Good Monday morning, we start the week with stocks under pressure in Europe. Stocks fell the most in a month, as the euro weakened (record low vs Swissie) as Europe’s sovereign debt crisis worsens.

By the numbers:

-Stoxx Europe 600 Index down 1.4% (off the lows of down > 2%

-Asian markets see broad based weakness

-MSCI All-Country World Index sank 1.2%

-Shanghai Composite Index dropped 2.9%

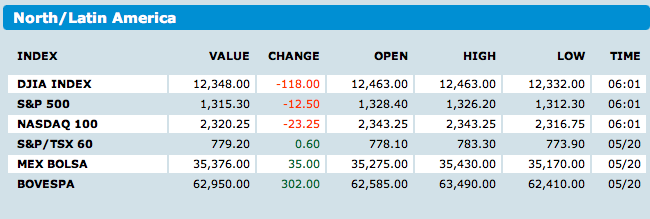

-Standard & Poor’s 500 Index futures fell 0.9 percent.

-Italy’s FTSE MIB Index slid 3%

-Spain’s 10-year bond yield jumped 10 basis points.

-Euro weakened to less than $1.40 for the first time since March 18.

-Oil and copper led commodities lower.

Over the weekend, Ron Griess of The Chart Store mapped out 5 major questions facing the market. His number 3 question: “How will the Eurozone problems be resolved?” We don’t yet have an answer, but it is in large part what is roiling markets this morning.

>

What's been said:

Discussions found on the web: