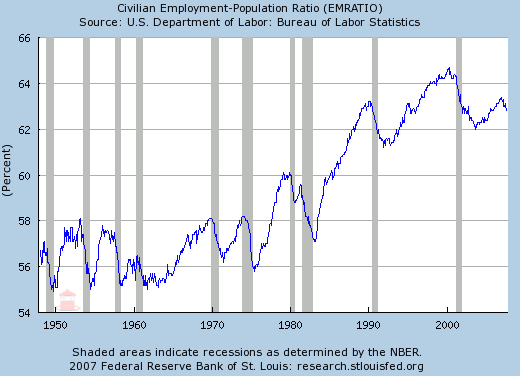

Directly on point with our last post on NILFs and the labor participation rate, David points us to this delicious econ-wonk chart (below).

It shows the relationship between a declining Employment Population Ratio, and subsequent recessions:

Fascinating chart — thanks for the pointer, Dave, and thanks Adam for the chart!

>

Source:

EM-Ratio — What, Me Worry?

Adam Oliensis

Safe haven, September 09, 2007

http://www.safehaven.com/article-8380.htm

Well, that graph seems to suggest that the ratio is predictive of recessions. But isn’t this mixing up cause and effect, that recessions result in a smaller ratio of the workforce employed? Notice that the declines are coincident with recession, not typically leading recessions. I think it basically tells us something we already knew, that unemployment goes up during economic downturns.

Tom,

Although the resolution of that chart is pretty course, it sure looks to me like the EPR ratio leads each recession.

Nevertheless, whether it leads or is coincident, a ’10 for 10′ record since 1950 is pretty impressive. What does that say about the little ‘downturn’ at the end of the graph in 2007?

Wow, you can really see where women enter the workforce. Interesting graph. Hey guys you are doing great, “household” income is up!

Gee, thanks…

almost identical to the 1994-95 time period, which makes a recession call hard to make

So a recession is always linked with a decline in employment population, but I see several declines in population that aren’t linked to a recession. The recent trend looks a lot like the decline around 1995. Not necessarily predictive of a recession (yet).

Actually I use this very chart to show why it is that declining labor force participation is not skewing the unemployment rate. The 90s were an aberration. We had labor force participation like we have never seen.

I agree with the ’95 similarities.

By the time you can work out if a recession is coming or it is just a mid-90s type slowdown you’re already in a recession…

I wonder how much of the current dip is due to abandonment of those who want to/need to work versus abandonment of those who were opportunistically rejoined the workforce during the boom/bubble period with housing. I know this is purely anecdotal but from 2003 to early 2006, in the part of Phoenix where I live, we saw a large percentage of supposed stay-at-home moms obtain their real estate licenses. The ability of anyone who could fog a mirror to sell houses in desirable areas of Phoenix and large numbers of people using housing appreciation to move-up neighborhoods in large hot developments led to quite a few former SAHMs selling houses of their friends. There were at least two brokerages that I know of that, with the exception of the broker, were staffed almost exclusively with SAHMs looking for an extra $5k here and there. With the fall-off in housing, nearly all of the ones that we knew have dropped back to being SAHMs. Although most that we know never considered themselves truly working, the Labor Dept probably counted them. Their dropping back out of the workforce is, in my mind, a healthy reflection of the deflating of the housing bubble rather than a negative sign of those wanting to work abandoning their efforts.

As a semi-OT aside, my personal bubble indicator is when I see numbers of friends and acquaintances leaving their current gigs in non-bubble industries for the hot/bubble industry. I saw it in the late 90s with IT and then a couple years ago in housing. When engineers were leaving for real estate, you could almost see the bubble reaching its elastic limit. At one point, a minister down the street and I were the only people on our 12 house block not involved in real estate.

I’ll tip my hat to the mid 90’s camp (shocker)….

Here’s a quote from one of the best — Tony Dwyer,

“in the last mid-cycle slowdown (1995), when the dollar was within 1% of a historic low, the Fed cut rates on weak employment numbers which began a multi-year run higher for the greenback.”

Talk about a variant view to this crowd! I agree.

Did someone say “NILF”?

«Wow, you can really see where women enter the workforce.»

You will be able soon to look back and see the Chinese entering the global workforce :-).

http://money.cnn.com/2007/08/22/news/economy/lazy_american_workers.fortune/index.htm

«Economists see it happening already, attributing some of the surprising flatness in Americans’ real total compensation of the past few years to the presence of millions of global workers competing for jobs.»

«More important, in the growing number of jobs not paid by the hour, people who work harder may just produce better results. General Electric chief Jeff Immelt put it bluntly while recalling a trip to Beijing last year, when he got a big order from the Transport Ministry: “The whole ministry was working all day on a Sunday. I believe in quality of life, work-life balance, all that stuff. But that’s the competition. So unless we’re willing to compete …”»

The new message from the plutocrats is ”There is a long queue of people begging to take your job outside the door, so work sundays till you drop.”.

It’s pretty clear that employment is coincident at best and lagging at worst indicator. You can’t use it to _predict_ anything!

I noticed that from ~91 to ~01 the EM ratio jumps by about ~2.5%, which corresponds with a nice jump in the stock market. Now the market has continued to do well since then (after the bear market of course), but the EMP ratio is only as high as it was in ’95. Don’t know how predictive this is of the economy and the consequent direction of the market, but it is worrisome.

Finally, for those who say this looks like the mid 90’s correction. How can you say that before the trend has reversed back into an uptrend. Is this just SWAG (scientific wild ass guess).

Any ideas on how/whether this figure in the retirees (baby-boomers). If not then this figure should be dropping now (for those that have hit 59.5 and chosen early retirement) and even more so when they hit 65.

Thanks

RobM: Whenever money is sloshing around, that creates a number of “surplus” jobs supported by that hot money, be it (as recently demonstrated) in dotcom ventures, real estate, or more discreet industries. More often than not those surplus jobs are characterized by a low value-add, but in a good number of cases (e.g. in dotcom but perhaps not precisely in real estate) they represent bonafide projects that will simply not be undertaken in a “normal” business climate because of priorities, resource scarcity, etc. That doesn’t mean they are not meritorious, there is a lot of useful work that doesn’t have a high balance sheet impact (at least that gets attributed to it), and will not usually be funded unless purse strings are loose.

What I’m seeing these days in my industry is that companies offshore and domestically try to draw on “highly experienced” folks and shun entry-levels, which creates somewhat of a crunch for “heavy hitters” but forces job market entrants to pursue other things. But at the end of the day it becomes Musical Chairs — if that many companies are not hiring domestically, somebody is going to be forced “out of the workforce” somewhere.

Adam,

I found your post really interesting and it has really improved my knowledge on finances. You’ve assisted my understanding on what is usually a hard to tackle subject.

Thank you!