Source: WSJ

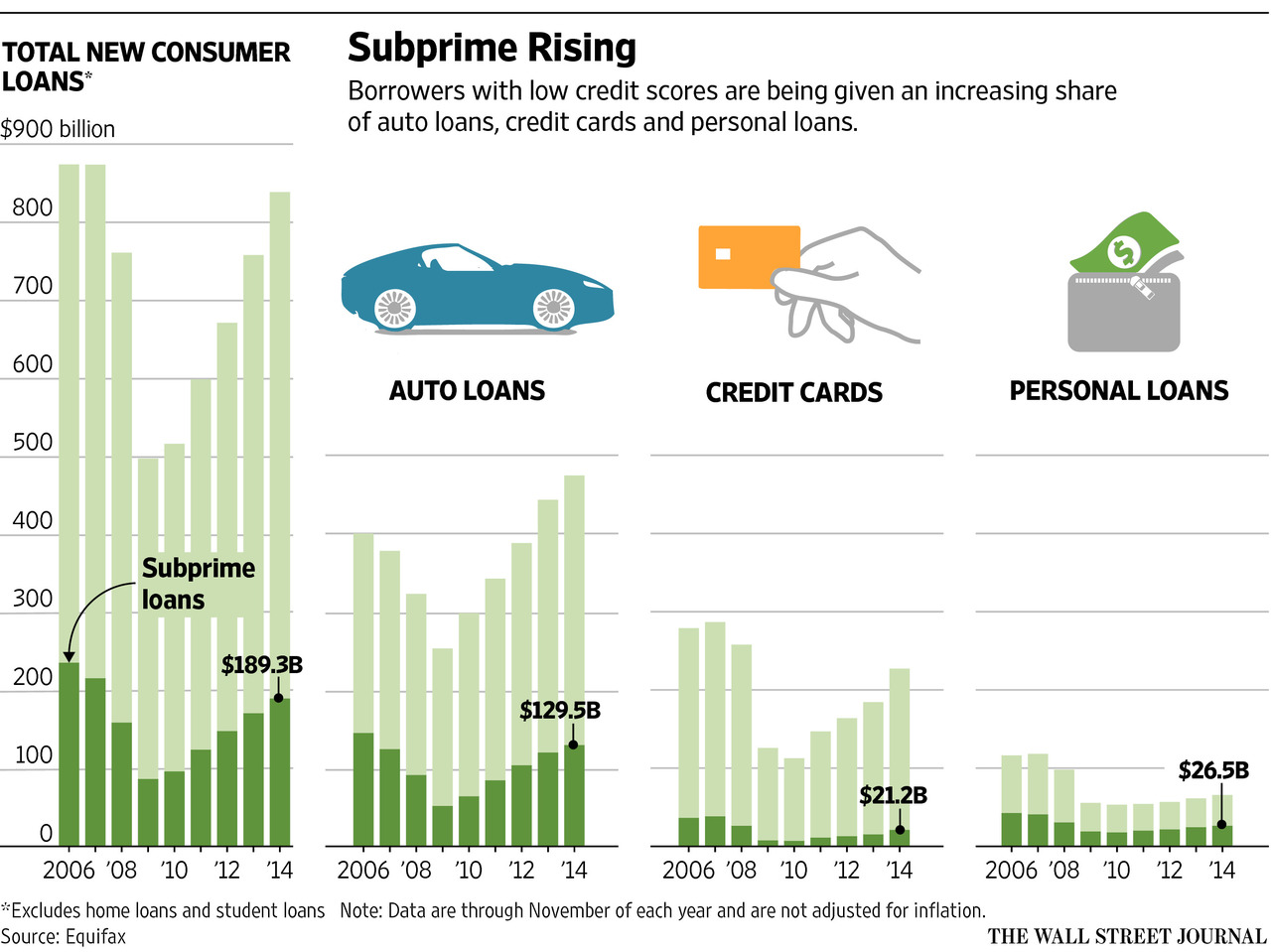

Subprime Rising

February 19, 2015 4:00pm by Barry Ritholtz

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment. The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client. References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers Please see disclosures here: https://ritholtzwealth.com/blog-disclosures/

What's been said:

Discussions found on the web:Posted Under

Previous Post

Swiss LeaksNext Post

Are We Becoming a Part-Time Economy?

There’s a gap several posts below where morning train reads was probably supposed to go – most people probably just went to Bloomberg, but if you didn’t, they’re here:

http://www.bloombergview.com/articles/2015-02-19/ritholtz-s-reads-don-t-panic-about-rising-rates

~~~

ADMIN: Ooops! My bad, I published that under the 18th — will fix (he is going to kill me)

Corollary to Stein’s Law

Trends that can continue, will.

I told a friend who defaulted on $25K of credit card debt that the good thing about his situation was the sheer volume of people in the same situation. The economy simply could not be sustained with such a large number of people unable to get credit. It’s sort of like relying on obedience with laws because you can’t put everyone in jail.

But, but…but we have BETTER “software” now!!!….It’s OK….we’ve REALLY figured out how to “qualify” these people now and we’re only making loans to those that will repay them. Really, it’s true!!! Trust us!!

On the other hand….let ’em “have at it”. The best bargains were found when things started blowing up last time. Looks like they’re setting us up for yet another opportunity. Loan away suckers.

For many people there’s a very good reason why they take on more debt. Take e.g. cars.

One can choose to borrow money to buy a (new) car and be able to drive to work with that car and have an income.

The other option is to not borrow money but that also means having no car at all and not being able to drive to work. But that also means no income.

I think then the choice is very easy for a lot of people.

So, let me figure this out.

All sub prime lending is less than it was in 2006, but sub prime lending is gaining an increasing share.

Sounds like climate deniers who concentrate their thoughts on 1998.

Subprime is very profitable for the CEO and leadership of the company. Since it is all about what is good for them and not at all what is good for long-term share holders, costumers or the country, we would expect that they will rob and destroy the companies and the economy again and again and again. Capitalism is dying – it’s eating itself from the inside.