Once more unto the breach, dear friends, once more:

The monthly NonFarm Payroll report rolls out today, and the consensus is none too cheerful: Median estimates of 82 economists surveyed by Bloomberg for April 2008 is for a job loss of -75,000 (Dow Jones had -85,000). Estimates ranged from -150,000 to -18,000. None of the economists surveyed had a positive estimate.

Imagine that: +5,000 is a huge upside surprise.

Let’s review the data points leading to NFP, starting with the positive arguments:

Let’s review the data points leading to NFP, starting with the positive arguments:

• According to Greg Mankiw there is no recession. Brian Wesbury agrees.

• James Pethokoukis went even further: “Out: Recession. In: Expansion.”

• Today’s WSJ notes: “In the past 10 business cycles, year-over-year growth in payrolls has averaged 3% in the 12 months leading up to a recession. Twelve months before payrolls peaked this time around, job growth averaged just 1.5%. That could mean there’s not a lot of payroll fat to be trimmed in this downturn. It could explain why weekly claims for unemployment benefits still haven’t climbed to 400,000, the level associated with recessions.”

• ADP employment report shows addition of 10,000 jobs in April.

Hey, that’s not too awful sounding — why are the economists so negative? Let’s consider a few reasons:

• ADP forecast a gain of 10,000 this month. How is that a negative? ADP has significantly understated job losses over the past 5 months. Their overestimates of private payrolls averaged +117,000. So if ADP remains consistent, a triple digit loss is a distinct possibility.

• Jobless claims data were 380,000 (April 26th week) — these are levels consistent with large payroll losses. Also, continuing claims backlog surged 74,000 to new highs (3.019 million). I expect we will see 5.5% unemployment rate by Labor Day.

• BLS has been adding Business Birth/Death estimate jobs at a rate equal to or greater than 2007 rates — a worrisome sign.

• Recent sentiment surveys — University of Michigan sentiment index surrounding the job market outlook was at the worst level since January 1991. The Conference Board perceptions over the labor market deteriorated markedly in April; their ‘jobs-are-plentiful’ index printed its lowest level in nearly three years.

• Challenger layoffs were 90,015 in April — a 68% increase from March, and up 27% Year over year, to a 19 month high.

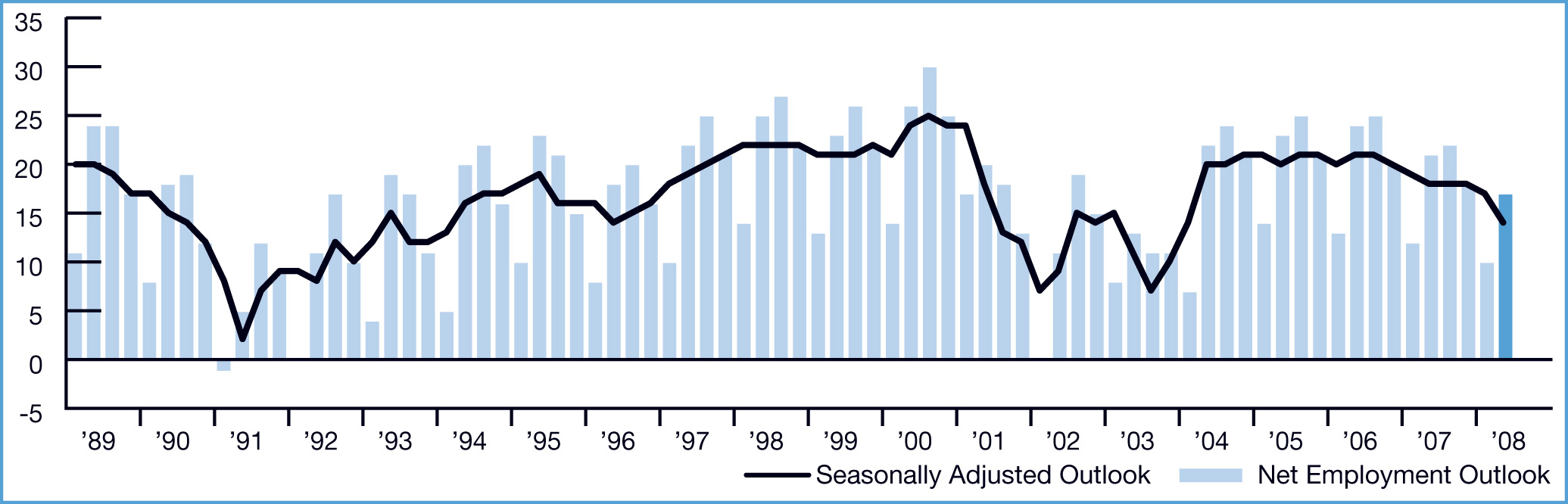

• Manpower hiring index sank in 2Q to 14 from 17 in the first quarter and 18 a year ago. This was the softest result in four years. Merrill Lynch’s David Rosenberg points out that “a 14-ish number in the past has often coincided with recession and deepening job losses – 2001Q3, 1990Q3, 1981Q1 just to name a few.”

Bottom line: A positive number would be a huge surprise; a 6 figure loss is a small but distinct possibility . . .

>

Sources:

Job Cuts May Not Get Too Deep

MARK GONGLOFF

WSJ, May 2, 2008

http://online.wsj.com/article/SB120968657093061245.html

The ADP National Employment Report

April, 2008

http://www.adpemploymentreport.com/pdf/FINAL_Report_Apr_08.pdf

Manpower Employment Outlook Survey

Q2 2008, United States

http://tinyurl.com/6nzemt

Another bearish idea (more subjective than your list): The Fed did not sound as bullish as everyone was hoping in their statement this week. If they had a peek at this number….

Hmmm… and now the Fed is making new extraordinary measures to the TSLF… just 15 minutes before NFP…. hmmm…. what is this signaling?

LoL

WTF is going on at the Fed?

Call me cynical, but I expect the jobs # won’t be good.

But rest assured boys and girls, everything is A-Okay.

Ouch. 13500 1450

They are selling you down Rio Grande, people.

Gas $5 this summer, milk $8… But everything is perfect according to the market.

MSNBC.com is breathlessly trumpeting: “Breaking news: April job losses 20,000, less than expected.”

Talk about soft bigotry of low expectations…

Don’t worry. The Govt. is on the job. Birth/Death model adds 267k jobs for a net less of ONLY -20k. way to go. They managed to make the unemployment rate go down in the middle of a recession. Beautiful.

Agree with Donny. WTF? Smoke and mirrors Friday.

The bears will get their just desserts… This we call the economy can’t defy gravity forever. But until then, cover your butts and ride the wave, just in case they are able to somehow maintain the illusion.

How can you lose jobs, revise previous months to show even more job losses and then claim the unemployment rate fell? Talk about stinking like a rotting fish!!

I am absolutely dumbfounded.

Either this number is completely bogus and the Fed knows it.

OR this Fed is out of its mind when they eased and issued a dovish statement. What are they doing?

my area talk radio stated that this years crop of high school grads would be the largest in years and imo the next boom of restocking is post 9/11 births

The Birth/Death adjustment was +267,000, including 45,000 construction jobs and 8,000 financial services jobs. This is fraud on a massive scale by the government.

Where is the birth death line in the release? Thanks

Is it worth focusing on one set of employment data, when knowing they are lagging indicators?

Birth/Death adjustment has increased to +276K from last month’s 142K. How in the world can you trust these figures. If Birth/Death adjustment were the same as last month, the jobs decline would have been over -100K!

If you google Birth death adjustment, it will take you to the chart on the BLS website. They would never put that info in the release.

Now all you “grassy knoll” economists are really confused. Should you be climbing into the concrete bunker or should you be buying what will be a strong summer rally?

That’s right stocks are going up. And this is NOT the great depression. Sorry to be the bearer of bad news.

http://www.bls.gov/web/cesbd.htm

2008 Net Birth/Death Adjustment (in thousands)

Natural Resources & Mining

1

Construction

45

Manufacturing

-10

Trade, Transportation, & Utilities

24

Information

3

Financial Activities

8

Professional & Business Services

72

Education & Health Services

31

Leisure & Hospitality

83

Other Services

10

Total

267

Construction added 45k jobs. unbelievable. This is unreal. Unemployment rate going down ???

If only it mattered what the true jobs picture was. All that matters is perception. And they seem to be masters at controlling perception.

And, yea, I’m short and dying, here.

Isn’t it ironic how we can turn a negative -20,000 figure into more positive news for the markets.

Meanwhile, we ratchet closer to the Dow all-time high set last summer. And the Bulls that still insist all these “credit/housing problems” were over stated, are running this morning.

Why is everybody fighting the tape?

BLS got caught with their pants down. Big downword revisions coming to this month. Whoever is brought in to run that organization 2009 needs to overhaul its methods.

Barry,

I love your blog and read it all the time- It’s a place where I can come to and get my share of “doom and gloom”.

However, the market is going up.

The very end of 2008 through 2009 will be the biggest bull run the stock market has seen EVER!!!!!

As I said last night…if you believed the gov’t figures, 5 Million jobs were created from 2003-2007…40% supposedly in real estate related industry. Those jobs were only needed in a bubble…they are no longer needed ever. Two million jobs have to go right now, no questions asked. Unless all the numbers have been bogus all along…then who knows.

“The Birth/Death adjustment was +267,000, including 45,000 construction jobs and 8,000 financial services jobs. This is fraud on a massive scale by the government.”

No word is strong enough to express my level of disgust and sense of shame for the puppet masters running this country. With bold audacity they look you in the eyes and lie to your face. The only people needing more pity are those that willfully believe this garbage, especially foreigners sucked into buying treasuries and GSEs… Caveat Emptor if ever, ever it applied.

Birth/death adjustment is in line with typical adjustment for April. Note, last year it was 262.

Dave S, EXACTLY. The fact they have it as a “typical” April is what the problem is about.

Question for the forum. If you missed the housing bust like Kudlow, he gets luaghed at. But if you overestimated its negative impact, you consider yourselves smarter than everyone else for being so contrarian. But aren’t you still just as wrong?

The BLS uses long term averages for the birth/death adjustment. It completely misses turning points in the economy. Use your common sense. Housing is down 70% and 45,000 construction jobs were created? WTF!!!!

I guess the only thing that will make people happy here is if the DOW goes to 5000, the SP to 700, and the NAS to 1000.

I suggest renaming this blog to “The Big Bear”.

Eddie, it is what it is. The BLS bleeped up. Now they will have to have a rediculous revision downward this fall and find out April DID have 100,000 lost jobs. Whoops, uh, shouldn’t they have known that then?

They also have no control over their poorly constructed unemployment rate either. It needs overhauled.

Wow, the bulls are really out in force today on the Big Picture. We must be near a top.

“Leisure & Hospitality 83”

I believe that one also.

As far as education, most states are running deficits now and have hiring freezes.

And the unemployment rate falling is just pure BS.

I know Barry’s covered the Birth/Death trends in the past, but this is really worth looking at – Does anyone have data going back during the 90’s?

Apr 01 – 75

Apr 02 – 45k

Apr 03 – 128k

Apr 04 – 225k

Apr 05 – 206k

Apr 06 – 271k

Apr 07 – 262k

Apr 08 – 267k

B/D is now averaging over a 1 mil/year.

Manufacturing workweek to 40.9 hours from 41.2.. not a good sign for industrial production.

ISM employment index hit 5 year low yesterday.

Remember – the stock market is a confidence game at its heart. Do you have confidence in you positions? I do.

The issue is not about a bearish attitude. The issue is about analyzing information that reflects what actually is transpiring in the economy so that one can develop a cogent investment strategy. Also, under normal circumstances we would have an administration that develops public policy. How can anyone develop good public policy when all the numbers are suspect? On top of that govt actions contradict the official word. Paulson states that the credit crisis is winding down the day before the Fed increases the TAF facitlity and announces that they will now accept collaterlized credit card debt and auto loans. If things are win ding down, should we the taxpayers be buying up Bubba’s loan on his pickup?

What the hell is going on?

Average Hourly Earnigns MoM 0.1% vs 0.3% expected.

45,000 jobs added in construction. You’d have to be a complete idiot or complicity naive to believe that figure. This will be revised next month. …. and those wages… McDonald’s must’ve expanded their staff.

“Why is everybody fighting the tape?”

More like: the alternative reality of government statistics and how that unfairly influences the stock market. Good name for economics thesis…

The BLS didn’t make this adjustment in the 90’s. They come up with these adjustments when it helps their leaders. If the CPI was calculated as it was when Volker was the Fed Chairman it would be 12% versus the 4% they report. Go to shadowstatistics.com for the chart.

OK, last April headline number was +88k. So we had a decline of 108k jobs holding apples to apples. Need 150k to keep up with population growth. 250k is a mid sized city of job losses year on year.

Actually, the economists ranges are probably right in the end. But April is the biggest adjustment month and we came on the highside of the ranges.

Usually the big gross losses don’t start to the 2nd half of a recession, they probably already are happening, but they aren’t being caught. So if April say ends up losing 110,000 jobs. That is that big of number. Probably shows a economy at the beginning of a recession.

If we start seeing months with 200,000+ losses intially, the economy is in the backside of a recession!

Also, yry continued to decline. Patience folks. Don’t frontrun and be to fast. That is what hurts investers all the time.

larster:

Just look at Paulson’s comments re: the strong dollar. No one I know took him seriously. Jawboning isn’t going to make the dollar strong over time.

This morning at 8:15 a.m., the FED decided to increase the size of the Term Auction Facility. That’s the one where commercial banks can get 28-day do-re-mi in exchange for a wide range of collateral, not all of it pristine. That $150 bil a month is up from $100 bil which was up from $60 bil already. Oh, boy, they made this liquidity-enhancing announcement 15 minutes ahead of the most widely watched economic release? That’s really shady, don’t you think?

This morning I bought the right to own $100K of oil. I’m a bear and sick of this nonsense.

I think other bears will buy oil until the entire market ceases up. I own $1K of $140 Jan 09 Oil contracts.

I’m sick of this BS. They lowered the rate and gave the green light, now everything is bubbling. Surely this will be the biggest US disaster yet.

Ok we all know about the Birth Death hijinks, but we are missing something even bigger. ALOT bigger.

The government only got 67.3% of its surveys back this month. So guess who is estimating the missing 32.7% of all jobs. That’s right, the BLS.

Last April of 2007, the BLS had 69.3% of all surveys back, so they estimated a smaller fraction. By the way the number of surveys that return is HIGHLY dependent on the economy. In good times it goes up, as the economy slows it falls.

You folks can parse the data anyway you want, but these government statistics seem to define “reality” for WS and the unsuspecting masses, who actually suspect something must be wrong but can’t quite figure out what.

The main difficulty I have with the birth/death model plug is that is is about the same size as last year… 260K. Problem is measured hiring for the year to date is about 150k-160k per month less than the same period last year. They CANNOT keep the plug the same as last year in this case. Period. This is why this figure has no credibility. The theory behind adjusting for birth/death of small business I can see, but they cannot keep the adjustment at the same level as prior periods when measured employed has materially fallen off. That’s just not correct and completely negates any credibility the figure has and explains why the birth/death model proportion of total jobs has significantly increased over the past year. For the BLS to continue to purport the merits of the data, totally undermines their credibility as well. M. Donnelly makes a great point as well about the return of surveys. So, basically the vast majority of the reported jobs data is a guesstimate…Niiiiiicce.

Check out the link above. B/D has been a joke, but even with that farce, new job growth has been with 16-19 year olds. No wonder average salaries aren’t rising!

Posted by: larster | May 2, 2008 9:45:25 AM

____

Exactly.

http://www.bls.gov/news.release/empsit.t12.htm

Note the U-6 category increased this month to 9.2%. The unemployment rate falling is not consistent with this unless it fell because more workers left the workforce, discouraged. One of these days the MSM will start doing some objective journalism and seriously critique this data.

Michael Donnelly, good stuff.

“If only it mattered what the true jobs picture was. All that matters is perception. And they seem to be masters at controlling perception.

And, yea, I’m short and dying, here.”

Well..I’m nor short nor long, all in cash right now, and if journalists were doing the freaking JOB instead of stenographing the press releases, there would be blood in the streets, for the real unemployment is far larger than advertised by the officialdom spin machine.

The Labor Department reported today that 20,000 jobs were shed in April, far fewer

than the 80,000 that economists surveyed by Reuters had anticipated would be lost.

The national unemployment rate fell to 5 percent from 5.1 percent in March.

Jobs cut: 20,000.00

Unemployment: – 0.1%

Employers need to cut another 1 million jobs to bring unemployment down to zero.

Cheers!!!