The Sunday New York Times had an interesting story by Dan Gross about one of our favorite themes: What happens When Statistical measures fail to comport with experienced reality?

This phenomena is the result of how the economy got to where it is today: Post crash, the massive government stimulus created an artificial recovery. The details of the stimuli — ultra low rates leading to a real estate boom, tax cuts that primarily benefited those in the highest tax brackets — are why the aggregates present a misleading picture.

The typical measure was never designed to capture the details of such a bifurcated economy. Perhaps these models are creatures of an era when wealth distribution was far less concentrated. They seem to be unable to keep up with the present shift, and the downsizing of the middle class.

“This strange and unlikely combination — strong and healthy aggregate macroeconomic indicators and a grumpy populace — has been a source of befuddlement to the administration and its allies. It’s not unreasonable to assume that Mr. Snow is being replaced as Treasury secretary in part because he couldn’t make Americans appreciate just how well the economy is performing. And it’s possible to detect among Bush partisans an element of frustration at the public for what they see as its failure to do so. In Iowa last month, Rudolph W. Giuliani bluntly dismissed concerns about the economy and higher gas prices by saying, “I don’t know what we’re all so upset about.”

Gas prices and the Iraq war have surely contributed to this disconnect. But a lesser-known factor is also at work: the misleading aggregates.

Aggregates — big-picture figures like the unemployment rate, productivity and growth in the gross domestic product — are highly useful to economists. But to most people, they’re abstractions. You can’t use a low unemployment rate to pay a mortgage.

As a result, large aggregates “are something that people may hear about in the news, but don’t have a direct impact on how people feel,” said Lynn Franco, director of the Consumer Research Survey at the Conference Board.” (emphasis added)

How can this be? Low unemployment (NILF), Low Inflation (Ha!), strong GDP (carried over from Q4). It turns out there is a simple explanation — the data is “simply misleading:”

“Aside from being abstract, many of the most popular aggregates are simply misleading. Dean Baker, a director of the Center for Economic and Policy Research in Washington, puts the Consumer Price Index — the main gauge of inflation — at the top of the list.

“It has no direct relationship to what people perceive as inflation,” he said. Mr. Baker notes that the index doesn’t take account of rapidly rising co-payments and higher insurance deductibles when it calculates health and medical costs. And to gauge inflation in housing, the index approximates a measure of rent instead of looking at home purchase prices.

“We’ve had a huge run-up in the price of housing, and that doesn’t show up in the C.P.I.,” he said. So while the index shows that inflation is elevated but still under control — up 3.5 percent from April 2005 to April 2006 — many Americans find themselves paying sharply higher prices for essential goods and services.”

Remember the concept of substitution: If beef prices rise, but chicken doesn’t, BLS allows a substitution in their basket of goods — therefore showing no price gains. But the shopper in the Supermarket says, “Damn! These meat prices keep going higher!” — hence the disconnect.

That’s only part of the explanation as to why we have no inflation (ex inflation). Real income has been negative, and people feel that. Most people don’t care about the BLS data, they are concenred with how much money they have at the end of the month after they pay their bills:

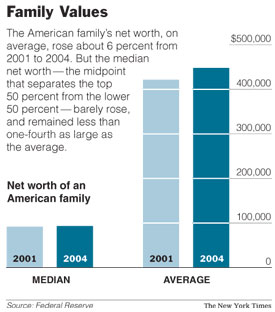

“In addition, aggregates generally are averages, which are of declining utility in an economy characterized by greater inequality of income and assets. In an interview with The Wall Street Journal in March, Mr. Snow took pains to point out that there had been substantial gains in per-capita income (8.2 percent, after inflation) and net worth (24 percent, before inflation) from the beginning of 2001 to the end of 2005.

The data he cited were averages, or means, and that can be misleading. “The average wage is a useful indicator if you want to know what’s happening to the tax base, but it might not tell you what’s going on for the individual worker,” said Alan B. Krueger, an economics professor at Princeton and a former chief economist at the Labor Department.”

As every student of statistics knows — and the chart below reveals — there is a big difference between median and average. Average is skewed by outliers (Bill Gates walks into a bar . . .) whereas Median is not:

>

Graphic via NYT

>

Then there’s the so-called Jobs recovery. This recovery cycle, Job creation has been overly reliant on Real Estate construction,

which will surely end as the Housing boom tails off. Other strong

sectors are dominated by low paying, low benefit positions, like Retail and Food

& Beverage Service. At the same time in Corporate America, there

has been a huge wealth transfer from Shareholders to CEOs and senior

mangement. People are starting to get upset about this, and it shows

up in Presidential polls and consumer confidence numbers:

“To see how typical workers are doing, it’s better to look at median wages and incomes — the midpoint that separates the top 50 percent from the lower 50 percent. And median income, which was stagnant during President Bush’s first term, is struggling to keep pace with inflation. “Median household income has gone nowhere since the turn of the decade,” said Mark Zandi, chief economist at Moody’s Economy.com.

Mr. Zandi puts the problem with averages another way. “If you put one foot in a tub of hot water and the other in a tub of cold water and take the average, everything is fine.”

THIS dichotomy accurately describes the economy. From 2001 to 2004, the average net worth of an American family rose 6.3 percent, according to the Federal Reserve’s Survey of Consumer Finances. But not everybody grew richer. For the bottom 40 percent of families by income, the median net worth fell. “It just doesn’t resonate with people when the Treasury secretary says everything is fine,” Mr. Zandi said. “It’s fine for half the population, and it’s clearly not for the other half.”

Bottom line — if you are in the top 10% or so, this has been a very good couple of years financially. Of course, everyone else is less than thrilled; Not only has their ships not come in, they are taking on water and beginning to sink.

I had very obnoxious friend in grad school named Andy. My crew were all pretty much cum laude, good academics, Journals, etc. Andy’s idea for a graduation speech was to say “those of us in the top 10% want to thank the rest of you for helping to make this possible.”

I wouldn’t be surprised to find out he was working for John Snow.

>

Source:

When Sweet Statistics Clash With a Sour Mood

DANIEL GROSS

NYTimes, June 4, 2006

http://www.nytimes.com/2006/06/04/business/yourmoney/04view.html

Americans continue to have an “Entitlement Mentality”.

The average retirement savings amongst baby boomers is $55,000 combined with the average home equity of $55,000. So, $110,000 says that people are hoping that pensions and social security will take care of them in retirement……..provided they live 2 more years!

I would assume most former CEOs are relatively competent strategists or, at least, long term thinkers. I suspect you can thank John Snow for alot of the massive run at CSX over this bull cycle. He’s not eloquent but he’s a brilliant man by nearly any measure.

Now we likely have another brilliant man who isn’t terribly eloquent either. He’s stepped into a big bag-o-shit and will soon be the next-former John Snow.

Regardless of their desire to think strategically and focus on long term pro-growth policies, how can one be successful when politics has turned into the sound bite of the week and the knee jerk actions that follow. With the election this fall, politics will trump common sense and Paulsen will likely soon regret his choice regardless of any negotiated assurances.

“I would assume most former CEOs are relatively competent strategists or, at least, long term thinkers.”

I would add CEOs of private cos. The golden parachute is specially designed to force CEOs of public cos. to think short term.

“those of us in the top 10% want to thank the rest of you for helping to make this possible.” Interesting concept. As most conservatives seem to consider the other 90% merely dead weight.

«Andy’s idea for a graduation speech was to say “those of us in the top 10% want to thank the rest of you for helping to make this possible.”»

But that is not obnoxious, it is a sort of ”noblesse oblige”…

Anyhow, he was wrong, it is more like the top 1% (or 0.1%), not 10%…

The Ayn Rand-style point of view, which is probably far more common around John Snow, would be like

”those of us in the top 1% want to thanks ourselves for preventing the rest of you from stealing the fruits of our superior abilities and fortune, you thieving, lazy, parasites, and we shall reclaim our just rewards from you lot as we have been for the past 10-20 years”.

That is, the top 1% seem to have a righteous sense of indignation at being brutally exploited since FDR’s socialist oppression by what they regard as the parasitic and dishonest losers down the income scale, and are getting even with them, abolishing or curtailing vicious instruments of exploitation of the deserving rich like the estate tax or welfare.

:-)

Didn’t Warren Buffett say his secretary paid more in income taxes than he did? Now that’s a good system with fairness built right in.

All of the Transports have had a huge run transporting building materials and Chinese goods around the US — I hardly give Snow credit for that;

During his tenure at CSX, if memory serves, the stock underperformed.

Hey Larry,

you conveniently left out the part where the guys depending on their pensions worked for lower wages for the last 28 years or so, only to find out oops, you just lost your pension, sorry. How do you suggest they make up 28 years of stolen saving via pension in 2 years? You must assume because Sam Palmisanno’s pension is $10,000 a day that everybody at IBM has a pension.

If you want to see the disconnect, just go to the Home Depot stock holders meeting. Nardelli, like Bush and congress, has contempt for anyone except those lining their pockets.

Those at the very top think everything is great and the rest of say huh?

This is the worst economy of my lifetime with the least amount of opportunities available today. People work longer hours today for a smaller piece of the pie. Every year you receive your benefits package to see what they CUT, not added.

So Larry, you are right “Americans continue to have an “Entitlement Mentality”. They earned it and were promised it. It’s called deferred income. And if you think they are going to roll over and give it up, all hell is going to break loose when they truly begin to understand what has been stolen from them.

me: I can tell many stories about the guy who earned $300,000 a year and saved nothing. I can also tell you about the guy who worked at the Post Office and retired a millionaire from a long-term savings and investment plan.

No pensions were eliminated for those who retired (unless the companies went bankrupt). Since they were employer only contributions, ask what people did to save money on their own?

And, too many people have thought of social security as a retirement income instead of the safety net it was intended to be.

If young people fund a Roth from ages 19-26 and stop, they will retire with $900,000 at age 66 as a result of compunding. What’s teh problem?

For the record, I am against 401K plans. (I am probably the only one as advisors suggest “maxing it out”)

«The typical measure was never designed to capture the details of such a bifurcated economy.»

Exactly! Perhaps it is unusual, but when I was doing undergrad economics I had to go through several fascinating (and very well taught) statistics and econometrics courses, and one of the staunchest warnings was: ”for bi/multimodal distributions just don’t use misleading summaries like average/median”…

«we have no inflation (ex inflation)»

As to this, the question I always ask is ”inflation of which prices?”.

My impression is that in practice for the government and companies the two measures that matter are the inflation (or rather deflation) in the price of low end labour, and the inflation in COLA indices…

Unfortunately most people ”mistake” inflation with living standards, the amount of stuff they can buy with their time.

Comrade if you continue this propaganda people will figure out you are just a socialist who happens to be a perma bear. I’m sure like a stopped clock you will eventually be able to claim you perma bear view is correct.

I knew I’d get that response from someone. Indeed, there are macro factors boosting rails. With oil this high, it pays truckers to have the rails ship their trailers. Commodities boom. Imported goods boom. Yes to all three. But, the real impetus for pricing power were the policies the rail companies instituted before any of this happened. That was consolidation. That happened under Snow. There is no pricing power without consolidation of such a fragmented, highly competitive business. So, as much or more than anything, what returned rails to profitability and then pre-eminence was that active policy. Before this undertaking CSX was a laggard. And the results were felt well before the China boom. Under Snow, CSX returned 450% and made record profits……UNTIL the 1999ish when transports cratered. He still returned 300% to shareholders taking that into account. Not bad for a boring business.

It’s no different than telco right now. Eventually a wash out occurs when no one has any pricing power and they all are clubbing themselves to death. That is, until they start to consolidate and gain pricing power. So, regardless of what the stock prices are doing now and who the telco execs of the future are, the ability to boost profits is being set by the executives of today.

Mr. Nusbaum,

I’ve seen that linear analysis many times, and I’m convinced it has no basis in reality. There are simply too many capital expenses that a person aged 18-30 would be foolish not to make to justify a fully funded Roth. These expenditures can be education, a home, or a vehicle. Most in this age bracket do not have the discretionary income to put $200 ($400 if married) into a Roth.

The financial community would do well to tell people that they need to put themselves into a financial position where they can save significant amounts of money for their retirmement when the reach the 35 to 50 demo. This would mean telling clients not to seek a jumbo mortgage at 40 for the tax deduction. Imagine how a person’s retirement planning would be if they actually had their home paid for at age 40 instead of plowing $3000 a month into a mortgage company.

Blissex: In 2005 inflation rate was 10.3 %. The true definition of inflation is THE EXPANSION OF THE MONEY SUPPLY and last year alone, the money supply grew by 10.3% and that’s real inflation, not the 2.3% reported by the U.S. Government.

Heck, while they’re raising rates upstairs, they’re printing money 24/7 in the basement……

“I would assume most former CEOs are relatively competent strategists or, at least, long term thinkers.”

With regard to compensation, CEO’s have been completely shortsighted. With skyrocketing executive compensation and stagnant wages for employees, the system has been broken. Forget globalization and competition. If companies had just spread some money around we would have a much healthier overall economy. How much money have CEO’s sucked out of their companies and local economies? What did companies and households cut from their budgets to pay executives? Or how much did they have to borrow? What’s the net effect? If businesses are not investing in human capital what does the business cycle look like long term?

douglas, u got it exactly right: people keep citing “competition” for the low wage rates and attack on comp and benefits of the working class, and lately the middle class. if there were true competition then we wouldt find profits as % of economy at highest rates since just before the Depression. managemnt and top 1% that owns majority of US stocks simply transferring income and wealth from employees/consumers to themselves. real competition would affect margins, profits foremost. as for “top 10%”, well even sharks need their handlers/remoras.

What measure of the money supply do you use to define inflation? Does someone have an accurate way of measuring the velocity of money? If you don’t measure that, all of your money supply numbers are meaningless. If every dollar in the economy is spent twice, the effective money supply is twice the amount sitting in whatever accounts you’re measuring. If every dollar is spent three times, then the effective money supply is three times the amount you can measure. Small changes in velocity have a much larger affect than small changes in account values. Hyperinflation is more often the result of the velocity of money going up than any actual printing of money.

I think that inflation is understated at 2.3%, but it is nowhere near 10.3%. I would believe anything from 4-6% pretty easily. If the money supply is increasing by 10% every year, someone is sitting on big piles of cash and dropping the velocity of money by a fair bit.

jkw: I understand what you mean, however, the 10.3% was the increase in 2005 money supply.

Page 1073 of the World Book Dictionary (Volume 1) 1974 edition defines Inflation (in part) as:

3. an increase of the currency of a country by issuing paper money.

M.Z. Forrest: “I’ve seen that linear analysis many times, and I’m convinced it has no basis in reality. There are simply too many capital expenses that a person aged 18-30 would be foolish not to make to justify a fully funded Roth.”

It’s all possible. But, something never discussed by economists and financial planners: Compounding from investing in real estate. Much more powerful than compounding interest!

Freddie Mac reports that the average home appreciation was 8.1% for the first quarter on 2006. That wasn’t supposed to happen! Where is the housing bubble that we have been reading about for 6 years? (That’s a decrease in appreciation from the 13% for the first quarter of 2005).

Now, that’s an example of compunding! The 8% this year means more actual dollars than the 13% last year when you consider the additional appreciation from the entire calender year of 2005.

No Go on Snow:

Snow’s CSX Was An Also-Ran

Dan Ackman, Forbes 12.10.02, 9:00 AM ET

http://www.forbes.com/2002/12/10/cx_da_1210topnews.html

NEW YORK – President George W. Bush appointed John Snow as Treasury secretary for his political acumen, not because he was a great railroad executive. But in his years as chief executive of CSX, the company’s performance was middling at best. Nevertheless, Snow was by far the highest-paid chief in the industry.

In 1995, CSX, one of five leading railroad companies in the U.S., reported sales of $10.3 billion and profits of $1.1 billion. For 2001, sales were $8.1 billion and profits were $293 million.

Over the past six years, Snow was paid $29.3 million in salary and other cash compensation . This pay package was nearly twice as large as the second-best paid railroad CEO, Norfolk Southern’s David Goode, who earned $16.8 million over that time.

Other railroads have managed to grow, however. Kansas City Southern, Norfolk Southern and Union Pacific have all increased revenue slightly in the last three years (see chart below). CSX has never returned to profit levels of the mid-1990s despite the fact that its asset base has increased to $20.8 billion, from $16.9 billion, since 1996 .

Perhaps for that reason, CSX shares trade for 47% less than they did five years ago. Over that period, CSX shares trailed three of the four other major railroad stocks, beating only Kansas City Southern. Over the past year, CSX is dead last in terms of share-price performance. In that year, the company paid its CEO $10.1 million. . . .

I’m a little late to this exchange but supporting the original title is a piece on the actual 1996 -2006 employment by category over at Vew from Silicon Valley: http://www.viewfromsiliconvalley.com/id228.html

Larry,

Nice solution for today. Where were you 28 years ago when the pension was the savings, as I have said.

Now, let;s take a look at you suggestion. 28 years ago did they have Roth IRAs? 28 years ago did they have any IRAs? 28 years ago did they have 401Ks.

So I guess when you take pot shots at people that made the best decision they could at the time, you really don’t have anything to offer other than a 2% pass book at the bank, of which they had no choice to got ot the company and say gee, give me that moen, don’t put it in the DB pan because you are going to steal 28 years from now anyhow.

And for all you financial advice, I will be happy to tell you, that 28 years ago people were taught about retirement as consisting of 3 parts. 1. Your pension, 2. your social security, 3. your savings.

When you change the rules at the end of the game what exactly do you expect prople to do?

“ask what people did to save money on their own?” Ever hear of deferred compensation? That is what they saved.

“No pensions were eliminated for those who retired (unless the companies went bankrupt)”

Gee , steel, autos, airlines, textiles, have you left anybody out. Tell your story to the Delta pilot or United pilot that has a pension that goes from $100,000 down to about $40,000. Try making up $60,000 a year after you are retired. Yeah Larry, we know, they should have saved more. They should have known they were going to get screwed and lose it.

Larry, most people in this country DON’T KNOW WHAT AN IRA IS.

That’s the problem. You assume everyone is educated, and if they aren’t, oh well, too bad.

It’s a really crummy attitude to have towards people.

«In 2005 inflation rate was 10.3 %. The true definition of inflation is THE EXPANSION OF THE MONEY SUPPLY»

Well, thats a very courageous definition, as usually ”inflation” is assumed to be something about prices, and not about an absolute quantity like the money supply (the supply of which type of ”money”, though?).

As M Friedman says inflation of prices (which prices?) is ultimately permitted by expanded money supply or its speed, but the impact of more or speedier money is shaped by terms of trade, so some prices go up more than others.

However, Barry (or some other blogger) once mentioned an econometrician that has computed ”inflation” as it was officially measure 30-35 years ago and he estimated it at around 8%…

“Try making up $60,000 a year after you are retired. Yeah Larry, we know, they should have saved more. They should have known they were going to get screwed and lose it.”

They were company contibutions only. So, like social security, people were entitled to free everything?

Donna: “That’s the problem. You assume everyone is educated, and if they aren’t, oh well, too bad.”

No, Donna, most people are well educated on what TV shows are on and when. Or, who won Survivor and American Idol. Americans are lazy. Period. Fat & lazy. Everything is right there in front of us and we have no interest in a people….other than sending 540 morons to Washington to sell us out and bankrupt the counrty while we impose our “democracy” around the world.

But, when it comes to what’s good for people they turn a blind eye……

Larry: Which part of “deferred compensation” is difficult to get? Do you think the companies funded pension plans “out of their own pocket”? All the “employer contributions” came from revenue obtained in exchange for employees’ labor and services to customers.

“They were company contibutions only. ”

Larry I sincerely hope you are a troll and not really this out of it. You can’t be so stupid to realize that a company sets a pay rate, and then deducts, pension, healthcare, unemployment insurance cots from that rate. The amount of cash offered is the remainder.

If someone has two job offers, one from IBM and one as an independent contractor. Both jobs pay $50 an hour. As a contractor you get $50 an hour and have to fend for yourself. You can take and save the whole damn $50 if you live with your Mom.

At IBM they say, well, $10 for healthcare, $10 for pension and $5 for unemployment and payroll taxes. You now receive $25 an hour. The $10 that IBM didn’t pay you in cash is EARNED and DEFERRED. It is not a company contribution as you put it. It came out of MY pocket.

Please tell us you do get it and are just pulling our leg. And just curious, what do you call the payroll tax? I suppose when they deduct that from my pay that is a company contribution also.

Troll? Good job “me”…..

It’s the government’s fault!

Larry, why do you even read this board? You are clueless.

Yes it is the government’s fault. When people save through a pension plan and then near retirement see their job go to India and the pension plan frozen or abolished, yes indeed it is the government’s fault. In my opinion, Sam Palmisanno, Lou Gerstner, Bankruptcy Bob Miller and all the rest belong in jail. It is only tolerant government, funded by corrupt contributions that would let this happen.

Yes, Larry, it is the government’s fault. The rest of the civilized world has universal healthcare. We have the most expensive healthcare system with the worst outcomes. Yes, that is government’s fault. The government passed a prescription drug plan. Did they incorporate it into Medicare? Do they negotiate for lower prices, even thought the VA, a government plan; does the best job on prescriptions?

Since you never address any of the issues and only put up cutsy one, this is my last response to you. I am sure that Barry will be grateful for that.

Larry: It is probably not far off the mark to say companies being able to renege on pensions constitutes a failure of contract enforcement. And by appearances it is not like companies want to bring unreasonable contract terms pressed from them in an emergency back to a fair arrangement. They have been systematically underfunding their obligations while filling their pockets, and now suddenly there is a crisis and “we have no money”.

The lesson that everybody has learnt is to not take contractual agreements over so long a time span seriously. The problem of course being, when you have a contract with short-range fulfillment terms on both sides, when one side doesn’t fulfill, the other side can stop fulfilling as well. When the terms are such that the other side has to fulfill only after 20-30 years (let’s say), there is no such recourse.

Unfortunately, confidence in long-term arrangements is an important ingredient in the fabric of society, which we are losing.

Your friend Andy was the kind of person who would find a coating of baby powder on everything in his room when he woke up in the morning in my days at brown. My crack Ego Suppression Team saw to it that humility was distributed fairly to those who required it.

“They have been systematically underfunding their obligations while filling their pockets, and now suddenly there is a crisis and “we have no money”.

SAD, BUT TRUE. HOWEVER, THE TWO AREN’T RELATED. BUT, ALL THE MORE REASON TO FEND FOR ONE’S SELF.

As a long-time Real Money subscriber, I can always count on Barry to make faulty conclusions from cherry-picked data.

Did anyone happen to notice that the two comparison years just happened to be very, very close to the beginning and the end of the recent bear market?

Duh… That surely wouldn’t have skewed the data, would it? All those big-time money managers, sitting in 95% stock, riding those 401k accounts down, down and down into the dust?

Freddie Mac reports that the average home appreciation was 8.1% for the first quarter on 2006. That wasn’t supposed to happen! Where is the housing bubble that we have been reading about for 6 years? (That’s a decrease in appreciation from the 13% for the first quarter of 2005).

Now, that’s an example of compunding! The 8% this year means more actual dollars than the 13% last year when you consider the additional appreciation from the entire calender year of 2005.

What good is this boom when all it is resulting in is people taking equilines against there home for low interest rates, and first time buyers only having taking 2 interest only loans to turn to in order move into a condo/townhome.

A home isn’t stock, you need a place to live. For people who had 200,000 on a home, they still need another place to live to cash out this income.

A agree people feel pinched because incomes haven’t grown with the cost of items, plus the amount of items that are supposed to be part of the American Standard

Four years ago I retired at 55 with no pension and no debts.

It was costing me two ounces of gold and 100 ounces of silver to meet my monthly living needs back then.

Today, it is costing me one ounce of gold and 50 ounces of silver to meet the same monthly living needs.

This stuff seems to be magic. My retirement plan is working better than I expected. You may want to get yourself a whole lot of gold and silver to retire on, too.

Figure the number of months you could possibly live past your retirement date and buy enough gold and silver to cover that amount of time at rates of expendature reasonable to you.

That could mean from 200 to 500 ounces of gold AND 10,000 to 25,000 ounces of silver.

Better hurry, it’s almost all gone and will resume its upward dollar-price spiral soon.

What about the SS safety net? By the time I am eligible to collect, I expect it will barely cover my entertainment expenses. You know, stuff like eye glasses, false teeth, hearing aids, medication co-pays, etc. It makes me wonder if I shouldn’t have adopted the retirement formula of the 1960s, “Live fast, die young, have a good looking corpse.”

Sadly, that boat has sailed a long time ago, sigh.

Larry, Bankruptcy is what most companies DID do to break union contracts and escape pension requirements. You make it sound like it’s uncommon for companied to go bankrupt to abrogate promises made and continue operating. It happens all the time.

Well enough people have given voice to pension plans 401’s and start saving at a young age (very Correct) So I’ll now throw in hopefully some food for thought.

The US dollar is universally perceived as an absolute yardstick – most of the world’s wealth is measured against it.

Yet, the mighty US$ is a fiat currency, a shrinking electronic/paper-based measurement of wealth with nothing but good faith to back its perceived value. The US$ is only worth as much as any other promissory paper note, and its worth is being excessively diluted and debased continually by the US Federal Reserve Bank as it continues to print more USD notes at an alarmingly accelerating pace, well beyond GDP rates. A year 2002 US$ is a very different dollar in 2006.

The true value of the US$ cannot be reliably measured against other currencies either. Those paper notes are also likely to be going through a similar devaluing process in order to stay in step with the US$, so that their economies may remain competitive in the world’s export markets.

A truer and objective measurement of the USD’s real value would be its real purchasing power at any given time.

The US$ value index above is basically a realistic measurement of the greenback’s (decreasing) purchasing power. The index measures the US dollar’s rate of change (RoC) against a small but essential basket of leading commodities:

Gold: putting aside temporary fluctuations, it is as close to an absolute and constant measurement of wealth over time as can be found. An ounce of gold took as many working hours to purchase 80 years ago, as it does with today’s average wage. An ounce of gold buys approximately the same amount of goods now, as it did then – the same can’t be said for one US dollar.

Oil: currently a most essential source of energy – civilization as we know it would cease to exist without it. Most of society’s goods and services depend on oil to some extent.

Wheat: one of the major sources of food for an increasingly hungry world.

So, what does the US$ value index mean in real terms?

• Since the start of year 2002, the US$’s purchasing power has halved.

$1,000 saved in Jan 2002, buys around $500 worth of essential goods just four years later.

• The US stock market’s true worth is much lower than generally perceived by the public. To compensate for a devalued US$, the Dow Jones index should now be trading at around 22,000 instead of the current 11,000 level.

• Price inflation as generally re-defined in today’s terms, has little or no relevance to the original meaning of monetary inflation – there are basic but important distinctions between real and nominal prices. More on these issues here.

• The US’s real monetary inflation (i.e. currency devaluation) is being massively under-reported as price inflation, and in reality is now above 10%pa. This is consistent with the growth in US$ money supply. Cheap Chinese goods and generally low wages also contribute to the everyday illusion of low “price inflation”.

The bottom line is that storing wealth in USD-based assets (or most other paper currencies) is a sure recipe for deteriorating wealth in the long term, courtesy of the Fed’s invisible tax.

Now that the US Federal Reserve Bank has stopped publishing money supply data (M3), relative measures such as the US$ value index have become an essential yardstick.

Keep an eye on it, for a true measure of the world’s default currency and all that is measured against it.

this disconnect between consumers and reality is a phenomena throughout the western world, and nowhere more stark as with expectations as to retirement.

In Australia, the national government’s actuary has said that both sexes can now expect to live past the age of 85. This means that the population must be able to fund at least 20 years of retirement.

However the pension today is just $21,000 for a couple, and various studies suggest that a couple need (in today’s purchasing power) an income of $48,000 to be “comfortable”.

But are people concerned? Not at all.

Research by the Association of Superannuation Funds of Australia shows that the “average” male accumulates a pension fund of $180,000 over his working life and a woman $95,000.

The median is probably one quarter of each figure.

But even if this “average” man and woman pool their pension funds to reach $275,000, their expectation of living a comfortable life in retirement can only be for 5.7 years.

The couple at the median – the line that seperates the top 50% from the bottom 50% – can only expect a comfortable life in retirement for 1.4 years.

Ouch!