In light of the recent fall in Home prices, as reported by the Case Shiller Index, why don’t we see what areas have under-performing loans? That might give us some insight into which areas of the country are suffering pricing problems.

LoanPerformance HPI puts together “comprehensive home price indices” and median sales

price datasets cover 7373 zip codes, 956 Core Based Statistical Areas

(CBSA), and 640 counties in all states and District of

Columbia—representing 30-plus years of repeat sales transactions and

more than 45 million observations.

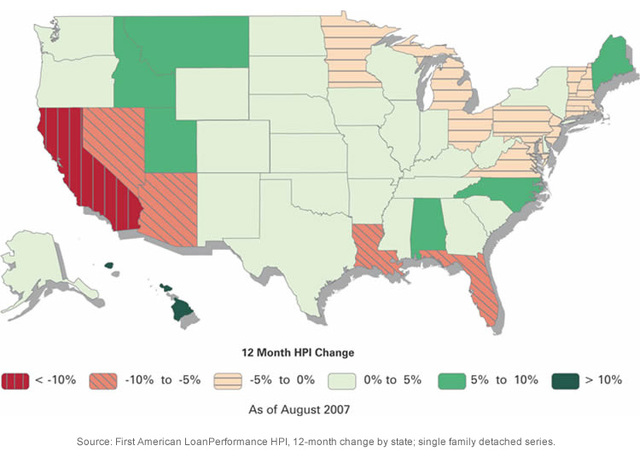

Here is their index in map format, which tracks changes in mortgage performances — the Redder states are getting worse (more delinquencies, defaults and foreclosures), while the green states are improving (less dd&f) over the prior 12 months.

Now let’s compare that with the actual regional price changes:

Pretty interesting . . .

>

Sources:

Loan Performance via Felix Salomon Market Movers

Property Derivatives via TFS Derivatives Corp

Go Tampa!

Off topic, but I’m looking at an article right now that says that investors will question the Fed’s commmitment to transparency if there is no rate cut. Are you kidding me? There’s been so much speculation/hope out there for another rate cut that we now expect it just to happen and if it doesn’t, we’ll throw a fit?

Good to see how Louisiana is benefiting from the whole post-Katrina economic stimulus rebuilding boom.

*rolls eyes*

Looking out my office at 4 brand new high end luxury condo buildings that have just finished in Orlando, they are all a ghost towns. 2 lights on in a 125 unit high rise.

I liken the construction of the housing bubble to the construction of the first “Death Star”. Alan Greenspan as the Emepror, Wall Street as Grand Moff tarkin, and the NAR as Darth Vader. We all know how it ends!

There are quite a few high rise condos and office buildings in the construction process in SF financial district. What does the real estate cycle look like for these high demand geographical locations. Seems like this is immune to housing woes despite being in California which shows 10% decline in housing.

It’s a new paradigm, and everybody who doesn’t buy, now, will be priced out forever. Anybody who does buy will be rewarded with a lifetime of riches, as their property will continue its 30% yearly price increase.

Renters, and anybody born in a future generation, will not be able to afford a $10,000,000 starter home in 15 years. They will live in tent cities, and Hondas.

This asset bubble is different than all of the others – it will never slow down, or pop. The gains are permanent.

I think I’ve met R.E. agent. Actually, dozens of them here in South Florida (Fort Lauderdale). We’re a high-demand geographic area, though we’ve got nothing on Manhattan or San Francisco. A realtor I know calls the current market ‘horrific’, and she’s seen sales prices decline 10-20%. We wound up cutting our price 10% to close our sale August 1. Just in time for the party!

Nightly Business Report correspondent Erika Miller:

“It’s not the Fed’s mandate to mind the markets, but plenty of economists think the Fed will cut rates tomorrow, partly to avoid a nasty reaction on Wall Street”

They’re Wall Street’s bitches now.

At least Volker had some balls.

.

Good to see how Louisiana is benefiting from the whole post-Katrina economic stimulus rebuilding boom.

Indeed! It’s positively spooky (happy Holloween!) how a force of nature (Katrina) managed to have such a huge impact on just one state (LA). Even more-so since a state is a human-defined geographic area. You’d think a storm wouldn’t no the difference!

Ahhh, the wonders of Mother Nature. Notice how all the surrounding states – they weren’t touched by Katrina, were they? No. I didn’t think so – are just fine. I wonder what could explain this. Global Warming? No. That’s not it. Coriolis forces? No. Racist weather? No. Hmm. What…could…it…be?

Potpourri

The Federal Reserve announces a decision on interest rates today, so a few economic notes: The 3rd quarter GDP is announced at a stronger than expected 3.9%. But consider this:Despite rising worries about commodity prices, the GDP price index, the…