The following comes from a senior long time Merrill asset manager, recently retired. You may assume he left on good terms, and that he is not happy with what has become of his Mother Merrill.

Enjoy:

~~~

The defections are coming fast and furious at Merrill Lynch. Nary a week goes by without an “On the Move” item crossing the wires about a producer or team leaving Merrill for the competition.

In what has become an idiotic, zero-sum, circle-jerk known as broker poaching, Merrill has wound up on the short end of the stick more often than not.

Why is this the case?

Consider the reasons Brokers typically jump ship. I believe there are three primary reasons (and lots of secondary ones), in descending order of importance:

1. To feather their own nests: Given the decimation of bank stocks through the financial crisis, many advisors have seen their net worth plunge, particularly in light of the fact that some of their compensation has been in the form of deferred stock that, by the time they received it, was near-worthless — literally down some 90+% over the period from award to vesting. Jumping ship, and getting some 2X one’s trailing 12 months’ commissions up front, eases the pain of having watched one’s deferred comp virtually vanish. To be clear on this point, as it’s important, this is deferred compensation, not money out of some discretionary bonus pool that’s gone away due to expense control. This is the advisor’s money — put away in bank stock over which he had no control, that evaporated as he watched, helpless, from afar.

2. The work environment becomes oppressive: Brokers are goal- and results-oriented entrepreneurs who, eating what they kill, are always on the hunt. When the work environment becomes too rigid, draconian cuts are made to compensation, the compliance pendulum swings way too far toward surveillance, and the bureaucracy becomes too labyrinthine, expect to see a mass exodus.

3. For the clients’ benefit: This is, of course, what the clients are always told by the advisor — “I’m moving to a superior platform where I can take better care of you,” or some such — but it’s rarely (though sometimes) actually the case.

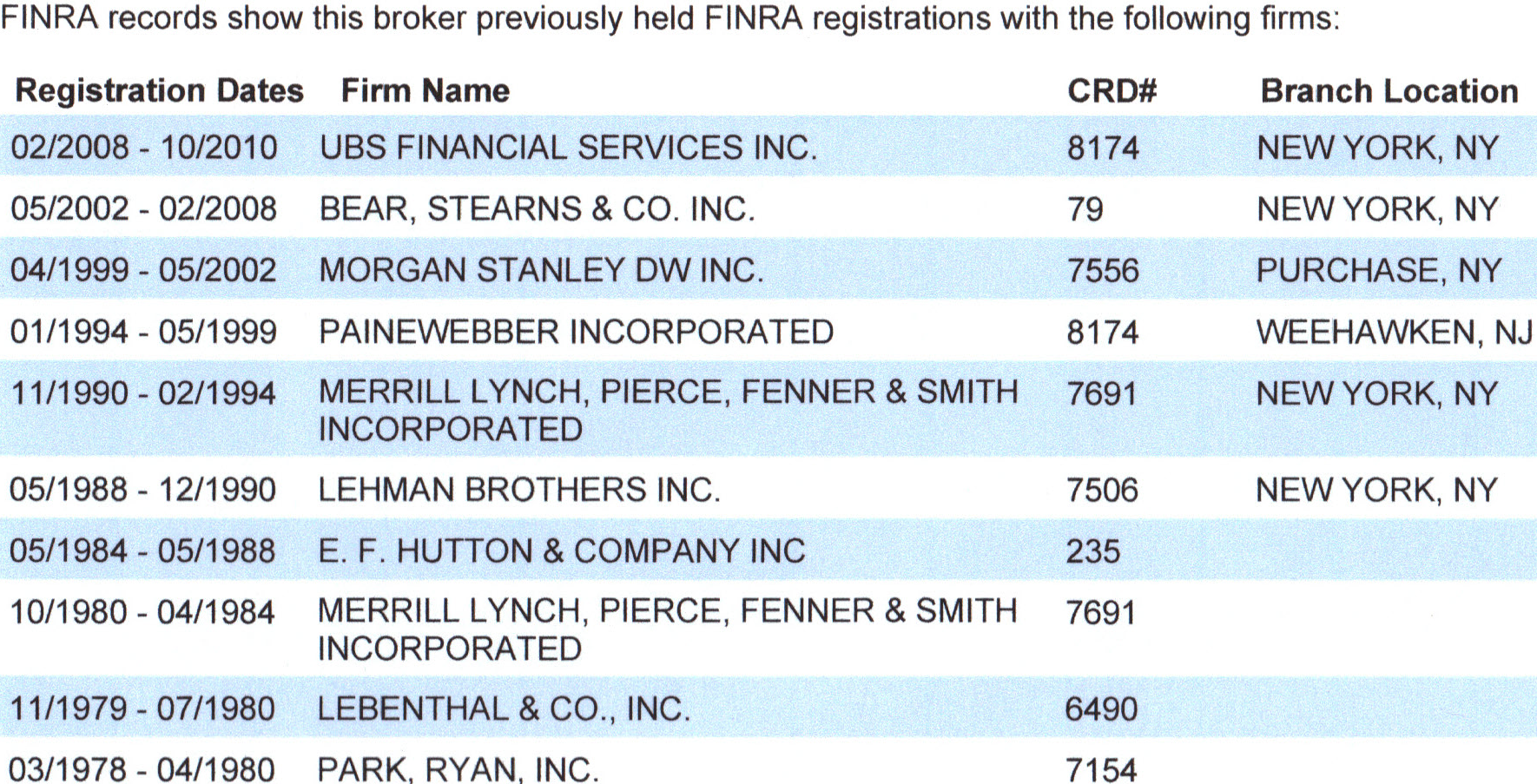

There is also a class of retail brokers known as serial jumpers. They work at shop after shop, their tenure at each is exactly contract expiry + 1. I have personally known and worked with many of these brokers who have circled back to the same shop twice (see below) — and got paid each time they came on board. It has always been a bit of a mystery to me how these brokers’ clients allow themselves to be dragged to 3, 4, or 5 firms. It’s frankly unclear to me why firms don’t blacklist the advisors who are serial jumpers.

Here’s an example of a serial jumper by way of publicly available information from FINRA. Lets call this gent Broker SJ3 — he is presently at Merrill Lynch for the third time (80-84; 90-94; 2010-12):

>

>

Returning to Bank America/Merrill Lynch, they seem determined to slip to the #2 spot.

Why?

Merrill is losing tenured, long-term, seasoned advisors — men and women who probably had to be extraordinarily fed-up to go through the considerable undertaking of moving a substantial book of business elsewhere –a significant challenge under the best of circumstances, and even more challenging these days.

Consider these news snippets from just the last few weeks (emphasis mine in all cases):

In a somewhat unusual move, Peter Sargent, a 20-year adviser with Merrill Lynch Wealth Management, is moving to regional brokerage Janney Montgomery Scott LLC. […]

The signing of Mr. Sargent, who manages $250 million in assets and had trailing-12-month production of more than $2 million, is a coup for the Philadelphia-based broker. Janney’s private-client group currently employs 725 advisers managing $53 billion in assets.

Mr. Sargent has been a Barron’s 1000 adviser for the last three years and served as one of 14 advisers on Merrill’s National Advisory Council to Management — most recently serving as chairman of the council. He said he has no complaints about his 20 years at Merrill Lynch, nor life at the firm since it was acquired by Bank of America.

What’s perhaps most interesting about Mr. Sargent’s departure is that he was chair of the firm’s Advisory Council to Management (ACTM). ACTM is the labor relations board between advisors and senior management to discuss issues surrounding the direction of the wealth management business, compensation, and practice management. Of course, in reality the ACTM is a somewhat toothless paper tiger, but the fact that its chairman up and bolted speaks volumes about the strife within the firm, notwithstanding Mr. Sargent’s comment that he had “no complaints.” One of my rules to live by is to watch what people do, not what they say. After all, the ACTM members are generally cheerleaders and Kool-Aid drinkers whose job it is to beg (usually in vain) that at least a bit of lubricant to be used prior to the firm’s penetration of the brokers’ wallets.

Advisers Harry Wall, Marc Young, Timothy Campisano and Brent Carlton joined Raymond James in Louisville, Kentucky, from Merrill Lynch, the brokerage unit now owned by Bank of America. Wall had been with Merrill for 26 years. [Ed note: Per FINRA, Campisano and Carlton had each been with Merrill almost 12 years.]

The advisers, who generated $2.7 million in revenue last year, represent the biggest team addition by client assets and production for Raymond James & Associates so far in 2012.

But wait, there’s more:

In its ongoing quest to gain a nationwide profile, registered investment advisory group HighTower has opened two new offices in Los Angeles and Baltimore, adding breakaway advisors with more than $1 billion of assets under management.

Chicago-headquartered HighTower announced Tuesday that Leo Kelly and Brian Grumbach, formerly of the Kelly Group at Merrill Lynch Wealth Management, joined HighTower as managing directors and partners on Feb. 17. Kelly and team currently manage $700 million of client assets and will lead HighTower’s expansion into the Baltimore market.

Publicly available FINRA records indicate that Grumbach had been with Merrill for about 15 years, as had Kelly. And, if we go back just a few months, we see that Merrill lost one of its top-producing, longest-tenured brokers:

Harvey Kadden and other high-profile Bank of America Merrill Lynch advisers based in New York City have jumped ship and joined Morgan Stanley Smith Barney LLC.

Mr. Kadden, a 30-year veteran at Merrill Lynch, was a member of the Circle of Champions, the highest financial adviser recognition club at Merrill, for over 10 years. He was named a managing director at the firm three years ago and has been a Barron’s Top 1,000 adviser for the last three years.

And let’s not forget about John Beirne, who left Merrill after a 45-year career that began in 1966:

After more than four decades working as a broker at Merrill Lynch, veteran adviser John Beirne has left the brokerage, now owned by Bank of America Corp, to start his own practice in partnership with Focus Financial.

Finally, Hightower Advisors recent snagged a $1.4 billion Merrill Lynch team. Interestingly, this team’s practice included “foundations, endowments, unions and pension plans.” Why interestingly? Because BAML recently decided that it was going to redefine what it means to be an “institutional client” and lowered the payout on many newly-minted “institutional accounts” (which true institutional sales folk would snicker at) from 40% to 20% which, by my math, is a 50% haircut for the brokers.

These are hardly isolated incidents, and appear to be occurring at an ever-increasing pace, reaching near-epidemic levels. Why?

• As previously mentioned, deferred comp is essentially worthless, and the coffers must be replenished.

• In a cost-benefit analysis weighing any remaining retention payments vs. launching the escape pod, the latter is now clearly preferable.

• Compensation cuts have been draconian and, in some cases, were not even vetted with the aforementioned ACTM, which is just really bad form (see above). I mean, even advisors like to get kissed when they get fucked.

• Banks in general, perhaps BAC in particular, are the DMV of financial services. Getting something done — which is the basis on which advisors get paid — requires an act of God. Brokers don’t like to be told “no,” they like to have a sense that everyone’s rowing together and that solutions will be found. No cookie cutters wanted.

The end game at BAC seems to be to to assimilate 16,000 independent, entrepreneurial, non-conformists into the Borg collective. Good luck with that.

To the extent there may be some ivory tower folks interested in understanding the dynamics at play here, let’s close with this:

• Good advisors own their client relationships. You don’t. Don’t delude yourself that there’s any caché associated with your brand. There isn’t. Quite the contrary, in fact. A quick look at a recent Harris poll [PDF] of companies’ reputations has the following financial service firms populating the bottom of the list: JPMorganChase, Bank of America, Citigroup, Goldman Sachs, and AIG. Advisors have spent the last few years overcoming the stain you’ve put on your businesses and, by extension, theirs. Contrary to what you may want to believe, advisors are not interchangeable cogs.

• Advisors are, quite literally, your means of production. Alienate them (and you’re doing a heckuva job) at your peril. This is fairly straightforward. Most advisors will tell you that they don’t leave their firms, their firms leave them and give them no choice but to bolt.

• You’re squeezing the goose that lays the golden eggs. You get 60 cents of every dollar your advisors generate, yet you continue to nickel and dime for more, in effect penalizing a cohort that, plain and simple, drives revenue and profit and had nothing to do with the dire straits in which you found (and find) yourselves. You’ve screwed with comp, retirement benefits, health benefits, and more. Enough. Exact your pound of flesh from those whose steered the ship into the iceberg, reward those who have kept it afloat.

You typically don’t want to screw with the folks who are responsible for news items like this:

So, you take the guys who have been the “bright spot” in your business, and you try to crush them. Makes sense to me. Of course, maybe that Countrywide division will start turning a profit some time soon and become the firm’s “bright spot,” thereby rendering moot for the firm the mistreatment of its advisors. But I wouldn’t hold my breath.

See also: The Rise of the RIAs (Investment News), March 2011

What's been said:

Discussions found on the web: