Nice mashup:

Source:

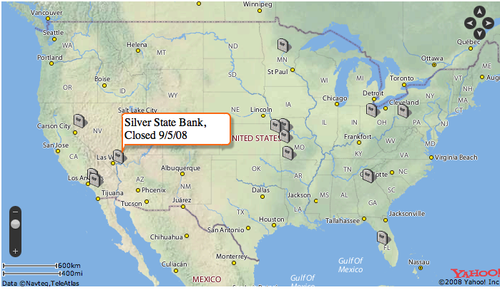

Bank Closure Map

Updated September 5th, 2008

http://www.feedba.cc/live/banks.html

September 10, 2008 5:00pm by Barry Ritholtz

Nice mashup:

Source:

Bank Closure Map

Updated September 5th, 2008

http://www.feedba.cc/live/banks.html

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment. The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client. References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers Please see disclosures here: https://ritholtzwealth.com/blog-disclosures/

Previous Post

The S&P 381 and Other OdditiesNext Post

Ditching the Apple iPhone . . .

Does anyone else find it odd that the closures are concentrated in flyover country, but CA and FL are the biggest real-estate losers?

That’s because they became enamored with brokered deposits and invested their “capital” in FL, CA, and AZ. I’m sure they also took numerous trips to check on their investments from Nov.-Mar.

Yes, I wonder about that too, especially the Kansas City area. That region has some of the lowest price housing in the country, and usually experiences much less price appreciation during housing booms. There must be many more and bigger shoes yet to drop in the harder hit coastal areas.

It looks to me like Wamu will be the next to fail, which of course is no surprise. And it opened above $5 Monday morning! What a great shorting opportunity that was! I missed shorting it again then because I was already all in; and even if I had had the cash, I was too scared that the rally would last for several days to jump on it. Plus, I think it only stayed above $5 for one minute, so I’m sure I would have missed it anyway.

Larster,

True story: I used to engineer drainage, water and sewer for new subdivisions in AZ, but this year I just engineer numbers to keep rich guys in NYC who “own” land in AZ happy. Lets just say that “money” ain’t from around here.

Maybe fly-over states have lower income jobs and lower deposit base and therefore more at risk during a recession. Just thinking out loud here.

I am wondering if the banking industry is more fractured there.

I would guess that the FDIC doesn’t want to take down WaMu (or any other large bank like Wachovia) before election day. It would then be politically feasible to close those in small electoral vote states.

I note that FDIC got VERY upset with Chuck Schumer for letting the cat out of the bag on IndyMac, which was CA.

Following on from the solutions to the economic problem Meme, I had a thought that perhaps looking for economic solutions from economists, traders and bankers is a bit like asking the barber if you need a hair cut. Not so much in the case of economists but they look more often in the rear vision mirror than they look ahead.

Nouriel Roubini can at least see what is coming but that is not the same as seeing a way out, far from it. In his last interview he more or less admitted that his proposal of giving a 5% hair cut to FM And FM bond holders would have been politically reckless.

So where do you look for solutions? Perhaps towards the purely technical professions and the sciences. There are engineers out there who are very good at modeling extremely complex problems.

Mr Roubini could probably compose the essence of the problem and hand it to a bunch of different engineers or scientists as a kind of black box situation and then along with some other experts, including foreign policy experts perhaps, select the some of the best ideas to come back. I would put Brad Setzer on the panel too.

I suspect, as Mohammed al Erian suggested, that a fiscal solution (not just hand outs like tax cuts or rescuing FM and FM) will be the way out. The problem has been inappropriate allocation of capital, giving more to people with a proven record of spending it badly is a very bad idea.

The answer is blowing in the wind…probably.

http://environment.newscientist.com/article/dn14701-100-billion-could-yield-two-million-green-jobs.html

I agree with JP. I think “they” are pulling out all the stops to prop things up as much as possible to give McSame a chance. That implies all hell will break loose in the months after the election, especially if Obama wins. Anyone else expecting this?

This making its way across the wires! – Warren obviously anticipates a wave of bank failures if he is pulling back the insurance he offers over and above FDIC limits.

(Reuters) – Billionaire investor Warren Buffett’s Berkshire Hathaway Inc (BRKa.N) has told one of its units to stop insuring bank deposits above the amount guaranteed by the U.S. federal government, the Wall Street Journal reported.

ADVERTISEMENT

The subsidiary, Kansas Bankers Surety Co, is notifying about 1,500 banks in more than 30 states that it will no longer offer a program called “bank deposit guaranty bonds.”

The order was made on Monday by Buffett, Berkshire Hathaway’s chief executive, two people briefed on the matter told the Journal.

KBS is an 18-employee subsidiary of Berkshire Hathaway, according to the parent firm’s 2007 annual report. It is one of a handful of firms that offer such insurance, a big selling point for banks trying to attract wealthy customers.

Dollar index breaks out above 80!

US Dollar Index Futures Spot Pr

(NYBOT: DX-Y.NYB)

Index Value: 80.17

Trade Time: 8:13PM ET

Change: 0.77 (0.97%)

Prev Close: 79.247

Open: 79.399

Day’s Range: 79.21 – 80.25

Whoa — looks like an unusual concentration of bank failures in Missouri.

Not to worry. Some long-forgotten KongressKlown from the Show-Me State who helped set up the Federal Reserve system gave Big Mo TWO Fed branches, one in St. Louis and the other in Kansas City.

Plenty of bailout capacity there! Let the billowing fiat roll. It’s only paper money!

Simon wrote:

> The problem has been inappropriate allocation of capital, giving more to people with a proven record of spending it badly is a very bad idea….

Truer words have never been spoken. Love the rest of the post, too.

Any one else feel that the capitulation phase is finally upon us? My sense is that these next 5 sessions are going to be really ugly.

I noticed Tijuana is half way in the United States, halfway in Mexico on that map–A lot of truth to that map.

Fannie to Pay Third-Quarter Preferred Stock Dividends (Update1) http://www.bloomberg.com/apps/news?pid=20601087&sid=aWIxk14_q3R4&refer=home

While I hate to, potentially, damn them by association, I, really, like the way “KJ Foehr” and “Jim Haywood”, are able to see through the Curtain, no X-Ray specs needed; we should all, do well by, take(-ing) a page.

Past that, I hate to think that I woke up the “Great Warren” by asking: “Who’s the counter-party of the USTreas complex CDS(?)”

But, then again, he wouldn’t be Great if he didn’t Think he hadn’t a Monopoly on Insight.

To, logically, jump, thanks BR, you provide, and allow, The Big Picture.

It is, in my estimation, that that makes you the Gold Standard of insight into things Financial, and then some..

How big is a small bank? Would 8 billion qualify as the size of a small bank? Medium sized bank?

http://www.bizjournals.com/eastbay/stories/2008/09/08/daily39.html

Then here is another small bank…disguised as the Federal Highway Trust Fund…

don’t worry, be happy…

interested to see the next couple of weeks TGIF(DIC) postings. Think they’re gonna be busy.

When it is all said and done, Florida and California will be just one big grey spot on the map from the wave of failures. Let the games begin.

Isn’t it possible that the banks are just head-quartered in the cheaper states to keep their overhead down, while they do their actual business in more lucrative markets elsewhere?