>

I will be swinging by Dylan’s place this afternoon about 4:15pm to discuss the Fed, the dollar and inflation.

A few bullet points:

• Inflation is elevated, but its far below where it was from 2001-08. Inflation was huge prior to the 2008 collapse. Today, it has the potnetial to rear its head, but it is more subdued for a variety of reasons.

• The Dollar has been pressured, but far less so than pre-collapse: Inflation is elevated, but its far below where it was from 2001-08. The Dollar is soft, but its been mostly range bound; It collapsed 41% from 2001-08 Why has “Stimulus” become a dirty word?

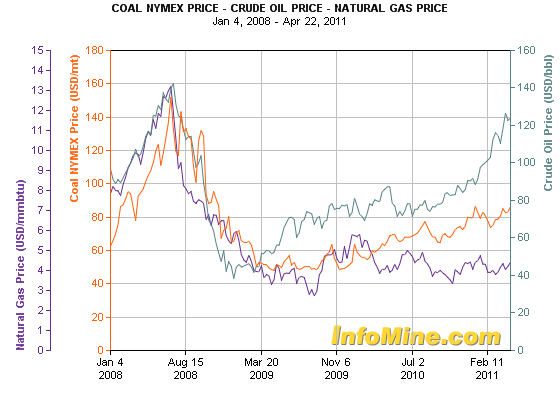

• Oil is pricey — but Nat Gas and Coal have not kept up. Maybe its more than just the Fed — what about Mid-Eastern politics and 3 hot wars?

• Food prices are also a story of supply problems droughts, flooding, reduced exports, supply issues, and increased demand for protein from Asia for Pork and Beef.

• Asset Prices continue to rise: The NASDAQ breaks its Oct. ’07 high — why is the Fed targetting asset prices?

>

Coal versus Oil vs Nat Gas

Why has Oil run so far ahead of Coal or Nat Gas in Price?

. . .

>

~~~

What's been said:

Discussions found on the web: