Productivity

May 7, 2008 1:30pm by Barry Ritholtz

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment. The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client. References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers Please see disclosures here: https://ritholtzwealth.com/blog-disclosures/

What's been said:

Discussions found on the web:Posted Under

Previous Post

Recessions Often Begin With Positive GDP DataNext Post

Greenspan Quote of the Day

Wage growth is the lowest in measured history. Including the 1930s. Care to guess why? I read some economist who said that and labor participation was because people wanted to stay home and make babies. That is really a good one. You mean in their foreclosed home?

This is getting a little scary. I had my house robbed last week. And, so have other people where I live. The police said theft is off the charts. A buddy of mine who is in the construction business said people are going to churches and large buildings and stealing the air conditioners for the copper tubing. He said NOW THESE CENTERS THAT RECYCLE METALS ARE REQUIRING FINGERPRINTS AND PICTURE ID.

His son lost his house two years ago and hasn’t made a payment since yet is still living there because the bank doesn’t want the house empty. Two builders I know said they have removed the chattel from their show homes because people are breaking in to steal refrigs, ranges, etc.

Most crime is based on economics. But, hey, it’s all good. Just hire more police officers. We don’t need to create jobs. Just need more people to control the mob.

Interesting. One open question for debate, should the decline in manufacturing jobs/hours worked, etc., be taken as seriously now given the declining place of manufacturing within our broader economy now and in the future? That is to say, shouldn’t we expect to see a declining trend in manufacturing going forward, even as the broader economy picks up?

The industrial economy is REQUIRED to increase the capital stock of society. To provide the wealth to pay our bills. To create leisure. To create a middle class. The believe that we are a services based economy pushing money around is a myth. A myth perpetrated by clowns wishing it to be a reality.

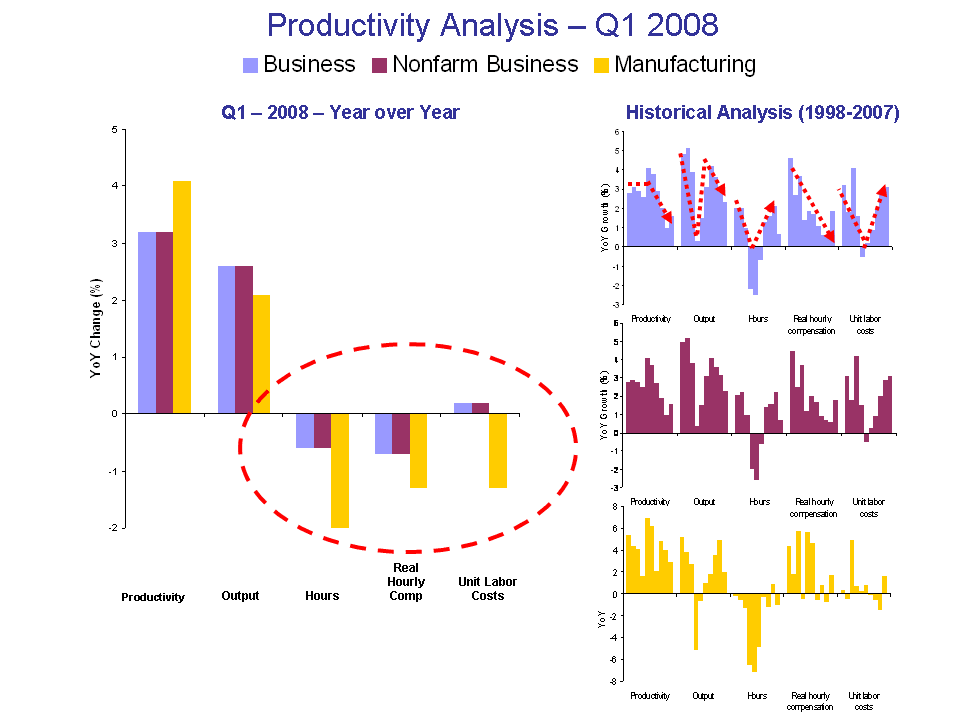

In a normal economic cycle productivity falls in the late expansion – early recession period

causing unit labor costs to rise faster then prices and squeezing margins and playing a major role in generating a wage-price inflationary spiral.

But this cycle prices are rising faster then unit labor cost, so at least in the non-financial sector profit margins and overall profits are holding up much better then normal.

Is this any way to have a recession?

On the other hand what we may be seeing is a reverse Say’s Law, where strong productivity leads to falling employment and falling incomes and falling demand and falling employment.

It’s stimulous.

If you are afraid to lose your job you are more productive because you want someone else to be chosen to go first.

Productivity and output determine our standard of living, since we consume output, not money. The increase in output shows that our standard of living is still increasing.

Having wages out of balance with productivity is not good. We either get workers with inflated balance sheets of f—-d companies or banks with inflated balance sheets of f—-d consumers. To increase wage inflation to get wages back in balance with productivity we need to throw tax cuts and stimulus at wage-payers. Corporate taxes should be slashed and SOX should be weakened since it makes corporations too risk-averse.

the other explanation is that manufacturing is shutting down and thus is outputting only what is already being fabricated. This allows them to lay off workers from the early production stages and claim the savings from not buying replacement raw stock as profit — hence the pop in productivity. Unless, of course, the Govt. numbers are sheer fiction.

Spencer May 7, 2008 3:30:50 PM: “On the other hand what we may be seeing is a reverse Say’s Law, where strong productivity leads to falling employment and falling incomes and falling demand and falling employment.”

I might add that productivity is measured by the cost of production, and generally the main cost of production is wages. So instead of saying that strong productivity leads to falling incomes, it might be more accurate to say that falling incomes cause strong productivity.

I’ve always thought that a more useful metric of productivity would something that does not include compensation paid to people, but instead includes man-hours, which might reveal “real” productivity changes, i.e. productivity due to actual process improvements.

Decreased bargaining leverage by employees is not a productivity gain!

There is a trade-off (nonlinear although) between productivity and labor force participation. the latter is currently decreasing, the former should grow.

Because of the nonlinearity (actually exponential relation) productivity change rate depends on the level of participation.

http://inflationusa.blogspot.com/

Ahhhhh, Nick should be a lean manufacturing expert. Cost accounting is a complete fallacy.

As the chart clearly shows, output is increasing. It is at an all-time high. It’s just the manufacturing jobs that have declined (since the peak in 1979). We are producing more with less labor input.

The same thing happened in the farm sector, which employed 40 per cent of the labor force just over a century ago. Now we produce more food with a fraction of that labor force.

Those manufacturing jobs are not coming back, but will continue to decline even as production grows. It’s a world-wide phenomenom.