“Some day interest rates will go up. Until then the Treasury bears are missing one of the greatest bond rallies in history.” — Jim Bianco, Bianco Research

Since 2015 began, everyone has been fixated on the U.S. dollar and oil prices. I want to direct your attention to what may be the greatest show now playing in financial markets: The 30-year U.S. Treasury bond.

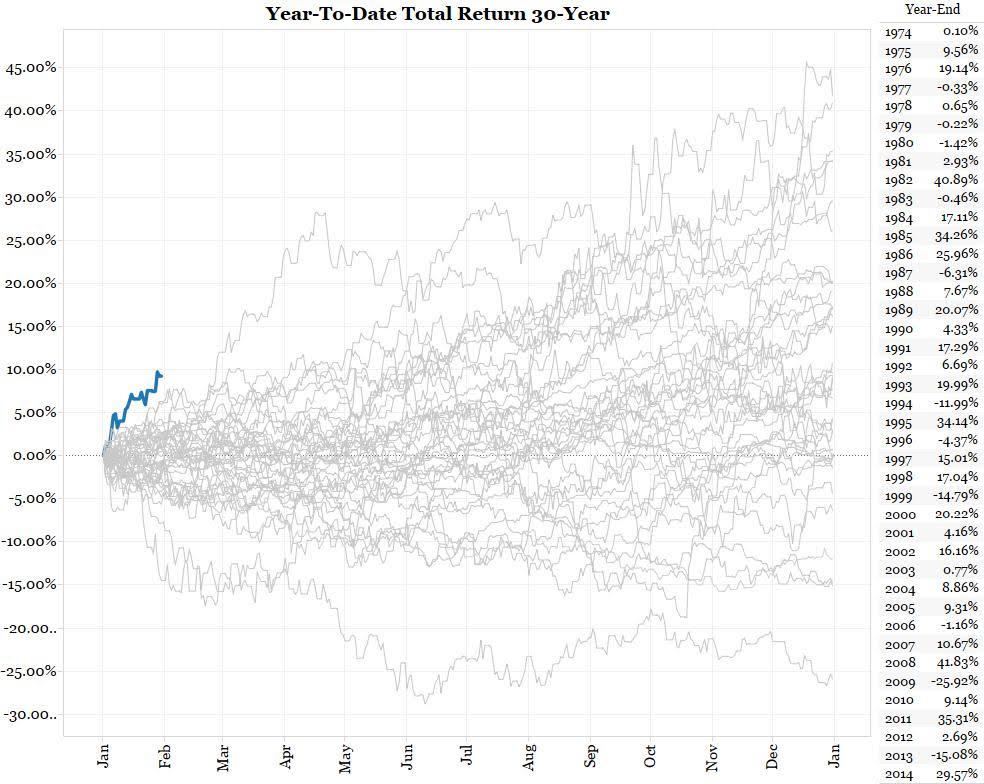

The chart above, courtesy of Bianco Research, shows the year-to-date returns of the long bond during each of the past 40 years. Never has the 30-year Treasury, depicted by the blue line, had a stronger start to a new year going back to 1974.

Jim Bianco of his namesake firm notes that in January the 30-year bond returned 10.71 percent. That ranks as the seventh best month ever for the security. We don’t know if that is going to continue, but it is certainly worth watching.

Even in the 70s, with raging inflation, the long bond didn’t do too horribly. Maybe the fear of this asset is overdone.

– Gary Shilling is gone to be proven wrong for once when he thinks Treasuries are going to rise more.

– There’re are some VERY good reasons to be bearish on the T-bond market. I already knew in mid 2012 rates (when the 10 year bottmed at ~ 1.3 %) were going higher somewhere in the future. Thanks to one Robert R. Prechter. And some charts I found on the internet provided me with a good framework WHEN those rates were supposed to explode/rise higher.

Hmmm,,but I notice every boom year is followed by a bust year with the exception of 1985/86. Watch out 2015 ?

““Some day interest rates will go up. Until then the Treasury bears are missing one of the greatest bond rallies in history.” — Jim Bianco, Bianco Research”

When did Bianco say this ?

~~~

ADMIN: That quote was pulled from his daily notes within his subscription service. Last years article on the bond rally similarly quoted Bianco. Here is the MiB interview

I have been expecting interest rates to rise. But have been repeatably fooled. This is why you need a well balance portfolio. No one knows for sure what will pay off in the short term.