Transcript: David Snyderman, Magnetar Capital

The transcript from this week’s, MiB: David Snyderman, Magnetar Capital, is below. You can stream and download our...

One of the reasons people in the investment community respect Howard Marks so much is he says what he believes and lets the...

One of the reasons people in the investment community respect Howard Marks so much is he says what he believes and lets the...

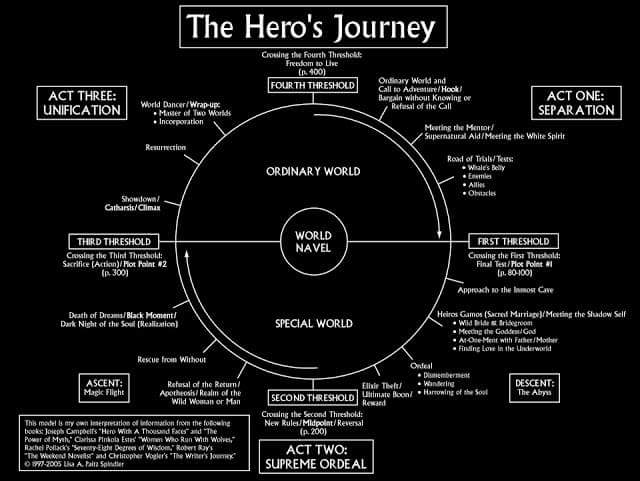

To hear an audio spoken word version of this post, click here. Joseph Campbell’s seminal work1 explores the...

To hear an audio spoken word version of this post, click here. Joseph Campbell’s seminal work1 explores the...

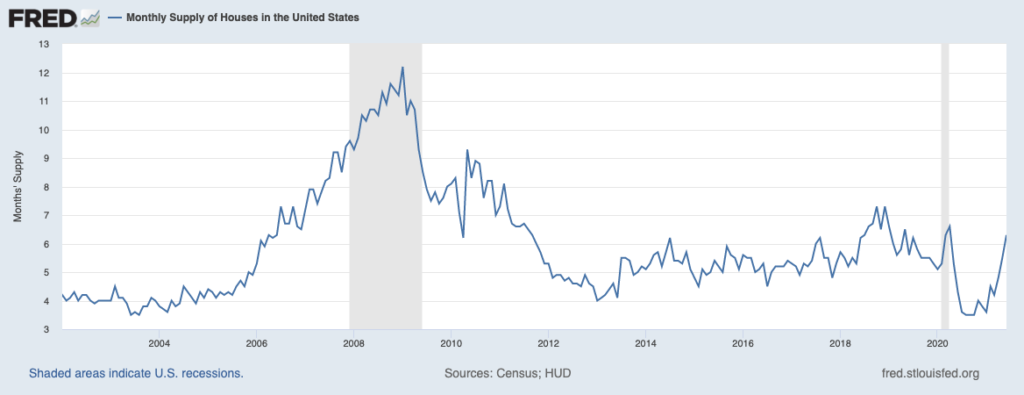

To hear an audio spoken word version of this post, click here. Why are there too few houses in general, and...

To hear an audio spoken word version of this post, click here. Why are there too few houses in general, and...

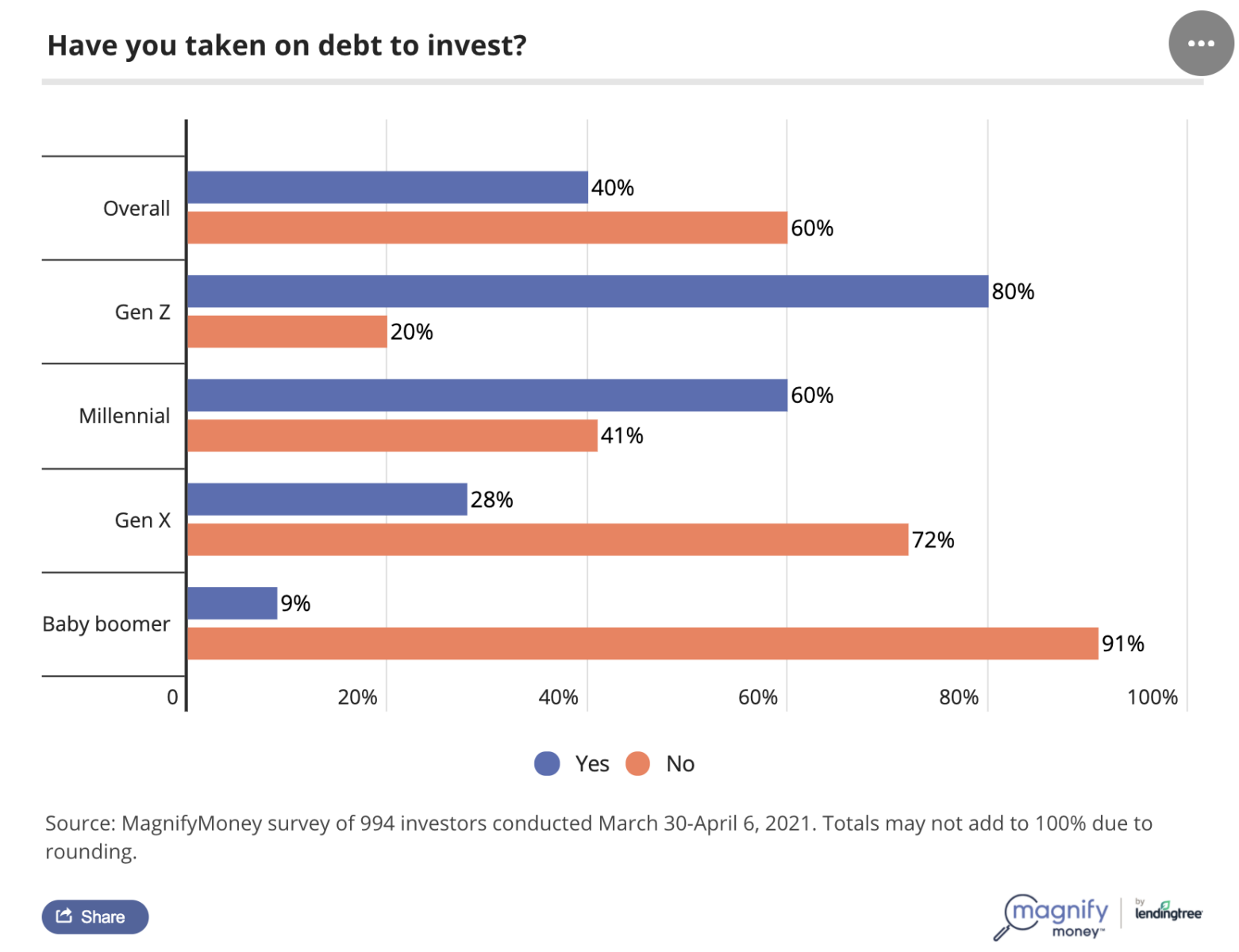

Let’s get this out of the way upfront: Using excessive leverage to speculate is a terrible idea, and often...

Let’s get this out of the way upfront: Using excessive leverage to speculate is a terrible idea, and often...

Get subscriber-only insights and news delivered by Barry every two weeks.