A few people have asked why I am not more enthusiastic about any bounce off of these technical levels. The simple answer is that we are still working our way through economic, credit, fundamental earnings, and and valuation issues.

The bounce is from a technical perspective, and recognizes that nothing goes in any one direction for ever.

Consider the market from a psychological perspective: There is certainly concern and fear out there — down 500 points on record volume cannot easily be waved off. But there are lots of other measures that simply haven’t pinned the needle.

I need to see these measures go to eleven, to make me really bullish.

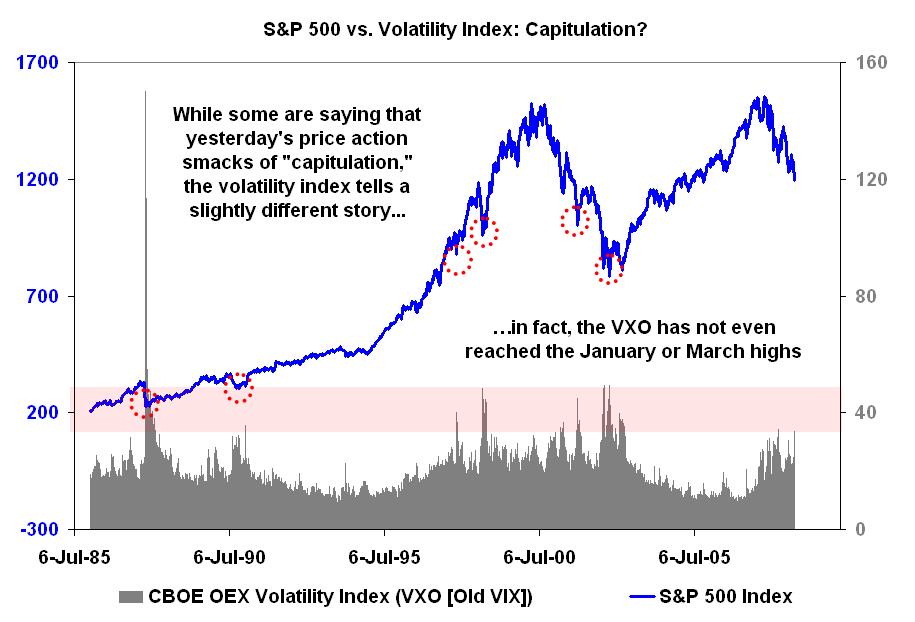

smacks of “capitulation,” the volatility index tells a slightly different story.

In fact, at 33.61, the CBOE OEX Volatility Index (VXO [or the old VIX]) has not

even reached the January or March highs of 39.02 and 37.17, respectively.”>

S&P 500 vs. Volatility Index: Complacency or Capitulation?

click for ginormous chart

chart courtesy of Michael Panzner, Financial Armageddon

chart courtesy of Michael Panzner, Financial Armageddon

What's been said:

Discussions found on the web: