Good Sunday morning. Rouse yourself, and enjoy these early morning lazing in bed reads:

• Where are the Cheap Firms Internationally? (Alpha Architect)

• American companies are investing way less in science than they used to (Vox)

• The European Central Bank Just Made Your Gas Cheaper (FiveThirtyEight)

• How Twitter Found Its Money Mojo (Medium) see also Twitter CEO: ‘We suck at dealing with abuse’ (The Verge)

• Morgan Housel: What I Read (And Why) (Motley Fool)

• Why Tiger Woods May Be Finished (Bloomberg)

• iPad Air 2 Review: Why the iPad Became My Main Computer (MacStories) see also What if the iPad ran iPad OS? (iMore)

• Media Titans Murdoch and Bloomberg at Play in Politics and News (NY Times)

• The BMW i8 Is Over-hyped, but That Doesn’t Mean It’s Not Great (Bloomberg)

• Scientists predict earth-like planets around most stars (Space Daily)

What are you reading?

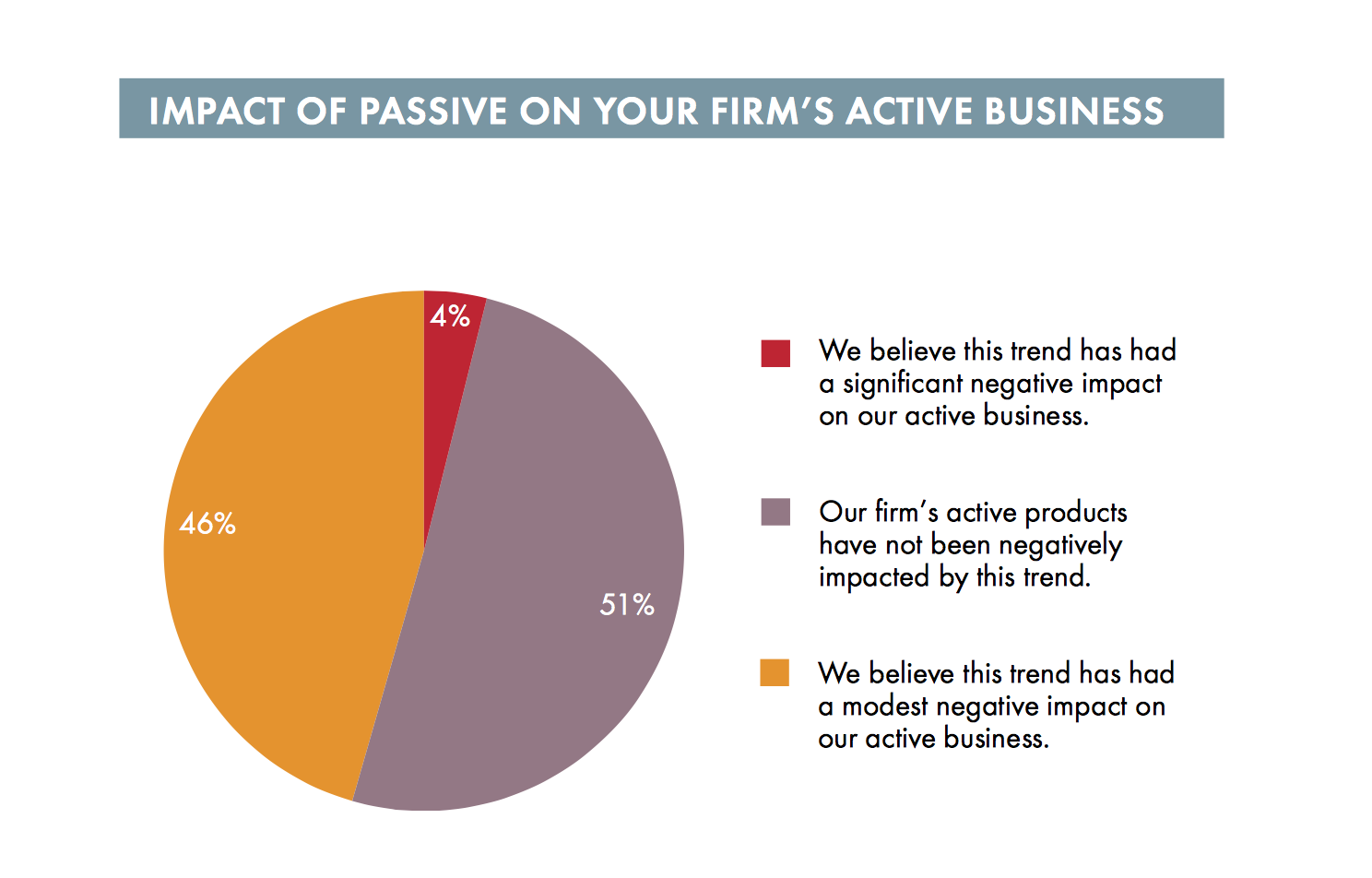

Is Smart Beta Shaking Up Active Management?

Source: Chief Investment Officer

Senate Democrats Block Republicans’ Homeland Security Bill – NYTimes.com

So the GOP attaches a bill to stop President Obama’s immigration plans (That the GOP simply can’t find a way to fix themselves) and THAT’S why the GOP has been sitting on the Homeland security bill?

So they could run around the Sunday gab shows saying the Democrats are “blocking,” “Filibustering” “playing politics,” “risking American lives with” Homeland security?!

Even the New Times headline gets it wrong, no wonder our low information voters are so angry at the wrong party.

http://www.nytimes.com/2015/02/04/us/politics/senate-democrats-block-vote-on-homeland-security-bill-creating-confrontation.html

The GOP is ludicrous. Anyone who’s dumb enough to fall for this deserves Republican in control of their lives.

http://www.fa-mag.com/news/indexing-s-existential-controversy-20652.html?print

Fundamental indexing can’t replace cap weighting in our lifetimes. It can only do that if the fundamentals drive the market cap for each stop which is the EMH assumption. Outperformance by the fundamental and value investors is predicated on their structure being different from the market cap weighting.

Arnott, Faber and others are trying to come up with algorithmic approaches to replace the human managers of Graham and Doddsville. Neither approach is passive. If you look at Vanguard’s small cap value index fund and Schwab’s RAFI small cap fund they had about 29% and 36% turnover last year which is not “passive”. This is because stocks were constantly moving in and out of the index as their companies’ fundamental performance improved or decreased with respect to price. At the large cap end, portfolio turnover was about an order of magnitude larger than the S&P 500 turnover. These are good approaches for retirement accounts but not necessarily so good for taxable accounts.

Bogle never argued that humans couldn’t outperform the market cap indices. He just argued that you wouldn’t know in advance which ones would outperform after fees and expenses were accounted for and that on average the average manager could not outperform the market because of the expense load. So the big question about the RAFI and other smart beta approaches is whether or not their algorithms mean that the fund expenses can be significantly lower than the typical 1%-2% that the humans charge. The Schwab RAFI funds charge about 0.3 to 0.5% of assets which is considerably lower than most of the human value managers charge. If the fundamental indexes can consistently get 2% outperformance of the cap-weighted indices that charge about 0.1%-0.2% then they are a great deal after expenses are considered. The Doubleline fund mentioned in the article is charging 1.24% in expenses. That is a steep hill to climb to get consistent outperformance, especially if held in a taxable account.

In my portfolio, I have had the human Graham & Dodd types of managers for a long time (since the late 80s) and they have been good, but expenses have definitely weighed on overall performance. I have also had cheap cap-weighted indices for quite a while, and have started experimenting with RAFI and Faber funds. We will see how the smart beta does to see if it worth the extra expense.

How is this statement not false?

“Arnott maintains that fundamental indexes have been road-tested in the market long enough to show they indeed add about 2% a year all over the world. “It adds more than that in the market’s less-efficient and more volatile segments such as small companies, global strategies and emerging markets”

Average annual performance—quarter end

VWO PXH Diff.

1.91 -1.71 3.62 Advantage Vanguard/Cap Weighting

VEA PXF Diff.

5.31 3.79 1.52 Advantage Vanguard/Cap Weighting

It is worse when considering the higher distributions of the RAFI portfolios.

Average annual total return—after taxes on distributions

VWO PXH Diff.

1.39 -2.58 3.97 Advantage Vanguard/Cap Weighting

VEA PXF Diff.

4.82 2.67 2.15 Advantage Vanguard/Cap Weighting

I don’t think this was on the agenda when everybody out-sourced manufacturing to Asia.

http://finance.yahoo.com/news/west-coast-port-congestion-could-135500206.html

But everyone knew about it. Don’t you remember the pilese of containers sitting outside of ports becaue no matter how fast they unloaded it was less expensive to load them back unto the ships returning. This does not dismiss many of the ships were usable for bulk shipping of raw material.

If anything it represents is the fact is employers do not want to share their wealth. She oil refinery workers striking against use of temp workers currently

Cullen Roche takes a sledge hammer to Rand Paul’s financial illiteracy

http://www.bloomberg.com/politics/articles/2015-02-07/rand-paul-rallies-iowans-to-audit-the-federal-reserve

http://www.pragcap.com/the-federal-reserve-could-be-worth-hundreds-of-billions-of-dollars

This is why while still Registered Republican, Florida is a closed primary state, I find myself seldom voting Republican. If you know a little history of banking and financial markets before the Fed was created you know why it was created. I hope Rand Paul is not really this ignorant being a Senator but just playing populism to the ignorant masses. In either case I will never vote for him if he runs for the Presidency.

Interesting article about measles in NYS. There is a map in the article that can be toggled to show public vs private school vaccination rates. Don’t be surprised if the news a year from now discusses private schools as ground zero for measles infections because many of these schools have relatively low vaccination rates and many of the students will travel a lot increasing their likelihood of getting infected.

http://www.syracuse.com/health/index.ssf/2015/02/measles_as_fear_grows_doctors_fight_to_sway_vaccine_skeptics.html#incart_related_stories

http://www.syracuse.com/news/index.ssf/2015/02/nys_immunization_rates_check_compare_any_school_in_new_york_state.html#incart_related_stories

NPR

To Get Parents To Vaccinate Their Kids, Don’t Ask. Just Tell

February 07, 2015 5:34 AM ET

As California’s measles outbreak continues to spread beyond state borders, many doctors nationwide are grappling with how best to convince parents to have their children vaccinated. Inviting a collaborative conversation doesn’t work all that well, many are finding. Recent research suggests that being more matter-of-fact can work a lot better.

Pediatrician Eric Ball, who practices in southern California, says, in his experience, the families skeptical of vaccines can be divided into two types.

“There are people who believe in grand conspiracies — that the whole medical community is trying to make money at the expense of their child,” he says. “They don’t really believe in science. They don’t believe in data, and no amount of discussion is going to really convince them.”

Ball says he sees other skeptical parents who are on the fence, and he works really hard, using a collaborative approach, to convince these parents that vaccines are safe and effective.

“We try to assess what their fears are,” he says, “why they’re not vaccinating — what they’ve read, what they’ve heard. And then we try to dispel myths.”

But some surprising research by Dr. Doug Opel, a pediatrician at Seattle Children’s Hospital and a researcher at the University of Washington, suggests Ball might want to try a less collaborative approach.

…

http://www.npr.org/blogs/health/2015/02/06/384322665/to-get-parents-to-vaccinate-their-kids-dont-ask-just-tell

I see the same thing in the work place. Different teams approach things different ways. Some teams are very focused on figuring out the logical course of action quickly, making a decision, and moving on. They want to hear from the primary people tasked to understand that particular issue and get a specific recommendation that can then be acted on. Meetings tend to be short with very few decisions deferred to a later date.

I also end up on some other teams that are more like kindergarten sharing sessions where everybody is expected to weigh in regardless of experience or understanding. There are usually many more opinions which all have to be respected so that nobody on the team has their feelings hurt. Major decisions often don’t get made for 6 months or more.

Guess which projects tend to get done on budget, on schedule, and with a high degree of success.

I’m afraid to ask, but has management in your company noticed the difference in results and made the decision to move to the team approach which is consistently producing better results?

It is semi-random. Teams are constantly being assembled and disassembled for different projects. You can be on multiple teams simultaneously. It is really more a function of what happens when you get semi-random team assemblies.

But no, there is very little after-action review in this business, largely because the highest degree of re-organization and turnover is at the mid-executive level. There will usually have been two or three different division managers during a decent-sized project.

Harvard Business Review

Productivity

The Ideal Work Schedule, as Determined by Circadian Rhythms

Christopher M. Barnes

January 28, 2015

Humans have a well-defined internal clock that shapes our energy levels throughout the day: our circadian process, which is often referred to as a circadian rhythm because it tends to be very regular. If you’ve ever had jetlag, then you know how persistent circadian rhythms can be. This natural — and hardwired — ebb and flow in our ability to feel alert or sleepy has important implications for you and your employees.

Although managers expect their employees to be at their best at all hours of the workday, it’s an unrealistic expectation. Employees may want to be their best at all hours, but their natural circadian rhythms will not always align with this desire. On average, after the workday begins, employees take a few hours to reach their peak levels of alertness and energy — and that peak does not last long. Not long after lunch, those levels begin to decline, hitting a low at around 3pm. We often blame this on lunch, but in reality this is just a natural part of the circadian process. After the 3pm dip, alertness tends to increase again until hitting a second peak at approximately 6pm. Following this, alertness tends to then decline for the rest of the evening and throughout the early morning hours until hitting the very lowest point at approximately 3:30am. After hitting that all-time low, alertness tends to increase for the rest of the morning until hitting the first peak shortly after noon the next day. A very large body of research highlights this pattern, although of course there is individual variability around that pattern, which I’ll discuss shortly.

…

https://hbr.org/2015/01/the-ideal-work-schedule-as-determined-by-circadian-rhythms

Cold War Redux

Russia getting military bases in Cyprus http://news.yahoo.com/russia-getting-military-bases-eu-193847584.html

Greece reassures NATO despite having discussions with Russia. Would that stop them from renting an island or two to Russia in exchange for cash? http://news.yahoo.com/greece-defence-minister-reassures-nato-over-russia-ties-183418122.html;_ylt=AwrBJSDA6tdUTwQA1RrQtDMD

Potential double-substitution move by Russia – work with Saudis to lower support for Assad in Syria in exchange for reduced Saudi oil import (more cash for Russia). Russia provides financial support to Grexit – gets closer ties to Greece with a potential base.

The Russians are paying Diana Taurasi more to take a vacation than she would get playing in the WNBA. A slight difference in pay between the men and the women in US basketball.

http://deadspin.com/diana-taurasis-russian-team-is-paying-her-to-skip-the-w-1683643165