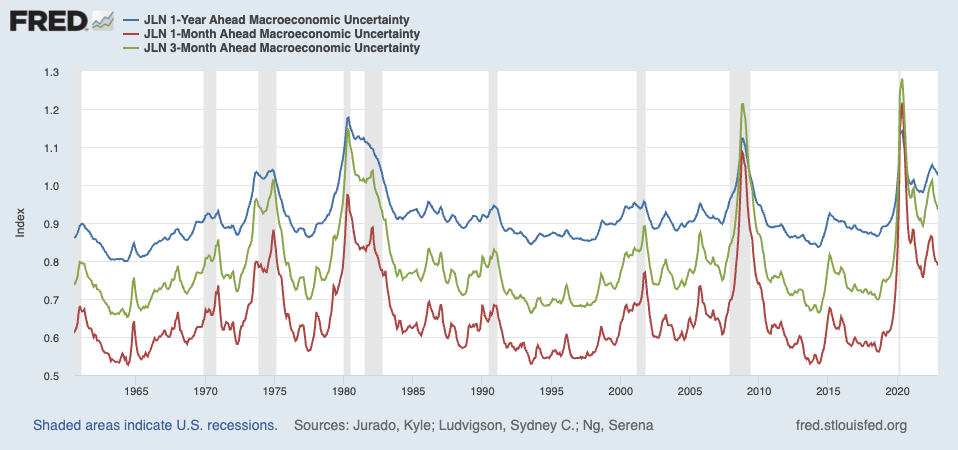

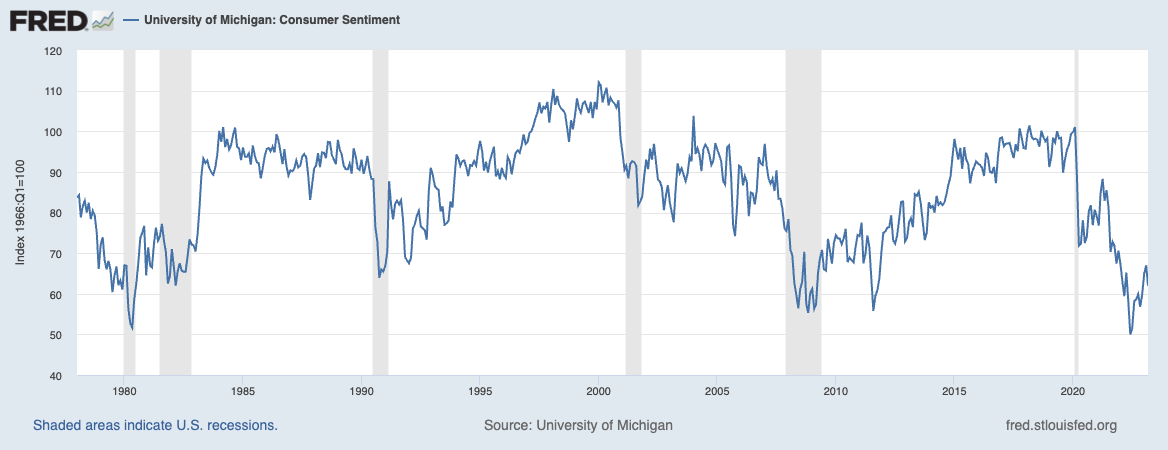

I love FRED — I am a big user of their charts and data (and even their swag). Where I go full heterodox are in things like...

I love FRED — I am a big user of their charts and data (and even their swag). Where I go full heterodox are in things like...

Read More

It’s a summer Friday and nobody has the patience for a long rant about whatever foolishness is bothering me today. So instead, a...

It’s a summer Friday and nobody has the patience for a long rant about whatever foolishness is bothering me today. So instead, a...

Read More

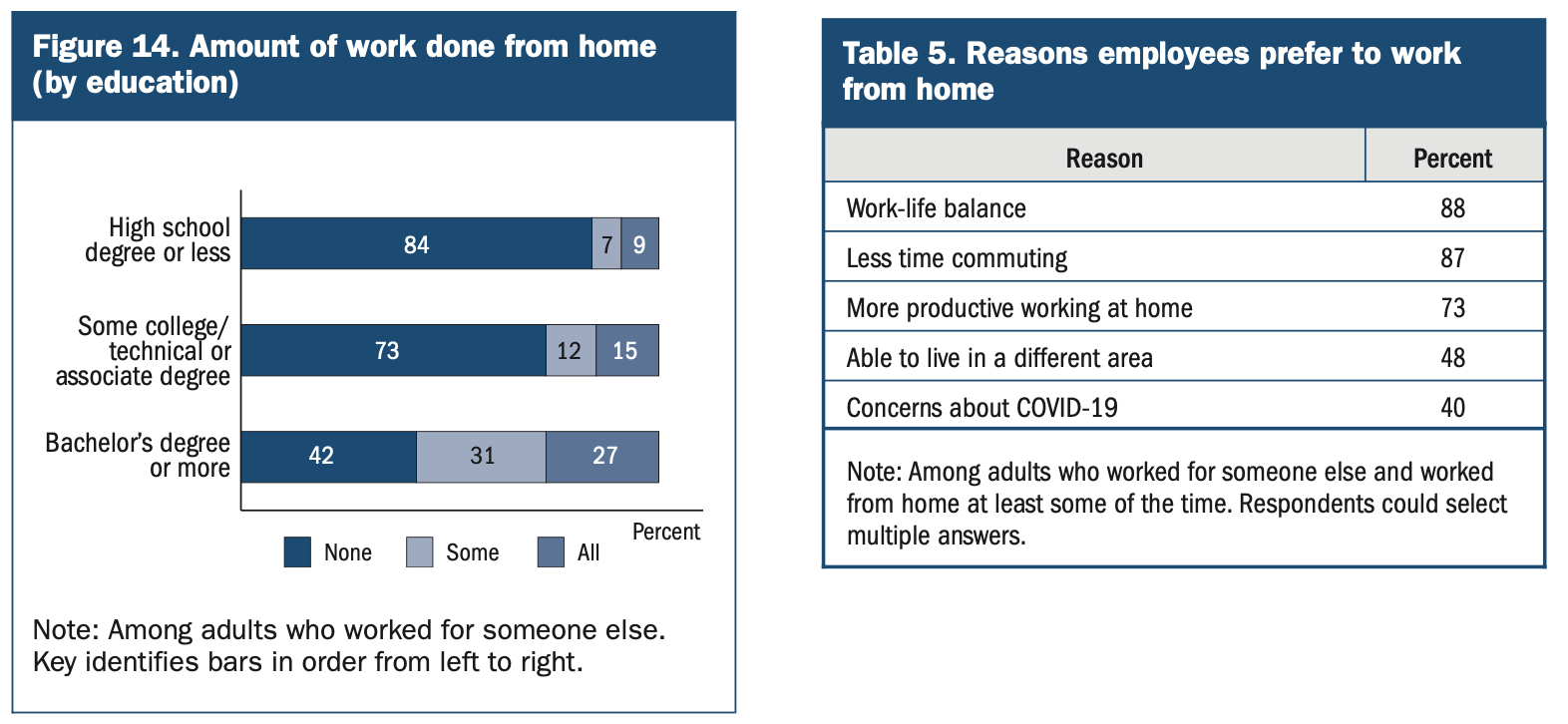

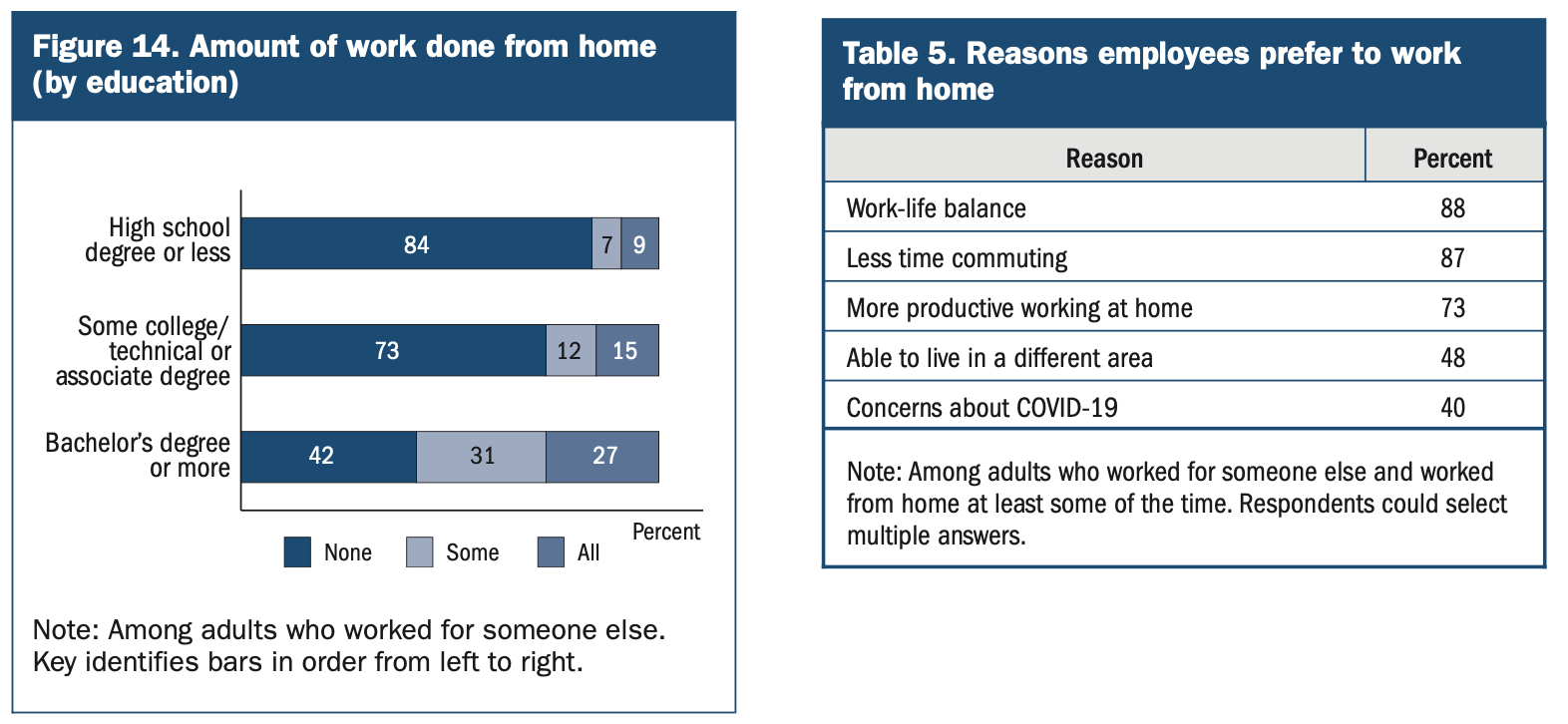

This week saw the release of the Fed’s big annual research report, Economic Well-Being of U.S. Households in 2022....

This week saw the release of the Fed’s big annual research report, Economic Well-Being of U.S. Households in 2022....

Read More

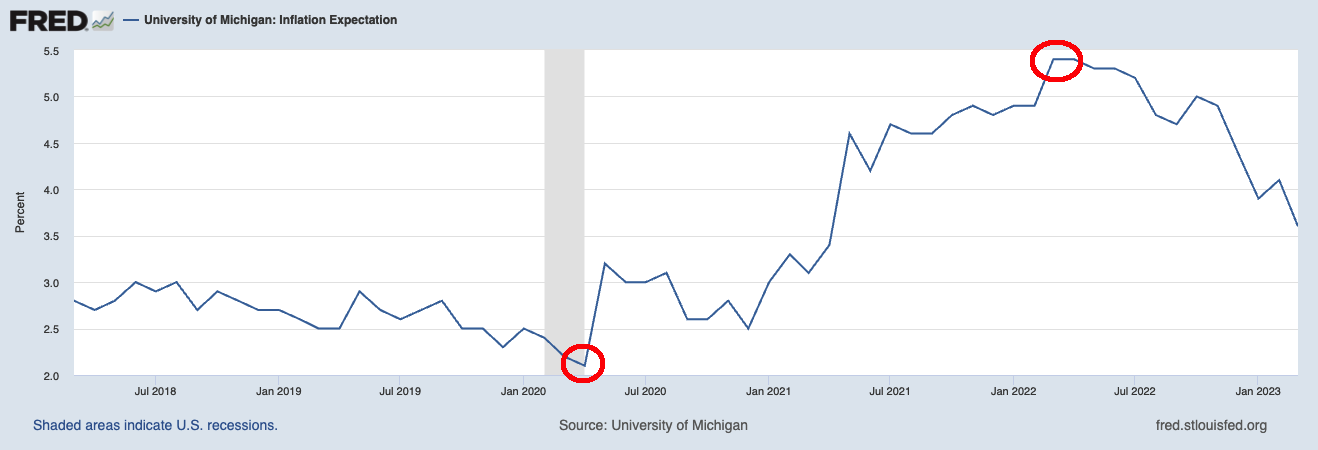

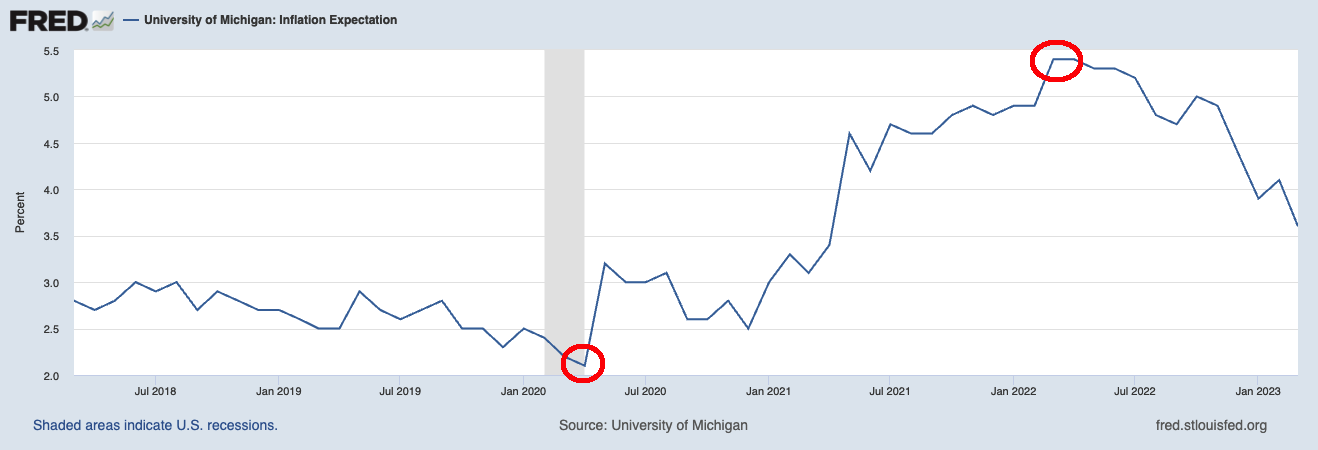

Jerome Powell and the Federal Reserve spend a lot of time worrying about Inflation Expectations. They shouldn’t. Generally,...

Jerome Powell and the Federal Reserve spend a lot of time worrying about Inflation Expectations. They shouldn’t. Generally,...

Read More

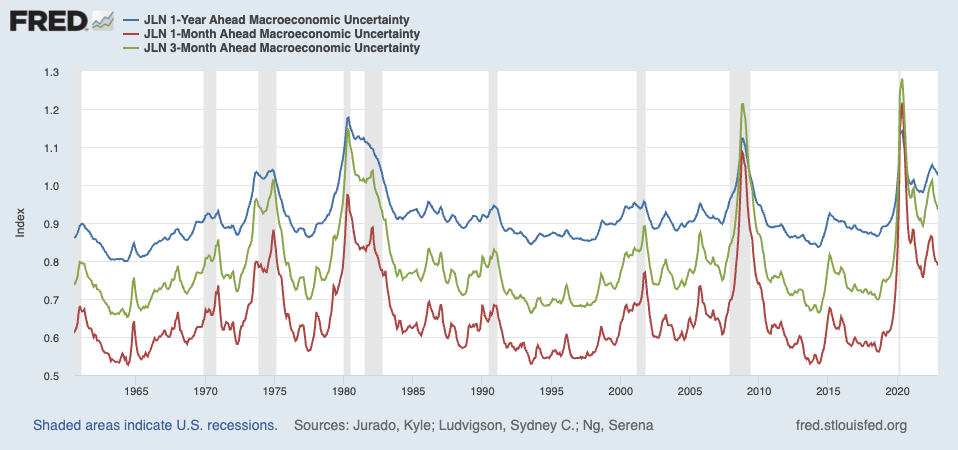

Source: FRED, May 8, 2023 There’s an old joke about a hypochondriac who is constantly complaining to his doctor about his...

Source: FRED, May 8, 2023 There’s an old joke about a hypochondriac who is constantly complaining to his doctor about his...

Read More

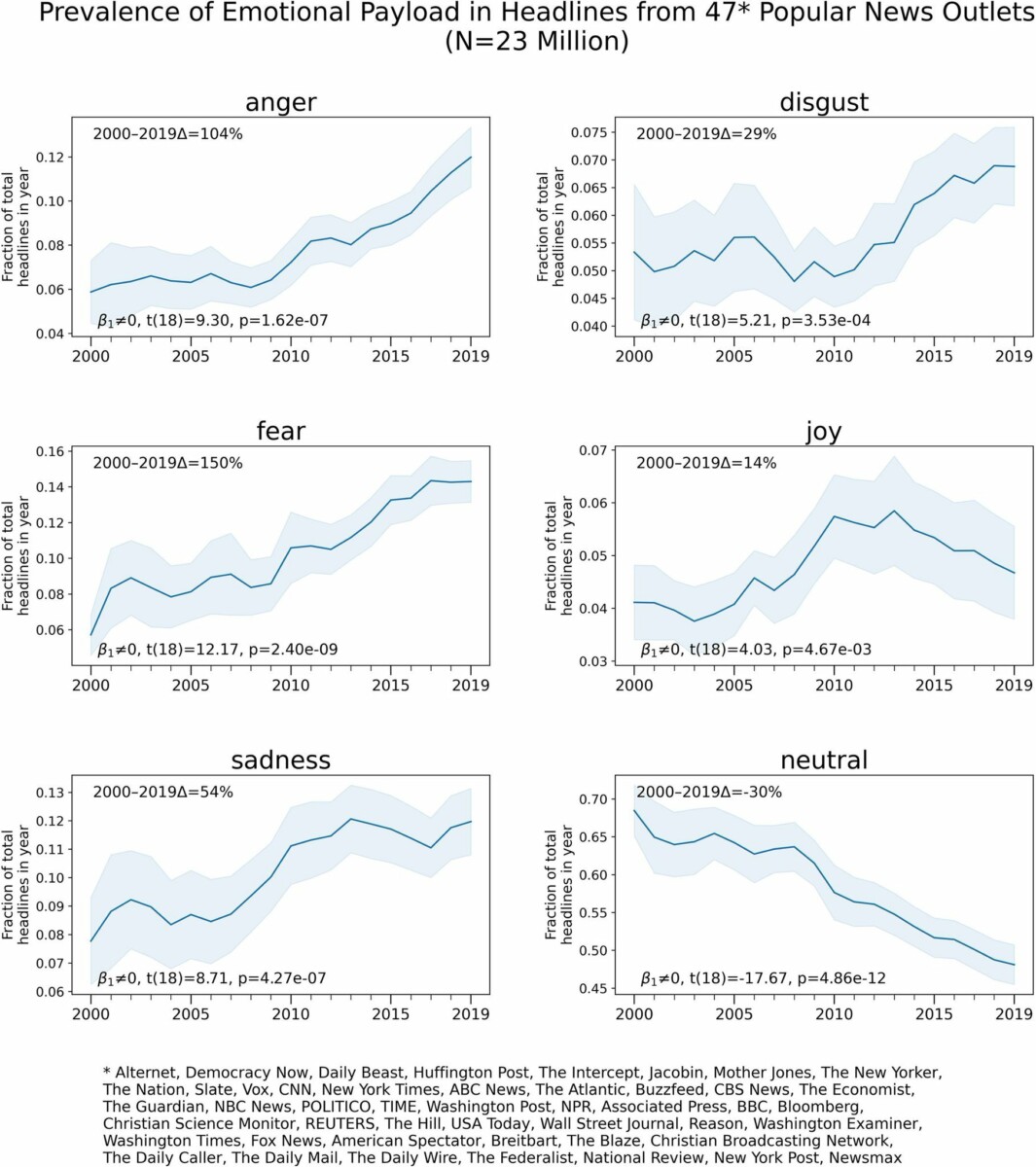

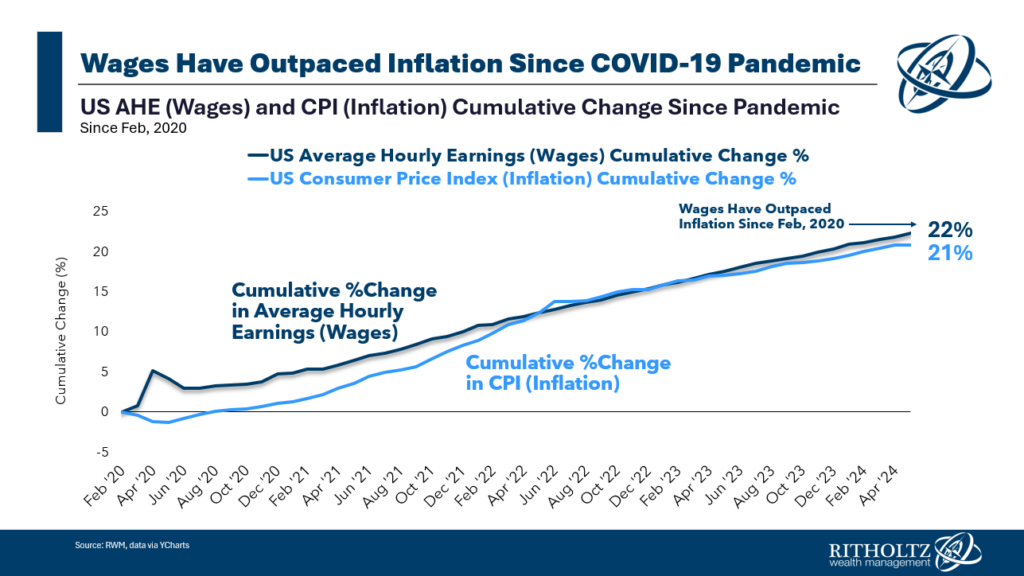

I’ve been observing how radically unusual various sentiment readings have been for a few years now. It made little sense to...

I’ve been observing how radically unusual various sentiment readings have been for a few years now. It made little sense to...

I’ve been observing how radically unusual various sentiment readings have been for a few years now. It made little sense to...

I’ve been observing how radically unusual various sentiment readings have been for a few years now. It made little sense to...