>

My Sunday Washington Post Business Section column is out. This morning, we look at Ritholtz’s rules of investing. The dead tree edition has the headline Think like a contrarian: Ritholtz’s rules of investing.

We have 6 rules today, and 6 more rules next week:

1 Cut your losers short and let your winners run

2 Avoid predictions and forecasts

3 Understand crowd behavior

4 Think like a contrarian (occassionally)

5 Asset allocation is crucial

6 Decide if you are an active or passive investor

Here’s an excerpt from the column:

“Each year on the Big Picture, the blog I call home, I update my top trading rules and aphorisms. It’s a collection I have gathered over the years of my favorite trader, analyst, economist and investor viewpoints on what — and what not — to do when it comes to investing in the capital markets.

Whenever I publish a list like this, someone invariably asks: “You have been at this for 20 years (and you seem to like numbered lists), what have you learned over that time?” Fair enough. You could probably cobble together my guide from what I’ve written for The Washington Post. Let me save you the trouble. Here is the first half of my dozen rules for investing.”

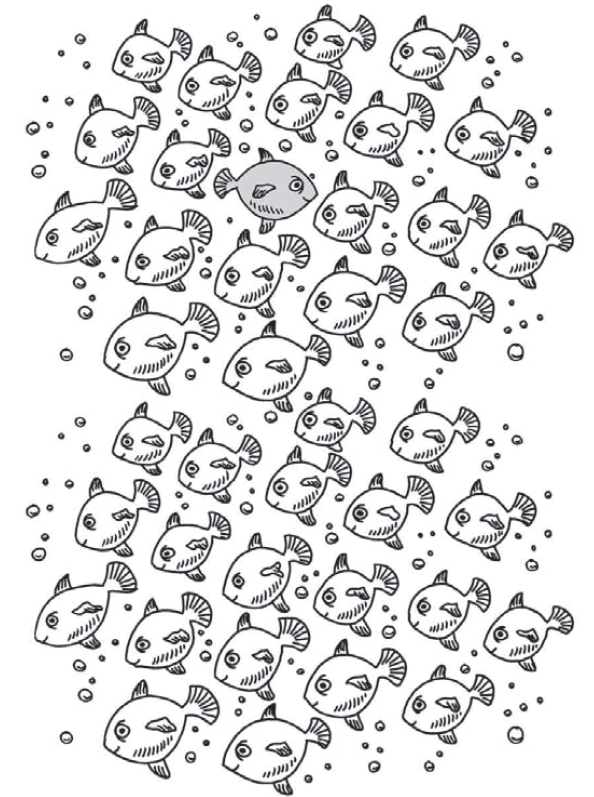

I’d really like to see what the Post did in the dead tree version of the paper(Awesome, thanks, WV!).I love the graphic that accompanied the print column:

Source:

Ritholtz’s rules of investing

Barry Ritholtz

Washington Post, September 30 2012

http://wapo.st/SqbqWZ

What's been said:

Discussions found on the web: