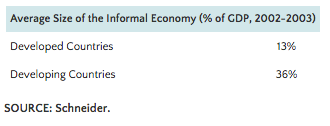

The informal economy, also known as the underground economy or black market, is very hard to measure. A good example is the produce vendor on the street who sells the same vegetables you find in the supermarket but handles only cash and pays little or no taxes. Nevertheless, this sector adds considerable value to the economy. In developing countries, the informal sector has been estimated to account for about 36 percent of gross domestic product (GDP). In developed countries, it has been estimated to be about 13 percent of GDP.1 (See table.) So how do economists measure the informal sector? This article explains the two main approaches—direct and indirect—and the difficulties that each entails.

Direct Approaches

These methods rely on surveys, samples based on voluntary replies, tax audits and other compliance methods. The problem is that the results depend directly on the questions asked by the survey, and few surveys are alike. As a result, it is very difficult to use the same parameters to measure and compare the informal economy in different countries.

Usually, what ends up happening is that the definition that is used has to be very simple and contain only one parameter. For example, the informal sector may be defined as those people who do not have the right to a pension when they retire. Clearly, this definition excludes several important elements that would describe the informal economy differently. Another very common definition is that people are considered to work in the informal economy if they work for a firm that has N or fewer workers. But a firm can be very small and still comply with the law, and its production can be reported to the authorities, meaning that its value added will appear in the GDP despite being a small firm.

If what is used is a direct questionnaire, people are not usually willing to admit that they are not reporting taxes or that they are engaging in fraudulent behavior, either because they feel afraid of getting caught or because they feel ashamed since they know this is a moral issue. This makes it difficult to estimate the extent of undeclared work.

Finally, a direct estimate of the informal economy can also be obtained by calculating the discrepancy between income declared for tax purposes and that measured by selective checks. For example, one can compare the number of jobs declared by firms with the number of employed people found through household surveys. The number of employed people exceeding the number of jobs represents the informal workforce. Once the informal number of workers is identified, informal workers can be attributed the same net compensation as similar workers in the formal economy.2

Indirect Approaches

These are macroeconomic approaches that try to use an indicator of the informal economy as a proxy for its size or growth.

Discrepancy between the National Expenditure and Income Statistics

In theory, the income measure of GDP and the expenditure measure should be equal to each other. However, informal activities can show up in the expenditure measurement but not in the income measurement. This is because the income side is measured through the value added of registered firms (the formal economy), while on the expenditure side there is some self-reporting. Thus, the difference between these two measures is an indicator of the size of the informal economy. The problem with this estimate is that statisticians would like to make the difference between the two as small as possible; so, using the initial measure rather than the published measure would be ideal.3 Moreover, there are differences due to sampling and statistical errors, which cannot be disentangled from the amount that can be explained by the informal economy.

Discrepancy between Official and Actual Labor Force

Assuming that the total labor force participation is constant, all else being the same, then any decrease in the labor force participation in the official economy can be seen as an indicator of an increase in the activity in the informal economy.4 The problem with this method is that changes in labor force participation can be due to other causes. For example, following the recent recession, many people have exited the labor force. It could also be the case that people work in both the informal and formal economy; so, this is not a very good estimator.

The Transactions Approach

In 1979, economist Edgar Feige developed this approach based on the quantitative theory of money MV = pT, where M is money, V is velocity, p is prices and T is total transactions. The main assumption is that the relationship of the volume of transactions and official gross national product (GNP) is constant over time.5 Using the value of total transactions (pT) as an estimate of nominal GNP, he calculated the informal economy as the difference between nominal GNP and the official GNP.

Several issues arise with this approach. He had to assume there is a base year when there was no informal economy. Then, the assumption that the ratio of transactions to official GNP is constant over time was quite strong. Additionally, obtaining accurate estimates of the total number of transactions was difficult.

The Currency Demand Approach

This approach uses the correlation between currency demand and tax pressure, assuming that informal activities operate with cash.6 Thus, if the tax burden increases and so does the demand for money, then that increase in the demand for money reflects an increase in the informal economy.

In order to calculate the excess in money demand, the economists behind this approach estimated an equation for money demand using econometric methods. They controlled for development of income, payment habits, interest rates and other related variables. In the equation, they also included government regulation, direct and indirect tax burden, and the complexity of the tax system. The most common critiques to this approach are the following:

Not all the transactions in the shadow economy are paid in cash.

Most studies using this approach include only the tax burden factor and ignore others, such as “tax morality,” regulation and attitudes toward the state. (There are usually no reliable data on these factors.)

A rise in currency demand deposits is usually due in large degree to a slowdown in demand deposits and not to a rise in currency due to informal economic activity.

Also, most studies assume that both the formal and informal economy have the same velocity of money.

The Physical Input (Electricity Consumption) Method

This method assumes that electricity consumption is the best physical indicator of both formal and informal economic activity. It has been observed that the electricity/GDP elasticity is usually close to 1.8 So, by using electricity as a proxy for the overall economic activity and then subtracting from it the official estimates of GDP, we get an indicator of informal economic activity. The difference between the growth of electricity consumption and official GDP is then attributed to the growth of the informal economy.

The critiques to this approach rely on the fact that not all informal activities require a considerable amount of electricity, or, if they do, other energy sources such as gas, oil and coal could be used. Also, the use of electricity has become more and more efficient in both types of economies. Finally, there may be differences in the elasticity of electricity/GDP across countries or changes over time.

Ultimately, the approach used to measure the informal economy depends on the specific question being asked by the researcher. For macroeconomic studies, indirect approaches usually suffice, but direct approaches are more generally used for microeconomic studies. Newer methods being developed to better gauge the size of the informal economy involve more-technical, model-based estimations.

I didn’t notice an analysis of retail sales in any of these measurement techniques. Retail Sales is certainly a respected measure that moves the market when it surprises.

Many people moved to the underground economy when the Great Recession happen. Lots of people still work under the tablet. Right now Orlando Florida is experiencing a start of a building boom. And a lot of people in construction are getting at least part of their income under the table. I hear how the ideologues think unemployment numbers are understating the actual number of those unemployed which has been debunked on this blog. But by the same token many people are employed but just under the radar. That runs counter to their spin so is ignored. My region has had the best tourist year ever. Which is highly correlated to how the overall economy is doing. With low inflation and a growing economy this is a great time I think to invest in our economy by the stock market. Ignore the ideologues as they will lose you money.

The “informal economy” (What few economists who study that area call it) has been around forever. Crime is a not insignificant part of it; mostly the mundane stuff as in technically illegal gambling, prostitution, drug dealing, etc. Throw in under-reporting of cash payments by retailers and service people (think waiters). Add traditional bartering – I’ll do your cabinets, you do do my kid’s periodontal work and so on.

The usual estimate for the U.S. is about 5-8% of the total economy never shows up on the radar.

What is astonishing is the neglect of this as a major factor – particularly the conversation about the Mediterranean countries. The primary reason why officially Italy has had terrible economic growth for decades, but every one is increasingly well off : 25% of the economy is off the books.