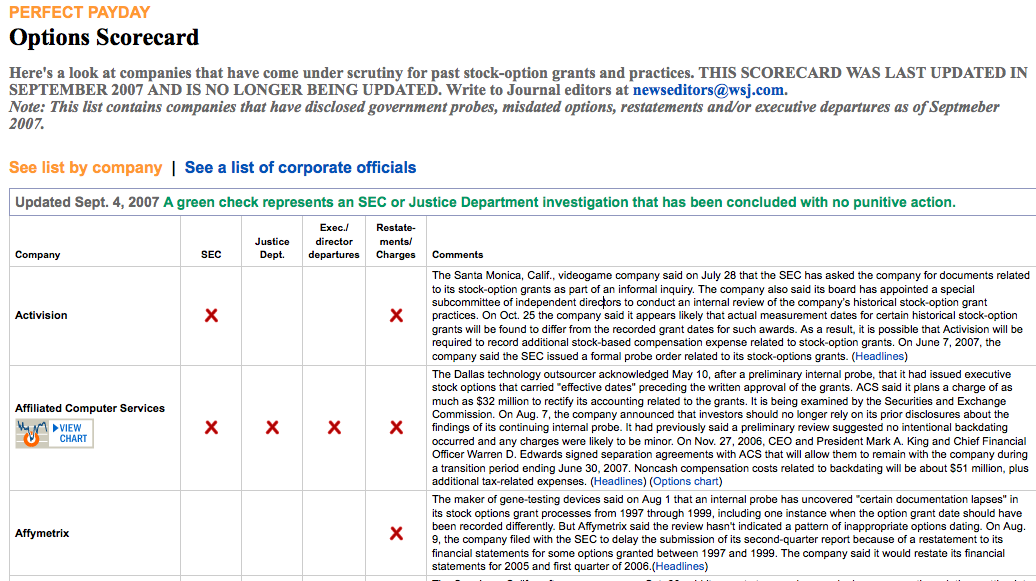

Here’s a nice free feature courtesy of the online WSJ.com: They posted an updated look at more than 120 companies that have come under scrutiny for past stock-option grants.

Note: This list contains companies that have disclosed government probes, misdated options, restatements and/or executive departures. Some companies that have undertaken or disclosed internal probes but no further news may not be included.

click for interactive site

Source:

WSJ Online

http://online.wsj.com/public/resources/documents/info-optionsscore06-full.html

This scandal makes steam come out of my ears. Every single executive associated with this should go to jail. These guys are grossly overpaid by virtually any measure but that isn’t enough. They want more so they steal it from the owners. They’ve breeched their fiduciary duty. Period. Fire them and send them to jail. Make them exchange their Brooks Bros suits for bright orange jumpsuits.

And Steve Jobs saying he didn’t realize it was wrong. That’s an insult to anyone that has just one live functioning brain cell. He gets a pass just because he’s one of the few truly exceptional brilliant executives?? No way. He should be picking up garbage along the interstate along with others convicted of stealing.

This is capitalism at its margins. We live in a society motivated by the desire to make money.

I guess we have to teach our children a little better about right & wrong, and leave the rest to the politicians and district attorneys running for reelection. But wait, they have their own problems, too.

hopefully the press can move onto their next “business is bad” jihad with the mutual fund kickback scheme revealed today. I’m disgusted by backdating – it’s probably illegal and definitely in contravention of accounting standards – but the Journal has a hardon for the heads that are rolling cause they initiated the whole brouhaha. The shareholders of the companies involved already got punished once by the executives taking from them, and now they’re getting punished again as the share price takes a hit and in some cases top executives are forced out. Oh, and no double standard at all right? Steve Jobs, well he’s a superstar CEO and a creative genius and we all like him, so he can stay.

hey guys! Glad to see some people with backbones posting on here! I believe the US has gone to the dogs. What are we doing halfway around the world when we can’t even get our own house in order. Yes, these executives shd be severly punished. It’s unexusable the amount of greed that have!

Also, this current market rally is discounting the housing boom we will have in 2051!

So please BUY as much stock as your empty brains can handle!

Backdating of options would not have gone forward unless it got the OK from outside Lawyers and

Auditors. Are the outside lawyers and auditors liable in any way? I’m sure Elliot spitzer would know. This kind of thing is usually suggested by these outside professionals.

Options Backdating Grid

Hat tip to Barry Ritholtz for pointing out the Journal’s excellent options backdating grid. With more than 120 companies now embroiled in some measure of options backdating investigation, it’s become a far more nuanced process in terms of the investment

Gotcha. The Enron defense. We covered our ass by getting board approval and advise from an independent law firm saying it’s fine to steal from the owners so don’t hold us grossly compensated executives accountable for the theft. Why not.

I agree, these low life thieves should be put in jail for life and all of the expenses for keeping this garbage in jail should come from their own pockets and from their hidden offshore accounts. The taxpayers should not pay a dime.

So restate earnings and the value of the options… even fine the people involved where they already realized benefits.

All I know is that any stock I own that is involved in this has taken a large hit. The CEO’s are walking away from the businesses they built while my portfolio declines in value. Who really got punished here?

Due to the wide-spread nature of this issue, I say give them all a pass and let them get back to work creating shareholder value.

You sound like armchair quaterbacks to me… if you think you can do better then show me the stock symbol of the company that you run and I’ll consider investing my now reduced portfolio there.

M.B.A.s: The Biggest Cheaters

http://biz.yahoo.com/weekend/mbacheat_1.html

V L is exactly right. Thousands of hard-working employees are being dragged down with the suspicion of any wrongdoing on the part of executives. We can’t transact any options and portfolios are being unfairly impacted by the SECs fishing expedition. Just like the thousands of Enron employees, who were in no way involved in the management deception, and yet lost their life’s savings, we can no longer trust the companies we work for to help secure our futures.

Diversification? Have you seen the list of companies involved in this scandal. Folks could have been the poster children of diversification and had each and every sector covered with blue chip companies, and they’d be out on the ledge today.

The AP doesn’t help matters either. In their small-minded, naive manner of reporting the story, the article is written with half the story. The article reads, “Company XYZ has announced it will restate its earnings statement due to the SEC’s investigation into Company XYZ’s options.” They leave out the part where Company XYZ is restating because of the cost to that company to cooperate with the SEC in the investigation (i.e., legal council’s time, employee time to collect and reproduce hundreds of thousands of pages of documentation, and subsequent lawsuits brought against Company XYZ when nothing has been determined by the fishing expedition). You can be sure, no one is going to do anything to help repair the reputation of that company even if they are completely cleared of any wrongdoing.