I have lots of charts to back up the specifics of today’s WP column, but unfortunately, we could not jam them all into the paper.

This run is a supplement to that column.

click on any graphic for a larger chart

1) The housing boom and bust was global

Source: McKinsey Quarterly

~~~

2) Nonbank mortgage underwriting exploded from 2001 to 2007, along with the private label securitization market, which eclipsed Fannie and Freddie during the boom

Source: University of North Carolina at Chapel Hill

~~~

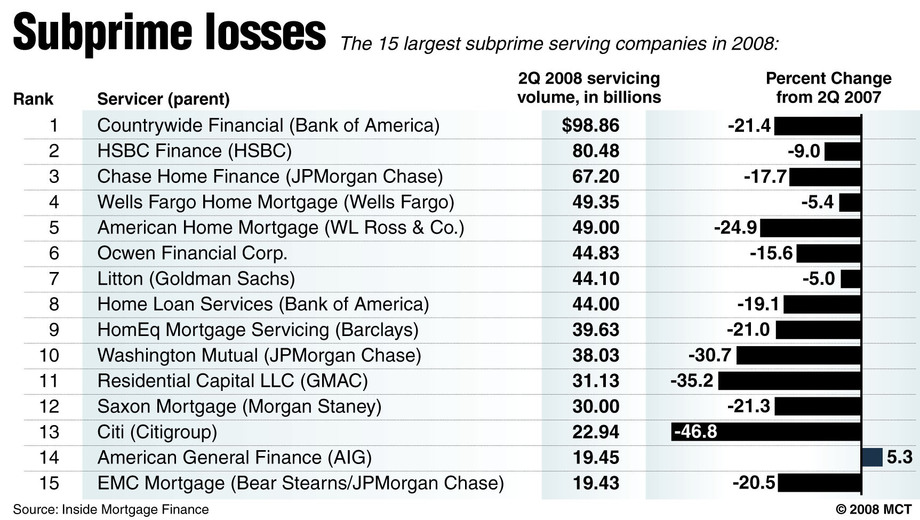

3) Subprime Lenders were (Primarily) Private: Only one of the top 25 subprime lenders in 2006 was directly subject to the housing laws overseen by either Fannie Mae, Freddie Mac or the Community Reinvestment Act

Source: McClatchy

~~~

4) Lenders made 12 million subprime mortgages with a value of nearly $2 trillion. Mortgage Companies and Thrifts NOT affiliated with CRA made 75% of Subprime Loans from 2004-07,

Source: Orange County Register

~~~

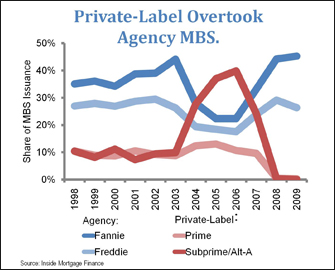

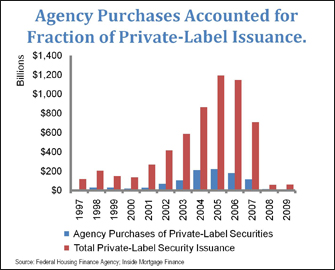

5) Fannie and Freddie risky loan purchases was dwarfed by Private Label Securitization

Source: University of North Carolina at Chapel Hill

~~~

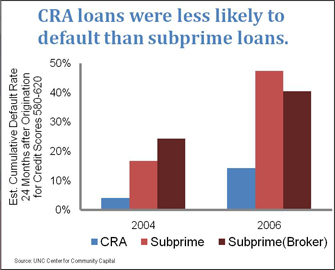

6) CRA were less likely to default than Subprime Mortgages

Source: University of North Carolina at Chapel Hill

~~~

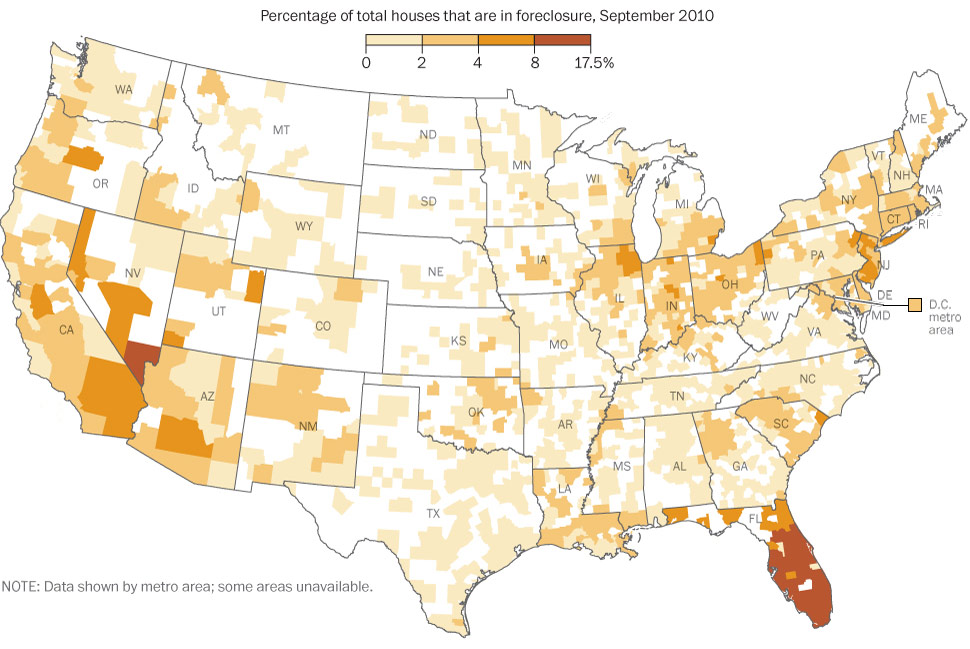

7) Suburbs and Exurbs were where the boom & bust occurred — not the CRA regions

Source: Washington Post

What's been said:

Discussions found on the web: