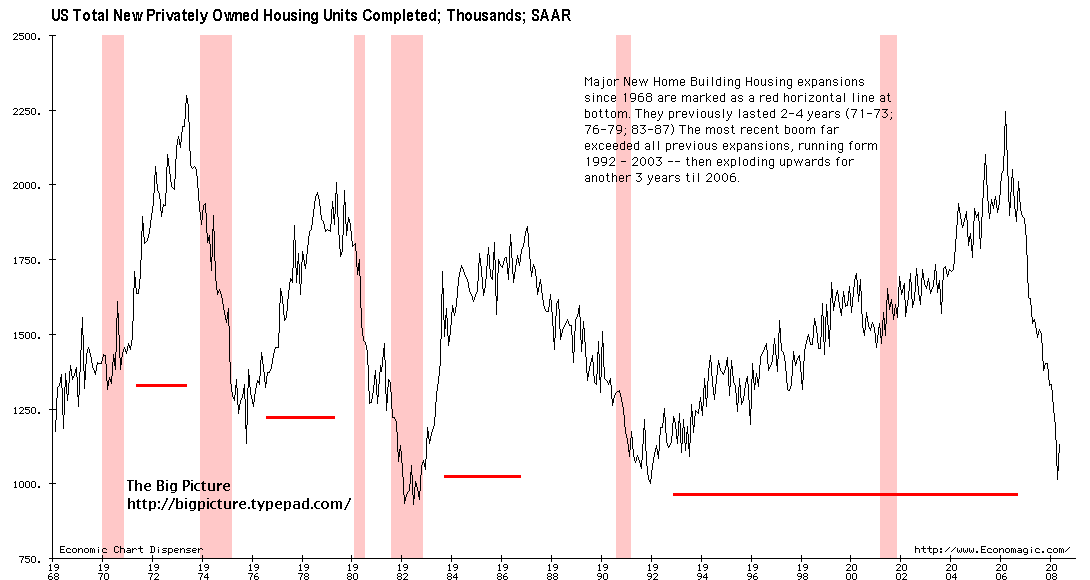

New Home Completions, 1968-2008

click for ginormous chart

Major New Home Building Housing expansions since 1968 are marked as a red horizontal line at bottom. They previously lasted 2-4 years (71-73; 76-79; 83-87) The most recent boom far exceeded all previous expansions, running form 1992 – 2003 — then exploding upwards for another 3 years til 2006.

>

~~~

>

During the Bull Market of the ’90s, I used to read Barron’s for their hard edged, skeptical look at many of the excesses on Wall Street.

During the past 5 years or so, that skepticism seems to be fading. Sure, Alan Abelson is still a curmudgeon, and Randall Forsyth is no cheerleader. The trader column is always worthwhile, and Santoli is usually interesting. Lately, the magazine seems to be drinking the same Kool-Aid my pal Larry Kudlow seems to enjoy so much.

The latest evidence of this is the wrong headed cover story on Housing, declaring “Home Prices Are About to Bottom,” and why “This Real-Estate Rout May Be Short-Lived.” I expect this cover to suffer the same ignominious fate as the recent cover story on General Motors (Buy GM) will.

The reason a bottom is in the offing, argues the article, is based upon specific data points:

• The U.S. housing market typically begins to improve after housing starts have fallen by a million units (which has now happened);

• Prices rose rose slightly in April in eight of the 20 markets covered by Case Shiller index;

• Sales activity seems to be picking up. NAR reports sales rose 2%

in May from April’s levels, the second month in the past 10 to have seen an

increase.• The ratio of sale prices to per-capita income in various locales — already has improved affordability.

• $300 billion congressional bailout is coming for troubled subprime mortgages;

• A government takeover of loss-ridden Fannie and Freddie is possible;

• Several analysts expect home prices to be steady by years end;

• NAR economist Lawrence Yun is optimistic home prices will stabilize in the next five months and begin to recover next year;

We’ve covered each of these in great detail over the years, but what the hell, once more won’t hurt:

• The explosion in home construction this cycle has totally and utterly exceeded all previous home construction booms. Its so much larger than any expansion over the past 40 years as to make the prior 1M drop meaningless (see chart at top);

• Housing completions passed the minus 1MM figure a year ago — you could have called a housing bottom in August 2007 by the same logic . . .

• An unprecedented 10% of homes built after 2000 stand vacant, according to Stansberry & Asssociates Investment Research;

• In just about every area of the country, the ratio of sale prices to per-capita income remains significantly elevated over its historical averages. And, that assumes there won’t be a significant economic downturn. As of July 12 2008, a significant recession is looking increasingly likely;

• Sales have ticked up several times, only to be revised lower in subsequent months. And, the selling season improves each month, from January (the slowest month) to August. Seasonal adjustments sometimes seem to not fully reflect this.

• Median Sale Prices are rising not because home prices are going up, but because less of the inexpensive homes are selling (i.e., smaller starter houses) . The mix of homes — not price increases — are skewing the numbers;

• By nearly every traditional metrics, Home prices remain extremely elevated; Median Price to Median Income or Homes vs. Rentals. All of these imply further price adjustment towards the historical norms;

• These same analysts who are calling for

stability in second half of 2008 have been incorrectly expecting home

prices to stabilize for years; why will the recession make home prices

stabilize?

• A takeover of Fannie and Freddie is somehow a positive? All that would accomplish is restoring mortgage purchases back to where it was in March 2008. So what?

• The bailout will only delay the inevitable repricing that needs to take place;

• NAR economist Lawrence Yun? Puh-leeze! He’s been optimistic housing would stabilize for years now.

Home prices rose 86% in the 10 largest markets, and 72% in the 20 largest. Incomes lagged so badly behind, that a mere 15% housing price decrease has failed to return the income to house price ratio towards normalcy. Look for another 10-25% over the next few years — or the inflation adjusted equivalent, sideways action for the next decade . . .

Source: Federal Reserve Bank of San Francisco

Finally, the author of the Barron’s piece notes: “With the benefit of hindsight, one can discern a concatenation of developments that made the latest cycle almost inevitable.”

What nonsense. Plenty of people — including yours truly — were warning about the inevitable housing collapse and pricing correction in real time. Dismissing those who made timely warnings is an ugly form of historical revisionism . . .

~~~

We can easily dismiss this article based on the simple Housing facts we know to be true. But this article discusses what might happen in the near future. (See Case Shiller chart above)

Perhaps this author is seeing things the present facts obscure. Maybe he has an ability to see what others miss. How has his track record been in making these articles forecasting improvements in weak companies or sectors?

Short Answer: Not so good.

Longer answer: Here’s a few excerpts from the past year:

1. AIG’s Selloff: A Huge Opportunity (FEBRUARY 18, 2008)

http://online.barrons.com/article/SB120312653758273245.html

Excerpt: Last week’s plunge was way overdone ($44.10). The stock could jump nearly 50%. (Yesterday’s close: $23.08)

2. MBIA: Priced for Catastrophe (JANUARY 21, 2008)

http://online.barrons.com/article/SB120071150488302379.html

Excerpt: MBIA’s shares were savaged anew last week, and now its stock looks

cheap. It trades for about $8, well below a conservative liquidation

value above $30 a share. (Yesterday’s close: $3.90)

3. Sears: A Storied Name on Sale? (OCTOBER 22, 2007)

http://online.barrons.com/article/SB119283873785565563.html

Excerpt: Money-management wunderkind Eddie Lampert is likely to succeed in turning around Sears. For investors, the big payoff lies in real estate. Sears Holdings sells for $134 a share, but could have a break-up vaule of more than $300. If Lampert turns around its retail operations, the shares could rally to 200 or more. (Yesterday’s close: $70.91)

4. Macy’s: Miracle on Private-Equity Street (JULY 23, 2007)

4. Macy’s: Miracle on Private-Equity Street (JULY 23, 2007)

http://online.barrons.com/article/SB118497718683573586.html

Excerpt: The shares, now about $42, could fetch more than 52 in a takeover. And there’s ample room for the current management to improve marketing and cut costs. (Yesterday’s close: $15.51)

~~~

To be fair, this has been a very difficult environment — particularly for financials and retailers. But while the market has fallen since these stories came out, they are all down 40-50% — far worse than the overall 20% drop the S&P500 has suffered. And while the Financials and Retailers have fallen even more than the SPX, one must question the wisdom of constantly suggesting buying those sectors under the greatest pressure.

The famed Barron’s Bounce has become become a bit of a misnomer — it is looking more and more like the Barron’s Trounce . . .

>

Previously:

Housing Price to Rent Ratio (May 2008)

http://bigpicture.typepad.com/comments/2008/05/housing-price-t.html

How Far Might Housing Prices Fall? (January 2008)

http://bigpicture.typepad.com/comments/2008/01/how-far-must-ho.html

Sources:

Bottom’s Up: This Real-Estate Rout May Be Short-Lived

JONATHAN R. LAING

BARRON’S COVER JULY 14, 2008

http://online.barrons.com/article/SB121581623724947273.html

Don’t Buy Housing Bubble Propaganda

Barry Ritholtz

RealMoney.com 5/26/2005 2:04 PM EDT http://www.thestreet.com/p/rmoney/barryritholtz/10225437.html

~~~

Love the dividend column, and Abelson is OK, but I only read Barrons for the money manager interviews anymore. The insistence on having Abby Cohen on their all-star investing panel is irksome. I think the blogosphere is eating their lunch.

How can you call for a bottom after the rumors swirling around Fannie and Freddie? I would also add that Bush’s comments yesterday indicate that this is another can to be kicked down the road to the next pres., along with greenhouse gas emmissions, Iraq, etc. Logic tells you that a Republican government does not have high level discussions about rescuing these entities unless they are in serious trouble. Bush saw the price tag and said “not on my watch”.

The bottom will come when the bank failures end, when Fannie and freddie are rescued, and when the mgt insurers are euthanized.

Mainstream media is gratuitous schlock, not worthy of consideration.

Famed? Perhaps to baby boomers who are used to respecting public figures.

I’m 30. Until proven otherwise, I believe everything I see on TV or in print.. is pure spin, and factually incorrect.

Back in the 90’s I called it the “Barron’s Curse.” It seems to be back in full force. Citing Yun as a source was really stretching credibility.

When I was trying to figure out the game I read Barron’s religiously. Now I can’t really stomach it at all. Don’t know if I’ve gotten smarter or it’s gotten worse, but not reading it has not hurt me a bit. Perhaps it is like Cramer and only good for fading????

Beautiful takedown. See, this is the kind of thing I wish the MSM would do: when someone says something, and they’ve been objectively terribly wrong in the past, we should be reminded of that. I’m told the Daily Show does it from time to time, but why not real news shows?

My wife just got back from pickup at summer camp and some of the mothers were talking about their monthly payment for home heating oil which the heating oil companies send out to their customers around now. Many people lock in their heating oil costs around now but many more agree to a monthly payment that remains the same year round. They were “shocked,” their 450 payment went to 900. The “SUV” house is going to become as hot a potato as the Ford Explorer and most of the “middle class” houses built in the past five years are indeed proportionally SUV’s.

This is going to be just like those stimulus checks but in reverse and multiplied by four… Home prices have bottomed? Reminds me of when BAC upgraded homebuilders to a buy in 2006. (At which time I had one third of our capital on a short of Pulte and Beazer Homes and my stops were hit. Still cursing myself for “the one that got away.”)

To Fenner’s point, natural gas is around $12. That will be a disaster this fall when people start receiving their bills. They have no idea what is in store like the heating oil folks are now finding out.

I see a future in which homeless suburbanites cluster around trash barrels, warming their blue, chapped hands over blazing piles of Barron’s, old broker confirmations, and moldy mutual fund statements.

Of course, with Barron’s down to 16 pages by then, and the cover price having reached 75 dollars, it’ll take a whole bundle of them just to make a decent fire. Maybe we can use discarded Bernanke portraits as firestarters. GOT MATCHES?

This article is classic DennisKnealerie ! A completely glib, polyannish viewpoint operating under the mindset that what has fallen in price must eventually go higher. Thanks, BR, for exposing the author of this article as a serial wealth destroyer.

Why is it so difficult to understand that asset classes have long cycles due to changing dynamics in the economy, and that due to permanently higher oil prices it has enormous ramifications on things like housing?

Here’s the inconvenient truth: Until we solve the oil dilemma and get energy costs down to an affordable level, stuff like housing can’t go up in price because fewer people can afford them. At a certain price housing will stop falling, but it certainly can be an L shaped recovery where housing prices simply flatline.

George W. Bush looks more and more like a modern day Herbert Hoover with each passing week.

Fenner

— hope you re-established those shorts higher!

You Like Santoli?

His column today was total garbage . . .

For your next trick, BR, could you please take down Fox News for their Bensteinery headlines. This is so long overdue !!!!

Forbes on Fox right now with this headline:

FANNIE & FREDDIE TROUBLES: GOOD NEWS FOR HOME PRICES !!

One statistic that I have never seen in analysis of the housing stock is the number of housing units lost. I would assume these would be due to condemnation, tear-downs for commercial property or higher and better use (there is a large grouping of older apartments about 4 miles from my house in Dallas that has been leveled and will be replaced with much lower density homes), and natural disasters (e.g. Katrina/Rita). Does anybody have a source for this valuable data?

Next Fox News headline:

IS THE SLOWING ECONOMY SAVING MARRIAGES?

You can’t make this up. They must have hired former employees of Pravda and Tass to be so imaginative.

you lied BR, that did hurt!

Barron’s was once a great rag. Isn’t Santoli the senior editor? Therefore, isn’t he really responsible in large part for the quality and depth of the journalism? He seems like a geniune guy but he doesn’t come across as a critical thinker. That’s a skill he should be consciously nurturing in that role. If he can’t find it, he shouldn’t be senior editor. Of course, the counter argument to that is those doing the writing also need to have better understanding of what they are writing about. We have a crisis in journalism and I wonder if it has to do with pell mell corporate buying of media assets. Corporations are more concerned about the bottom line than hiring the old-fashioned hard-nosed journalists. Some of the authorship names in Barron’s makes me cringe.

Barry, thank you, that article was so simple minded it made me angry. The most important omission was any mention of inventories. Homeowner vacancies are now at an all-time high 2.9%. During the 1990s downturn, the peak was 1.8%. That’s a million empty houses, there’s never been anything like that before.

Not only that, rental unit vacancies are also elevated, at 10.1%, compared to the ca. 7-8% range in the early 1990%.

(Census Bureau: Housing Vacancies and Homeownership)

I’m starting to think Barron’s isn’t worth the extra $20/year.

Back in the day Barron’s was pretty good and, like Byte in its’ hayday, if you were getting up to speed a good place to start. It’s been several years since it’s struck me as reliable, though Santoli and had several constructive exchanges on Technology. He’s a sharp guy who paid attention and dug in behind the charts, stats and arm-waving. At least then. But that string of articles should never have seen the light of day – as you imply each was a disastrously poor call. And each was disastrously poor for the same reasons – not understanding and investigating the fundamentals of the business and bouncing it against changes in the environment. The chart you posted yesterday on F, GM, Leh, et.al. makes the same implicit point – you’ve got to understand the business and its’ drivers. For example Detroit has three major challenges post the cash crunch – new smaller and desirable models then re-doing manufacturing then a deep structural makeover. Right now they’re still in denial the same way Citi was until Pandit. This is sad if it didn’t make you want to throw-up. A partial dissection of Detroit is this: http://tinyurl.com/6rqyxx

Actually, while we’re dumping on Barron’s be sure to check out the story on how their picks did in the first half. There’s bullish picks fell 4.24%, but hey, the benchmarks chosen for each stock fell 4.45%!

Ironically, there bearish list only fell 2.15%.

They essentially made the case for index funds and not wasting time reading Barron’s.

I only read Barron’s intermittently on train or plane journeys and suchlike. I thought for years they had a touch of WSJ ed page disease but I agree broadly with BR that back in the nineties there was a bit more scepticism around. This seems to have disappeared completely over the past seven years. I don’t want to sound paranoid but I basically put it down to the fact that in the nineties there was a democratic administration in office so it suited their book to be more critical in the broadest sense but once we got a Republican admin the objectivity went out the window. I’ve read stuff in there over the past six years that was totally laughable and I remember a couple of the cases Barry cites. As for the story about housing it’s bizarre. Someone above mention Forbes whose another joke as an objective source of info about the economy. These people like Forbes, Kudlow, Cramer et al are so totally discredited it’s laughable. Why does anyone pay attention to this crud.

“See, this is the kind of thing I wish the MSM would do: when someone says something, and they’ve been objectively terribly wrong in the past, we should be reminded of that.”

“I’m 30. Until proven otherwise, I believe everything I see on TV or in print.. is pure spin, and factually incorrect.”

Tranchefoot and unsympathetic, you’ve identified one of the most fundamental problems we have in the country today: a virtually useless class of allegedly professional mainstream “journalists.”

Sure, there are notable exceptions, but if you were to catalogue one month’s list of: (1.) incredibly shoddy and inaccurate reporting; (2.) brainless, sycophantic, stenographic cheerleading, (3.) astounding laziness; and, most importantly, (4.) a complete and total lack of interest in getting to factual truth, you’d end up with a volume dangerously heavy to lift.

And this applies to virtually every sphere of our lives: politics and public affairs, economics and business reporting, sports, science, law, medicine, and whatever else you want to throw in the pot. IMHO a big part of the problem is found in the gradual corporatization of the media, but I also have concluded it’s also a product of crappy journalism programs at the collegiate level. And you can also include our rotting and decrepit public education system.

For obvious reasons, an adequately functioning democracy absolutely requires the voting public to be well-informed, and a crucial link in that process are people who work at furnishing the truth to the public. Today’s class of journalists are, by and large, more suited to an authoritarian state than a democracy. The trouble is, I doubt that your average mainstream “journalist” would be able to write a coherent paragraph describing the functional and legal differences between the two systems. As long as they have a nice lunch and get to quit work at 5, it’s all the same to them.

Which is why the dirty, filthy bloggers laboring amongst the internet tubes are so important. Yes, there’s plenty of crap on the internet, but if you know where to look (this site, as an obvious example), the truth — and real, hard, information — is available.

“George W. Bush looks more and more like a modern day Herbert Hoover with each passing week.”

It’s an easy comparison to make, given Hoover’s reputation, but if you take a look at the entirety of Hoover’s career and life, one thing should be obvious: George W. Bush wouldn’t be qualified to be Hoover’s personal butler and errand boy.

Here in Chicago I know real estate investors that can’t rent out condos they have bought. Yet they are still building 90 plus story condo high rises in the downtown area. I’m afraid the supply of housing will last for years. Aren’t local governments supposed to regulate the amount of building happens in a town/city ???

Barry will have the ‘poor’ guy fired. Good stuff.

Anyone need more evidence of a recession?

The real story on housing is the demographics that will mean 40% fewer buyers in the future.

What journalism does today is mimic TV/movie script creation by using an emotional hook to involve the reader, rather than unbiased informing. These can be many but are usually the topical. In writing on finance it is often some simplistic heuristic, “Stocks go up” “Housing never declined” “Government ruins business” etc.

I’ll pick on one in J. Laing’s article – sourced, of course, to the ubiquitous Yun – proclaiming the importance of “Household Formation.”

This is a ratio derived from the houses occupied and population in those homes. It doesn’t “cause” anything.

If people “formed” households, wouldn’t that actually mean less abodes needed to be occupied? Where did these “formers” live before? The ether?

Maybe Bush/Rove were right that gay marriage will wreck America. All those gay households being formed will sell two places and move into one ruining the American Dream.

Wonderful piece, Barry. I note that most of the egregious errors of the past 2-3 years have been on the part of value investors who were (self) touted as being much more rigorous than the dot com kool-ade drinkers of the late nineties. We now see that it is just as easy to gulp the Citigroup/Bear Sterns/Fannie Mae kool-ade as it was to down the mo-mo tech stuff. The Nygren’s and Pzena’s of the world might consider giving back the ‘Best Of’ trophies they earned in the 2000-2002 bear market. Bottom line: the biggest risk we investors run is to fall victim to the tunnel vision of our dogma, made more extreme after some success. Barry, you are a great anti-toxin to all this. Thanks for the great work.

It sure does seem that Barrons has changed over the last 3 years. Not for the better. Could be that I have more experience at trading now but doubtful.

Will not renew, even though I will miss Ableson and a few other columns.

How about that recent call to buy GM????

I don’t think people are paying attention to home affordability enough. Yes, prices have come down 15 or 20 percent but prices doubled in many places from 2000 to 2006. I live in the suburbs of San Francisco where an average single family home costs about 700k. If you can get a mortgage you need a 20% down payment so you need close to 150k just for the down payment. If you figure in miscellaneous expenses plus money to live on for the first six months you probably need 200k in cash if you are a first time home buyer. In previous generations people would save everything they could to get that down payment. The current generation doesn’t save like that anymore. My point is that I think we have priced out the first time home buyer until prices come down a lot more.

“The U.S. housing market typically begins to improve after housing starts have fallen by a million units or more, says economist Karl Case…”

And what, exactly, is so “typical” about this housing bubble/decline??

From Wall Street Journal,

IndyMac Bank, a prolific mortgage specialist that helped fuel the housing boom, was seized Friday by federal regulators, in the third-largest bank failure in U.S. history.

IndyMac is the biggest mortgage lender to go under since a fall in housing prices and surge in defaults began rippling through the economy last year — and it likely won’t be the last. Banking regulators are bracing for a slew of failures over the next year as analysts say housing prices have yet to bottom out.

The collapse is expected to cost the Federal Deposit Insurance Corp. between $4 billion and $8 billion, potentially wiping out more than 10% of the FDIC’s $53 billion deposit-insurance fund.

The director of the Office of Thrift Supervision, John Reich, blamed IndyMac’s failure on comments made in late June by Sen. Charles Schumer (D., N.Y.), who sent a letter to the regulator raising concerns about the bank’s solvency. In the following 11 days, spooked depositors withdrew a total of $1.3 billion. Mr. Reich said Sen. Schumer gave the bank a “heart attack.”

“Would the institution have failed without the deposit run?” Mr. Reich asked reporters. “We’ll never know the answer to that question.”

The bank will be run by the FDIC and reopen Monday. The FDIC typically insures up to $100,000 per depositor. IndyMac had roughly $19 billion of deposits. Nearly $1 billion of those deposits were uninsured, affecting about 10,000 people, the FDIC said.

I’m finding Barrons and the WSJ increasingly useless – hence, I’m canceling my subscriptions to both. The WSJ editorial page has become absolutely ridiculous – my favorite from this month was when they said Obama was going to be Bush’s third term. My god, you may or may not like Obama, but that editorial was from Planet 9 from outer space.

Another Barron’s bullish call was Bear Stearns when it was trading around $115 in early August of last year saying it was a takeover candidate, which it was, but at a much, much lower price!

Bear Stearns Turned Bullish

The past couple of week I have been having the same sentiment about Barron’s. I thought maybe I was just getting old and cranky, but this week’s cover story has sealed the deal for me. I guess one of two tings is at play here:

1. They have taken a page out of CNBC’s playbook and become cheerleadres, because who wants to hear bad news and better to keep readership up with possigblities of making money.

2. Like the Harvard econmics professor (who’s name escapes me) during 1929, who was calling a steep market correction all year and finally threw in the towel in August of that year admitting he was wrong, Barrons has become more comfortable with selling feel good stories than giving you the cold hard facts.

I too read Barron’s all through the 80’s and 90’s.. but recently, I stopped buying. Once Rupert Murdoch bought the paper, I decided I couldn’t trust their coverage anymore. Pressure will be brought to bear on the writers, and articles will be approved for publication only if Rupert’s personal goals are met. I need good information to make good investments, so I turn to Barry and others like him on the internet.

My one regret – Alan Ableson’s column!

From today’s Wall Street Journal, there’s an article with the following title:

STOP WORRYING, AND LEARN TO LOVE THE BEAR

Take It From Graham and Buffett, These Miserable Markets Are A Gift From the Financial Gods

First, I agree with everyone here that we are nowhere near a real estate bottom.

Second, if we really want some insight, why haven’t we seen a basic survey asking Americans about their home buying intentions over the next 12 months?

My site brings in quite a bit of traffic, so I’m going to run a survey next week (starting Monday) and see what we get. I know what my response would be.

Barry, perhaps I could provide you with a link to the survey for everyone here?

Regards,

George

Yes, it’s very important not to forget that Barron’s is a Dow Jones publication, so you are now reading it courtesy of Rupert Murdoch.

Any news organization owned by Murdoch is completely tainted by his agenda, so anything Barron’s writes has to be taken with huge grains of salt.

I think it’s very dangerous that Murdoch owned financial publications should be considered to have the same level of credibility before the takeover of Dow Jones. Simply put, they have as much

integrity as Don Luskin’s opinions.

I agree the Housing article was absurd.

Thanks Barry for the counter point.

As for Barrons. I enjoy reading it for the most part. However as of late seems like they do not want to increase the negative sentiment so trying to be very positive. This is not reporting but shilling for the likes of CNBC and Kudlow.

Also agree the Santoli article on inflation was as if the author just got back from outer space. The heating oil story is scary for some that is for sure.

There was a farmer on Happy Hour on Fox last night that said a bag of chicken feed had gone from 8 to 21 dollars in a year. I guess since chicken feed is food that comes out too. LOL

Michael

Thbat WSJ column about loving the bear was equally moronic. “It’s great to own a stock that’s fallen 50%, think of the future appreciation!”

Then he gives the example of 1982-2000. So everything will be great, as long as you weren’t planning on retiring for another 15-20 years, and there’s another stock market bubble!

Not in my life time…

Bravo, BR. Nice work!

There will be a bailout of Fannie and Freddie.

The housing bailout bill has no chance of working (probably won’t anyhow) without Fannie and Freddie to help make loans. Eventually the gov’t will wake up and decide they need to do it. There’s no economic recovery until housing

gets better, one way or another.

Inventory, Inventory, Inventory….

did I mention inventory??

Not gonna happen when it’s at the level it’s at. But keep trying to induce a recovery just in time for Nov. 6th. All the jaw-boning is designed for that event.

Go ahead…buy a house. I dare you

Ciao

MS

Jonathan Laing wrote in the June 21 issue that MBIA was perfectly safe because “MBIA’s insurance unit is still rated double-A, according to S&P, just like such stalwarts Met Life (MET), Allstate (ALL) and AIG (AIG).” (He was serious.) Apparently he didn’t see that MBIA’s latest offering was at 14% and in less than two weeks traded at 80 cents on the dollar. Hardly double-A material. This was such an egregious, ignorant mistake that I know not to take anything he writes seriously.

If you’re looking for the last idiot who actually still believes in the ratings agencies, Jonathan Laing is your man.

@tranchefoot and others – Why does MSM typically take a Pollyanna viewpoint?

What too many people fail to understand is that MSM exists NOT for the reader but for the advertiser. They are afraid to paint too negative a picture or remind people that the information they featured in the past was wrong. To do so might cause the public to realize that “We are all bozo’s on this bus”. Then people will cancel their subscriptions, stop reading/watching and with less readers/viewers, advertisers will buy less advertising, resulting in layoffs and/or bankruptcy. And this is actually happening as most newspapers and magazines continue to report declining readership and revenues.

The blogsphere is where the accurate information is these days.

I was thinking on this point recently. For those old enough, remember how difficult it was to get good financial information and analysis pre-internet? Such information, if available at all, was quite expensive and generally not available to the public. Remember how much you had to pay for real-time quotes? And the information we did get was mainly stale and massaged representing what TPTB wanted us to see. Most of the financial world was dependent (and reacted appropriately) to what they saw/read in rags like the NY Times, WSJ, Barron’s, IBD, Forbes, Fortune, ValueLine, etc.

The internet has changed [for the better] the financial and general news ball game tremendously!

btw: CNBC Fast Money does do a short segment where they show the failed recommendations that their trader talking heads made.

Aren’t local governments supposed to regulate the amount of building happens in a town/city?

no they want taxable property

and they’ll offer $9:15 Mil salestax rebate/TIF to get it (to SuperWal*Mart)

Barry,

I have found that listening to people who actually make a living at what they do is often the most insightful…not journalists…an example.

When my wife and I moved here in East Tennessee from a very large metropolitan area we bought our farm from a man who made 90% of his living buying and selling land. He is a very, very wealthy man, and he is a friend of mine at this point. No education past high school other than the school of hard knocks…

2 years ago, he and I were talking as we sometimes do about investments, and he told me that he was not buying any more houses or raw land here in East Tennessee…his reasoning (he’s in his late 50’s) was that he thought the land and real estate bull market would hit hard times and explained his reasons to me at that time…these were cogent, well thought out ideas that would have been taken seriously here or on any website that discusses ideas…

Well, call it what you like, but this fellow always seems to land on his feet…and I have met several others through the years who just seem to “know” when to take down the mainsail and prepare for a blow….

I imagine you have met fellows like him too..he’s not especially liked in town, by the way…but I like and respect him and am always willing to listen if he has anything he wants to tell me…

Bruce in Tennessee

As I read barron’s cover story I saw the smoke coming out of Barry’s ears. The stupidity is breathtaking. Santoli didn’t help. It’s probably the worst issue I’ve read. Thankfully Epstein wrote on summer books since his analysis can often be tortured. I still remember how in 1999 he denied there was a bubble brewing.

Spoke with a man from Vegas today. He said that he put in a $92K bid for a foreclosed home being pushed for $180K. Got it. Original value: $280K.

Said the bank would take anything from anybody with credit just to move product because they were anticipating so many more houses coming on the market.

Incredible.

I would like to remain anonymous but please note that Mr. Paulson would like to single handedly bring down FNM and FRE to help Goldman . Please check into this important story.

“They were “shocked,” their 450 payment went to 900. The “SUV” house is going to become as hot a potato as the Ford Explorer and most of the “middle class” houses built in the past five years are indeed proportionally SUV’s.”

I am in this boat. My discretionary spending has gone to zero. There will be many people in my boat. I think this is a huge issue.

My buddy is paying $5400/month interest on a house he could rent for $2500-3000/month max. He finally gave up the ghost this week on the hope of any increase in value making any sense out of this and put it on the market. Luckily for him I told him, he’s still got some equity (maybe) and while get out without declaring bankruptcy or having to walk away. (Something we speculated on here about this time last year.)

I expect there are a lot more like this happening right now.

I noticed about 5 years ago that big spreads in the financial magazines that spotlighted a company’s great growth and brilliant prospects usually happened just before those very same companies went bust. Enron. WorldCom. I’m not even an investor and I noticed. I didn’t even read those magazines that often and I noticed.

It seems we have come to the point that traditional media is a mine of misinformation.

“Tranchefoot and unsympathetic, you’ve identified one of the most fundamental problems we have in the country today: a virtually useless class of allegedly professional mainstream “journalists.”

Bingo!

Add to this problem, a public that can’t be bothered by hard, in-depth news. An experiment was attempted by the Chicago NBC affiliate during the Microsoft vs. DOJ affair. They basically tried to do good, solid journalism on topics that could easily deemed important by reasonable people.

Turns out that it was a disaster. Ratings kept going down down down and the plug was pulled after 6 months.

Looks like no one in the MSM is eager to repeat the experience.

Now! What does that tell us about the audience? *evil grin*

OTOH, corporatization of the MSM means profit first, the rest be damned. Much easier to have empty talking heads spewing their BS under the meekly eye of a moderator which moral aegis is the “fair and balanced” doctrine (excuse me while I reach the baaaaaaaaaaaaaaag) than having a tough-minded moderator that won’t hesitate to call on participants trying to bullshit their way into nonsense.

An extreme example of how bad it has become can be found here:

http://economistsview.typepad.com/economistsview/2008/07/i-am-not-paid-e.html

where the insufferable Apostle of Neoconservative Economic Fuckwadism Grover Norquist was “debating” Prof. Brad Delong on the BBC/Newsnight show.

Beyond pathetic.

Bespoke Investment posted on July 9th:

“This is the highest reading of bearish sentiment since September 1998 when Russia defaulted and Long Term Capital blew up”

Now recall what happened to the stock market after that. And consider the almost unanimous dire tone of the posts here. That’s why investor sentiment is watched. When Larry Cudlow is pounding his chest after a bull run, be careful. Bears do the same thing. This is sooooo predictable. I went long INTC, CSCO and VSH last week.

Agreed. But unless you were actually shorting the market over that same period, you are likely down as well. Also, I do not recall many of your recommendations being that close to the mark either. At the end of the day, both of you are a little right and a little wrong. How about commenting on whether we are at the bottom and is it time to go long? With the IndyMac news and the likely takeover of Freddie and Fannie next week, does this present a buying opportunity after the dust settles?

basehitz writes: Bespoke Investment posted on July 9th:

“This is the highest reading of bearish sentiment since September 1998 when Russia defaulted and Long Term Capital blew up”

Now recall what happened to the stock market after that. And consider the almost unanimous dire tone of the posts here. That’s why investor sentiment is watched. When Larry Cudlow is pounding his chest after a bull run, be careful. Bears do the same thing. This is sooooo predictable. I went long INTC, CSCO and VSH last week.

——————————–

I’ve been reading and posting on this blog for perhaps 9 months now. I wish I had been reading it well before that. I have noted a consistently bearish (realistic) tone in the comments on the message board of TBP since my first day. So don’t assume that sentiment here has turned suddenly bearish and therefore a sign of the bottom. As for the readings of very high bearish sentiment Bespoke mentions, well I think those folks have probably saved themselves quite a bit of money over the past few months by reducing their exposure to the stock market. The VIX is the sentiment indicator I am watching and while it’s trending upwards it’s been an orderly rise we aren’t seeing the spikes yet that are reminiscent of real market bottoms. Not to mention the continued deterioration of the dollar, recent rise in gold, relentless rise in crude oil etc etc. all of which reinforce the point that there are very valid reasons to be bearish.

basehitz writes: Bespoke Investment posted on July 9th:

“This is the highest reading of bearish sentiment since September 1998 when Russia defaulted and Long Term Capital blew up”

Now recall what happened to the stock market after that. And consider the almost unanimous dire tone of the posts here. That’s why investor sentiment is watched. When Larry Cudlow is pounding his chest after a bull run, be careful. Bears do the same thing. This is sooooo predictable. I went long INTC, CSCO and VSH last week.

——————————–

I’ve been reading and posting on this blog for perhaps 9 months now. I wish I had been reading it well before that. I have noted a consistently bearish (realistic) tone in the comments on the message board of TBP since my first day. So don’t assume that sentiment here has turned suddenly bearish and therefore a sign of the bottom. As for the readings of very high bearish sentiment Bespoke mentions, well I think those folks have probably saved themselves quite a bit of money over the past few months by reducing their exposure to the stock market. The VIX is the sentiment indicator I am watching and while it’s trending upwards it’s been an orderly rise we aren’t seeing the spikes yet that are reminiscent of real market bottoms. Not to mention the continued deterioration of the dollar, recent rise in gold, relentless rise in crude oil etc etc. all of which reinforce the point that there are very valid reasons to be bearish.

The NYSE short interest ratio (NYSE short interest divided by average daily volume) went over 100 (readings above 2 or so were considered to show extreme pessimism) in the early 1930s, but the stock market kept falling, and falling and falling…. 90% before it was all over. The point is, excessive bearish sentiment means nothing when you’re in the mother of all financial crises.

Just happen to be watching CNBC this morning and lo and behold Joe Kernon has proclaimed that housing prices are at the bottom based on the weekend Barron’s newspaper headline. I guess thinking for yourself is a little to hard for Joe.

It will be interesting to see where house prices actually are in 6 months??

Barron’s has jumped the shark. You all know it. They are still figuring it out. Same with WSJ. They used to be indispensable to me. Not any more. I rarely read them. Saw an old Barron’s from March 28, 2008 sitting at the store, unbought. Touting bank stocks at the bottom.

They suck, and are in the same camp as CNBS. Useless. Better info elsewhere.

Can’t help noticing that blog readers, and most blog writers, are more intelligent, and willing to recognize reality, than the public at large, and definitely any main stream media.

But remember, the vast majority of American do NOT read blogs, and have minimal understanding of economics and investing. Most are in 501k’s (which they are tapping to make ends meet, penalties be damned) invested in index funds tied to the S&P 500. They still read Barrons and the WSJ or other even worse MSM outlets to ‘learn’ what is happening.

Not only Barrons, so many professionals were so wrong, there should be a mechanism to held them responsible for their actions like other professionals, so that their reports are based on research not on fiction or personal gains.

Have you noticed that as the number of MBA’s increase, the reality aspect of the future decreases

Perfect contrary indicator.

Barron’s: Bearish all the way up, and Bullish all the way down.

At least they’re consistent.

ps. Beware of “peak oil” lies and the lying liars who tell them:

1. there is no oil shortage

2. oil is being stored in tankers off-shore so the oil doesn’t show up in inventories

3. Thank Phil(“Yall r jest a bunch of whiners”)&Wendy Gramm for the legal loophole that lets commodities get bid up like a stock price

All proven in 2006 Senate hearings: how could our idiot representatives not know the Senate already went over all of this? Read it all here in 2 parts:

http://www.star-telegram.com/ed_wallace/story/651928.html

http://www.star-telegram.com/ed_wallace/story/659081.html

pps. we went into Iraq to curtail supply not obtain it, and that is just what we have done: kept the violence stirred up so that oil didn’t get pumped and drive down the price. Oil is on it’s last legs and they need to wring every last dollar out of existing inventory. XOM is buying stock and raising dividends; nothing is going toward exploration even at these prices because they know they already have all the product they will ever need sitting on the shelf.

Where do you people come up with all this stuff? If you’re so smart, I presume you’re also rich??? The reality, and the facts, are most likely somewhere in the middle between the likes of Barrons/the WSJ and your exalted blogsters. By the way, at least the MSM can spell.

Ditto Barons, I accidentally re-upped about three months ago but that will be the last time. It has changed along with WSJ. They both have become soft, and the housing article was just the frosting on the cake. The blogs are have replaced them, although there is a lot more material to go through. I usually throw out the Journal in the same wrapper it came in.

1. Portland Cement Assocation sees it as bleak: tepid sales recovery late 2008, no recovery in starts (which drive portions of the economy) until 2010.

I think they are optimistic, although not if by “sales recovery” they mean rate of sales only with no counting of price of comparable. Prices will keep declining. Even Mr. Yun will notice sometime in 2009 (Q2? Q3?) that prices did not recover an iota in 2008.

2. Without doubt, Case-Shiller understates the situation.

– Only includes sales that went through, does not reflect unsold comparable inventory that in a declining market will sell for even less.

– Condos are excluded. The national vacancy rate for condos is 5x that of single-family homes (3% vs. 15%) and thus the market is more depressed. My guess is that there was proportionately more speculation in condos than in single family structures.

– REO’s and outliers are excluded.

– Downweighting of more aged sales pairs implies a slight bias toward newer construction and thus deemphasizes properties where the earlier sale was at the absolute peak

– Exclusion of developer sales misses the huge decline in new home prices. (The average developer is smarter than the average home seller and wants to get out quickly rather than hold on to a declining asset.

– Increasingly, the lack (I am not 100% certain of this one) of inflation adjustment further understates the true decline.

It may be about the best metric we have, but it is undoubtedly skewed so as to understate the actual drop in values that is occurring in most areas.

Why the blame on Bush and Republicans? Oh, that’s right.

You think the government should take care of you from cradle to grave – free food stamps – free health care – free tuition – free mortgage bailout – free oil – no wait – that ain’t happening.

The number one economy-killer – high oil prices. The cure? The Democrat-controlled Congress now run by a bunch of former 60s drug using addled-brain hippies are more concerned about the environment than you, your family, your home, your job and the US economy by preventing increased drilling for domestic oil and the construction of sorely-needed oil refineries.

How about free gasoline vouchers? How about half the population of the US die off to lower the demand for oil all “for the children” and to “save the environment”?

This would be the result as we all wait for a slow painful death before “alternate” forms of energy replace Al Gore’s hated internal-combustion engine. Save the Polar Bear!

First, Bruce in Tennessee – I moved in February to Vonore from a major metropolitan area…..hmmmm, how close to me are you?

Yeah, housing is going to bottom, I guarantee it, just don’t think its gonna happen real soon. And while we wait for that disaster to head into the past, future problems are pounding on our front door faster and faster. And, with the next election providing us with the leadership we deserve….

Makes you understand why the superhero movie summer is in full swing, our last refuge for hope for the future….fiction (just for clarity, that’s a reference to the movies, not the political campaigns)…

Lewis in East Tennessee

Lawrence Yun is optimistic

When is that stupid bitch not “optimistic”?

Well, it seems that all this optimism and calling the bottom has the intention of setting up one more big “Bull Trap” by the end of 2008. Over the next few months, the news reports may even appear giddy and excited about finally reaching the bottom. Then when the last sucker has dropped his money, we’ll begin to see prices drop more than they already have as the economy begins to show us what the credit crisis caused, a tremendous contraction in wealth and commerce that will destroy many, many jobs.

“If you’re so smart, I presume you’re also rich???”

That attitude is ruining our country.

Judge a person’s intelligence by the cogency of their arguments, not their net worth.

Thanks again for pointing out the only valid arguments about house prices. Yun, Bernanke, Bush, Barron’s, et al have one argument only: house prices will go up because they have dropped really far and gosh it would be better if they went up.

Price-Income ratios, Price-rental Ratios, Inventory, Savings Rates, Mortgage Cost and Availability. These are what matter. Anything else is just bubble talk.

I was led to believe that median house prices are related to median individual income at a ratio of 2.5 to 3. Median income is about $49k so median house price should be about $122k tops (optimistic level based on recession, inventory, lending). Basically another 30-35% drop before we can even think about bottoming.

I would appreciate feedback on my income and house price numbers? Am I using the correct income?

It would be great if we had an economic wizard who could declare that the housing market bottom was here, but I’ve been through four decades of rises and falls.

The housing market is fickle and it has needed a correction for a long time. The cost of labor is over-priced. There are general contractors out there that are living on seven figure incomes and many of them have no college education at all.

The storm hasn’t run its course quite yet.