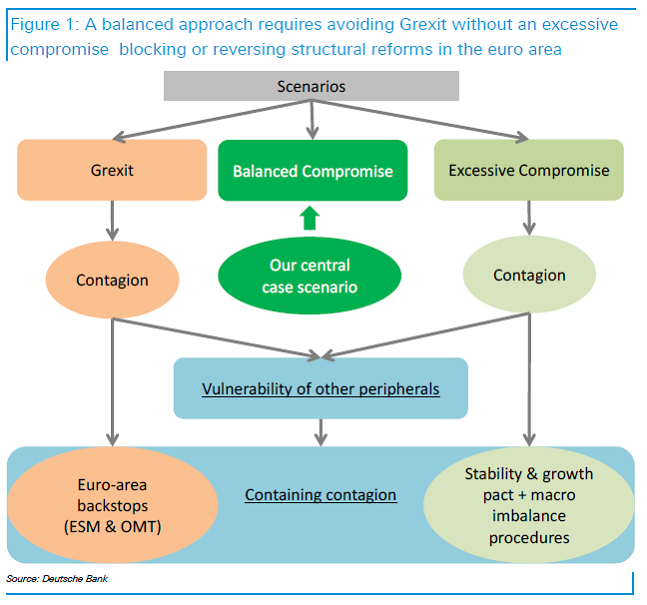

Fascinating flowchart from Deutsche Bank:

It is wrong to think that contagion stems only from Grexit. An excessive compromise with Greece could result in moral hazard, particularly in relation to structural reforms. This could undermine the medium-term stability of the euro area. The tail risk is that Greek politicians try to leverage too much the fear of Grexit “contagion risk”. We complete our analysis by looking at the vulnerability of other euro peripherals and the ex-post tools to limit contagion.

Source: Deutsche Bank, The Greek Issue

A big bank lecturing on moral hazard. I must admit, it’s a challenge to take that seriously.

“The peasants are revolting” – Marie Antoinette

“Yes, aren’t they” – Louis XVI

Change can come abruptly and unexpectedly, especially if you don’t respect the people and the people believe they have nothing left to lose. A year-old anti-austerity political party may win substantial seats in Spain. Political upheaval in the PIIGS is not going in the direction Brussels and Berlin want.

http://uk.reuters.com/article/2015/01/31/uk-spain-podemos-idUKKBN0L40CE20150131?feedType=RSS&feedName=worldNews

Gee, it’s almost as though this system isn’t dynamically stable.

It may be that the Greeks don’t have much to export (other than bright people) and thus are likely to remain poor but they have some bad habits that exacerbate their problems. Last time I was there, a Greek explained to me that residences are never finished (rebar for a top floor in place but no walls, etc.) as completing the building would increase their tax. While clever, if true, it poses a problem for the government’s budget if ridely practiced and the number of homes with rebar sticking up seemed to be numerous..

There have been a number of articles in the last five or six years about the tax collection system being gamed in various ways (not declaring a swimming pool, bribing the local tax man) and until the Greeks recognize there is no free lunch, their problems are likely to remain their problem (rather than exporting them to the rest of the EU).

It’s sad.

Fear is rampant and the potential for ever greater vol howls: makes me feel young again; I’m in like Flynn.

“In like Flynn” has a very interesting story behind it. Discover it, I won’t ruin the surprise here.

I read the letter the new Greek Prime Minister sent to “the German people” and it seemed to me to make a great deal of sense. Basically, it said that the country was bankrupt, owing far more than it could ever pay, and that the austerity programs the EU had imposed upon the country had only made things worse.

He went on to say the problem was the banks didn’t want to take the financial hit that would come from admitting that Greece could never pay back its huge loans, and thus had instituted a policy of “extend and pretend” that the loans would be repaid.

IMO, the situation with Greece is similar to the subprime problem in the US, where too much money was loaned to people who couldn’t pay, and the banks pretended otherwise and hoped that the borrowers could somehow grow their way into being able to pay the loans. Sure there’s moral hazard in borrowing money you can’t pay back, but it seems to me that people ignore the moral hazard of the bankers who make stupid loans for short term bonuses and promotions.

We live in an age where the freeloaders characterize themselves as victims and where hard work and values are muddied in a cesspool of contrived pseudo facts that cloud slovenly behaviors.

Thus,Greece, a backward country in more ways than one.

@Deutsche Bank:

“An excessive compromise with Greece could result in moral hazard, particularly in relation to structural reforms.”

Gosh, ya think?

Isn’t it between 4 and 20 years late to finally be thinking this through?

Greece has been “moral hazard” writ large, starting with how the large investment banks helped fraudulently restate the national accounts in order to obtain entry to the Euro way back (in the 90s?). Even in 2011 when the opportunity presented itself to solve the issue, the solution was “extend and pretend”. Well, it’s too late for that now.

Decap and Recap – Decapitate the banks (flush out the rotten leadership), then Recapitalize them.

Nope, PM Tsiprios doesn’t have the money to back up his promises to the population, costing some Euro 12bln. Hasn’t got the plans or wherewithal to come up with a plausible source of such money.

Antagonizing his (former-) partners doesn’t help to convince them to provide funds.

Claiming out loud that “the Greeks have suffered so much and won’t take it any longer” antagonizes the electorate of the lender-populations who’ve been promised by their politicians that “Greece will repay its debts!” Baloney! In a financial union there will always be financial flows to the poorer parts – which never come back! See Florida, Mississippi, Kentucky.

Contagion? Nope! The demonstrations in Spain, Portugal and/or Italy may be good to blow off steam, but their leaders know that the ECB QE-spigot is the only financial way out. A bookkeeping exercise to create “a bad bank” (somewhere in the corners of the balance sheet of the ECB), so that the ratios of the indebted can show better. For its own charter the ECB will not be able to buy Greek bonds under the QE program if they are declared “not credit worthy”. If the Greeks themselves say so, who is to argue otherwise?

It is age-old strategy to make an example of one mutineer to show the others to toe the line or meet the same fate. Greece has volunteered to be the example. Have pity on the population for the folly of its leaders.

I hear RAND has some ideas about how to apply “prison dilemma (they used it for trillions in MAD spending) to austerity strategies……..

Shorter, don’t let any of these guys near Vegas bookies.

Except that funding the American South created a low cost non union production zone with docile, subservient workers who will not unionize to increase wages. Germany and France haven’t moved factory production to Greece like the US and Germany have moved their auto and aircraft production to the American South. Greece is simply being ground down as a show of power in a financial war the citizens lost long ago. In the meantime no one has seized the byzantine fortunes of, say, the Onassis family, because there is a separate law for the rich in the EU as elsewhere.