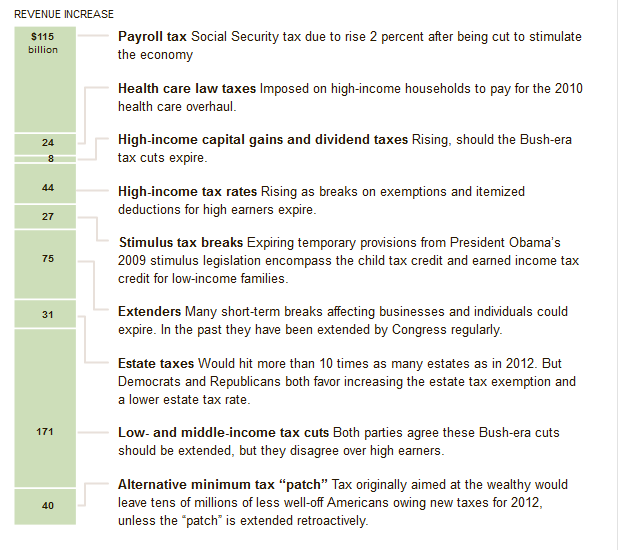

Without legislative action, most of the tax cuts enacted since 2001 will expire on Jan. 1, when new taxes also take effect. Result: the government would take in more than $535 billion in increased revenue and the average family’s tax bill would go up $3,500.

Source: NYT

Breakdown of the increases, ranked by the Tax Policy Center in order of likelihood.

What's been said:

Discussions found on the web: