138 Years of Economic History Show that Keen and Minsky Are Right … And the Mainstream Economists Are Wrong

The National Bureau of Economic Research has published a new paper analyzing 138 years of economic history in 14 advanced economies, which proves that high levels of private debt cause severe recessions.

As summarized by Business Insider:

Through a series of tests run on a sample of 14 advanced economies between 1870 and 2008, Mr Taylor establishes a link between the growth of private sector credit and the likelihood of financial crisis. The link between crisis and credit [i.e. private debt] is stronger than between crises and growth in the broad money supply, the current account deficit, or an increase in public debt.

Over the 138-year timeframe Mr Taylor finds crisis preceded by the development of excess credit, as in Ireland and Spain today, are more common than crisis underpinned by excessive government borrowing, like in Greece. Fiscal strains in themselves do not tend to result in financial crisis.

The study shows that excessive private debt is a much more accurate and consistent predictor of financial crisis than the amount of public debt. (However, high levels of public debt exacerbate the problems caused by massive private debt, since governments which are already “in the red” have little ammunition left with which to help out the economy.)

The NBER study validates what Steve Keen has been saying for years: excess private sector debt is the main driver of deep recessions and depressions. And yet Ben Bernanke and all other mainstream economists literally believe that the amount of private debt doesn’t matter and isn’t even important to quantify.

As Michael Clark notes, high levels of public debt are detrimental … but it is high levels of public debt which initiate depressions:

American Private Debt [was] 310% of Gross Domestic Product in 2008, the highest since 1929, the last Great Depression, when Private Debt was 240% of GDP.

***

Government debt in 1929 was a paltry 40% of GDP. In 1945, when America was financing its participation in World War II, government debt exploded to 120% of GDP. That is the highest government debt has been in America, making the 85% of GDP in 2011 seem almost insignificant.

***

Government debt vis-a-vis Gross Domestic Product is not astronomical, according to this chart. It was not high in 1929 either, the last time the global economy had a heart attack and died. Public Debt is, in fact, at the time of this chart at least, lower than in 1945, when the public financed American involvement in World War II.

***

There WAS a Real Estate/Housing Bubble and subsequent banking crisis in the 1920′s. In fact, the asset bubble that began in 1921 helped to cause the massive PRIVATE DEBT BUBBLE that destroyed the global economy then also. The web site below examines the housing bubble of 1921-1926.

www.library.hbs.edu/hc/crises/forgotten.html

The famous stock market bubble of 1925-1929 has been closely analyzed. Less well known, and far less well documented, is the nationwide real estate bubble that began around 1921 and deflated around 1926. In the midst of our current subprime mortgage collapse, economists and historians interested in the role of real estate markets in past financial crises are reexamining the relationship of the first asset-price bubble of the 1920s with the later stock market bubble and the Great Depression that followed….

What this all suggests is that American Big Business (Wall Street and Wall Street’s political lackeys in Washington) is refusing to take the blame for the Global Collapse it helped to create through the same mechanism it used in the 1920s, Private Greed, pursuing recklessly their own economic empires — asset price inflation fueled by lower and lower interest rates – and has attempted to shift the blame on to the governments of the world ….

The debt that must be destroyed before the global economy can reach a state of organic growth again is, primarily, Private Debt — private enterprise debt and private consumer debt….

Of course, Big Business has now found a convenient method for unloading toxic debt: by selling it at face value or even at future inflated value to the governments of the world. The governments are willing to buy worthless private debt in the hope of keeping themselves in power, of keeping their societies from unraveling into civil war and revolution. Why would Big Business ever concern itself with risk if there will always be a buyer of last resort willing to absorb the crimes and failures of the Free Market in pursuing the demon of Unlimited Wealth?

Then, of course, this forced ingestion of toxic (criminal?) debt by the governments in question — in hopes of avoiding civil war — has been followed by the political gambit of Big Business and the political supporters of Big Business screaming and shaking of fists at the government for taking on too much debt. Well, the ‘too much debt’ the public was taking on was the Disaster Debt of unregulated Big Business which made careless business decisions without considering risk or even to crimes in many cases (organized crime almost certainly, organized crimes in white shirts on Wall Street).

Clark notes that the same is true in Europe:

***

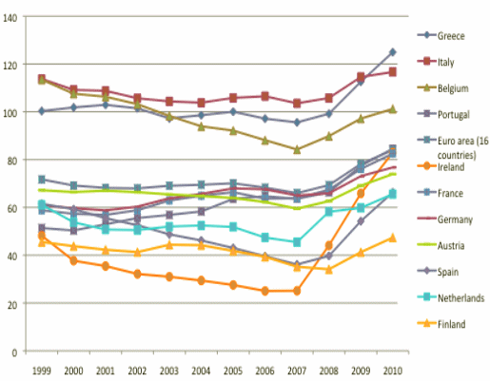

According to Paul De Grauwe, writing in the web-page below, only Greece, Italy and Belgium have government debt over 100% of GDP.

www.voxeu.org/index.php?q=node/5062

In fact, Spain and Ireland had very little government debt when the global economy sank in 2008. But they had huge levels of Private Debt, all connected to the Housing Bubbles out of which they were just emerging. Spanish government debt was less than 40% of GDP until the Titanic struck the ice. Ireland’s Public Debt was a fraction over 20%.

France (socialist France) had Public Debt that was only 45% of GDP.

***

Those who say that it is government profligacy that is the source of the debt crisis are mistaken. They also fail to see the inevitable connection between private and public debt. This connection is particularly strong in countries like Spain and Ireland that have been hit badly by the debt crisis.

***

Spain and Ireland were spectacularly successful in reducing their government debt to GDP ratios prior to the financial crisis, i.e. Spain from 60% to 40% and Ireland from 43% to 23%. These were the two countries, which followed the rules of the Stability and Growth Pact better than any other country – certainly better than Germany that allowed its government debt ratio to increase before 2007. Yet the two countries, which followed the fire code regulations most scrupulously, were hit by the fire, because they failed to contain domestic private debt.…

So, what happened to us? Why did we crash? We crashed because businesses and individual consumers (Wall Street and Main Street) over-leveraged in an attempt to reap dream-like profits on the Housing Bubble, both as credits and as debtors. This feeding frenzy — encouraged by the Fed and the banks — it is an illusion that the Fed Chairman is not the pet figurehead of the banking establishment — destroyed our economy and is sending us into decades of pain.

***

Now — as Japan did — we are attempting to pare down Private Debt by handouts and bailouts and by the government buying toxic assets of the guilty parties — that is, to turn Private Debt into Public Debt [background], while we try to preserve the status quo, keep Old Money in Power, and avoid civil war — i.e., spending billions to try to keep asset prices elevated [background], and voters/citizens soporific.

There is a moral element that we should not miss: giving public money to the fools and crooks that destroyed the economy through greed and self-interest so they can try to do it again — the idea that Ben Bernanke would squat on interest rates so that he could feed money to reckless billionaires at the expense of retirees and savers is appalling.

(Indeed … see this, this and this.)

Financial Sector Debt Is a Bigger Problem than Consumer Debt

As Anthony Randazza notes, Americans started to reduce their debt and deleverage at the start of the financial crisis … but have slid backwards again in the last couple of years:

America had started the process of household balance sheet deleveraging after the bubble burst. Mortgage debt levels have fallen sharply. And consumer credit—all debt other than mortgage debt—was declining as well. But in the summer of 2010, as the post-recession faux-recovery created false hope that the good times were back and as savings decimated by the bursting bubble began to hit zero in the midst of a weak economy, consumer credit levels (led by credit card purchases) began to rise again.

The figure below shows that consumer credit fell 7.1 percent from June 2008 to June 2010, but since then has grown 6.9 percent to June 2012 (according to data released this month by the Fed).

This is indeed troubling.

But as we’ve previously documented, it is financial company debt – i.e. leverage – which is the main problem (and see this and this).

As Keen notes:

Figure 5: Separating out private sector and public sector debt in the USA

This is more apparent when we look just at the change in debt: private and public debt move in opposite directions.

Figure 6: Private and public debt move in opposite directions

Finance sector debt matters

Ignoring finance sector debt is a mistake. Firstly, it’s huge: by far the largest component of debt, private or public, in the USA (see Figure 7).

Figure 7

Secondly, finance sector debt is not a “zero sum game”. Though lending by a non-bank financial company to another entity doesn’t create money, it does create debt; and the initial lending by a bank to a non-bank creates both credit money and debt. Since the finance sector was the source of most of the speculative debt that fuelled the bubble, and it is by far the major force in deleveraging now, leaving it out of the analysis exempts a major causal factor in both the pre-2008 boom and the post-2008 debacle.

Angry Bear writes:

[Consumers certainly rang up too much debt.] But that ignores the really massive runup: financial corporations’ debts. Starting at a little over 10% of GDP in 1970, they hit almost 80% by 2000, and when the crash hit they were over 120% of GDP — a 10x, order-of-magnitude increase over 40 years.

***

The basic story is very simple. It goes like this (in my words):

• Banks (and shadow banks) make money by lending. Bankers have every incentive to increase their loan books, even by extending questionable loans, because bankers don’t personally bear the eventual, down-the-road losses from loan defaults — they’ve gotten their money already.

• When banks run out of real, productive enterprises to lend to — enterprises that can pay back loans and interest from the production and sale of real goods that humans can consume — they start lending to speculators (gamblers) who are buying financial assets in hopes that their prices will rise.

• That lending — extra money being pumped into the system — does indeed drive up the price of financial assets, far beyond the value of the real assets that (according to most economists you listen to) supposedly underpin those financial assets’ value.

• Eventually people realize that the value of financial assets far exceeds the value of real assets — and far exceeds the capacity of the real economy to service the loans that drove up those financial asset prices. Prices of financial assets plummet, borrowers default because there just ain’t enough real income to service the loans, financial-asset prices plummet some more, all in a downward spiral — with all sorts of collateral damage to the real economy.

There’s your (economy-wide) Ponzi scheme. Households and nonfinancial businesses definitely participate (the financial industry makes it almost irresistible not to), but it’s driven by the financial industry, and a huge proportion of the takings go to players in the financial industry.

And Michael Clark notes:

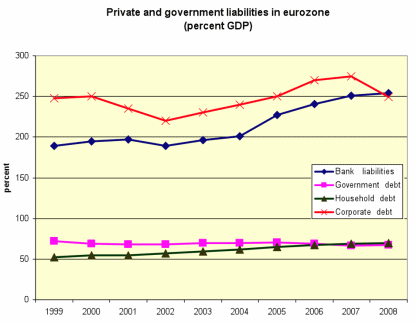

While the government debt ratio in the Eurozone declined from 72% in 1999 to 67% in 2007) the household debt increased from 52% to 70% of GDP during the same period. Financial institutions increased their debt from less than 200% of GDP to more than 250%.

What’s the Solution?

We are in a bit of a pickle.

As Keen warns:

[We’re going into] a never-ending depression unless we repudiate the debt, which never should have been extended in the first place.

What’s the solution?

To remember history.

Specifically, we’ve known for over 4,000 years that debts need to be periodically written down, or the entire economy will collapse.

The ancient Sumerians and Babylonians, the early Jews and Christians, the Founding Fathers of the United States and others throughout history knew that private debts had to be periodically forgiven.

Debt jubilees are a vital part of the Christian and Jewish faiths. And the first recorded word for “freedom” anywhere in the world meant “debt-freedom”.

As some of the leading modern economists argue, forcing big banks, bondholders and other creditors to write down some of their bad debts is the only way out of our economic malaise.

Nerdy Postscript: If you want to know learn about Minsky’s economics, read Steve Keen or Minsky himself. Don’t listen to faux Minskyians.

We noted in 2009:

Everyone – from Federal Reserve governors to Nobel prize winning economists – are dusting off their history books and studying Minsky right now….

But few, if any, understand Minsky better than Keen.

What's been said:

Discussions found on the web: