Hey, I thought that the glut of foreclosed homes had driven U.S. home prices down so much that buyers were jumping back into the market?

Didn’t I read that somewhere?

Oh, that’s right — that was actually an erroneous front page article in the WSJ. It turned out the the February pop was just the ordinary seasonal pattern.

Oops, sorry, my bad — pardon the interruption . . .

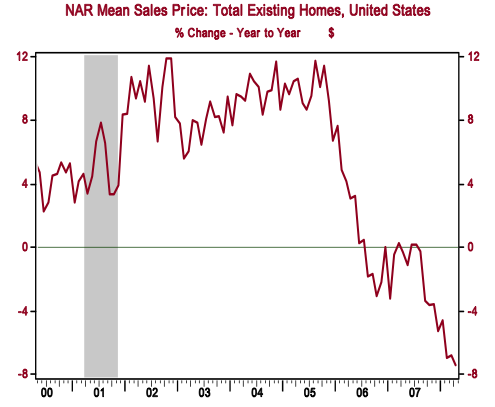

Housing Prices Deflated

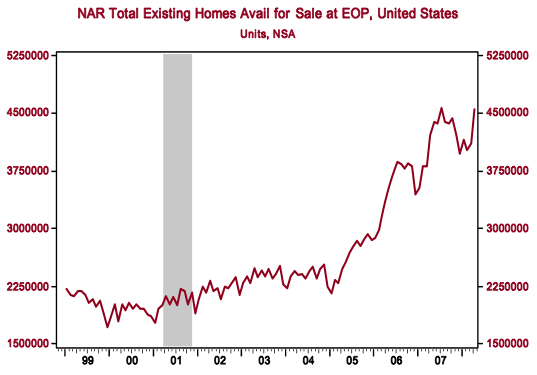

Unsold Inventories Pile Up

charts courtesy of Haver Analytics, Merrill Lynch

>

Previously:

Existing Home Sales, Non Seasonally Adjusted, Explained (March 2008) http://bigpicture.typepad.com/comments/2008/03/existing-home-s.html

How Counter-Productive is Realtor Association Spin? (March 2008) http://bigpicture.typepad.com/comments/2008/03/how-counter-pro.html

Wave of Foreclosures Drives Prices Lower, Lures Buyers

Oversupply Triggers Lenders’ Fast Sales; Mr. English Bids

JAMES R. HAGERTY and KRIS HUDSON

WSJ March 25, 2008; Page A1

http://online.wsj.com/article/SB120640573882561087.html

No need to get sarky – reality will assert itself, WSJ articles or not.

Has anyone seen Dennis Neale?

I’m still trying to figure out who Sarky is. ..

Its not very often I see a screaming screw up on the front page of the WSJ.

Just a gentle (&snarky) reminder.

It looks to me, like the tradeable bottom that Barry talked about several weeks ago is over.

JMHO … I suspect, it the coming months are not going to be pleasurable for the PermaBulls.

Dean Baker came down hard on the WSJ for this as well. But I’m sure, like clockwork, when next year’s seasonal inventory decline occurs, the WSJ will be shouting about the market turnaround…. for the 100th time.

Barry, didn’t you note some time ago that the WSJ seemed to be shifting to a more entertainment-oriented front page? Clear evidence, it seems to me…

The Wall Street Journal is to quality reporting as Reno 911 is to police departments nationwide…

Wait a second…. don’t “houses on average double in price every 10 years?” (NAR ad btw) Something is really wrong with that chart… :-)

When people stop believing the hype, the papers start printing the obvious as if it is unexpected.

Reality is such a pain to the vowel stretching rich class.

You want to scare yourself silly, read some of the articles here:

http://www.viewfromsiliconvalley.com/

$12,000/month rentals, roving gangs, flippers living with renters.

I don’t think I’ll be able to sleep for weeks.

Economists React: Housing Weakness ‘Far From Over’

Economists and others weigh in on the decline in existing-home sales and prices, while inventories surged.

While sales declined, inventories of homes for sale jumped 10.5% to 4.55 million. However, since the data is not seasonally adjusted, it could be biased higher as inventory typically increases for the spring selling season. This pushed the supply of homes on the market at the current sales pace to a new cyclical high of 11.2 months. The rise in inventories is quite concerning. As long as inventories are high, there will be downward pressure on construction and prices. The housing weakness is far from over.

–Michelle Meyer, Lehman Brothers

Single family starts stood at Sales have been little changed on net over the past six months, as high levels of housing affordability appear to be helping sales bottom out. The months’ supply of unsold homes rose sharply to a new high in the history of the data back to 1999, though this measure is a mix of seasonally adjusted sales and unadjusted homes for sale and typically rises significantly in April during the key spring selling season… Still, even if supply was more stable after accounting for seasonal patterns, clearly the market remains badly out of balance relative to more normal inventory levels of 5 to 6 months.

–Ted Wieseman, Morgan Stanley

The headline increase in starts given the reliability of the numbers the past few months’ sales have been more or less flat after a calamitous plunge in the final few months of last year. We regard this as a temporary phenomenon, like the small upticks in sales in the spring of 06 and early 07. With prices collapsing the incentive not to buy a home is increasing by the week, and with inventory showing no sign of improvement prices will keep falling.

–Ian Shepherdson, High Frequency Economics

The latest data are not altogether awful and can be seen as justifying hopes that sales may be nearing a bottom… Still, the near record overhang of unsold homes implies further price softness in the months ahead.

–David Resler, Nomura Securities

The fact that supply continues to rise in advance of what we expect to be close to 3.0 million in foreclosures hitting the market over the next two years, regardless of what pittance Congress offers up in the guise of mortgage relief, should provide another splash of cold water from a housing market deep into a multiyear correction. The sharp increase in inventories will continue to keep potential buyers out of the market and depress overall prices further. Given the sharp increase in oil prices over the past two months and continuing fall in the price of homes could portended a very ugly final quarter of the year for overall consumption.

–Joseph Brusuelas, Merk Investments

Inventories are very high relative to sales rates, and would probably be even more so if all those wishing to sell their home actually had the house on the market instead of pulling it off in the face of weak demand and eroding prices. While price declines seen so far represent a reasonable start, we still have a long way to go before prices sink to levels necessary to balance supply and demand in the housing market.

–Joshua Shapiro, MFR Inc.

With demand side conditions softening, due to flagging consumer confidence, further erosion in labor market conditions, heavy household debt burdens, and the inability of many potential buyers to meet heightened mortgage lending standards, sales can be expected to continue drifting lower over coming months. Along with already bloated inventory levels – to which will be added a significant number of foreclosed homes over coming months – this suggests continued downward pressure on house prices.

–Richard F. Moody, Mission Residential