Earlier this week, I asked, “What’s Wrong With Billionaire Fund Managers?”

We noted the very top % of this profession carried enormous compensation for those Alpha creators who earned tremendous returns for their partners. Most of the top earners are also have very significant holdings in their own funds. They not only get paid for taking risks with OPM, but with their own money at risk as well.

At the same time, if you really want to be upset at enormous paydays, the collection of thieving former CEOs who helped destroy shareholder value then parachuted out with 100s of millions of dollars were better targets for your ire.

All About Alpha looked at manager compensation from a different perspective, and asked Is high hedge fund compensation really that new?

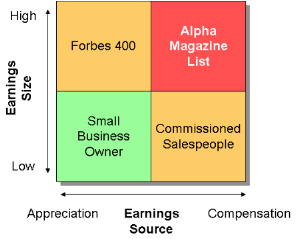

Their approach was from a different angle, based on both earnings size and source

1. Appreciation vs. Compensation

2. Paper vs. Cash

3. Income vs. Options

4. “Creating” vs. “Speculating”

Here is the quadrant they put together:

In today’s NYT, Harvard prof Greg Mankiw also looks at wealth disparities, using Lloyd C. Blankfein, chief executive of Goldman Sachs and Bill & Hillary Clinton as examples (The Wealth Trajectory: Rewards for the Few).

Note to Professor Mankiw: From a statistical perspective, perhaps another example from a pool of candidates greater than three (living former US Presidents) or one (the most recently retired President) might be more suitable, informative and tad a less political. That choice tainted an otherwise fine article…

Courtesy of NYT

>

Previously:

What’s Wrong With Billionaire Fund Managers? http://bigpicture.typepad.com/comments/2008/04/whats-wrong-wit.html

Source:

Is high hedge fund compensation really that new?

All About Alpha, 17 April 2008

http://allaboutalpha.com/blog/2008/04/17/is-high-hedge-fund-compensation-really-that-new/

The Wealth Trajectory: Rewards for the Few

N. GREGORY MANKIW

NYT, April 20, 2008

http://www.nytimes.com/2008/04/20/business/20view.html

You kept telling us how they put there money at risk. Look if the game is fixed, is their money at risk? Take a basketball analogy. You bet on your team to win. You put your money at risk. Is the risk more or less if you know the players in the game. You know one player and he is going to to toss the game for extra reward. Certainly your money is at some risk depending on how much this guy will be able to control the game. Certainly not as much as if you didn’t know anything.

CEO’s didn’t create a false market to get rich. They didn’t fall back on taxpayers to bailout their poor choices.

If you honestly think that hedgies are not using taxpayer money now to play in oil futures, your blind. That is going to affect everybody that posts here. I don’t think you can say that about any golden parachutists.

What kind of crystal ball do you have that you know that “money earned” by hedge funds isn’t just a mirage, like the banking profits?

Hedge funds lack transparency and without it to suggest that they’ve earned tremendous returns is speculation. You can’t possibly know if it is real or just an illusion like the illusion the banks had until it faded.

~~~

BR: Because they get mark to market daily, weekly quarterly. The compensation is based on the net gains in the account.

Short of fraud, the money is either there or not. Its not merely an accounting entry — its real cash.

I vaguely recall some data out in later 2006 or 2007 which showed the failure rates of hedge funds approaching that of a typical US small business (within five years 70% failure… something like that.)

If that’s the case, more power to the ones that succeed. But as in investor in them, realize you’re basically investing in a business that’s a bit more successful than a liquor store (the most failures in five years) and worse than a dry cleaner (one of the best.)

yawn….

I don’t hear an outcry over the “excessive pay” of Britney Spears or the Olsen twins.

I don’t hear the parents of thousands of top tier college students complaining about hedge-fund-return-subsidized scholarships.

Money managers get paid “exorbitant” amounts cuz their skills are massively scalable, just like entertainment celebrities.

Backlash against fund managers is just the 21st continuation of the media’s/intelligentsia’s/populist’s disdain of “the East Coast Banker” just as in John Ford’s film *Stagecoach* or Capra’s *It’s a Wonderful Life*.

Sincerely,

Leftie, pinko, progressive who believes that capitialism is the worst economic theory except for all the others that have been tried.

MANKIW is a no talent hack, a sycophant to the Bush administration, that’s the reason why Clinton is mentioned multiple times.

I think the uneasiness of the Hedge fund compensation, is because we’ve heard the exact same justifications all before when CEO pay started to go to obscene levels.

And in the past nobody cared about excessive income inequality, because everybody was doing well. Corporate performance used to be tied to employment growth, increased pay, better benefits, but there’s a growing disconnect between what’s good for the boardroom is good for Main Street.

Americans have had a more favorable attitude towards Corporations because they did many of the things government didn’t do. Health care, pensions, sick time, quality of life. And in return, Americans had the least restrictive rules than all other western nations.

Over the last 25 years, the corporations have been abandoning their caretaker role, but at the same time they want the freedom to act as they always had (low taxes, low regulation). And what you are seeing is the American people slowly realizing they can’t have it both ways.

As American companies move further away from their society and worker caretaker role, the American people will move towards more socialist policies.

All of this debate on income inequality is very interesting. I believe Mankiw is wrong in his conclusions but at least he brings up a topic many don’t want to discuss. For Mankiw to identify the problems, he would need to unlearn many of the biases that define him and define the general consensus of group think by current economists. The answer is right in front of him yet he is blinded to what it is.

One can’t assume just because a hedge fund manager made a lot of money that they were doing wrong or that they did so because the game is fixed or rigged or because they took undue risk. Although undue risk, lack of transparency and unsustainable profits do play a role in general financial industry profits.

Bill Gates made billions but people look at that differently because it was ‘business’ and not Wall Street. But his game was, to use wording from another poster, rigged as well. Microsoft did not abide by free market principals. They are a monopoly and as such their business practices entailed unsavory deeds that destroyed capital and competitors just as has happened with many hedge funds. That is capitalism. And it provides everyone who posts on here with a job. It isn’t always pretty. And, it doesn’t always entail free markets. And, neither hedge funds nor Microsoft represent free markets.

That said, who gets to decide what is moral and what is not? What business should be able to earn money and which should give it all back? To assign morality to business is a false notion. Business does not have a conscience. People do. Society does. Business does not have a mandate to meet some extraneous morality that has a different definition depending on the person asked. It has an obligation to operate within the framework of rules. Those rules are defined by the referee or the government. Those being laws and regulation. The problem is with the rules and by conclusion the rule makers not with those playing the game. Although indirectly those playing the game have impacted the rules in ways they should not be able to. That too is a problem. If society doesn’t like the rules, change them. Or get a new referee. Or both.

Barry,

The compensation of hedge fund managers is indeed getting out of control, but to almost defer the blame to just CEOs that plunder shareholder wealth doesn’t even begin to explain it.

Entertainers (athletes, actors, musicians, etc), CEOs (and other executives), and those that manage money (ibankers, money managers, etc) – all have had their pay scales rise exponentially in comparison to the average worker.

As far as I’m concerned, the U.S. is now divided into 4 social classes, and 3 of them can’t keep up:

– lower class

– middle class

– slightly better than middle class

– the ultra rich

We live in a world that’s all about the bonus. If your job doesn’t have some ridiculous bonus type compensation attached to it, you’re most likely getting screwed (hello teachers, doctors, nurses, etc).

Barry,

Just a question (and this is coming from one of your most loyal readers), but: what’s your breaking point in all this to when you come out and say there needs to be more regulation for ‘exponential pay’?

Dave

I’m with you, Ken H.

If this isn’t a rigged game, it certainly has all the appearances of one.

Just look at the top dog in the former post–“What’s Wrong With Billionaire Fund Managers?”

John Paulson’s an intimate of the very guy who was key in creating this mess. And at the same time Greenspan was assuring us common dopes that everything was OK, Paulson was busy maneuvering behind the scene to make billions off the very fiasco his buddy was overseeing. Now Greenspan works for Paulson!

But if their insider information and priveleged foreknowledge isn’t enough and they still crap out? Why then they’re the first ones bellied up to the public trough, claiming they are “too big” to fail and their failure would cause “systematic failure.” And almost without fail, they get what they ask for, often by fiat of autocratic entities like the Fed who answer to no one. For it is big business and big finance–not labor, not consumers, not small investors–who have their armies of paid lobbyists and insider contacts and who hold the initiative in framing the codes and policy decisions.

You cannot defend this heap of stinking dung. As Frederick Lewis Allen said of Wall Streeters back in the 1930’s, “they inevitably lost prestige among the less fortunate. For the rich and powerful could maintain their prestige only by giving the general public what it wanted. It wanted prosperity, economic expansion. It had always been ready to forgive all manner of deficiencies in the Henry Fords who actually produced the goods, whether or not they made millions in the process. But it was not disposed to sympathize unduly with people who failed to produce the goods…”

Honestly, who cares..

Inflation adjust compensation for a hundred years ago (divide by .02) and billionaire is just the old millionaire.

After 3 generations or so, the deck gets re-shuffled. Except in history books or endowments, what happened to the Morgans, Pullmans, Kellogs, Rockefellers, Sloans, Posts, Hursts and other ‘old’ money fortunes?

The inequality of compensation has been institutionalized over the last 30 years. We went from wage inflation to asset inflation with the help of the Federal Reserve and our government. Exactly how much money has been given to business outside of the finance rabbit hole? ZERO!

There is a mean when it comes to compensation, and like all things it swings wildly but always returns to the mean. This issue will be no different once it sinks into the consciousness of our society. $3.7 Billion because you were better at gearing money that was borrowed in a Vegas style casino makes you a lucky gambler. Don’t believe me? Just ask The Hedge Fund of the Year that was toasted at a ceremony in Jan. – Feb. before it was toasted in the market. Red or Black?

We know that equity is granted as a form of compensation. If earlier-year “pay” is presented as later-year “equity” I’m not going to be that impressed.

In fact, I’m going to go with my guy and say that little, if any, of this “personal investment” came in the door with them, as their old money.

(I say this even, as someone who did make a fair chunk on options granted for my services as an employee.)

I think you’re running a fast one on us.

re Britney … her misbehavior did not cause the Fed to drop rates, reduce my income, and increase the level of inflation I face.

Ye Gods! To call “communism!” in the face of Wall Street’s socialization of losses!!!

(Britney also did ever pretend fiduciary responsibility.)

Geez, this is turning into another sour grapes/socialism thread.

Nobody is preventing any of you from

“speculating” like the hedge funds and making

millions. Just go ahead and do it.

Mortgage your house, your job, and just do it

instead of complaining of people that did not

break any laws.

I’m all for socialism / grass roots movement for the avg joe out there, with more healthcare, higher minimum wages, better pensions, more holidays.

But complaining about someone else’s success at investing/speculatin is pointless.

Fine, we can raise the capital gains taxes for these guys… and let Bush spend it on the war in Iraq.

heh s/guy/gut/

the gut may be growing in middle age but is not yet another person

An expert always comes from somewhere else. People who are likable also are sincere. Friendly experts who manage money in a far off place are godlike beings. Give them your money. They deserve it. You will be better off for having trusted their omniscience. Especially if their funds are highly leveraged and their pay is guaranteed.

Remember, high profits are just around the corner and the hedge funds always have the correct answer waiting for you. They have charts to prove it.

Derivatives are your friend. You can makes bundles of money with only a tiny down payment. Don’t stop with the hedge funds. Manage your own investments and watch the money machine roll in the dollars. Make your friends jealous and win!

If you only know the right people, markets only go up. All you have to do is believe!

Someone calculated that the interest rate cuts have reduced income of Americans with CDs by an aggregate of 90 billion dollars.

Socialization of losses, anyone?

The inequality of compensation has been institutionalized over the last 30 years by the Federal Reserve and our Government. Wage inflation was stomped down while asset inflation was encouraged at every step. How much has been given to business outside of the finance rabbit hole? ZERO!

$3.7 Billion Dollars because you used gearing on borrowed money is insane, and it shows the Vegas style casino we call the market is badly out of whack. Just ask the Hedge Fund of The Year which was toasted in London in January of this year before they were toasted by said market months later. Red or Black Barry!

“Xavier Gabaix, a finance professor at New York University, said it is not clear whether such gaping inequality is necessarily bad. “Because hedge fund managers make their money by charging fees on investments from rich people, these fees represent the redistribution of wealth from the rich to the very rich, he said.

“By contrast, the income inequality plaguing many developing countries represents rich people profiting at the expense of the poor, he said.”

…Make their money charging fees on investments for rich/ “accredited guardians” of capitalism – but by doing what?

If you honestly think that hedgies are not using taxpayer money now to play in oil futures, your blind. That is going to affect everybody that posts here. I don’t think you can say that about any golden parachutists.

Posted by: Ken H. | Apr 20, 2008 8:40:07 AM

????????????????????????????????

Duh ?? Hedge funds are using Tax payer money ??

Source please !!!

Are you people delusional? Of course this is a rigged game.

And not, Darvin, this not like Microsoft-in fact, it is the exact opposite. There can be no monopoly but government-run and government-sponsored monopolies. Free-market capitalism means a company can act as it pleases, as long as it doesn’t aggress against other people and their property. The should be able to compete fiercely, collaborate fully, and charge whatever amount that they think the market can sustain. If they charge “excessively” then that is a profit signal for new, often disruptive competitors. Look what hapenned to IBMs “monopoly”, Xerox’s “monopoly”, now Microsoft’s “monopoly”, and someday Google’s “monopoly”.

Now, the banking system and Wall Street is unique because they ARE a government sponsored monopoly. Why? Because they are “systemically important” to the economy. Commercial banks are the first to receive newly printed money, the only business allowed to produce multiple claims on the same assets (frax reserve), and the only industry to have a guardian-angel “of last resort” to fall back to when things get tough.

And now these privileges are being afforded to the “shadow financial system” as well, who in the mean-time had the leeway (rightfully so IMO)to conduct its business with almost zero regulation. Let them spin derivatives, domicile offshore, and short the market, as long as YOU LET THEM PAY when those margin calls come in.

The moral hazard that is currently built into the system will have catastrophic consequences when (not if) the very clever passing game of moral hazard–>undue risk-taking–>socialization of losses–>monetary inflation–>ballooning foreign debt, eventually stops.

How? Quite simply, the dollar cannot go on being the global reserve currency when other more sensible alternatives appear on the horizon…(euro maybe?) Once China and the PetroStates find an alternative to the sucker game they’ve been forced in for so many years, they’ll stop buying into US debt. And then and there, the whole system comes apart.

ALL of this is because the US has been trying to finance an empire. Through this scheme, it has succeeded to use OPM to do it, but it can’t go on forever, and there are many signs to suggest that we are at the beginning of the end.

All gloom and doom you say? The US is leading the charge in transitioning to a market-state from a nation-state. The problem is that unlike the theoretically “ideal” outcome, the transition period is fraught with corruption and rigged games, and THAT is the hardest to leave behind.

Why should JP Morgan root for a truly free-market when it can have all the benefits, with zero risk (government sponsoring).

We went from governments running the show, and are trying to go to a place where private enterprise runs the show.

Trouble is, the transition means that the current reps of “private enterprise” have ever larger powers, but are still protected by government’s mantle.

This cozy relationship is far too tempting to leave for a “purer” one. To move past it means that government will not be free to use this system of conduits (that’s what they are to them) to inflate the money supply, and use that money for what THEY think must be done (wars, intelligence, plus the inevitable lining of pockets for the “conduits” to keep the system going).

And for private enterprise to move past it means to give up the “special” status they enjoy every time the fed runs the printing presses, or give up the no-fee insurance policy the government runs on their behalf.

And when options get fewer? Shit, there’s always someone out there to invade!

THIS is where I think the road to the market -state will first stick, and its only undoing will be a collapse of trust in the US government and the greenback.

The question is, will the backlash be toward true free markets, or back to more authoritative, socialist systems of governance?

Unfortunately, I don’t see any true free-market economy rising to compete with the US and show the way. Up-and-coming socialist models of “capitalism” however…(monetarism)…well I could point to a few.

God help us if we move down that road again.

Sorry-meant dbg123 not Darvin above.

Although indirectly those playing the game have impacted the rules in ways they should not be able to. That too is a problem. If society doesn’t like the rules, change them. Or get a new referee. Or both.

Posted by: bdg123 | Apr 20, 2008 9:31:21 AM

______

What’s the easiest way to rob a bank? Own the bank.

What’s the easiest way to avoid going to jail for robbing a bank? Own the police, the prosecutors, and the judges.

Therein lies the fixing of the game (impacting the game by failure to enforce existing rules and/or by changing the rules to favor certain players).

Interestingly, the second part of your conclusion – that society can change the rules – points out a larger and more alarming situation: “Society” already had/has rules in place to prevent the merger of corporate and political powers (and the attendant looting of national wealth) such as we are currently witnessing.

Although this transformation of our basic government structure appears legitimate (seemingly having sprung fully formed from the ether by magic, and having merged seamlessly and effortlessly with the pre-existing infrastructure), this apparent legitimacy is only because the system has abrogated its responsibility to enforce the laws governing such a merger of political/economic power.

The electorate has defaulted – not by choice, but by failing to recognize the subtle but fundamental political changes in our regulatory and enforcement systems. In doing so, it has remained ignorant of both the magnitude and the inherent danger of those changes.

I think we’ve witnessed the first bloodless coup of the 21st century. We are now non-voting shareholders in our own government (sure you get a vote, but it’s non-binding on management). In a stunning display of the power of mass marketing, we have been persuaded to focus on the flag (our corporate logo) instead of our Constitution (our corporate bylaws). This is clearly the path to serfdom (the end-game of unregulated capitalism).

Meet the new boss. NOT the same as the old boss.

Harvard prof Greg Mankiw writes “A top education is no guarantee of great riches, but it often helps.”

Society can’t be full of chiefs, it must have its share of indians.

The indians drive the majority of markets, you all know that.

Hey Barry,

Why are you obsessing with hedge fund managers and CEO compensation, but at the same time ignoring “draconian” compensation paid to Hollywood freaks, baseball players, and people like Oprah (she is a billionaire)?

Marcus Aurelius,

Well said.

Posted by: Bear Requiem | Apr 20, 2008 11:05:29 AM

____

Are you invested in Oprah? How ’bout the Hollywood freaks and baseball players? Can I buy stock in the Yankees? MLB? Johnny Depp? Brangelina?

On an interesting note, Washington Redskins owner, Dan Snyder, paid $20M for the right to rub elbows with Tom Cruise.

http://www.forbes.com/2006/08/29/cruise-dan-snyder-cx_po_0829autofacescan03.html

FWIW, I’m not too focussed on what they were paid. To me it’s more about what they were paid to do. If it were just about them, and their clients, it would be no big deal.

It’s about the externalities.

(I note that the supporters of HF compensation focus on the ‘internal’ part of the deal, and not the follow-on effects.)

☺☺☺”re Britney … her misbehavior did not cause the Fed to drop rates, reduce my income, and increase the level of inflation I face.”

“Ye Gods! To call “communism!” in the face of Wall Street’s socialization of losses!!!”

“(Britney also did ever pretend fiduciary responsibility.)”–Posted by: odograph | Apr 20, 2008 10:23:58 AM

Excellent post, odograph. You have to give these defenders of the oligarchy one thing. They are masters in sophism.

The irony of Mankiw’s comments are made all the more hilarious by the bio given at the end. Advisor to Mitt Romney’s campaign. LOL!

Marcus Aurelius: “Can I buy stock in… Johnny Depp? Brangelina?”

Of cause you can!

Oprah works for ABC that is owned by Disney (NYSE:DIS). If you want to invest in other Hollywood freaks, consider buying Time Warner Inc. (NYSE:TWX), CBS (NYSE:CBS), etc.

If I were to advise a young college grad in what field to specialize, I would suggest labour law. There is a 30 career there somewhere.

It is a real good thing we are a banana republic with Nukes. Thank God for the Nukes. I shudder to think what would happen if the Chinese sent gunboats up the Mississippi to protect their laundry interests.

Rick,

http://www.ogfj.com/display_article/217398/82/ARCHI/none/none/1/Hedge-funds-and-petroleum-markets:-a-primer/http://www.ogfj.com/display_article/217398/82/ARCHI/none/none/1/Hedge-funds-and-petroleum-markets:-a-primer/

Old article but it explains how hedgies are involved. Times have certainly changed so they will undoubtably be “hedging” against inflation in oil futures, right. the Fed opened the discount window to investment banks like JP and it was even stated that it would have saved BS if done sooner, right. Now is this not taxpayer money? Oh,, but hey, it’s backed up by solid paper, right. Bullshit! To save the nation by god!! Total bullshit!

Dollar index for the most part has strenghtened or stayed flat since the window was opened to hedgies. Oil futures have soared from around 104 to almost 117. Wow, 12% increase. Must be those peskie pigmies disrupting the flow of oil somewhere?

Microsoft may have a monopoly but they never used taxpayer money to strengthen their position when they where in trouble.

The question of hedge funds accessing public funds has been validated now that the Federal Reserve Bank of New York has become part of the “shadow banking system”.

Greenspan’s conundrum, explained by Bernanke at Jackson Hole, was the inability of the Fed to impact the “other” banking system – Fed rate manipulations did not filter through. Bernanke has come up with an ingenious answer to this conundrum, and that is open up the discount window to non-depository institutions, in essence making the Fed a partner to the shadow banking industry.

What elements have access to these funds, now? Where does the Fed draw a line on who is “too big to fail” and who is not? Can a “too big to fail” institution become an intermediary for a failing hedge fund, as did JPMorgan intercede for Bear-Stearns?

Who makes this decision?

The oddity is that if you were to create a system that you had to rely upon, you would make certain that the failure of one circuit would not disrupt the entire chain – a la old fashinoned holiday lights; however, in our financial system we have done the opposite, i.e., create a system where a handfull of enterprises cannot fail else the tree stops glowing.

There is only one reason to create this imperfection in system – “too big to fail” is synonymous with “too powerful to fail” – the imperfection is allowed because it concentrates both wealth and power.

And the media has become become a propaganda machine to sell the idea to the masses – that big is better and anti-trust laws violate the spirit of free enterprise.

As long as you charge the new IPod on your Visa, everything will be swell…trust us…

To the commenter that Microsoft is different, and that free markets and capitalism are synonymous, you need a history lesson. Capitalism is not synonymous to free markets. Nazis and Chinese communists love(d) capitalism. And, no one loved either case more than American corporations that benefited from both. That is, until the shit hit the fan.

Marx wrote about unregulated capitalism and everything he said would come true is what you are living through today. You have been brainwashed. Capitalism must be regulated. Unregulated capitalism shows us robber barons, abusive labor practices, pollution before safety, corporations killing their own workers, predatory lending and on and on and on. I guess you never met a Pinkerton guard.

This isn’t the first time in history we’ve come to this point. Nor is there any reason to believe it will be the last. I guess you might interpret it as a bloodless coup as MA mentions above. But, it happened not because of Wall Street or government. It happened because society developed beliefs that were generally accepted by everyone. Perpetrated by some but you believed them. Just as you believe capitalism is synonymous with free markets. And, just as in the past, we shall see what happens when the impact of those beliefs come to pass. We’ll get new rules and new referees. The politicians and Wall Street still doesn’t get it. Those most removed are always the last to realize a trend has changed. But they will. Because the rising tide of populism cannot be stopped. And, if you want change, you’ll embrace the mob and join the revolution.

I’m surprised that entertainers and athletes are getting clumped in with hedge fund managers and CEOs. First of all, there is a healthy functioning supply and demand market for entertainers and athletes, unlike CEOs where they use incestuous board postings to jack up each other’s pay. How many Yankees outfielders also sit on the Cubs board and therefore decide their pay? Um, none.

Secondly, and more importantly, in the case of entertainment and athletes, *someone* is going to make the money, so you are basically arguing that the nameless CEO of the team or the studio should make it rather than the star. If you hire a star for your team or your movie and it makes money as a result, shouldn’t the star get a large cut of it? They earned it. Now, you may argue that it should be better tied to the success of the project, and that would be reasonable, but ask some of the novelists who’ve sold the rights to their novels for a residual and gee, imagine, there never are any. Hollywood is one of the larger rigged games out there, so if the star gets their cut up front, it’s because that’s the only way they can be assured of getting anything at all.

As a potential social ill, there are far more CEOs (180,000) than sports and movie stars. I don’t think their pay is having much of an impact on bifurcating the country into haves and have-nots. Not to mention that their careers are vastly shorter.

Marcus Aurelius pretty good!

bdg123 also good.

The biggest problem I have with the hedgies is that they claim their compensation should be treated differently than ordinary income. They should be treated like a mutual fund manager.

The govt bailouts to business are disgusting. Bring back glass stegal it was there for a reason.

It is also about the use of leverage. Being smart enough to finagle the system to acheive high double and triple digit ratios of leverage with HUGE bets does not make you smart, it is a step closer to the lottery mentality, it is dancing on thin ice with heated shoes.

Where in the constitution is does it say govornment for the corporation? A corporation is not an individual and should not be treated as such unless we change the constitution.

>Microsoft may have a monopoly but they never used taxpayer money to strengthen their position when they where in trouble.

Um, yeah, right. From 1999, probably up until the changes in expensing of options, Microsoft paid no federal taxes on current income. During that time, they had the help of the FBI when hackers broke into their network, not to mention all the other benefits of national security to protect their assets, etc, paid for by you and me, who of course, can afford it, right? Unlike them.

– I am made uncomfortable with the increasing income inequality in this country. I am not sure what ultimately should be done about it, but could we at *least* start by taxing all of this income??

– Oprah hasn’t yet caused me to worry about my retired mom’s money market income.

– Microsoft didn’t paly by the rules. So the government stepped in and now they operate under anti-trust rules their competitors don’t have to follow. The system worked.

Thanks, Darkness, for that very well-expressed rebuttal to the whole aburd sports star/entertainer argument.

To your argument, I might add that no one is forcing me to go to an Eagles concert. However, I AM forced to provide money for Halliburton, Bechtel, and Blackwater. I AM forced to back up JP Morgan. I AM forced to bankroll tax cuts for hedge fund managers. I AM forced to provide hurricane assistance for rich folks who build giant second homes on the shores of Florida. (But not, of course, for New Orleanians.)

When you scratch the hide of someone who brings up the pay of sports stars as something comparable to the theivery of CEOs and fund managers, what you will always discover is a resentment that the rich person they are watching on TV is black.

Back in 1893, a bunch of banks, brokerage houses and railroads went bankrupt. The tycooon Pullman was losing money building his fancy railroad cars so he laid people off in his company towns. However, he didn’t drop the rent his laid off emplotees had to pay on their Pullman owned houses. Pullman moved his family out of Chicago and hid his best china. Violent strikes ensued and began to spread accross the country. President Grover Cleveland sent federal troops to Chicago to deal with blocked trains and burned railcars.

1) Who paid the wages of the federal troops ?

2) Is it different this time ?

3) Do sophists ever get tired of bullshit about our “free enterprize”, capitalism, the joy of pulling yourself up by your bootstraps while your legs are being cut off and how they worked so hard to be rich ?

The big picture in our country is that the pie is getting smaller. Consequently the fight for a piece of it is getting meaner. Protect yourself but try not to equate compassion with weakness. There are many, many deservibg people who have done everything right and have had evrything go wrong. To say “tough shit” to them is bad for your health.

Most of the comments above pertain to the issue of morality and “fairness”. But there is an equally important issue, which is that of what to do about it.

In the case of hedge fund managers, what would be the consequence of trying to raise taxes on them?

The first point is that there are too few ultra rich hedge fund managers to make much difference to the federal budget. If you confiscated 100% of the annual earnings of the 100 highest paid hedge fund managers, you couldn’t run the government for more than a few hours.

Second, there is the matter of tax deferral or outright avoidance. These guys can set up a corporation that can be domiciled anywhere… Ireland, Singapore, the Caymans. They can set up a holding company in one country that owns a second company in another country. If you impose some sort of income tax over and above the capital gains tax, these fund managers are likely to find ways to defer or avoid the taxes. Furthermore, higher taxes on the rich would have to apply to all of the rich, even Oprah Winfrey.

And finally, if marginal tax rates on the rich are raised, “victims” of the tax

will do their best to persuade members of Congress to introduce even more tax loopholes.

DL, who is paying you?

You say that if we confiscate all of the top 100 hedge fund managers’ income, that would pay for a only few hours of federal spending.

The top 50 hedge fund managers made a total of $29 billion. The federal budget this year is $2.9 trillion. That means the incomes of those managers alone—just 50 people!—equals 3.65 days of the federal budget.

The highest marginal tax rate in the late forties and in the fifties was over 90%—the peak was 94%—and you know what? The rich people did just fine, and they presided over the greatest economic expansion the world has ever seen.

Posted by: DL | Apr 20, 2008 3:03:32 PM

____

I’m willing to bet that our national debt correlates pretty closely to the holdings of the top 3- or 4% of America’s most wealthy (including foreign holders of said wealth). Not 1 to 1, but a correlation, nonetheless.

I thought it might be appropriate to quote in this thread from Lee Iacocca’s new book:

“I hardly recognize this country anymore. The President of the United States is given a free pass to ignore the Constitution, tap our phones, and lead us to war on a pack of lies. Congress responds to record deficits by passing a huge tax cut for the wealthy (thanks, but I don’t need it). The most famous business leaders are not the innovators but the guys in handcuffs. While we’re fiddling in Iraq, the Middle East is burning and nobody seems to know what to do. And the press is waving pom-poms instead of asking hard questions. That’s not the promise of America my parents and yours traveled across the ocean for. I’ve had enough. How about you?”

I had begun to wonder if I was the only one who felt this way.

Winston: So what are we going to do about it? I’m in.

As far as the hedge fund managers go, kotowing to the ultra rich That lets me know who is running the scene. We just make it so that If you do not domicile the fund in the US you don’t have American Investors. As we discussed there are sufficent very very wealthy folks here to make this a BIG market for their services.

Also we should not employ large corporations to do the govt work unless they domicile here. Like Haliburton. Funny how the VP’s former company leaves the USA and he has naught to say about it.

We need to have rules that benefit all Americans.

I wrote earlier “indians drive the majority of markets”

but if the current business plan (with no new land being found) is:

repossess their wealth to resell it to them again .. well … thats a path

“Panem et circenses”. Bread and circus.

The problem surfaces when when the price of bread increases and the people find out they are part of the circus.

But hey, we’re Americans. We’ll fix it. That’s what we do. Just work the problem!

Alexd wrote: “So what are we going to do about it?”

Invest in lifeboat manufacturers and cold-water gear.

My goodness bdg123, either you didn’t read what I wrote or you’ve just left the “socialism 101” tape playing on repeat…

What I said is that what we have is NOT true capitalism, nor can it ever be when government intervene so blatantly in so many respects, and most often in order to benefit a select few (who in turn help them on their way to power).

Pollution you say? Well of course you have pollution if nobody owns the air, sea, forests, or whale population. I don’t see any wasteful practices occurring where you have private property though. You see it hurts when you actually own the stuff. But camping in a communal forest? Why care if a litter the place?

Regarding income inequality…

You think free-markets are to blame for that? Lack of regulation?

How about endless and undocumented monetary inflation (remember those dissapearing M1, M2, M3, MZMs??) that benefits a select few while eroding the assets of so many others? How would you like it if I ran a photocopier that printed perfect dollars, gave them all to my friends, who in turn loaned more of them out to their friends, who in turn to theirs….and you were the last to receive some of this new money….as debt!

You think more government meddling is going to help? Tariffs? Quotas? Higher Minimum wage? More regulation?

You think idiot politicians who have never worked a day in their life have all the answers? They’re going to fix the economy by clever little schemes and programs? You must not know what an economy IS to say that.

Governments can’t calculate, can’t be rewarded and can’t be punished as market does. Choosing one person every 4 years who in turn chooses 10 who choose 100, who choose 1,000,000…..That’s no way to “simulate” a market.

Rather, having 300,000,000 choose 300,000,000 for each and every task they want, every second of every day is a tad more efficient.

Will you EVER get income equality? No. Never. Not even under blatant communism.

But you can get fairness, and true equality of opportunity. In a true market, even giants can fall, and you know what, if it’s functioning properly, you won’t have some academic ideologue who thinks they’re too big to fall and so must be saved. Instead, what will happen is that someone will fill that gap, along with the jobs, and services the “giant” provided to the economy. If not, then they were probably doing something utterly wasteful and inefficient, a situation that usually occurs when you have massive monetary inflation and credit booms like the ones witnessed during the 20’s, 90’s and 00’s.

BTW, please excuse the confrontational tone-it’s not directed at you, but rather at the dangerous ideas that lead us to a path of more government control, intervention, and ultimately tragedy.

The bigger governments get, the bigger the tragedies. Aren’t WWI & WWII adequate enough to teach us that?

File this under “utopian Horse Hockey”:

EVERYONE pays the same percentage of income in taxes as the previous year’s official CPI. Capital gains shall be considered just plain income.

ALL politicians shall be required to employee their entire family in the military in any war they vote for or the President declares as Truman, Johnson, Reagan, Bush, Clinton and Bush have. Family members unable to perform combat will peel potatoes in the mess halls for the duration of congressional funding.

Money managers of all stripes will be required to employ their family members in the military if their investment funds are profiting from war.

A complete and monthly updated list of all persons listed as beneficiaries of life insurance policies on recently deceased people shall be posted on the internet. Hell, while you’re at it list all the people currently paying life insurence premiums and the beneficiaries. It might prevent a few “accidental” deaths.

I really do like that potato-peeling proposal, AGG.

I have visions of Laura Bush and Bill Clinton peeling into the same pot. Bill will try to get Laura to go back into the pantry with him. Laura, not having had any in years, agrees. Then, Suzanne Craig (Larry’s long suffering wife) finds them there when she goes to search for some carrots, and joins them in a three-way…

Whitespiral,

It is you, sir, that isn’t really looking at the big picture. People are really tired of the ideology thing. It doesn’t matter what kind of government you have. What matters is the character of the people in government. You want anarchy? Is that your “free market”? You are avoiding the issue.

The issue is that economics without morality destroys a country, a people, it’s culture and takes a few other countries with it. I’m sure you don’t agree. You’ve got yours’ and the libertarian ideology accepting that everyone is an egotist in disguise is fataly flawed. I’ve been there. I even voted for Reagan. It was a dream, pal. They sold us a bill of goods. Sorry you are still hooked.

Winston

Some months ago I was likened to a dung beetle for my tenacity towards conspiritorial cynicism. I believe the analogy was not meant to be derogatory. My bias against the FED system has since tempered as I have come to believe that with proper regulation the system might have continued to function. However recent changes regarding the monetization of debt without clearing the appropriations though congressional channels would lead one to believe that government of the people is being substituted for a centrally managed economy run by the central bank. All the warnings are coming to the fore. I realize that Chartalist money is frought with the same dependancy of “benevolent rulers”. Can’t we just get back to the firewall that existed between commercial and investment banking pre Graham-Leach. Why should investments ever be too big to fail isn’t that the point. If an investment can not fail what becomes a measure for success vs mal-investment.

Jim,

Yep, it’ll be tough to keep those people peeling potatoes. They are much more experienced at screwing people.

On a note of praise, I thank you, Marcus Aurelius, bdg123, DownSouth, Winston Munn for profoundly logical and convincing arguments. The debate has been not only scholarly but also very REAL.

GREAT BLOG, Barry.

Great topic and many interesting comments

Whitespiral,

You, my friend, are clueless. Re your remarks, please don’t take me as confrontational. You are off on a tangent that has nothing to do with my criticism of your post. Let’s not reframe the discussion because you realize your original post is indefensible so you are off on some tangent trying to salvage your position.

More government control? Uh, let me clue you in on something. We have a representative government. Got that? People want it to work. People want more representation. That doesn’t necessarily mean more government or less government. It’s not an ideology statement as you are trying to frame it. People of all ilks are Fed up. Pun intended. Americans can agree on one thing regardless of their political beliefs. 85% realize government isn’t working. We want a government that works for the people. By the people. That doesn’t mean more government or less government. It means a government that represents the ideals our fathers and mothers died for to uphold.

I read your post fine. Now, go learn yourself some’in.

“I don’t hear an outcry over the “excessive pay” of Britney Spears or the Olsen twins.”

Those girls are not being taxed at a 15% rate.

.

Stormrunner,

I hope this answers your question, and I would say that yes, it could. The key to me would be diversification into entities small enough to “feel their fuck ups”, instead of being systemically so important as to be “too big to fail”.

What we have produced is a system where actions have no consequences. In this sense, there is a god-like arrogance that some are above natural laws – the ruling class. It is the thinking that has permeated the minds of rulers from pharoahs to kings.

It occurs when power and wealth are centralized.

As I noted originally, I am not discussing the tax issue — this is strictly a question of straight compensation.

Jim wrote @ 3:15:41 PM:

The top 50 hedge fund managers made a total of $29 billion. The federal budget this year is $2.9 trillion. That means the incomes of those managers alone – just 50 people – equals 3.65 days of the federal budget.

The highest marginal tax rate in the late forties and in the fifties was over 90% …. the rich did just fine, and they presided over the greatest economic expansion the world has ever seen.

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^

Jim,

I’ll assume your number about the top 50 hedge fund managers is correct. But there’s no way in hell the government would ever get 90% of their money. As for the 1950’s, I think that you’re right about the 90% marginal rate; what I don’t know is what sort of deductions people were eligible for to avoid the tax. But consider the 1970’s. Marginal tax rates were very high then too (70%, I think). But the tax code was riddled with loopholes. In 2006, the top 1% paid about 40% of all federal income taxes. But in the 1970’s, they paid less than 20% of all federal income taxes. So marginal rates are only a small part of the story.

Furthermore, if it were really possible for the IRS to extract 90% of the earnings of hedge fund managers, some of them would probably just throw in the towel and buy municipal bonds (which might be good or bad, depending on your point of view).

Given the $29 billion at stake that you have referred to, how many suitcases full of 100 dollar bills would it take to convince a few key senators and House members to introduce (or maintain) loopholes about taxing foreign corporations (which happen to be owned by hedge fund managers)…?

I’m not morally opposed to the government extracting money from rich people.

But it’s not that easy to do.

Do y’all realize how much money Greg Mankiw has made from his textbooks? ($130 a pop, times over 1 million sold)

How about he discloses his income and profit margins?

My taxes subsidize his sweet life in the ivory tower and the inflated budgets of his

studentscustomers AND I don’t remember having a choice in the matter.For those of you who don’t follow him closely, he’s technically a capitalist but so afraid of the socialists that he panders to them on the issues of “climate change” and “income inequality”.

Mankiw has no idea what causes wealth disparity or that there are scores of past civilizations to study that answer that very question. Here’s what Will Durant said on the matter in discussing the French Revolution:

Revolution – or legislation – repeatedly redistributes concentrated wealth, and the inequality of ability or privilege concentrates it again. The diverse capabilities of individuals demand and necessitate unequal rewards. Every natural superiority begets advantages of environment or opportunity. The Revolution tried to reduce these artificial inequalities, but they were soon renewed, and soonest under regimes of liberty. Liberty and equality are enemies: the more freedom men enjoy, the freer they are to reap the results of their natural or environmental superiorities; hence inequality multiplies under governments favoring freedom of enterprise and support of property rights. Equality is an unstable equilibrium, which any difference in heredity, health, intelligence, or character will soon end. Most revolutions find that they can check inequality only by limiting only by limiting liberty, as in authoritarian lands. In democratic France inequality was free to grow. As for fraternity, it was knifed by the guillotine, and became, in time, an agreement to wear pantaloons.

If Greg truly wants to understand the phenomenon of income inequality he should open a history book rather than rely on the masterbatory research of one of his co-ignorant academic peers. He may even learn a thing or two about the millennia-old politicization of weather.

AGG, BDG. Are you guys seriously saying that people are fed up so your solution is “let’s just get them what they wanted in the first place”?

Hmmm….I wander how we got here in the first place.

Buddy, you want your government for the people, by the people to work? Wait for it to work then, and in the meantime, try to help your fellow Americans by taking the shortcut and redistributing all the profits you want. See what happens then.

You guys want to wait for the “quality” of politicians to get better? For morality to return to public life? Hmmm…I wonder if the Ancient Greeks where waiting for the same to happen. I swear, these guys were JUST there….

I am no anarchist. I believe in a government for the people, by the people, the way it was intended in the constitution.

But more or less government makes a hell of a lot of difference. It’s one thing to ask government to provide 1000 things to its people, and quite another to ask them to provide 10 things.

What you’d get is a more effective, just and fair steward of the constitution, with less involvement in public life, less corruption and less sheer incompetence.

But you still want your knee-jerk reaction back to socialism, like many of our fellow citizens.

Regarding being off on a tangent, I apologize if I touched on too many issues. Please pick one of your choice so we can concentrate on debating that.

I think your instincts are right, as our most Americans’, when they bear witness to this grand-scale theft. But emotional backlashes like the one brewing right now almost always give rise to a situation much worse than the previous.

And by the way….Let’s see how this grand federal system works. All this boils down to is whether Hillary, McCain or Obama will take the wheel. Whatever happened to the states? Who cares! Watch as this government grows so big (either on a new-new-new deal platform, or an even greater military/intelligence component), the whole country won’t be enough to feed it.

If you honestly think that hedgies are not using taxpayer money now to play in oil futures, your blind. That is going to affect everybody that posts here. I don’t think you can say that about any golden parachutists.

Posted by: Ken H. | Apr 20, 2008 8:40:07 AM

????????????????????????????????

Duh ?? Hedge funds are using Tax payer money ??

Source please !!!

>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>

Ken, you point out to me in that dumb article about hedge funds, where they are obtaining Tax payer money to play the oil markets !!!!

Ken , why don’t you visit Phyll Flynn, a

parasitic oil futures trader…( I can’t stand this speculator) and see what kind of position he has put on oil futures.

“But more or less government makes a hell of a lot of difference. It’s one thing to ask government to provide 1000 things to its people, and quite another to ask them to provide 10 things.”

Go ahead and name the things that you’d like the government to control, and I’ll finish the list with the hundreds of other things that *only* government can control if we want to have a fair and representative government that serves the people. You mentioned private parks – yeah, good luck with that once the owner decides that they can make more money by selling the whole thing to a lumber company. Do you even *think* about what you type ?

This is the problem with libertarian ideology – everything that isn’t pure is socialism, and if we just click our heels three times everything will be okay. I can tell one of these posts a mile away, because they’re the only posts that ever use the word socialism to describe the same form of government that had worked pretty damn well with a modern economy between WWII and the 80’s. It was only *after* we dismantled most of it that things starting going to shit.

“his is the problem with libertarian ideology – everything that isn’t pure is socialism, and if we just click our heels three times everything will be okay. I can tell one of these posts a mile away, because they’re the only posts that ever use the word socialism to describe the same form of government that had worked pretty damn well with a modern economy between WWII and the 80’s. It was only *after* we dismantled most of it that things starting going to shit.”

I’ll give that one a good solid, reinforcing, back-bench “harrumph!”

The only thing I’m really tired of is ideologues like you that have infiltrated our government. You can’t seem to stay on topic and somehow keep assigning arguments to me that I’ve never supported. But, that’s what ideologues do. They aren’t critical thinkers and really can’t defend their positions past the thin veneer of mindless chatter.

If our founding fathers thought that we would be better off with no government, they would have founded a society of anarchy. Even the ultra-radical Thomas Paine admitted that because of man’s devilish nature, government was a necessary evil. In other words, the only thing worse than government is no government. Which appears to be your argument.

This late twentieth century view that all government is bad government so we should dismantle it, and in the process dismantle society, while using the constitution as a backdrop is nothing more than audible reflexings usually reserved for the vomitorium. In other words, it’s pure puke.

I don’t care if someone has a position that is exactly opposed to mine. But, at least provide some critical thought with it instead of hurling senseless phraseology and accusations.

The lumberjack theory is just not representative of any market. Do you not know of any private parks, gardens, forests, islands existing today, without having been sold to lumberjacks?

Or is it public access that you want now? Do you think that there would be no market value for a park that the public can use, ESPECIALLY if they’re as rare as you imply they would be (if not outright gone in your theory).

Or would that too be only for the rich? Would there not be a market for cheaper private parks? Free private parks even who raked in revenue from other sources?

Or is it bad to have that choice and difference in price? Should the government subsidize Maseratis for the poor too? Should everyone have the right to fly first class?

BTW-short reminder here….Try to stay away from remarks like “do you even *think* about what you type”. It gives away the whole emotional, and ironically enough, thoughtless, reaction I mentioned earlier.

Arguing that everything was fine until the ’80s is evidence of either little historical knowledge, or political fanaticism. And taking a slice of history without accounting for the aftermath is exactly why we’re in this mess today.

Until you understand the unsustainability of booms and busts, the robbing of your assets, and the transfer of wealth toward the banking system, all courtesy of our lovely fed and its endless monetary inflation, you’ll keep “telling libertarian posts a mile away”, and asking for the government to step in and help by some new grand program.

Buddy, you can’t even stick to what I’ve said. I specifically stated that I do not support anarchy. You’re making up this debate by yourself, obviously choosing “positions” you can say something about, while avoiding the issue.

For the record, I support ANY government by the people, for the people, that can finance EVERYTHING it was given a mandate for, out of ANY transparent taxes it is able to acquire from its constituency.

I strongly oppose a fiat currency that can be debased everytime government and Wall Street dream up of something new to finance, and strongly oppose fractional reserve banking.

If the people want to pay extra in social security, taxes or what have you to finance a Federal RESERVE Bank, let them. If the system chooses it needs that level of protection, price it in and pay for it the old fashioned way.

I think you’re too emotionally blinded to conduct a critical discussion, evidence of which is a systematic retreat from real debate, in order for you to voice your emotions about “libertarians, ideologues and govt infiltrators”.

Choose what you want. If you want issues, there are plenty to pick from above. If you just want to voice your frustration than you can do it without us going back and forth here.

“The lumberjack theory is just not representative of any market.”

What ? It’s representative of something that the government manages and owns, and that libertarians like yourself have consistently and reliably called for privatization of. According to libertarian ideology, everything is possibly subject to market control, and the result will be better and more efficient. I gave you one example of where it wouldn’t. I can keep giving you more and more, if you would like.

“Or is it public access that you want now? ”

I think it was pretty clear that I was referring to government-owned parks, which by their very nature involve at least partial public access.

“Do you think that there would be no market value for a park that the public can use, ESPECIALLY if they’re as rare as you imply they would be (if not outright gone in your theory).”

*My* theory ? This is not *my* theory – this is the theory proposed by folks like yourself. I just happen to know that it’s bunk.

“Or would that too be only for the rich? Would there not be a market for cheaper private parks? Free private parks even who raked in revenue from other sources?”

Most large state and national parks already charge some form of admission, so they already generate revenue. But nice job of side-stepping the critical issue of ownership.

“Or is it bad to have that choice and difference in price? Should the government subsidize Maseratis for the poor too? Should everyone have the right to fly first class?”

Public ownership of vital national property and infrastructure = Maseratis and first-class tickets for the poor.

“BTW-short reminder here….Try to stay away from remarks like “do you even *think* about what you type”. It gives away the whole emotional, and ironically enough, thoughtless, reaction I mentioned earlier.”

It wasn’t emotional – it was a valid question, and you reinforced my reason for asking it with your bullshit question above about giving cars and plane tickets to the poor.

“Arguing that everything was fine until the ’80s is evidence of either little historical knowledge, or political fanaticism. And taking a slice of history without accounting for the aftermath is exactly why we’re in this mess today.”

So you’re supposition is that the WWII to 1980 run was not “fine” ? It sure as hell was fine by my standards, at least economically. And what aftermath ? Are you somehow going to blame the current mess on FDR ? This should be good, so let me go get the popcorn.

“Until you understand the unsustainability of booms and busts, the robbing of your assets, and the transfer of wealth toward the banking system, all courtesy of our lovely fed and its endless monetary inflation, you’ll keep “telling libertarian posts a mile away”, and asking for the government to step in and help by some new grand program.”

We only started having booms and busts once the regulatory apparatus that we had in place was removed. Check out the recessions that occurred prior to the creation of the Fed. They were more frequent, longer, and caused much more dislocation, and even violence in most cases. Without a Fed and our monetary policy, the booms and busts would be *much* worse because we would have no way of combatting the economic forces at work. The fact that we had a jack-ass like Greenspan running the Fed for so long has been our major problem recently.

Calling Easy Al a jackass is definitely sign of progress.

If you have the time and interest, I am willing to give this book as a gift to you.

http://www.amazon.com/Money-Bank-Credit-Economic-Cycles/dp/0945466390/ref=pd_bbs_sr_1?ie=UTF8&s=books&qid=1208861192&sr=8-1

Let me know if you’re interested.

“Calling Easy Al a jackass is definitely sign of progress.”

Well, somehow we’ve got to make sure that our Fed doesn’t keep the spigot open again just to make sure that someone like the boy king doesn’t look bad.

“If you have the time and interest, I am willing to give this book as a gift to you”

No need. I use the local library (I’m paying for it, after all), so I’ll check it out. I’m always willing to read something new.