Source: Fortune

Why Warren Buffett is $72 billion richer than you

March 10, 2015 3:30pm by Barry Ritholtz

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment. The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client. References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers Please see disclosures here: https://ritholtzwealth.com/blog-disclosures/

What's been said:

Discussions found on the web:Posted Under

Previous Post

Real Wages Are RisingNext Post

Domestic Bond Markets and Inflation

I was going to say “because he has a lot of money.” ;)

He has $72 billion more than I do, even rounding to the nearest $100 million ;-)

Did you mention, starting with a load of money, at just the right time (a long time ago), and listening to Benjamin Graham – plus eventually using his accumulated capital advantage to screw down labour’s wages?

Or is simply down to being a sage, and living in Omaha? Yes, surely that’s it.

Fitzgerald: The rich are different than you and me. Hemingway: Yes, they have more money.

Bow down and worship.

I read half of Alice Schroeder’s biography of Buffett and put it down because (my reason):

He lives for nothing but the ceaseless accumulation of money.

I’ve been reading about this guy in Fortune Magazine for 30 years by his ‘fluffer’ Carol Loomis.

Is there something peculiarly American about its [or, Time-Life’s, err, ‘Warner’s’ former business masthead’s] infatuation with businessmen as transcendent royalty? Exhibit ‘A’: this superannuated geezer who’s got a line for the rubes, whilst simultaneously ‘surfing the wave’ he decries, e.g. ‘Derivatives are weapons of mass destruction’.

Are Americans this credulous?

What I want to know is where buffet falls on the narcissism test:

http://psychcentral.com/quizzes/narcissistic.htm

and if abnormally low narcissism is a feature of investors who consistently beat the S&P.

Also, where millionaire hedge fund, PE and other active managers who consistently under-perform the S&P score on this test.

The average person is in the 18 range. 30 means your in love with yourself. Doing the test the way I think Warrant Buffett would answer leads me to a 4 or 5.

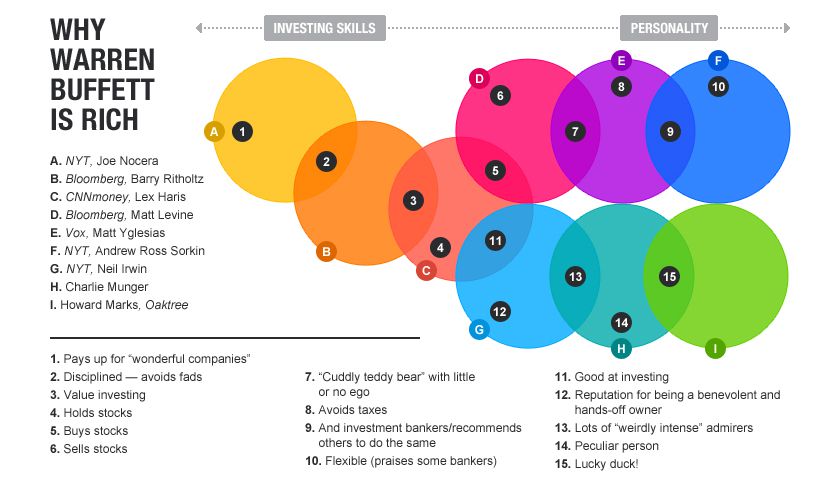

The chart makes it look like no one can agree what makes him successful. In reality, 1 though 6 (and also 9 and 11) are pretty much the same thing. If you compress those, there is a lot of cross-over.

Compounding is a wonderful thing. But, it’s getting a lot harder these days.

I believe AQR/Cliff Asness’ ‘Robo-Buffett’ simulated him well enough to surpass him.

The primary reason Mr. Buffett is one of the richest fellas, is that he is a willing student.

A majority of the population is not. Mark Twain would have explained that to you in the late 1800’s.