Themis Trading points us to this Nanex analysis of nit HFT, but what they call what “HF Quote Spamming”:

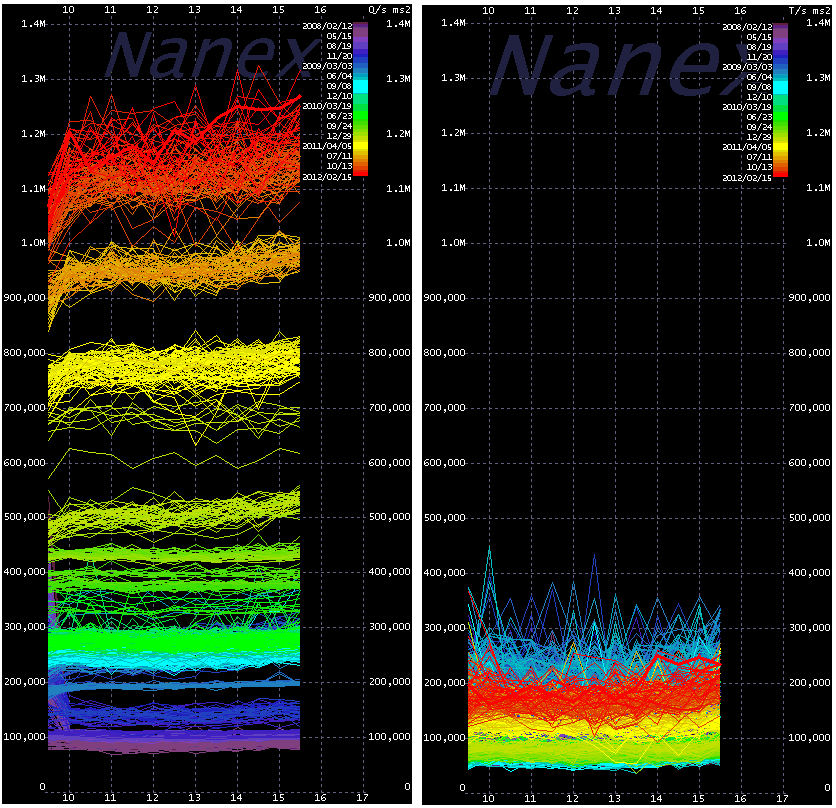

It’s not High Frequency Trading that concerns us. It’s high frequency quote spamming that should be everyone’s concern and is cause for alarm. The two images below tell the story. The one on the left shows growth from high frequency quoting.

The one on the right shows (the lack of) growth from high frequency trading. Quote data from CQS, trade data from CTA, both which cover stocks listed on NYSE, AMEX, and NYSE-Arca between 2008 and 2012.

One has exploded (with no signs of stopping), the other has stalled and is actually lower than it was years ago. Each day is plotted in a separate color over the course of a trading day (9:30 to 16:00 Eastern): older data uses colors towards the violet end of the spectrum, recent data towards the red end of the spectrum.

>

HFQ: High Frequency Quote Spamming

Source: Nanex

What's been said:

Discussions found on the web: