From the author of The Long Emergency, comes this just about perfect summation as to the present situation:

From the author of The Long Emergency, comes this just about perfect summation as to the present situation:

“Last week’s stock market meltdown suggested that a financial sector rigged for the falsification of reality eventually enters a danger zone where reality implacably reasserts itself, expectations dissolve, and all that remains is the sour odor of fraud.

This long episode of market mania, running for seven years, was based on the idea that non-performing loans could be turned into money by removing them from their point of origin and dressing them up in respectable clothes — like taking all the winos in downtown Los Angeles, putting them in Prada suits, and passing them off as the faculty of the Harvard Business School. It was a transparently ludicrous racket and the wonder is that America proved to be so utterly bereft of regulating authority — not to mention plain decency and self-restraint — at every stage.

It’s really hard to account for the stunning failure of responsibility. What you had was a whole industry that surrendered the standards and norms that brought it into being and enabled it to function in the first place. Mortgage lenders stopped requiring house-buyers to qualify for loans; bankers stopped caring what stood behind the paper they issued; dubious loans were bundled and resold like barrels of rotten anchovies — in such numbers that no individual stinking minnow would stand out — and the barrels were traded up the

line, leveraged, hedged, fudged, fobbed, and fiddled until, abracadabra, they were transformed into so many Tribeca lofts, Hampton villas, Piaget wristwatches, million-dollar birthday parties, and Gulfstream jets.It worked for the Goldman Sachs bonus babies, and the private equity scammers, and for the corporate CEOs and their board members, and for the politicians who parlayed their votes into cushy lobbying jobs, and even for the miserable quants in the federal government’s termite mounds of statistical reportage. It even worked for about 18 months for millions of feckless US citizens gulled into contracts for houses they could never hope to pay for, under arrantly false and ruinous terms . . .”

Ouch!

>

Source:

Vanishing Point

Jim Kunstler

Clusterfuck Nation, July 30, 2007

http://jameshowardkunstler.typepad.com/clusterfuck_nation/2007/07/vanishing-point.html

Poetry.

Barry:

“like taking all the winos in downtown Los Angeles, putting them in Prada suits, and passing them off as the faculty of the Harvard Business School.”

The winos in downtown Los Angeles would never alow this indignity. Prada suits…? Harvard Business School…? Are we trying to pass them off as the “gifted children of neurotic self loathing parents”………? The next thing you know Kustler will be trying to buy them Bentley roadsters…..

Good luck to all…. ;-)

Econolicious

Why didn’t you quote him all the way to “entropy rules?” You missed your chance.

—

Where would “To Be Or Not To Be” be without the slings and arrows of outrageous fortune?

Where would The Tappet Bros. be without Click and Clack?

Where would TBP be without trenchant and erudite Eclectic comments?

~~~

BR: Fair use. Thats a big excerpt as is, and I prefer not to cut & paste entire posts . . .

It is sad, Wall Street, the place where a lot of the brightest minds go to work real hard. Instead of working to produce anything of value, they run a big scam.

Alittle tid-bid from “SUDDEN DEBT” by Hellasious.

“My prediction is that in the coming weeks and months we will be witnessing another type of “can’t sell the loans” news, similar to the recent Cerberus, KKR and Blackstone items. In this case it will be the old deals going sour because they will simply be unable to find anyone to re-finance their existing loans/bonds.”

Apollo/Reaology/Harras… Hi Mom, SEND CASH….!

If ever there was a bad deal where the calculators malfunctioned, this is it. Not a huge deal by any stretch of the imagination, but a trailer for an awful film….

Look out below…. Perhaps since we have all thosee “winos” dressed up in their Prada suits, with their fancy Harvard BS education, we can put some of them to work at Sotheby’s International Realty, selling mansions to the “winos” on Wall Street.

How that for market efficiency….?

Econolicious

No, here’s your true quote of the day:

“…perception has turned to reality.”

–Jack Bouroudjian, with Quintanilla and Kernen, CNBC, about 6:40 E.S.T.

“Perhaps since we have all thosee “winos” dressed up in their Prada suits, with their fancy Harvard BS education, we can put some of them to work at Sotheby’s International Realty, selling mansions to the “winos” on Wall Street.”

I’m sorry… I’ve just been told that this has already happened…

SORRY…!

It reads and rings true. It would be nice to think that serious reform would arise from this debacle. Every gatekeeper that was in place fail due to greed and a “not my problem” attitude. Everyone with an ounce of grey matter in their head that was along this food chain had to have an inkling of the impact, but thought perhaps they would have “made theirs” and been isolated from the losses because of the process of selling mortage loans, repackaging, slicing, dicing, etc… Well it doesn’t work that way. The excess supply of homes, condos, etc. really exist–just like those Sun computers, Cisco routers, The massive amount of fiber buried under that ground that is still dark of the 2000 mess. Sure, the “stock” of the company and many times the company itself ceased to exist, but the half-life hangover was caused by the “stuff” left behind. Displaced workers, capital equipment, etc. People in our business–especially as you work yourself up to the higher eschelons of investing lose sight that these pieces of paper represent stuff, things, people. It is not just a product, a fee, a bonus, a risk. What we do is anchored in reality. A reality that ultimately pays the price for their indesretions.

How long until the government bailout begins, and once again the taxpayer is stuck with a bill for a party he wasn’t even invited to attend?

It was all about making the deal. Everyone-borrower, broker, warehouse, rater, bond seller, hedge fund, servicer– got their quick reward from doing the deal, but no-one thought about the remaining 30 on the mortgage.

Let’s not forget the Fed, who aided and abetted with the low rates, property speculators who drove prices up beyond affordability, investment banks worldwide who bought US stuff without reasonable diligence… and let’s not forget that this has not yet unwound – only a few strings have popped here and there. There are some long months and years ahead.

Not to worry about subprime – Fed Paulson sez all is fine – “economy couldn’t be stronger” – subprime mess is contained .We are stronger than we have been in decades- (why does 1987 come to mind ) HOW DOES HE KNOW ? The banks and institutions that created these things don’t know what they are worth ( CDO’s CLO’S CMO’s) . He basically said rates are going up without saying it . What a den of thieves . Bill

A little more on Paulson’s statement:

Quote: “Wednesday August 1, 8:19 am ET

BEIJING (Reuters) – Treasury Secretary Henry Paulson said on Wednesday that the market impact of the U.S. sub-prime mortgage fallout is largely contained…”

If you read carefully, he says the “market impact” is contained – contained to the financials and any other company that needs to borrow money, I guess is what he means.

True.

I’d still recommend everyone read the entire thing.

That was one of the best descriptions of the last seven years I have ever read.

When I started as a loan officer 7 years ago, individuals actually had to provide documentation to qualify for loans. By 2005, a borrower didn’t have to show ANYTHING as long as there FICO was over 700. They could get a loan to almost 1 million dollars at 100% loan to value.

Seemed like a time bomb to me when I heard from guys in subprime of cleaning ladies owning 3 investment properties.

Of course, those ladies are in foreclosure.

Well written article, but I disagree with the point about the US citizen being “gulled” into contracts……

Very few of those “innocent ” buyers didn’t know what they were doing. They just figured they could sell higher to another sucker. Just like all those poor citizen traders who got wiped out in 2000-2002…..who was pushing the buy button? How about a little personal responsibility.

Barry was right to stop before the “entropy” comments. I am one of those “hard-ass science types” that Kunstler refers to in his post. Finance is a bit more complicated than “energy in/energy out, because there is a feedback loop effect embedded in human psycology that makes a financial crisis worse than any simple energy loss resulting from work performed by a closed system.

The scripts of these episodes are already written from previous debacles, the press will pull out Wall Street veterans and economists whom will be reported to have foreseen and foretold the present events.

The plaintiffs will be silently waiting in the lobbies of law firms.

The party’s organiser’s will team up with the banks, which were involved in the scams, and few abuses will be reported as a sacrifice to the crowd, the rating agencies will be sanguine and will downgrade two or three CLO/CDO.

A lip service from the banks CEO’s « there has been few exaggerations which will have to be remedied »

The working life will command other « added value » ideas, and may be after all oil and commodities do not seem so overstretched if mixed with a little zest of currencies and interest rates? And may be after all stocks will look look cheap?

Usually Kunstler’s entries are diatribes against society. Glad to see he toned it down a bit to get a good message across. i try to take his commentary with a grain of salt as he has predicted Dow 4000 for back to back years.

Is anyone over the age of 60 surprised? A growth economy is driven by dissatisfaction-which is emotionally, not rationally based. When the desire for a better life morphs into an addiction to more, borrowers and lenders both lose their perspective in the rage to get more.

It always comes to the same end. The upcoming total unwinding will be a great learning experience for anyone who has yet to see one.

Good Luck!

Rod

perhaps the single best article I have read for a long time.

BTW Hanky-Poo dropped anutha $10b LARGE today

total of $49 billion in a week’s time.

He’s busy even when he’s not lying his ass off. I wonder if he’s looking at houses in China???

Ciao

MS

MS, …

Overnight Repo: A repo with a term of one day.

We had this dialog months ago and you still don’t get it. You cannot add up loans that are canceled overnight to reach some fantastic billion dollars amount per week. You CAN add the other TERM repos though, until they are canceled.

Go look at the treasurey site, not the fed site.

These are not the same as the Fed drops……these are straight to the desks of the traders.

Do a little research before you “try” to argue.

Ciao

MS

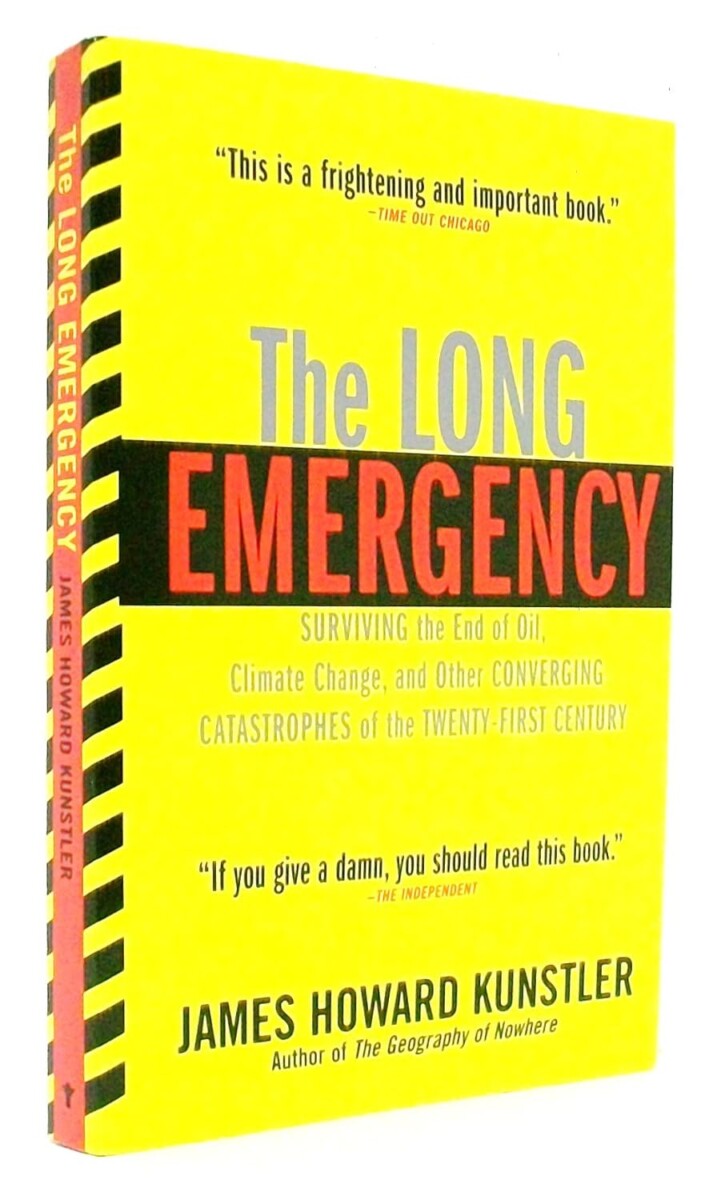

I read Kuntsler’s book, “The Long Emergency” and it scared the crap out of me. Almost literally. I got real depressed and started drinking, swore I’d never get married and have kids (which I’m told requires a willing participant).

Then some things happened since then. I sobered up, and I discovered that there was the possiblity that internal combustion isn’t the only game out there. And I discovered that we are being manipulated by oil shills (who would have imagined!) with this false demand neocon side (war) and the *supposed* peak oil side helping them from both sides.

Gas was supposed to go up so we’d get progress on alternatives. Let the market work. Then the market was of course manipulated. Gas prices went down from bets and inventory increases supposedly.

So what I’m seeing this summer is, we were way over bought with too much supply? Where was the problem. Gas is cheap.

I think Kuntsler is a shill. Bring on the hydrogen. There’s a guy who can make it from water that tens of thousands of people have seen on the internet. That would completely blow away his no time to convert fear mongering for big oil.

John, I think u’re catching on. Now if only the rest of the country could sober up. (I still haven’t.)

Vietnam War => Massive LBJ deficits => the Oil shock of the ’70s.

War On Terror => Massive Bush deficits => the Oil shock of the ’00s.

Bartender, another round for my fellow countrymen.

Why is Russia putting a flag on the ocean floor at the North Pole?

isn’t one of the potential next “phases” so-to-speak the melding of the primary, secondary and tertiary capital markets? wall street has been for a while now a follower of opportunity versus a leader. in other words much like the phasing out of human specialists on the NYSE, wall street used to serve a meaningful purpose but that has been a thing of the past for a while now.