Am I seeing this correctly? Has Barron’s finally thrown in the towel on the Citibank Panic Euphoria measure? We have voiced our criticism of this indicator (repeatedly), which has been pinned in the Panic range for the past year or so.

For those who want a major firm substitute, allow me to suggest the following:

James Montier of Dresdner Kleinwort Wasserstein Fear/Greed indicator

>

DrKW Fear and Greed Index

click for larger graph

Source: Thoughts from the Frontline

or

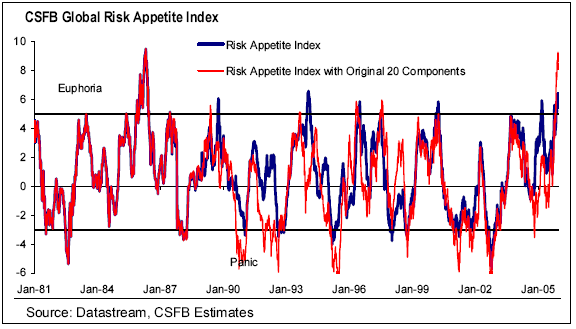

Jonathan Wilmot of CSFB, which measures “Risk Appetite”

Risk Appetite: Too Soon To Panic About Euphoria

Source: Jonathan Wilmot, CSFB

>

Each of their sentiment readings actually is perceptive, swings to and fro, and has a degree of anticipatory prescience . . .

>

UPDATE: March 25, 2006, 8:52 am

Doh! Its in the print edition, but not the online version.

The Citibank Market Sentiment measure lives — and its moved into the neutral zone between panic and euphoria.

Never mind . . .

Good call. They will not replace that index with any of the names mentioned because they are unknown to the media.

Understand, Tobias Levkovich has become a media darling over the past couple of years. His attempt at quantifying a tough to quantify measure was difficult. With backtesting a simpler task than ever, something went wrong or the analysis was incomplete for it to have been presented, amended and dropped so quickly (by Barrons, not by Citi).

Tobias may be eventually right, if the market continues this rally and gets to overbought on his model. But, just like Rukeyser unceremoniously dropped some market technicians ((bearish when it was uncool) who did not fit the WSW agenda, it seems that Barrons may be biased as well.

Anyway, who really cares. I am sure no one made a decision based on that analysis anyway.