click for interactive infographic

Source: The Upshot

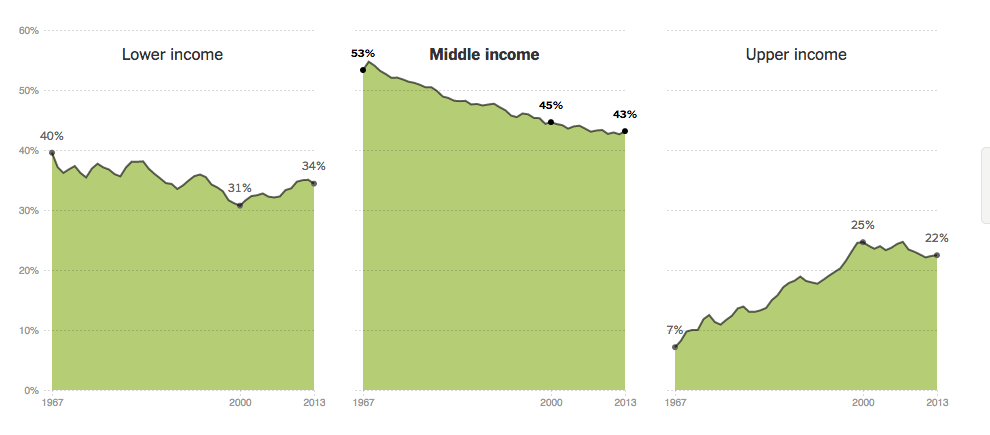

The Shrinking American Middle Class

January 27, 2015 12:00pm by Barry Ritholtz

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment. The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client. References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers Please see disclosures here: https://ritholtzwealth.com/blog-disclosures/

What's been said:

Discussions found on the web:Posted Under

Previous Post

Look Out Below, _____ edition!

The lower income class has stayed roughly the same, and upper income has the largest gains. This means that many that were in the middle class has moved to the upper income class. So this means there has been upward mobility in the last 30 years.

The “middle class” was a government invention. Before the 1940’s the middle class was a small subset of merchant and professionals. After the 1940’s, the government’s boosting of NSC 68, public expansion of social services filtered down to the private sector.

The indicates that the 0.1% are now cannibalizing the upper income people as there is less money to extract form the middle class. The important thing though is to increase the number of poor to maximize income and wealth transfer.

at first blush, one would think that bigger wealthier middle class, would mean more profits to the 1%, but, more poor and poorer makes sense if you want to make cheaper, and lots more of it, offerings, plus you dont have to work so hard making them happier, so the 1% dont have to work so hard. maybe they learned that from China?

Futuredome I believe you’ve dipped yourself in the cesspool of ignorance and sipped a little of it on the way out.

Except that China is (and has been for at least a decade, prolly longer) purposefully expanding their middle class … providing some higher octane filling to their expanding economic pie …

They are still contaminated by that Communist thingie. They will learn in time to focus on concentrating wealth at the top.

Globalization = developed countries like the US becoming more like Brazil (Prosperous but with plenty of poor people and a wealthy class that reaps mots economic rewards) and countries like China becoming more like the USA but also like Brazil. In brief, importing poverty, exporting prosperity, producing a global wealthy class that views all taxes as evil and avoids them and is loyal to no particular country.

You are right. But I think it is unstoppable. Even the “socialist” Obama is pushing for this Trans-Pacific Partnership that will equalize the economies of India and the USA.

Wait… per the graphs, I see a percentage decline in both lower income and middle income population, but an increase in upper income. Unless the lower tiers’ reduction is because they’re migrating out or literally dying off (no evidence of that), then the remaining explanation is that the lower incomers are moving up to middle income and middle incomers are moving up to upper income.

Why the long faces?

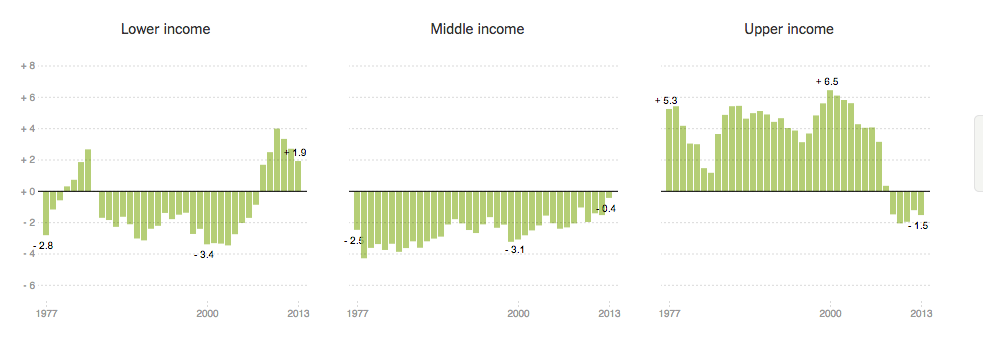

Lower income group, while smaller than in 1977, is growing since 2000. It’s the only group that increased during the past 13 years. We want that group in particular to shrink, but it looks like something when wrong in 2000.

That’s why the long face.

Well… the times and you MUST adapt. The article says that for the first time incomes considered high have gone down. I’d like to see what % of income is spent on housing and ownership costs relative to other periods of time since the census data began.

My father is pre-war generation. When expenses go up but wages are not rising or even falling, his modest expectations taught him to downsize, even when the value of held assets were rising. The end game was to have your money working for you once you realized that your work income will not pull more weight up a steeper incline.

The rolling 20 year on the S&P since 1971, or shortly after this polling began, has been at worst 7% and as high as 18%. Yet according to recent posts on this blog the average investor over 20 years manages a 2% return on what is probably single digits of earned income. Unless you have the skills needed to see a rising wage, like in math, science, engineering or IT, then this economy has concluded that your income will not rise. If that’s the reality then you have to rethink the bigger house, or even buying a house in the first place and just about everything else that diverts income away from savings and investment and towards quality of life. This has been the best time in my life to invest. For others it has been the best time to take on more debt.