Yesterday, we discussed the potential impact of the ongoing weakening of the US dollar.

Today, we look at a few printing press Money Supply issues. Our focus: The spread between the Fed liquidity action (a/k/a Repos) and the M2 money supply measures.

This is simply a measure of how much cash the Fed is injecting into the system.

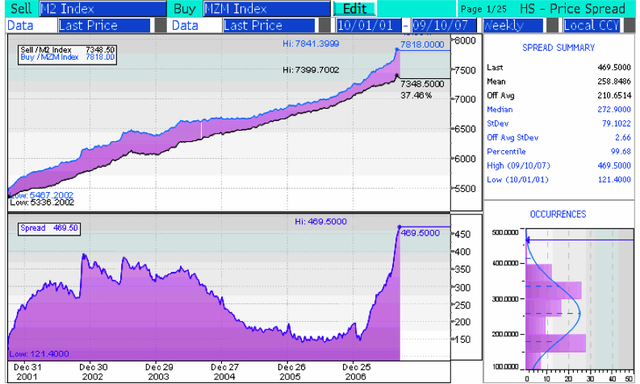

The following Bloomberg chart shows the spread between the two of these monetary measures. It is quite instructive:

>

Speaking of surges: As you can clearly see above (bottom left chart), the amount of MZM (repos) versus M2 during 2007 is enormous.

This means that the Fed is “inflating” at a rate faster today than it did right after 9/11, or during the deflationary scare of 2003.

As we asked Wednesday night, “What did the Fed Chair and the FOMC see that spooked them into a half point (over) reaction?” I am not sure what is was (and we’ve discussed many of the potential issues over the past 2 years), but the Fed is obviously scared witless.

The manifestations of this free printing press are many: Any commodity priced in plentiful dollars will cost more. Crude is now $82; and Inflation Fears Send Gold to 27-Year High.

Why? One way to think about it is supply and demand. Print ALOT more dollars and each one is worth a little less.

Or, consider it this way: Extracting Oil or Gold from the earth ain’t easy: We have to explore for Oil, determine where it is, how deep, what quality, etc. Then we have to use lots of heavy machinery to extract it, ship it to where it gets processed, refined, used in chemical manufacturing. Some of it gets refined into gasoline, and it is then transported to a network of gasoline stations, and it gets pumped into your car — all for less per gallon than diet Coke or peach Snapple!

For gold, the process is not all that dissimilar.

Just crank up the printing press: Its cheap and easy. But why should us gold and oil producers exchange our hard won commodities (its hard work) for pieces of paper you people are simply cranking out for free? Either give us something of real value — or instead, we will insist on more of your crappy ittle pieces of green paper.

Thus, the inflationary repercussions of a “free money” policy. In fact, every commodity that is priced in dollars can potentially see much higher prices: Gold, Oil, Wheat, Soybeans, Copper, Timber, Corn, etc.

Its easy to understand why inflation has been called The Cruelest Tax.

~~~

BTW, for those of you without a pricey Bloomberg terminal on their desks, a good source for (free) data of this kind is the Federal Reserve Bank of St. Louis’ publication, Monetary Trends. There are always a solid collection of charts showing money supply, economic conditions, etc. Not to get too wonky on you, but this is simply pornography for econ geeks.

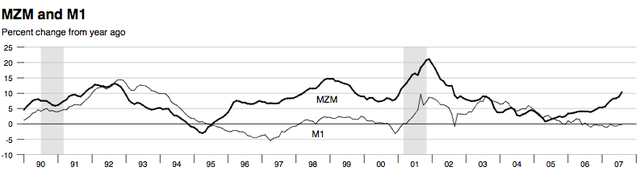

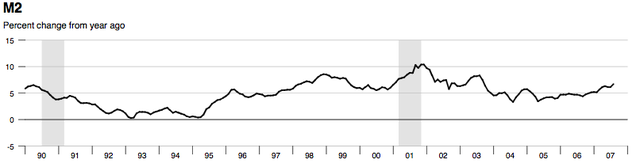

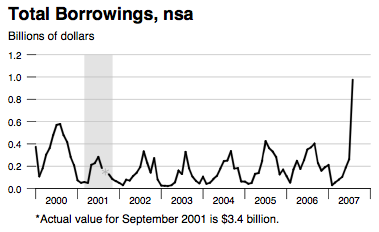

There are a few charts after the jump worth reviewing. For the less visual of you, they show that Money Supply continues to grow at a rapid pace, that bank borrowings are increasing.

>

Sources:

Monetary Trends

Federal Reserve Bank of St. Louis’

October 2007

http://research.stlouisfed.org/publications/mt/20071001/mtpub.pdf

Where Crude Goes Now May Depend on Dollar

Futures Close Near $82

MATT CHAMBERS

WSJ, September 20, 2007; Page C1

http://online.wsj.com/article/SB119019169756632291.html

Inflation Fears Send Gold to 27-Year High

Weakening Dollar Also an Influence; Metal Hits $732.40

ALLEN SYKORA

WSJ, September 21, 2007; Page C6

http://online.wsj.com/article/SB119028926640733763.html

>

Money Supply, MZM, M1

M2

Reserves Markets, Short term Credit Flows

I honestly cannot say what the repercussions of this chart are. But man, is that a spike or what?

In a sign that slower US growth and the weak US$ is having an impact overseas, European services and manufacturing PMI was less than expected and fell to its lowest level since Sept ’05. The euro fell off its highs vs the $ in response. One Canadian $ is worth more than one US$ for the 1st time since 1976. US and UK LIBOR overnight and 3 month rates are modestly lower again, so from a short term rate perspective, the Fed’s interest rate cut helped to thaw things out. Commercial paper rates have also ticked lower. On the flip side, the implied inflation rate in the 10 yr TIPS is at 2 month high. No economic data today but it is triple witch expiration and the quarterly S&P rebalancing. The Fed’s Kohn, Plosser and Warsh all speak today but likely won’t comment on monetary policy.

the only thing the fed saw was howling politicans.

Incidentally, I have never definitively identified the source of the quote “Inflation is the Cruelest Tax.”

Suggestions range from Keynes to Theodor V Houser (Committee for Economic Development 1958) to Pres. Gerald Ford to Ted Houser.

Milton Friedman’s quote was INFLATION IS TAXATION WITHOUT LEGISLATION

Other nominees include John Anderson (1980), Henry Hazlitt, Leonard Read, William Jennings Bryan, Secretary of the Treasury William Simon (1974), Vladimir Lenin, Thomas Jefferson, Percy Shelley (Nineteenth Century), Carl Schurz.

I thought this was the earliest printed version we found was this: 1920 Nebraska Blue Book; on p.823 it reportedly reads in part: “Inflation is the cruelest tax of all.

Bu then I was referred to this: Aristophanes, The Frogs c. 405 BCE.

CAN ANYONE DEFINITIVELY ANSWER THIS QUESTION?

Check out this reconstructed M3 (which the gov got rid of). Annualized at 14%!

http://www.shadowstats.com/cgi-bin/sgs/data

“Aristophanes?” Ridiculous!

Barry does the below post by Mish contradicts your post? (sorry, i am not much savvy with monetary stuff, to see it for myself)

http://globaleconomicanalysis.blogspot.com/2007/09/is-us-printing-money-like-mad.html

I don’t think you’re going to improve on the Nebraska answer. I mean… it ain’t a phrase that you can track to an historical point, nor to a word like “Xerox,” or like some company called “Cruelest Tax, Inc.” And nobody has likely written a book, “How I survived the Cruelest Tax.”… or at least not since the NebBlueBk reference some enterprising soul has already beat the bushes and found for you.

What?… Some Neanderthal chip it out on a cave wall?

—

On to pressing matters of overall import:

http://tinyurl.com/3266xd

When did the phrase “increase information asymmetry” first hit the scene, huh?… Was it before or after proforma EBITDA found its way into the lexicon?

Karl, would you mind translating that one for us?

—

BTW, Karl,

Here’s a pretty good analysis of the current situation. From Comstock Partners:

http://tinyurl.com/35n6xp

They acknowledge the more-or-less knee-jerk actions of the FOMC, but conclude, as I do, that they won’t work in the event of a radical decline in asset prices.

The FOMC is trying “Hair of the Dog.” However, not only will it not work, it will just sow the seeds of future failure by continuing to destabilize USD. That’s what the initial shock to the bond and commodity markets after the FOMC actions mean. What Greenspan said recently in his book and in interviews is correct. His Fed that acted to reduce rates (while he did hold them too low, too long) did so after an existing period of extremely low inflation had resulted from the late stages of the collapse of the dot com bubble, the recession during the time, and the 911 attacks. He did it in concert with bond market yields that were already reflecting that deflation. Here’s a table with historical inflation rates:

http://tinyurl.com/36ercw

Notice late 2001 and 2002 as these generally support what Greenspan has said.

You and I can philosophize until the bell-cow comes home, but it won’t change the fact that the markets themselves tell us how effective or ineffective FOMC actions are. At least until now, the markets are thumbing their noses at the FOMC. And, I don’t mean the equity markets… Equity markets are like cocaine addicts. Bond markets are like seasoned analytical accountants… but not like the big league accountants of today’s corporate world, bond markets don’t fall for EBITDA pro-forma hocus-pocus.

Karl, I appreciate your dialog. I sort of thought the count was 3 and 2 after our last little exchange… figured I’d have to slip a high and tight fastball by you. Hit it if you can.

From the FT, via Russ Winter’s blog:

(quote)

Kroger, the largest US supermarket group, said on Tuesday that inflation in its core grocery business is running ‘at a level not seen in several years,’ underlining concerns over the broader economic impact of higher food prices. Rodney McMullen, chief financial officer, said that the prices the retailer paid for products increased 21.6 per cent during the second quarter.

(end quote)

Yes, cut the rates because inflation is tamed!! Only 21.6% in one quarter!!

Heck of a job Bennie!!

Neal, good post. Russ also nailed it square on in terms of identifying what Ben saw to address BRs original topic. Piles upon piles upon piles of fictitious capital. Trillions……

Off Topic:

did anyone analyze goldman’s earnings….seems like they made a ton in short trading…..isnt it nice to be in power and in the know and use it to beat other institution..

http://money.cnn.com/2007/09/20/magazines/fortune/eavis_goldman.fortune/index.htm?postversion=2007092017

Neal, it was 2.6%

Barry…I think today’s comments from your (ubber) smart fishing buddy, David Kotok, are worth a cut and paste:

“Rumors that the Saudi Arabian Monetary Authority (SAMA) was about to drop the peg of its currency to the US dollar triggered market reaction yesterday. There are fears that this could lead to substantial sales of dollar assets. Markets worry that SAMA and other central banks have contributed to the latest dollar slide. These rumors were sparked by SAMA’s failure to follow the Fed in cutting rates. But SAMA’s governor has indicated that high inflation in the Kingdom was the reason rates were not reduced. The Saudi-US dollar peg remains in place.

Kuwait dropped its dollar peg in May of this year. There was negligible effect on currencies. At some point the Saudis could do the same. But even if they should take this step, we consider it unlikely the Saudis would choose to move out of US dollar assets in a major way. All Saudi exports are denominated in US dollars. So are 75% of its imports. Their reserves continue to accumulate and must be invested in deep liquid markets.

Similarly, the largest central bank reserve holders in Asia are not likely to engage in major changes in their reserve allocations. They would only risk adversely affecting the value of their current holdings. Countries manage their reserves with policies that are in their best interest. Those Cassandras who predict they will inflict self injury are mistaken.”

BP,

On MZM. Do the fact that repos expire not reduce the amount of liquidity the FED adds?

E.g. the effect of a 2day repo of $1bn is zero 3 days later except for temporary add to banking system

barry-

so what is the fed afraid of? i agree that they are scared “witless,” but what’s even more scary is *why* they are. i have no idea.

it can’t be housing, b/c they’ve already known this is a disaster for some time.

it’s not the stock market, we’re near new highs.

the employment data was just one bad month, not a trend.

last quarter’s GDP was 3% or something.

the banks are under some duress, but they are big enough to handle this on their own.

the only thing i can think of that would warrant such an action is the fear that the credit derivative/ABCP problems spread to the +400 trillion in off balance credit default swaps. and if it were that, they would have cut more than 50bp…

am i missing something here?

On one hand, I am happy to see my huge student loans (at 2.65%) inflate away.

On the other hand, I am horrified at the prospect of my huge savings (for a down payment)inflate away

talk about conundrum! what should savers do?

Techy 2468 beat me to it as I too wonder if your post contradicts Mish Shedlock’s post at Minyanville:

http://www.minyanville.com/articles/U.S.-hyperinflation-Weimar+Republic-M+Prime-printing+money/index/a/14099

Seems it does, but I’m not a monetary expert by any means either.

I would love to hear a explanation or clarification between your post and his.

Thanks!

Back in the day (Volcker and Friedman), money supply was headline news.

The first thing you turned to in Barrons was the money supply page.

Then with ATMS, credit cards, etc., tracking and analyzing money supply dropped out of favor. Interesting (and perhaps foreboding?) that more attention being paid to it. Regardless of how one interprets the stats and charts, that it is more in vogue is telling us something?

Memo to Ben: Please listen to Mozillo and just raise housing prices so we can all refi and enjoy home price nirvana again. Since you cut rates, cost of gas and food has really cut into my paycheck.

The Housing Ponzi scheme is falling apart. Nice try tho.

FWIW, the dollar closed last night @ 78.64, .31 cents from the low close of 78.33… Sept 1992.

The Fed needs to let the derivative markets cave in. There has been way…WAY too much of these things created. Light needs to be shined into that area to clean it up.

>> talk about conundrum! what should savers do?

The best way to participate in an inflationary cycle is to be in the markets that are inflating.

If you think it’s oil, buy an oil stock. (Added bonus, buy a foreign oil company whose currency is appreciating against the dollar at the same time — eg. Petrobras). Actually, in general, the stock market tends to be a good way to ‘defend’ against inflation.

Mish’s post is ok until you click on the chart he provides.

His article states that money supply is only growing at about 2%….the problem is that he provides a chart that shows a reconstruction of m3 with no reference to where his time frame begins or ends.

I guess there is only one way to show a parabolic rise in money supply-a sheer wall of % increase can only be seen for what it is…not how you can reconstruct it and then cherry pick where you are viewing it from.

he needs to specifically state where his 2% is in relation to.

I even emailed him about it and all he did was to drop some names that agree with him but do nothing about the obviously glaring error in the chart.

I posted this yesterday and from the looks of it I am not the only one who sees this error.

Ciao

MS

Strasser…. i do not think falling dollar is all bad news for USA.

a steep drop of 20-30% in 1-3 months is bad news, but not a drop of 10%…..which is happening right now.

it will punish the currency manupulating countries….make our exports cheap…..deflate our debt…..

higher inflation…leading to higher wages….since it will also lead to higher local manufacturing…

right now GAS is priced almost 50% higher in most parts of the world than USA…we can easily live with $3.5/gal gas. (>$100 oil)

i am looking forward to slow decline in dollar….but it wont go too far….things will balance themself due to falling exports of other countries.

i do not believe that extreme things happen in the world….(even though it makes interesting reading about economic armageddon)

USA is going into recession….all data are pointing to that…..but we can come out of all that if we were given a huge discount on our current debt (40% discount will do for now)….and it is possible by deflating dollar….and inflation in wages.

It will adjust. With the end result, of course, being that the arabs, europeans and asians will own most of our corporate and real estate assets.

If the dollar collapses, then we are cheap indeed. And there are always buyers for US assets…

Reminds me of asia after the ’97 crisis.

Eddie..

your comment makes sense….but right now there is so much speculation and volatility in all assets that one can get burned by upto 10% in a month…

i am not much of a risk taker…hence right now i will prefer a non usa government bond…(particularly a non pegged currency state like Aussie, Euro, NZ etc..)

Austrian Economics Barry. It used to apply, but they have thrown out reason and are now in full panic mode. Commodities will be the next bubble, and anyone who thinks they are high now hasn’t seen anything yet. A generation has passed without having to confront inflation like we had in the 1970’s and early 80s, but everyone will either learn or relearn what it means, and they ain’t gonna like it one bit.

I certainly expect some central banker to start selling gold. The reason is because they want to inflate stock and real estate asset bubbles, not gold and oil. If oil gets too high, Bush will threaten to release oil from the reserves. They have proven they like to burn the conservative investor in favor of the risk-takers.

Off Topic:

did anyone analyze goldman’s earnings….seems like they made a ton in short trading…..isnt it nice to be in power and in the know and use it to beat other institution..

http://money.cnn.com/2007/09/20/magazines/fortune/eavis_goldman.fortune/index.htm?postversion=2007092017

Posted by: techy2468 | Sep 21, 2007 10:09:53 AM

With the FASB allowing classes of assets that go from mark to market to mark to a coke addiction what difference does looking at the financial’s financials do? These assclowns are desperate, and they will do anything at this point, but we don’t have to believe all the bullshit.

“Kroger, the largest US supermarket group, said on Tuesday that inflation in its core grocery business is running ‘at a level not seen in several years”

Pizza Hut in Atlanta just raised prises over 13%. But hey, pizza probably is excluded from core.

The Fed needs to let the derivative markets cave in. There has been way…WAY too much of these things created. Light needs to be shined into that area to clean it up.

Posted by: IMHO | Sep 21, 2007 10:47:28 AM

—————–

But what do we do with all those people now without a job they are trained up in?

Maybe pick produce out west. Are you outfitted light and mobile and ready for deployment? Maybe keep your place in the east and do a 15 month stint with a 9 month hiatus. Ready for barracks life and video conferencing with the family?

Maybe we could start retiring at age 50. Maybe?

That said by IMHO – I kinda agree – get real jobs.

Another great resource for those with Bloomberg terminals from the St. Louis Fed — FRED.

http://research.stlouisfed.org/fred2/

You can download the data series to Excel.

Techy2468 – [A lower dollar] “will punish the currency manupulating countries”

No, certainly not in the short run. The pegged currencies drop with the USD versus those not “manipulated”, so it’s the countries with floating currencies (eg. CAD/GBP/EUR) who get punished. In the meantime, the “manipulators” are building out infrastructure, developing a more skilled workforce, and moving up the value scale.

Eventually, the manipulators will re-peg or float and take a hit on forex reserves, but that’s just a cost of doing business.

Good stuff. Here’s more info on global money supply figures, for reference.

http://financetrends.blogspot.com/2007/07/money-supply-and-m3-data.html

off topic… has anyone seen or heard anything about the strike on Syria last week? If it’s true, media has pretty well kept it under wraps.

“WASHINGTON, Sept 12 (Reuters)-U.S. officials on Wednesday confirmed Israel launched air strikes against Syria last week…”.

http://www.alertnet.org/thenews/newsdesk/N12283664.htm

Micheal Schumacher I think you’re barking up the wrong tree.

The following is a quote from Mish’s article:

http://globaleconomicanalysis.blogspot.com/2007/09/is-us-printing-money-like-mad.html

“But M2 and M3 represent credit transactions which are vastly different from monetary printing. Please don’t take my word for it, I would rather you take the word of someone who up to now thinks hyperinflation is likely, Gary North as presented in Monetary Statistics”

Below is the link to Monetary Statistics:

http://www.lewrockwell.com/north/north557.html

Also see the following link at the Wall St Examiner which disputes the Fed has been printing money:

http://wallstreetexaminer.com/blogs/winter/?p=970

Also looking at some of the charts from the Monetary Trends by the St Louis Fed is does not appear the Fed is massively expanding the monetary base.

http://research.stlouisfed.org/publications/mt/20071001/mtpub.pdf

Mr Bubbles….let’s not let facts get in the way of a good story.

The Fed has had a restrictive policy in place before these cuts.

Barry, I’m not an expert by any stretch of the imagination.. However, could it be possible that the Fed running scared and inflating like mad is due to Bernanke seeing precursors that look hauntingly familiar to the run-up to the Great Depression in the data? Otherwise, why risk a fall/crash in the dollar and inflation if all this is is a garden variety recession threat? I say this mainly because, as I understand it, Depression-era research was a formative area of his and a credit bubble crash followed by a lack liquidity/inactive Fed is often cited as a cause that event.

“off topic… has anyone seen or heard anything about the strike on Syria last week? If it’s true, media has pretty well kept it under wraps.”

Apparently North Korea was supplying nukes to Syria and Isreal took them out, most likely with chimpy’s blessing:

Schedule on for six-party talks amid Syria woes

September 22, 2007

In what appeared to be an acknowledgement that reports of a nuclear connection between North Korea and Syria are being closely scrutinized, Foreign Minister Song Min-soon said yesterday that the six-party nuclear talks are also a venue to address proliferation concerns.

The remarks echoed comments on the subject by U.S. President George W. Bush on the same day that the Chinese Foreign Ministry announced that the six-party talks will resume on Thursday for four days in Beijing.

Referring to the six-party talks, Song said, “The basic idea is proliferation. We are talking about nuclear disablement and dismantlement, but the broad concept is proliferation and the six-party talks serve to counter proliferation.”

The foreign minister said that Seoul was watching “very closely,” what Washington was saying on the issue.

Bush warned Pyongyang on Thursday, Washington time, about sharing its nuclear technology with other nations. “We expect them to honor their commitment to give up weapons and weapons programs, and to the extent that they are proliferating, we expect them to stop their proliferation,” said Bush, according to the White House Web site. He did not confirm news reports that Pyongyang had aided Syria with a clandestine nuclear program.

Song’s remarks reflect growing anxiety inside the Foreign Ministry following news reports that an Israeli attack earlier this month on a Syrian facility was prompted by nuclear cooperation between Pyongyang and Damascus. North Korea has been known to supply Syria with missiles and missile technology. Officials worry that a nuclear connection with Syria, if proven, could derail the six-party talks. With the inter-Korean summit less than two weeks away, Seoul officials, and to some extent their U.S. counterparts, have voiced cautious optimism on the prospects for the talks, now in their fifth year.

http://joongangdaily.joins.com/article/view.asp?aid=2880795

So, why haven’t inflationary fears been better reflected in the 10-year Treasury. 4.6% doesn’t seem like a yield someone would be satisfied with if they were expecting a period of serious inflation..

Apparently North Korea was supplying nukes to Syria and Isreal took them out, most likely with chimpy’s blessing:

Either that or a SCUD missile site.

If the recent increase in MZM were expressed as a percentage of M2, the recent figures would not generate such a spike.

According to these charts, since late 2001, M2 has increased from about 5800 to 7350, quite a percentage rise. The recent spread of MZM of 470 (above M2 of 7350 or so) is not large compared to the spread of 400 after 9/11/01 (above M2 of 5800 or so). [Kind of hard to read the figures accurately from the charts above.]

Moreover, the high spreads of MZM over M2 after 9/11/01 marked a market bottom, although granted the bottom took a year or so to take hold with quite a few turbulent lower lowers occurring before the actual market bottom took hold.

Is the recent infusion of MZM the beginning of such a bottoming process? Time will tell.

David wrote; “4.6% doesn’t seem like a yield someone would be satisfied with if they were expecting a period of serious inflation..”

That is absoultely the question I want answered I don’t get it. Who is loaning this money and what is their thinking?

Do they know something we dont? likely, but What?

Does someone really think that 4.6 for 10 years is a good deal in this climate?

Maybe it is but I keep looking at the CRB index and thinking 100% increase in 5 years can not explain todays bond prices.

But what does?

Is this cut blowing bigger bubble in credit card market? My wife just got four phone calls offering credit cards in the past ten days; this has never happened before. And a mail from WF bank for $1million credit card line, huh?

What is the Fed afraid of? Maybe that the house of cards is more fragile than ever?

http://articles.moneycentral.msn.com/Investing/

SuperModels/AreWeHeadedForAnEpicBearMarket.aspx

[remove spaces for one URL]

If you want to know what the Fed fears, look at a chart of ABCP.

Goldman’s last quarter was too good to be true–I simply cannot believe that they so completely outperformed market. They took a few writedowns, but not enough to be convincing. Above and beyond that, it was very bad form for them to announce big earnings even as their *clients* were losing money. The Alpha Fund investors lost hundreds of millions while Goldman made hundreds of millions off the exact same fund–who’s going to give money to a company that’s making big money even as its clients lose big?

May want to read Russ Winter and Mish Shedlocks data Barry, Fed is not printing heavily. Ofcourse Mish’s primer on M’ (e.g. cash vs. credit) is required reading.

Noting all of the basura floating around going to 2% on the FFR will make little difference.

Crack-up Boom has arrived, Deflation next!

insolvency yes

lack of liquidity no

without rising wages forget it folks, just another head-fake for J6P to be left holding the bag.

market top in less than 30 days

Who profits from higher wheat, soybean, corn, grain, etc., prices?

I can’t figure out if the big grain traders (Bunge, ADM, etc.) win or lose — because they are buyers/processers….

I think what has the Fed scared witless is the same thing that has the Bank of England scared witless: the run on Northern Rock bank.

The Northern Rock bank run erupted in the week before the Fed’s Sept 18 meeting. Thousands of Brits lining up on the streets tried to withdraw their savings. Mervyn King, head of the BOE, made a complete about-face, and bailed out Northern Rock. The bail out annoucement came on Sept 17.

Mervyn King, the BOE, and the British banking establishment were scared witless of bank run contagion. I believe the Northern Bank run, front page news in England, pushed Ben and the FOMC into full panic and the .5% drop in the Fed funds rate.

Using plots of M2 vs. MZM as an indication of “how much cash the Fed is injecting into the system” does not appear to be correct. If you extend the M2 vs MZM back to ’81 it would appear that that the FED was removing cash from the system from ’81 to ’01, which cannot be correct. What gives?

Uh oh! Uncle Ben will scared witless again when he learns that the U.K. Financial Services Compensation Scheme holds only 4.4 million pounds.

“Sept. 25 (Bloomberg) — The yen gained versus the British pound and the euro as the Independent newspaper reported the U.K.’s deposit protection plan needs more cash to cope with the bailout of mortgage lender Northern Rock Plc.

The yen climbed against the 16 most-active currencies as investors reduced holdings of higher-yielding assets funded by loans from Japan, known as carry trades. The U.K. Financial Services Compensation Scheme holds 4.4 million pounds ($8.9 million), while a similar U.S. fund has $49 billion, according to the article on the newspaper’s Web site.”

http://www.bloomberg.com/apps/news?pid=20601087&sid=asntCOyV3lBU&refer=home#

As I mentioned in my Sept 24 2:17am post, the reason Ben was scared witless on September 18 is the same reason that Mervyn King of the Bank of England was scared witless: the run on Northern Rock bank.

Mervyn King of the BOE acted to prevent bank run contagion. I believe the Northern Bank run, front page news in England, pushed Ben and the FOMC into full panic and the .5% drop in the Fed funds rate.

Yes, there were many other factors involved, but the straw that broke the camel’s back was the Northern Rock bank run. The run on the Countrywide bank was fresh on the Fed’s mind. News of the Northern Rock bank run sent the BOE and the Fed into panic operations.

FED is PRINTING MONEY IN THREE SHIFTS DAILY – ECB is not better

.

We are presently enjoying a most exceptional advance of productivity thanks to both unprecedented technological innovation and economic progress resulting from globalisation.

.

Under a gold standard such massive productivity gains would result in rapid increase of buying power. Under the present system without any gold backing our real living standard is on the contrary declining despite this most exceptional progress.

.

Why is there still inflation when it is presently costing only half the price to produce it did cost 10 years ago for products like electric and household equipment, textiles and air travel, down even to 10% only for items such as or picture prints, computers, mobiles, printers….?

.

The reason is that the monetary policy of the FED (as well as the ECB) are deliberately targeting an inflation rate of about 2% and thereby deliberately prevent the average price level from declining and people’s buying power from rising. For the purpose of the matter central banks keep interest rates at an inflationary low level, generating excessive credit demand an (asset) inflation. By targeting inflation at 2% central banks prevent increased productivity benefiting to the average consumer.

.

As long as the gold-backed money standard is not restored only a money supply rate near to the growth rhythm of the real economy could prevent inflation and allow purchase power to keep up with productivity. Any growth rate above this rhythm is inflationary in the true sense. Inflation targeting therefore in practice means nothing less than institutionalised confiscation of all prosperity gains resulting from progress.

.

The FED’s August M3 money supply rate is not at the growth rate of the real economy of some 2%, but has just reached its fastest rate in 35-years (about 14%). This means that for the moment a 14% larger amount of money is chasing a quantity goods and services that is hardly 2% larger than twelve months ago.

.

Consumer Price Indices are not representative for real inflation. By definition they cover consumption items only as asset prices are unaccounted for. The CPI also does not ponder the lowering quality of goods as it compares today’s low quality import stuff with the top quality domestic produce we were used to a few years ago. In Europe the fastest rising items such as oil or cigarettes and MOST IMPORTANTLY TAXES do not even figure on the CPI list just as if these were unimportant details in the family budget….

.

The exorbitant money growth rates both of the FED (14% /yr) and the ECB (12%/yr) are the only cause of the credit and housing bubble. The present rate cut is fighting fire with fire and is paving the road for the next bubble in raw materials and run away inflation very soon…

Read more at …

here at Workforall.net

.

Paul V.

Gold will go way up, maybe to $1,500 an ounce or higher because the dollar will fall for years. The dollar will keep falling and here is why:

The U.S. cannot sustain 800 bilion a year trade deficits. We cannot export our way out of this mess. The only answer is a sharply lower dollar to drive manufactruing home and to lower the trade deficit. The dollar has much farther to fall. What you are seeing is a long term effort (it will take 20 years) to get the trade deficit back under 1% of GDP. We are currently running a trade imbalance of nearly 6% of GDP. No nation can do this. The IMF would be stepping in to help any nation if its trade imbalance went to 6% of GDP becuase its currency would collapse! The U.S. is different, but still, we cannot sustain a trade deficit of this magnitude. People must understand that when we buy an item from say China, we pay in dollars. The Chinese company we just bought from them goes to an Exchange Bank in China and converts those dollars to Yuan. The Chinese banking system (Chinese Government) is now sitting on those dollars. They can either 1, buy oil, 2, buy Treasuries, 3. buy U.S goods, 4. buy U.S. Corporations, 5. other. Over time if we (the U.S. ) continue to run a trade deficit we could simply be completely bought and controlled by foreigners. Warren Buffet has explained the situation as being like a rich Texas farmer who loses a small piece of his land year after year and never notices for a while. When he then notices, tragedy sets in because he no longer controls his land. So in sum, we need to get the trade deficit way down. This is why the Fed has abandoned the dollar. It wil be going down for the next 20 years. That is how long it is going to take to correct this imbalance mess. Bottom line: Lower, much lower dollar will equal higher inflation and higher GOLD prices. Much higher!

worldbguide scam