Household Formation within the “Boomerang Generation”

Zachary Bleemer, Meta Brown, Donghoon Lee, and Wilbert van der Klaauw

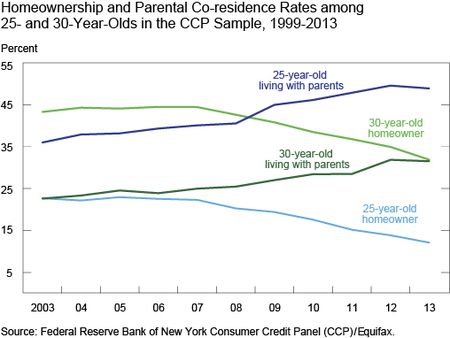

Young Americans’ living arrangements have changed strikingly over the past fifteen years, with recent cohorts entering the housing market at much lower rates and lingering much longer in their parents’ households. The New York Times Magazine reported this past summer on the surge in college-educated young people who “boomerang” back to living with their parents after graduation. Joining that trend are the many other members of this cohort who have never left home, whether or not they attend college. Why might young people increasingly reside with their parents? They may be unable to find employment, they may be saving their income to pay down increasing levels of student debt, or they may be unable to afford the rent for an apartment in the face of lower income or higher housing prices.

In a new Federal Reserve Bank of New York staff report, we discuss our analysis of these trends using the New York Fed Consumer Credit Panel (CCP). The CCP is a unique data set that includes information on the ages and locations of a large, representative sample of U.S. individuals and households. This data set’s size allows us to analyze residence patterns for very narrow age groups, here twenty-five- and thirty-year-olds, at very fine geographic levels. Such fine age and geographic detail helps us distinguish among the various local economic forces that may be driving young people home.

Being from the generation under analysis, I think student loan debt to income ratio is absolutely correlation, but only part of the cause. The chart of the country shows the rates of living at home are highest in the most expensive places to live. Crappy temp jobs are in abundance in those cities, and low wages keep people living at home. Low savings rates are certainly hurt by student loans, but other expenses that come with living in expensive places are a culprit too.