Macro Factors and their impact on Monetary Policy

Macro Factors and their impact on Monetary Policy

the Economy, and Financial Markets

MacroTides@macrotides1@gmail.com

Special Update – October 2, 2011

:

Stocks

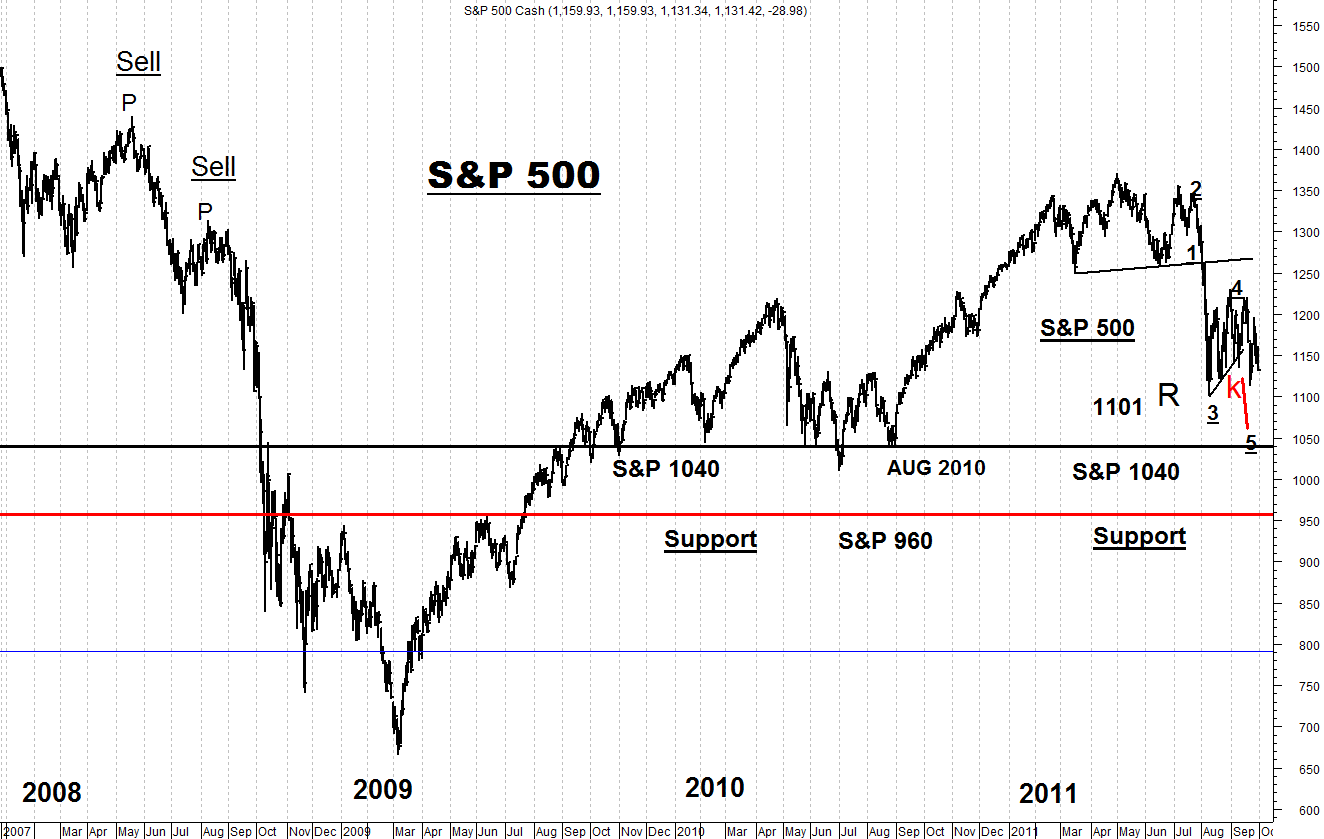

In our September 25 Special Update we noted, “If the S&P does drop below 1101, it may hit an air pocket, especially if the European banking crisis and political situation deteriorates further. Our guess is that many will contribute to an effort to stabilize the financial system with something (many central banks cutting rates or expanding their balance sheets, and many governments increasing fiscal stimulus). However, the S&P could plunge to just above 1040, before Europe gets its act together. Buy 20% of a total position at 1085, buy another 20% at 1070, and the last 20% at 1055.”

We are canceling these instructions, since the probability of a decline below 1040 has increased.

In the wake of the financial crisis in 2008 triggered with Lehman Brother’s collapse, Treasury Secretary John Paulsen and Federal Reserve Chairman Ben Bernanke could get on the phone and hammer out a game plan to deal with the crisis within hours. That’s not the case in Europe, which must get 17 disparate countries to agree on terms, even though each country has different priorities and political agendas. This process virtually guarantees any game plan will be behind the curve, as markets react to increasing evidence that the global economy is slowing more than expected. The final country to vote is Slovakia, but that vote isn’t scheduled until October 17. A lot can happen between now and then.

As we have repeatedly noted, the primary problem facing too many countries in the E.U. is too much debt and too little economic growth to support their debt loads. Italy has a debt to GDP ratio of 120%, and has averaged GDP growth of .6% for the last decade. No matter what is done to support Greece, if won’t take long for attention to shift to Italy. Developing a game plan to recapitalize the weakest banks in Europe could take up to $1 trillion, from the $225 billion in place now. Even if this is achieved, it will do very little to spur economic growth. This means the most important underlying problem will not be addressed.

Technically, every rally attempt this week was met with aggressive selling. Investor concern is shifting from pricing in a slowdown in the U.S., to weighing the prospects of another recession. On balance, economic data points are going to show more weakening, not only in the U.S., but around the globe. There is the potential that any short term good news out of Europe will be overshadowed by the bigger story – a global slowdown that is also impacting the previously high growth countries of China, Brazil, and India.

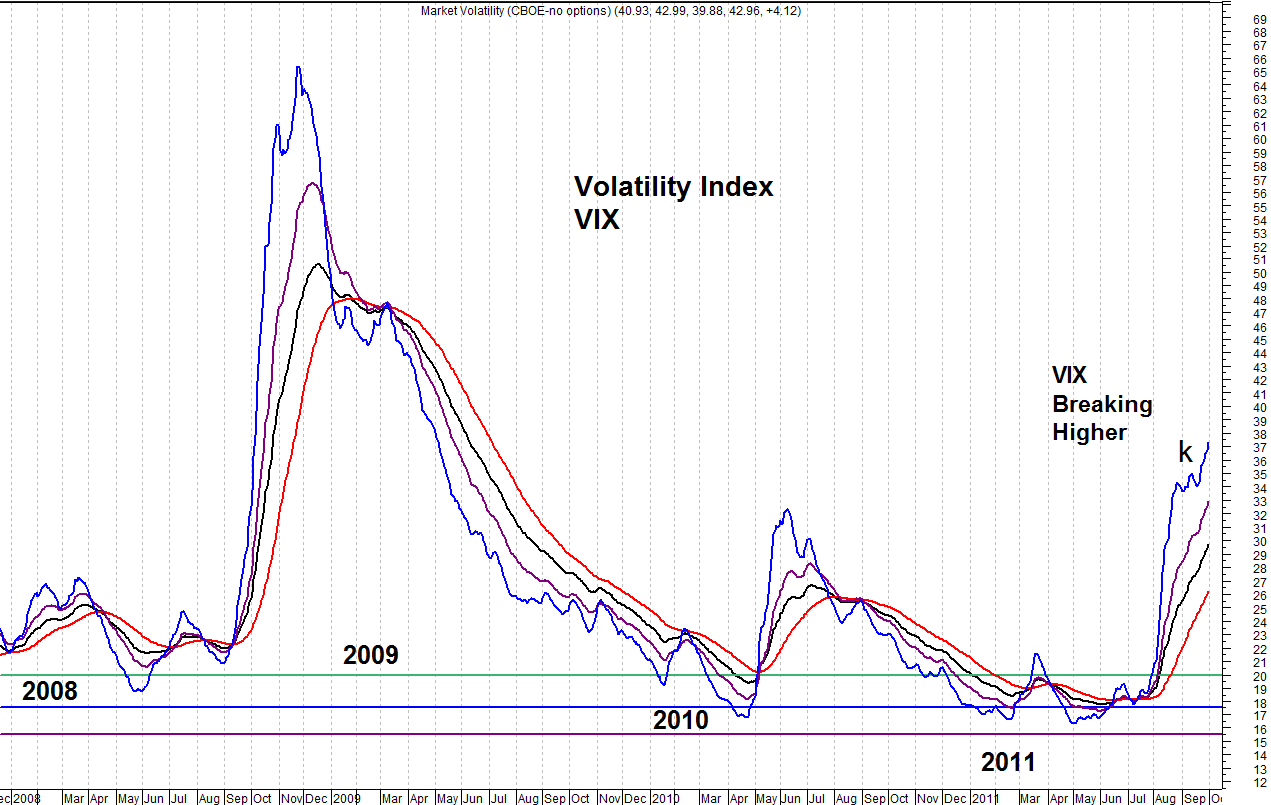

Volatility rises as the stock market declines. As the chart below shows, after hesitating and trying to top between August 24 and September 20, volatility started moving decisively upward last week. This is not a good sign. The S&P 500 has tested and held the 1120 level on seven occasions since early August. We have not felt this support would hold, and the increase in volatility as the S&P approaches the 1120 level again, suggests the decline below 1120 is imminent. This indicates that the test of 1040 is likely to be more intense, which increases the odds 1040 will not hold.

The rally from the March 2009 low carried the S&P from 667 to 1370, a gain of 703 points. A 50% retracement of the rally would take the S&P down to 1018, which is just above the August 2010 low of 1010. A 61.8% retracement targets 935. The distance between 1120, which is short term support and 1040, which is intermediate support, is 80 S&P points. A break of 1040 would then target 960 as the next level of support, which isn’t much above 935.

Sentiment has become quite negative, as the combination of weaker economic reports and extreme volatility in the stock market wears investors down. We continue to believe that after this decline, the stock market will be poised for a significant rally, probably inspired by monetary and fiscal policy moves in the U.S. and Europe. Most investors will equate any new measures launched by the E.U. as their version of the U.S.’s TARP program, or the Fed’s QE1 and QE2 programs. If this rally materializes, it could be especially violent.

We want to emphasize that any short term stimulus efforts in the U.S. and Europe are unlikely to lead to a sustainable economic recovery. It may buy a few months of time, but any rally inspired by policy moves will be followed by another round of disappointment, and subsequent market decline. Sooner or later, investors are going to realize, and have to accept, that the monetary and fiscal policies used to reverse every other post World War II recession have been neutered by the magnitude and scope of the problems we’re facing. And this reality is not going to change even if there is a new administration in Washington in January 2013.

We suggest going 12.5% long the S&P 500 ETF SPY if the S&P drops to 1025, and add 17.5% if it dips to 990, adding another 15% if it falls to 975. Conservative investors may want to sit this out, until some measure of calm is restored.

Don’t forget to buckle up, as the ride is likely to get even more volatile.

Macro Tides

What's been said:

Discussions found on the web: