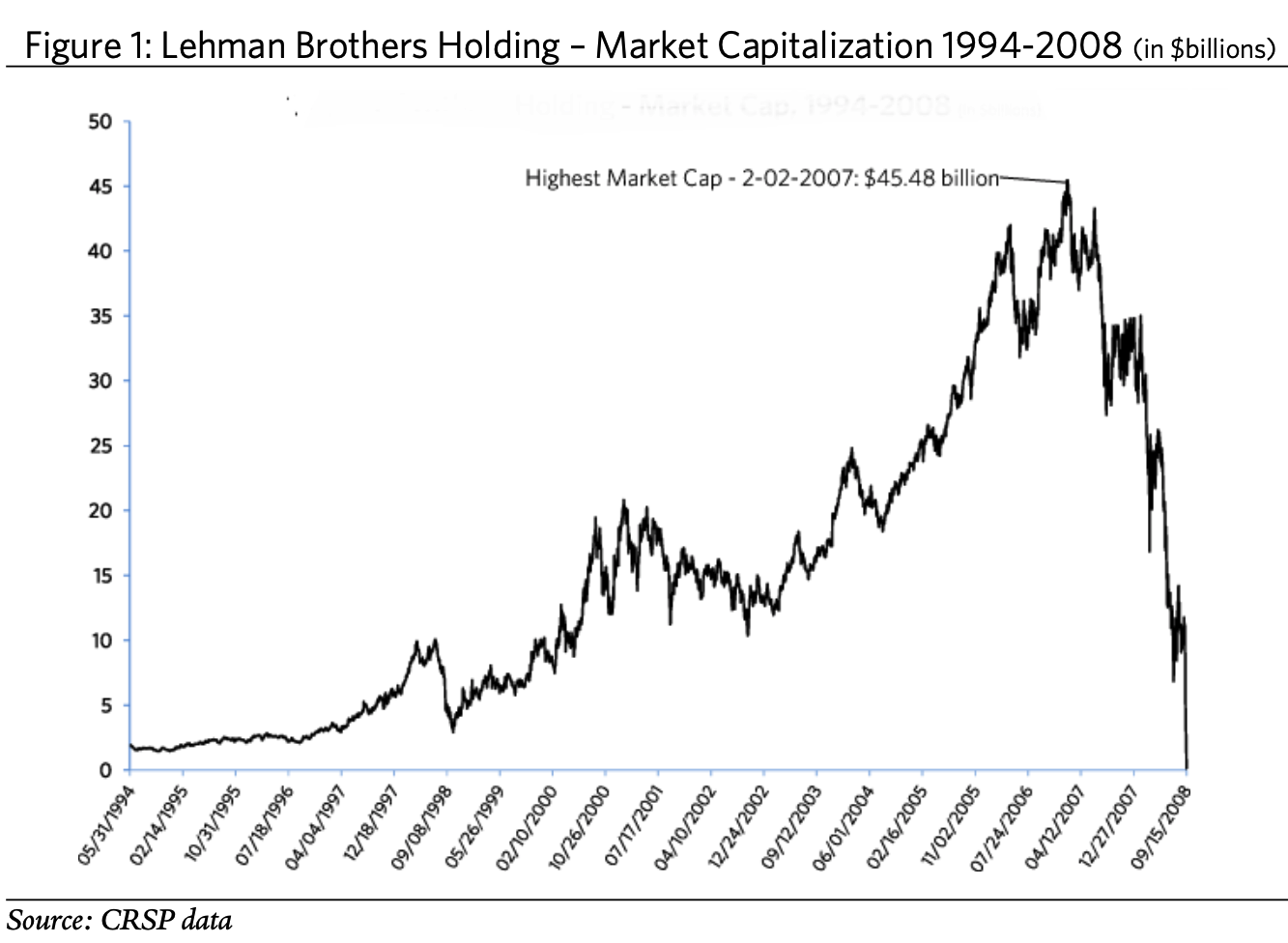

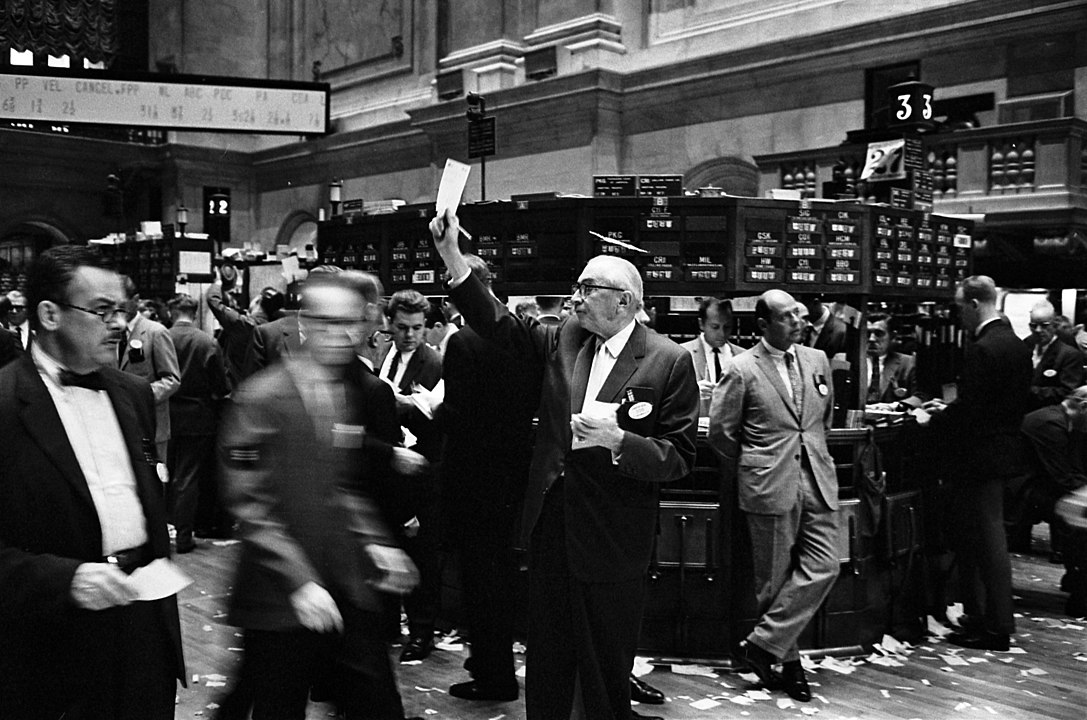

What My Worst Trades Taught Me About Investing Losing money on Wall Street can be profitable in the long run. Bloomberg, September 4,...

What My Worst Trades Taught Me About Investing Losing money on Wall Street can be profitable in the long run. Bloomberg, September 4,...

Read More

What My Worst Trades Taught Me About Investing Losing money on Wall Street can be profitable in the long run. Bloomberg, September...

What My Worst Trades Taught Me About Investing Losing money on Wall Street can be profitable in the long run. Bloomberg, September...

Read More

What I Wish I Understood When Starting Out In My Career From learning to “time travel” to good habits, here are 10 pieces of advice...

What I Wish I Understood When Starting Out In My Career From learning to “time travel” to good habits, here are 10 pieces of advice...

Read More

What I Wish I Understood When Starting Out In My Career From learning to “time travel” to good habits, here are 10 pieces of advice...

What I Wish I Understood When Starting Out In My Career From learning to “time travel” to good habits, here are 10 pieces of advice...

Read More

White House NEC Director Brian Deese Says Mergers Have Cost Families The White House estimates that consolidation across industries means...

White House NEC Director Brian Deese Says Mergers Have Cost Families The White House estimates that consolidation across industries means...

Read More

White House NEC Director Brian Deese Says Mergers Have Cost Families The White House estimates that consolidation across...

White House NEC Director Brian Deese Says Mergers Have Cost Families The White House estimates that consolidation across...

Read More

Ten Simple Money Rules for Investing Success Bad decisions and poor behavior are the primary reasons why many fail to meet their...

Ten Simple Money Rules for Investing Success Bad decisions and poor behavior are the primary reasons why many fail to meet their...

Read More

Ten Simple Money Rules for Investing Success Bad decisions and poor behavior are the primary reasons why many fail to meet their...

Ten Simple Money Rules for Investing Success Bad decisions and poor behavior are the primary reasons why many fail to meet their...

Read More

Market Narratives Have Pushed Aside Fundamentals Logic and mathematics once made up the basic laws of investing. No more. Bloomberg, June...

Market Narratives Have Pushed Aside Fundamentals Logic and mathematics once made up the basic laws of investing. No more. Bloomberg, June...

Read More

Market Narratives Have Pushed Aside Fundamentals Logic and mathematics once made up the basic laws of investing. No more. Bloomberg, June...

Market Narratives Have Pushed Aside Fundamentals Logic and mathematics once made up the basic laws of investing. No more. Bloomberg, June...

Read More

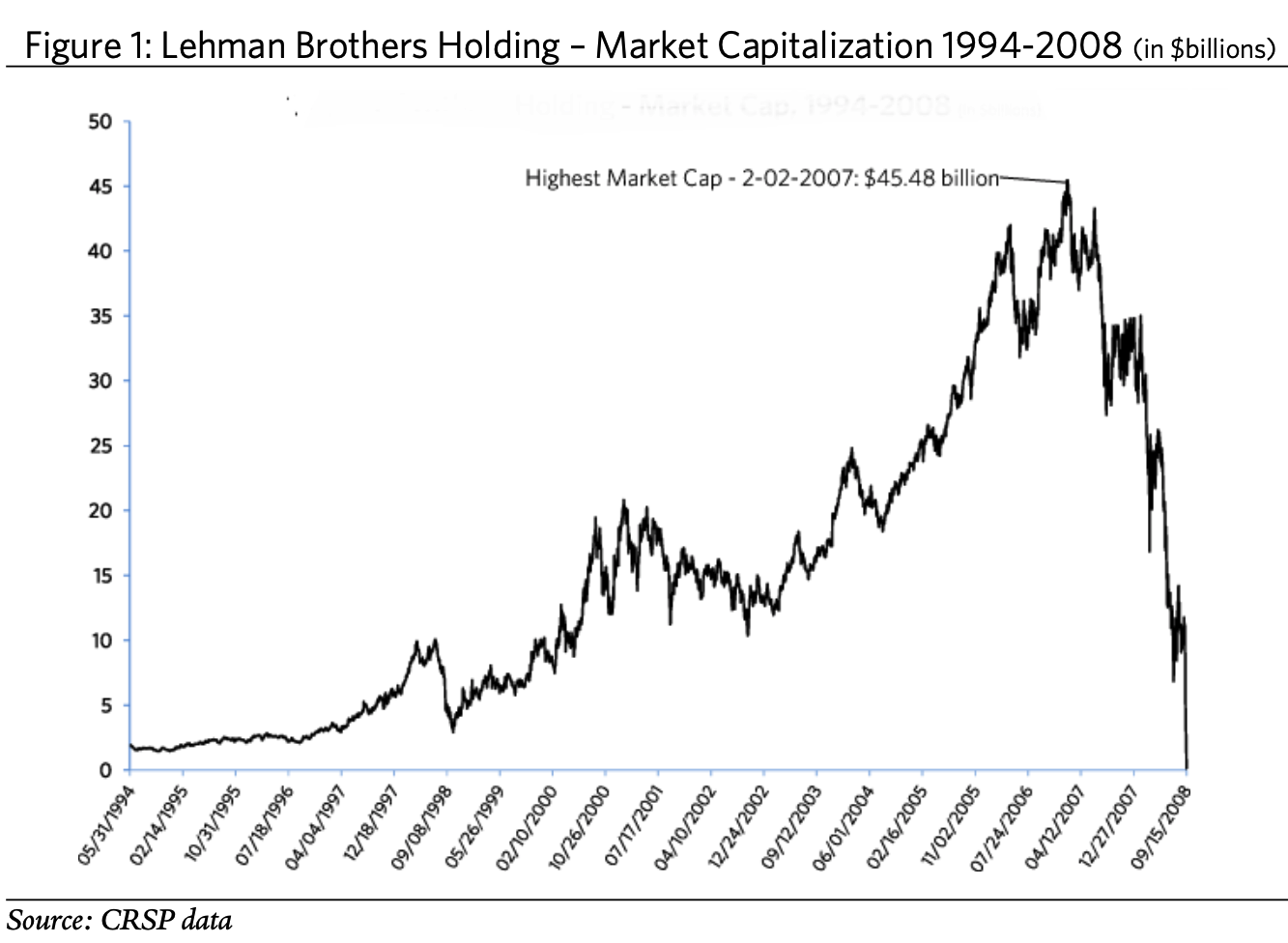

What My Worst Trades Taught Me About Investing Losing money on Wall Street can be profitable in the long run. Bloomberg, September 4,...

What My Worst Trades Taught Me About Investing Losing money on Wall Street can be profitable in the long run. Bloomberg, September 4,...

What My Worst Trades Taught Me About Investing Losing money on Wall Street can be profitable in the long run. Bloomberg, September 4,...

What My Worst Trades Taught Me About Investing Losing money on Wall Street can be profitable in the long run. Bloomberg, September 4,...